by Calculated Risk on 9/08/2017 02:25:00 PM

Friday, September 08, 2017

Q3 GDP Forecasts

From Merrill Lynch:

Hurricane Harvey may end up being the most expensive natural disaster in history. We expect to see the impact of Harvey in upcoming economic releases, including jobless claims, manufacturing and consumer-related data. Factoring in Harvey, we take down our 3Q GDP tracker by 0.4pp to 2.5%. Hurricane Irma may be an additional drag.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 3.0 percent on September 8, up from 2.9 percent on September 6. The forecast of the contribution of inventory investment to third-quarter real GDP growth increased from 0.87 percentage points to 0.94 percentage points after this morning's wholesale trade report from the U.S. Census Bureau.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.1% for 2017:Q3 and 2.6% for 2017:Q4.CR Note: Looks like real GDP growth will probably be in the 2s in Q3.

Hotel Occupancy and Hurricanes Harvey and Irma

by Calculated Risk on 9/08/2017 11:31:00 AM

Note: Hotel occupancy rates increased noticeably following Hurricanes Katrina and Rita in 2005. I expect the overall occupancy rate will also increase following Hurricanes Harvey and Irma - and stay elevated for several months.

The hurricanes reduce supply (damaged hotels), and increase demand (damaged homes and apartments). This increases the overall occupancy rate. The impact from the hurricanes might even push 2017 to a new occupancy rate record.

From HotelNewsNow.com: STR: US hotel results for week ending 2 September

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 27 August through 2 September 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 August through 3 September 2016, the industry recorded the following:

• Occupancy: +2.2% to 65.9%

• Average daily rate (ADR): +2.1% to US$121.76

• Revenue per available room (RevPAR): +4.3% to US$80.22

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+23.4% to 69.1%) and RevPAR (+29.8% to US$70.13). ADR in the market rose 5.2% to US$101.44. STR will release a detailed analysis on Hurricane Harvey’s impact on hotel performance early next week.

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate to date is slightly ahead of last year, and behind the record year in 2015.

Seasonally, the occupancy rate has peaked and will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Black Knight: Hurricane Harvey Could Result in 300,000 New Mortgage Delinquencies

by Calculated Risk on 9/08/2017 09:28:00 AM

From Black Knight: Black Knight: Hurricane Harvey Could Result in 300,000 New Mortgage Delinquencies, with 160,000 Borrowers Becoming Seriously Past Due

• FEMA-designated disaster areas related to Hurricane Harvey are home to 1.18 million mortgaged properties

• Harvey-related disaster areas contain over twice as many mortgaged properties as those connected to Hurricane Katrina in 2005, carrying nearly four times the unpaid principal balance

• Post-Katrina mortgage delinquencies in Louisiana and Mississippi FEMA-designated disaster areas soared 25 percentage points, peaking at over 34 percent

• A similar impact to Harvey-related disaster areas would equate to 300,000 borrowers missing at least one mortgage payment, and 160,000 becoming 90 or more days past due

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released an updated assessment of the potential mortgage-related impact from Hurricane Harvey. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, using post-Katrina Louisiana and Mississippi as benchmarks presents the possibility for significant rises in both early and long-term delinquencies.

“Although the situation around Hurricane Harvey continues to evolve, millions of American lives have already been impacted by the storm and immense flooding,” said Graboske. “For many, their struggles are just beginning. Using post-Hurricane Katrina as a model, Black Knight has found that as many as 300,000 homeowners with mortgages in FEMA-designated Harvey disaster areas could become past due over the next few months. Post-Katrina, delinquencies spiked in Louisiana and Mississippi disaster areas, jumping 25 percent to peak at 34 percent of all mortgaged properties being past due. The serious delinquency rate – tracking mortgages 90 or more days past due, but not yet in foreclosure – rose to more than 16 percent. New Orleans was hardest hit, with its delinquency jumping by 46 percentage points to nearly 55 percent, and the serious delinquency rate increasing by 24 percent

Thursday, September 07, 2017

Mortgage Rates at 2017 Lows

by Calculated Risk on 9/07/2017 07:06:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed at 2017 Lows

Mortgage rates didn't move much today, despite plenty of strength in underlying bond markets. This would normally coincide with lower rates, so what's the deal?

The main issue is timing. Bond markets weakened yesterday afternoon. This would imply higher rates, but most lenders never went to the trouble of adjusting rate sheets intraday. As I said yesterday, those lenders would begin today at a disadvantage. Indeed they did, and that disadvantage was generally erased by the improvement in bond markets. Thus, lenders who didn't move rates higher yesterday were able to keep today's rates relatively unchanged, thanks to bond market gains. Lenders who DID raise rates yesterday were able to offer slightly lower rates today.

All in all, the average lender is quoting the lowest rates of 2017, with more than a few lenders at 3.75% on a top tier conventional 30yr fixed scenario. Most lenders are able to quote 3.875% now, though a few remain at 4.0%.

emphasis added

AAR: Rail Traffic decreased slightly in August

by Calculated Risk on 9/07/2017 04:15:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

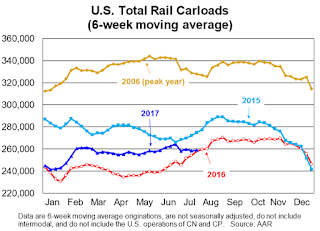

August 2017 U.S. rail traffic was like a glass that’s either half full or half empty, depending on your point of view. Total U.S. rail carloads were down 0.3% (4,571 carloads) from August 2016, thanks mainly to big declines in carloads of grain (down 24,565 carloads, or 20.4%), motor vehicles and parts (down 10,321 carloads, or 11.2%), and petroleum and petroleum products (down 8,362 carloads, or 15.8%). ... On the other hand, carloads of coal were up 25,926 (5.8%) in August, and carloads of crushed stone, gravel, and sand had their best month ever, with carloads up 14,506, or 12.1%, over last August, thanks mainly to booming frac sand shipments. August 2017 was also the best month ever for intermodal: U.S. railroads originated an average of 280,216 containers and trailers per week, more than in any month in history. Year-to-date total U.S. rail carloads were up 4.5% through August; year-to-date intermodal volume was up 3.4% through August.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,343,405 carloads in August 2017, down 4,571 carloads (0.3%) from August 2016 and the second straight small year-over year monthly decline. (Carloads fell 0.6% in July — see the top right chart below). Average weekly total carloads in August 2017 were 268,681, the fewest for August since sometime prior to 1988, when our records begin, but the most for any month since August 2016

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,401,081 intermodal containers and trailers in August 2017, up 5.6%, or 73,790 units, over August 2016. Weekly average intermodal originations of 280,216 in August 2017 were the highest for any month in history for U.S. railroads, breaking the previous record set in June 2015

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 9/07/2017 11:36:00 AM

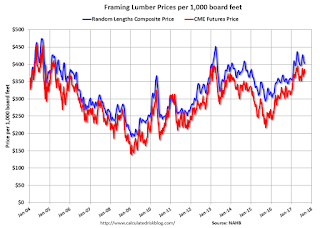

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early Sept 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might approach or exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 15% from a year ago, and CME futures are up about 25% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Goldman: Demographics and Inflation

by Calculated Risk on 9/07/2017 11:17:00 AM

I've been writing about the possible impact of demographics on inflation. As an example, in Demographics, Unemployment Rate and Inflation, I noted that in a period with somewhat similar demographics as today, inflation didn't pick up until the unemployment rate fell below 4%.

However, Goldman Sachs economists think the demographic impact is minimal. Here are a few excerpts from a research piece by Goldman Sachs economist David Mericle: Inflation and Demographics

The combination of low unemployment and low inflation has led many market participants to search for disinflationary structural forces that might be at work. Today’s note explores one often-cited explanation: demographics.

Demographic trends could influence inflation via their impact on growth, the dependency ratio, or inflation expectations. Other researchers have found that faster population growth is associated with higher inflation in cross-country studies; using US city data, we find a very small positive effect that arises only via the shelter component. Researchers have found mixed results on the effect of the dependency ratio, and we do not find a statistically significant effect.

Overall, our results imply a small and very gradual drag from demographics of about 0.05pp relative to the effect in 1980. While demographic effects via lower inflation expectations are intriguing and more difficult to test, any such effect would be very gradual and—with the expectations of all age groups still above 2%—not inconsistent with returning inflation to target.

Weekly Initial Unemployment Claims increase to 298,000

by Calculated Risk on 9/07/2017 08:34:00 AM

The DOL reported:

In the week ending September 2, the advance figure for seasonally adjusted initial claims was 298,000, an increase of 62,000 from the previous week's unrevised level of 236,000. This is the highest level for initial claims since April 18, 2015 when it was 298,000. The 4-week moving average was 250,250, an increase of 13,500 from the previous week's unrevised average of 236,750.The previous week was unrevised.

Hurricane Harvey impacted this week's initial claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 250,250.

This was above the consensus forecast, but an increase was expected due to Hurricane Harvey.

Note: Claims will probably increase further over the next few weeks due to Hurricane Harvey and possibly due to Hurricane Irma.

Wednesday, September 06, 2017

Thursday: Unemployment Claims

by Calculated Risk on 9/06/2017 07:46:00 PM

From Noah Smith at Bloomberg: Don't Believe What Jeff Sessions Said About Jobs

While announcing President Donald Trump’s decision to end the Deferred Action for Child Arrivals program, which protects undocumented immigrants from deportation if they arrived as children, Attorney General Jeff Sessions made a startling and blatantly incorrect claim:The Lump of Labor fallacy is frequently heard. I wrote this in 2010: Older Workers and the Lump of Labor Fallacy

"[The DACA program] denied jobs to hundreds of thousands of Americans by allowing those same jobs to go to illegal aliens."Hundreds of thousands? How did Sessions arrive at this number? It appears that he simply counted the number of adult Dreamers (as the program’s beneficiaries are known) and assumed that each one of them had denied a job to an American.

That’s terrible economics. It’s a classic application of a well-known fallacy called the Lump of Labor -- the idea that there are a fixed number of jobs in the world, and those jobs get divvied up among people.

Unfortunately Span concluded:Thursday:

So to that Wisconsin reader who grumped, “Too many older people (professors, Morley Safer, etc.) continue to work for selfish reasons, thereby taking jobs from the young and unemployed” — I’m afraid you ain’t seen nothin’ yet.That is a classic lump of labor fallacy. This is a common error people make with immigration - that immigrants displace other workers, when in fact immigration increases the size of the economy. I suspect we will see more and more of this age related "lump of labor" fallacy. The number of jobs in the economy is not fixed, and people staying in the work force just means the economy will be larger.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 236 thousand the previous week.

• At 10:00 AM, The Q2 Quarterly Services Report from the Census Bureau.

Fed's Beige Book: "Modest to moderate"expansion, Labor markets "Tight"

by Calculated Risk on 9/06/2017 02:57:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Chicago based on information collected on or before August 28, 2017. The information included in the District reports was primarily collected before Hurricane Harvey made landfall on the Gulf Coast. However, some Districts received preliminary information from business contacts regarding the impact of the storm, which is compiled in a special paragraph in the national summary. "

Economic activity expanded at a modest to moderate pace across all twelve Federal Reserve Districts in July and August. Consumer spending increased in most Districts, with gains reported for nonauto retail sales and tourism, but mixed results for vehicle sales. Capital spending also increased in several Districts. Manufacturing activity expanded modestly on balance. That said, reports were mixed regarding auto production, and contacts in many Districts expressed concerns about a prolonged slowdown in the auto industry. Both residential and commercial construction increased slightly overall. Low inventories of homes for sale continued to weigh on residential real estate activity across the country, while commercial real estate activity increased slightly. Activity in the energy and natural resources sector was generally positive prior to shutdowns arising from Hurricane Harvey. Agricultural conditions were mixed overall, with drought conditions reported in multiple Districts. Business and consumer loan demand grew at a modest pace in most Districts, with a number of banks reporting rising competition from both other banks and non-bank lenders.And on Hurricane Harvey:

...

Employment growth slowed some on balance, ranging from a slight to a modest rate in most Districts. Labor markets were widely characterized as tight. There were reports of worker shortages in numerous industries, most notably in manufacturing and construction. Firms in the Atlanta, St. Louis, and Minneapolis Districts said that they had turned down business because they could not find the necessary workers. Many Districts indicated that businesses were having difficulty filling openings at all skill levels. In spite of the tight labor market, the majority of Districts reported limited wage pressures and modest to moderate wage growth. That said, there were reports from firms in the Dallas and San Francisco Districts that labor shortages were pushing up wages.

emphasis added

Hurricane Harvey created broad disruptions to economic activity along the Gulf Coast in the Dallas and Atlanta Districts, although it was too soon to gauge the full extent of the impact. Many firms and organizations in the affected areas closed due to flooding. A fifth of the oil and natural gas production in the Gulf of Mexico was offline, and many onshore producers in the Eagle Ford region temporarily stopped production. Harvey also affected fuel and petrochemical production, forcing fifteen refineries in the region to shut down temporarily and several others to operate at reduced capacity. Some areas experienced gasoline shortages, and supply was expected to remain tight in the Southeastern United States because of pipeline disruptions. Contacts in the Richmond District indicated that spot freight prices jumped after the storm, as freight was being redirected around the country. The Port of Charleston expected increased volumes in coming weeks as freight traffic is routed away from the Port of Houston.