by Calculated Risk on 4/10/2018 01:35:00 PM

Tuesday, April 10, 2018

Q1 Review: Ten Economic Questions for 2018

At the end of last year, I posted Ten Economic Questions for 2018. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2018 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q1 review (it is very early in the year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.It is still too early to determine the impact of the new tax law on housing.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

9) Question #9 for 2018: Will housing inventory increase or decrease in 2018?

I was wrong on inventory last year (and the previous year), but right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent changes to the tax law.According to the February NAR report on existing home sales, inventory was down 8.1% year-over-year in February, and the months-of-supply was at 3.4 months. This was the smallest year-over-year decline since last August, and some local inventory data suggests inventory might increase this year.

8) Question #8 for 2018: What will happen with house prices in 2018?

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.If is very early, but the CoreLogic data released last week showed prices up 6.7% year-over-year in February. The CoreLogic year-over-year increase is about the same as last year, and there is no evidence of price increases slowing yet.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

7) Question #7 for 2018: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.Through February, starts were up about 2% year-over-year compared to the same period in 2017, and on pace for about 1.28 million this year. New home sales were also up about 2% year-over-year and on pace for about 620 thousand in 2018.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

6) Question #6 for 2018: How much will wages increase in 2018?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.Through March 2018, nominal hourly wages were up 2.7% year-over-year. This is about the same as last year, and it is too early to tell if wages will increase at a faster rate in 2017.

5) Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

My current guess is the Fed will hike three times in 2018.The Fed has already hiked once in 2018, and they are still forecasting three hikes this year.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

4) Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.It is early, but inflation has moved up closer to the Fed's target.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

3) Question #3 for 2018: What will the unemployment rate be in December 2018?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%. My guess is based on the participation rate declining about 0.2 percentage points in 2018, and for decent job growth in 2018, but less than in 2017.The unemployment rate was at 4.1% in March.

2) Question #2 for 2018: Will job creation slow further in 2018?

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.Through March 2018, the economy has added 605,000 thousand jobs, or 202,000 per month. This is somewhat above my forecast, but I still expect employment gains to slow this year.

1) Question #1 for 2018: How much will the economy grow in 2018?

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.Once again, GDP will be sluggish in Q1 - the Atlanta Fed GDPNow is forecasting 2.0% in Q1 - and it is way too early to tell if there will be any pickup in GDP growth this year.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

It is early, but currently it looks like 2018 is unfolding as expected - although, based on Q1 data, employment gains might be slightly higher than I originally expected.

Philly Fed: State Coincident Indexes increased in 46 states in February

by Calculated Risk on 4/10/2018 12:35:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2018. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. In the past month, the indexes increased in 46 states, decreased in two, and remained stable in two, for a one-month diffusion index of 88.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is all green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

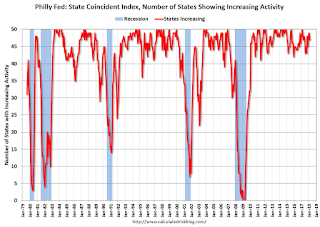

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In February, 47 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Small Business Optimism Index decreased in March, "Difficulty of finding qualified workers" is Top Problem

by Calculated Risk on 4/10/2018 09:40:00 AM

From the National Federation of Independent Business (NFIB): March 2018 Report: Small Business Optimism Index

The 104.7 March reading, down from 107.6 in February, remains among the highest in survey history and for the first time since 1982, taxes received the fewest number of votes as the number one problem.

..

Job creation remained solid in the small business sector as owners reported a seasonally-adjusted average employment change per firm of 0.36 workers, one of the best readings in survey history. ... Twenty-one percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, exceeding the percentage citing taxes or regulations. Thirty-five percent of all owners reported job openings they could not fill in the current period.

emphasis added

Click on graph for larger image.

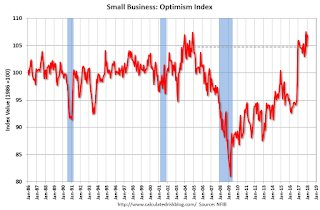

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.7 in March.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, April 09, 2018

Merle Hazard: "A trucking song for the information age"

by Calculated Risk on 4/09/2018 06:31:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 8:30 AM, The Producer Price Index for March from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

It has been almost five years, but long time readers will remember Merle Hazard - he provided us some welcome musical relief with his songs such as "Inflation or Deflation" and How Long (Will Interest Rates Stay Low)?

Merle has a new song out today: Dave's Song. Enjoy!

Hotels: Occupancy Rate Down Year-over-Year

by Calculated Risk on 4/09/2018 02:33:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 31 March

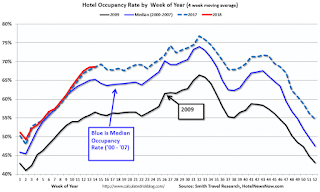

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 25-31 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 26 March through 1 April 2017, the industry recorded the following:

• Occupancy: -2.8 to 66.4%

• Average daily rate (ADR): +3.6% to US$130.81

• Revenue per available room (RevPAR): +0.7% to US$86.90

STR analysts note that performance in many major markets was affected by a drop in group business due to the Easter holiday.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is third overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com>

Weather Adjusted Employment

by Calculated Risk on 4/09/2018 11:14:00 AM

Note: Before the employment report is released each month, Chicago Fed economist Francois Gourio provides an estimate of the impact of weather on employment (this has been very useful).

After the employment report is released, the San Francisco Fed has a model that shows weather adjusted employment. See: Weather-Adjusted Employment Change

This page provides estimates of weather-adjusted employment change in the United States for the past six months. Beginning with the official Bureau of Labor Statistics (BLS) series on the monthly change in total nonfarm payroll employment, we adjust for deviations of weather from seasonal norms following the methodology described in Wilson (2016).

The approach involves estimating the short-run effects of unusual weather on employment growth at the county level using historical data from January 1990 through December 2015. We then use the statistical model to estimate the effect of unusual weather in recent months on employment growth at the county level. We aggregate these county-level effects to the national level, weighting counties by employment levels, to yield estimates of the effect of unusual weather around the country on national employment growth. Finally, we translate these growth effects into level effects using the level of employment in November 2015 as an initial base.

The figure and table present three employment change series for the past six months. The first (left) group is the official BLS series. The other two are alternative estimates of weather-adjusted employment change calculated using our county-level statistical model estimated over the January 1990–December 2015 period. The second set of bars is shows the most recent county-level series (also shown in Figure 2 of van der List and Wilson 2016). The third set of bars is an extension of the county-level model that allows for each weather variable to have different marginal effects in each of the Census Bureau’s nine regions. For example, an inch of snowfall can have a different effect on employment growth in the South Atlantic region than it does in New England.

Click on graph for larger image.

Click on graph for larger image.This graph from the San Francisco Fed show employment gains as reported by the BLS (left graph), and two weather adjusted graphs.

The San Francisco Fed estimates weather reduced March employment by about 100,000 jobs.

There is also a table at the weather adjusted website.

Goldman: Economic Environment "Becoming Less Pleasant"

by Calculated Risk on 4/09/2018 09:31:00 AM

A few brief excerpts from a note by Goldman Sachs chief economist Jan Hatzius: Less Pleasant

The 103k jobs gain in March was well below expectations. Part of the miss reflects a greater-than-expected payback for prior strength in weather-sensitive sectors such as construction and retail. But other industries were also soft, prior months were revised down on net ... While growth is looking softer, it remains far from soft. ...

We view the widening of the LIBOR/OIS spread as a technical and mostly temporary consequence of the international provisions in the new tax law, rather than a sign of banking stress. ... Even if the LIBOR move is technical, one might worry about its direct impact on private-sector borrowing costs and hence aggregate demand. ...

...

Following President Trump’s threat of tariffs on another $100bn of imports from China, the risk of a broader trade confrontation has grown. ... it is harder to rule out continued escalation to a level that does ultimately have a first-order impact on the economy, either directly or (more likely) via tighter financial conditions.

In the end, we think the environment is becoming less pleasant but the baseline outlook for the economy and monetary policy hasn’t really changed much. Growth is a bit weaker, inflation is a bit higher, financial markets are definitely more volatile, and economic imbalances (especially in government finance) are starting to become more visible.

Sunday, April 08, 2018

Sunday Night Futures

by Calculated Risk on 4/08/2018 08:12:00 PM

Weekend:

• Schedule for Week of Apr 8, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 10, and DOW futures are up 90 (fair value).

Oil prices were down over the last week with WTI futures at $62.16 per barrel and Brent at $67.24 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon. A year ago prices were at $2.39 per gallon - so gasoline prices are up 26 cents per gallon year-over-year.

Leading Index for Commercial Real Estate Increases in March

by Calculated Risk on 4/08/2018 09:54:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Climbs in March

The Dodge Momentum Index moved 6.1% higher in March, rising to 155.0 (2000=100) from the revised February reading of 146.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. March’s gain was the result of a 9.6% increase in the commercial component – more than erasing the 5.1% decline it had seen the previous month. The gain in the institutional sector meanwhile was milder, moving 1.6% higher, following an 8.1% gain in February. During the first nine months of 2017, the overall Momentum Index made little progress. However, planning activity shot up in the fourth quarter, with that impetus continuing into the first three months of 2018. In the latest quarter the Momentum Index gained 5.1%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 155.0 in March, up from 146.0 in February.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth in 2018.

Saturday, April 07, 2018

Schedule for Week of Apr 8, 2018

by Calculated Risk on 4/07/2018 08:11:00 AM

The key economic report this week is the Consumer Price Index (CPI) on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

2:00 PM: FOMC Minutes for the Meeting of March 20-21, 2018

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 242 thousand the previous week.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.312 million from 5.667 in December.

The number of job openings (yellow) were up 15.9% year-over-year, and Quits were up 3.2% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April). The consensus is for a reading of 100.8, down from 101.4.