by Calculated Risk on 9/27/2017 08:29:00 PM

Wednesday, September 27, 2017

Thursday: Unemployment Claims, GDP

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 259 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 2nd quarter 2017 (Third estimate). The consensus is that real GDP increased 3.1% annualized in Q2, up from second estimate of 3.0%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September This is the last of the regional Fed surveys for September.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/27/2017 05:03:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through June 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Zillow Forecast: "August Case-Shiller Forecast: Annual Home-Price Gains Aiming Higher"

by Calculated Risk on 9/27/2017 03:10:00 PM

The Case-Shiller house price indexes for July were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: August Case-Shiller Forecast: Annual Home-Price Gains Aiming Higher

The Case-Shiller U.S. National Index is expected to continue its upward climb in August, gaining 6.0 percent year-over-year following a 5.9 percent increase in July. The monthly gain is forecast at 0.4 percent, slightly below the 0.5 percent uptick in July.The year-over-year change for the Case-Shiller National index will probably be slightly larger in August than in July.

The 10- and 20-city indices are expected to post annual gains of 5.3 percent and 5.9 percent, respectively — both climbing a hair faster than they did year-over-year in July. And both are forecast to post monthly gains of 0.3 percent in August.

Below is Zillow’s full forecast for August Case-Shiller data. These forecasts are based on today’s June Case-Shiller data release and the August 2017 Zillow Home Value Index. The August S&P CoreLogic Case-Shiller Indices will not be released officially until Tuesday, October 31.

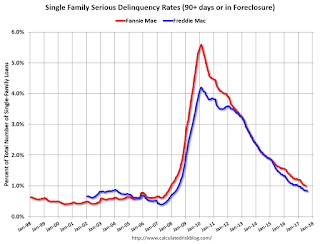

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since April 2008

by Calculated Risk on 9/27/2017 12:18:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in August was at 0.84%, down from 0.85% in July. Freddie's rate is down from 1.03% in August 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since April 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still generally declining, the rate of decline has slowed.

In the short term - over the next several months - the rate will probably increase slightly due to the hurricanes.

After the hurricane bump, maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for August soon.

NAR: Pending Home Sales Index decreased 2.6% in August, down 2.6% year-over-year

by Calculated Risk on 9/27/2017 10:05:00 AM

From the NAR: Pending Home Sales Fall 2.6 Percent in August; 2017 Forecast Downgraded

Pending home sales sank in August for the fifth time in six months, and slower activity in the areas hit hard by Hurricanes Harvey and Irma will likely pull existing sales for the year below the pace set in 2016, according to the National Association of Realtors®.This was below expectations of a 0.1% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, retreated 2.6 percent to 106.3 in August from 109.1 in July. The index is now at its lowest reading since January 2016 (106.1), is 2.6 percent below a year ago, and has fallen on an annual basis in four of the past five months.

...

The PHSI in the Northeast fell 4.4 percent to 93.4 in August, and is now 4.1 percent below a year ago. In the Midwest the index decreased 1.5 percent to 101.8 in August, and is now 3.2 percent lower than August 2016.

Pending home sales in the South retreated 3.5 percent to an index of 118.8 in August and are now 1.7 percent below last August. The index in the West declined 1.0 percent in August to 101.3, and is 2.4 percent below a year ago.

emphasis added

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey

by Calculated Risk on 9/27/2017 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 22, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.04 percent from 4.03 percent, with points remaining unchanged at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 26, 2017

Wednesday: Durable Goods, Pending Home Sales

by Calculated Risk on 9/26/2017 07:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.1% decrease in the index.

Real House Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/26/2017 03:50:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.9% year-over-year in July

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 3.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now in the 5% to 6% range. In July, the index was up 5.9% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to November 2005 levels.

Real House Prices

In real terms, the National index is back to August 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to early-to-mid 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to August 2003 levels.

In real terms, prices are back to early-to-mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Yellen: "Inflation, Uncertainty, and Monetary Policy"

by Calculated Risk on 9/26/2017 12:50:00 PM

From Fed Chair Janet Yellen: Inflation, Uncertainty, and Monetary Policy. Excerpts:

Today I will discuss uncertainty and monetary policy, particularly as it relates to recent inflation developments. Because changes in interest rates influence economic activity and inflation with a substantial lag, the Federal Open Market Committee (FOMC) sets monetary policy with an eye to its effects on the outlook for the economy. But the outlook is subject to considerable uncertainty from multiple sources, and dealing with these uncertainties is an important feature of policymaking. Key among current uncertainties are the forces driving inflation, which has remained low in recent years despite substantial improvement in labor market conditions. As I will discuss, this low inflation likely reflects factors whose influence should fade over time. But as I will also discuss, many uncertainties attend this assessment, and downward pressures on inflation could prove to be unexpectedly persistent. My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation. In interpreting incoming data, we will need to stay alert to these possibilities and, in light of incoming information, adjust our views about inflation, the overall economy, and the stance of monetary policy best suited to promoting maximum employment and price stability.Yellen still thinks inflation will pick up, and that the FOMC is on the correct course.

...

To conclude, standard empirical analyses support the FOMC's outlook that, with gradual adjustments in monetary policy, inflation will stabilize at around the FOMC's 2 percent objective over the next few years, accompanied by some further strengthening in labor market conditions. But the outlook is uncertain, reflecting, among other things, the inherent imprecision in our estimates of labor utilization, inflation expectations, and other factors. As a result, we will need to carefully monitor the incoming data and, as warranted, adjust our assessments of the outlook and the appropriate stance of monetary policy. But in making these adjustments, our longer-run objectives will remain unchanged--to promote maximum employment and 2 percent inflation.

emphasis added

A few Comments on August New Home Sales

by Calculated Risk on 9/26/2017 11:30:00 AM

New home sales for August were reported at 560,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months combined were revised down. However there was probably some negative impact from hurricane Harvey (not clear the size of the impact).

Sales were down 1.2% year-over-year in August.

Earlier: New Home Sales decrease to 560,000 Annual Rate in August.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were down 1.2% year-over-year in August.

For the first eight months of 2017, new home sales are up 7.5% compared to the same period in 2016.

This was a solid year-over-year increase through August.

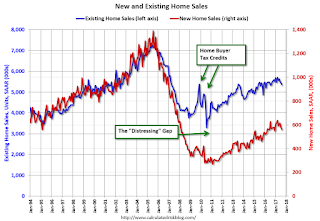

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.