by Calculated Risk on 4/14/2018 08:11:00 AM

Saturday, April 14, 2018

Schedule for Week of Apr 15, 2018

The key economic reports this week are March Housing Starts and Retail Sales.

For manufacturing, March industrial production, and the April New York, and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: Retail sales for March will be released. The consensus is for a 0.4% increase in retail sales.

8:30 AM ET: Retail sales for March will be released. The consensus is for a 0.4% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis in February.

8:30 AM ET: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 18.2, down from 22.5.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.6% increase in inventories.

8:30 AM: Housing Starts for March.

This graph shows single and total housing starts since 1968.

The consensus is for 1.269 million SAAR, up from 1.236 million SAAR in February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to decrease to 78.0%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 233 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 20.1, down from 22.3.

10:00 AM: State Employment and Unemployment (Monthly) for March 2018

Friday, April 13, 2018

LA area Port Traffic Decreases YoY in March

by Calculated Risk on 4/13/2018 08:42:00 PM

Note: The Chinese New Year boosted inbound traffic in February, and slowed inbound traffic in March this year.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.0% compared to the rolling 12 months ending in February. Outbound traffic was down 0.2% compared to the rolling 12 months ending in February.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Trade has been strong - especially inbound - and setting record volumes most months recently.

In general imports have been increasing, and exports are mostly moving sideways recently.

Oil Rigs "Horizontal oil rigs come in flat"

by Calculated Risk on 4/13/2018 04:02:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 13, 2018:

• Total US oil rigs were up, +7 to 815

• Horizontal oil rigs were flat at 717

...

• Not a lot of enthusiasm for adding horizontal oil rigs, high oil prices notwithstanding.

• Last week’s impression remains: Shale production growth is going to underperform expectations.

• Global oil demand growth has been running hot; +2.0 mbpd / year since November (EIA), explaining high oil prices and draws notwithstanding 1.6 mbpd US crude + ngl production growth over the last year.

• The Brent spread is above $5 / barrel – quite bullish

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q1 GDP Forecasts

by Calculated Risk on 4/13/2018 03:29:00 PM

Here are few Q1 GDP forecast.

From Merrill Lynch:

We continue to track 1.8% for 1Q GDP. [April 13 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.0 percent on April 10, down from 2.3 percent on April 5. [April 10 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.8% for 2018:Q1 and 2.9% for 2018:Q2. [April 13 estimate]CR Note: It looks like another quarter around 2% or so, although there might still be some residual seasonality in the first quarter.

The Longest Expansions in U.S. History

by Calculated Risk on 4/13/2018 12:08:00 PM

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in March 1991 to a peak in March 2001 (120 months).

2 Tied) From a trough in February 1961 to a peak in December 1969 (106 months).

2 Tied) From a trough in June 2009 to today, April 2018 (106 months and counting).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current expansion is currently tied for the second longest, and it seems very likely that the current expansion will surpass the '90s expansion in the Summer of 2019.

As I noted last year in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market. Single family housing starts and new home sales both bottomed in 2011 - so this is just the seventh year of expansion - and I expect further increases in starts and sales over the next couple of years.

Recently the story has changed, but I still think the current expansion will end up being the longest in U.S. history.

Note: Here are five questions that people ask me all the time and my answers late last year.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

BLS: Job Openings "Little Changed" in February

by Calculated Risk on 4/13/2018 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.1 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.5 million and 5.2 million, respectively. Within separations, the quits rate was unchanged at 2.2 percent and the layoffs and discharges rate was little changed at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.2 million in February. The quits rate was 2.2 percent. The number of quits was little changed for total private and for government. Quits decreased in other services (-41,000). The number of quits was little changed in all four regions.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in February to 6.052 million from 6.228 in January.

The number of job openings (yellow) are up 7.7% year-over-year.

Quits are up 6.3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are near the highest level since this series started, and quits are increasing year-over-year. This was a solid report.

Thursday, April 12, 2018

Mortgage Rates Steady at 4.5%

by Calculated Risk on 4/12/2018 09:12:00 PM

Friday:

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for February from the BLS.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for April). The consensus is for a reading of 100.8, down from 101.4.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Bounce Back

A day after hitting the lowest levels in more than 2 months, mortgage rates bounced back up today. The good news is that they didn't land too far from yesterday's levels in the grand scheme of things, and are still technically closer to the bottom of their March/April range. [30YR FIXED - 4.5%]Here is a table from Mortgage News Daily:

emphasis added

Hotels: Occupancy Rate Down Year-over-Year

by Calculated Risk on 4/12/2018 04:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 April

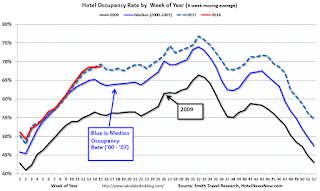

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 1-7 April 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 April 2017, the industry recorded the following:

• Occupancy: -2.7 to 68.3%

• Average daily rate (ADR): +0.7% to US$128.84

• Revenue per available room (RevPAR): -2.0% to US$88.03

STR analysts note that performance in many major markets was affected by a drop in group business due to the Easter holiday calendar shift.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fourth overall - and behind the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Update: Predicting the Next Recession

by Calculated Risk on 4/12/2018 11:30:00 AM

CR April 2018 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and in the summer of 2015, in January 2016, in August 2016, and in April 2017) because of all the recession calls. In late 2015, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR April 2017 Update: Now it has been over four years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

[CR January 2018 Update: Now it has been five years!]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The recent recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2017 Update: Austerity was a mistake (obvious at the time). And it is possible that we will see serious policy mistakes from the new administration (a complete wildcard). And it is possible the Fed could tighten too quickly. ]

[CR April 2018 Update: We are seeing policy mistakes from the Trump administration on taxes, immigrations, and trade. See: When the Story Change, Be Alert. I'm watching for the impact of these policy mistakes.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR April 2018 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession in the immediate future (not in 2018). ]

Weekly Initial Unemployment Claims decrease to 233,000

by Calculated Risk on 4/12/2018 08:33:00 AM

The DOL reported:

In the week ending April 7, the advance figure for seasonally adjusted initial claims was 233,000, a decrease of 9,000 from the previous week's unrevised level of 242,000. The 4-week moving average was 230,000, an increase of 1,750 from the previous week's unrevised average of 228,250.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 230,000.

This was slightly higher than the consensus forecast. The low level of claims suggest relatively few layoffs.