by Calculated Risk on 8/24/2017 11:30:00 AM

Thursday, August 24, 2017

MBA: Mortgage Delinquency Rate in Q2 at Lowest Level Since 2000

From the MBA: Delinquencies and Foreclosures Continue to Decline in Q2 2017

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.24 percent of all loans outstanding at the end of the second quarter of 2017. The delinquency rate was down 47 basis points from the previous quarter, and was 42 basis points lower than one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the second quarter was 0.26 percent, a decrease of four basis points from the previous quarter, and six basis points lower than one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 1.29 percent, down 10 basis points from the previous quarter and 35 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.49 percent in the second quarter, down 27 basis points from the previous quarter and 62 basis points lower than one year ago.

Mortgage delinquencies decreased in the second quarter of 2017 across all loan types - conventional, FHA and VA - on a seasonally-adjusted basis. The conventional delinquency rate dropped to 3.47 percent from 4.04 percent in the first quarter, reaching its lowest level since 2005. The FHA delinquency rate decreased to 7.94 percent from 8.09 percent in the first quarter, reaching its lowest level since 1996. The VA delinquency rate dropped to 3.72 percent from 3.90 percent in the first quarter, reaching its lowest level since 1979.

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey results:

"In the second quarter of 2017, the overall delinquency rate was at its lowest level since the second quarter of 2000. The foreclosure inventory rate was at its lowest level since the first quarter of 2007. In addition, the seriously delinquent rate, which combines loans that are 90 days or more past due with those loans in the process of foreclosure, dropped to a ten-year low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the overall delinquency rate is the lowest since 2000.

The percent of loans 30 and 60 days delinquent decreased in Q2, and is below the normal historical level.

The 90 day bucket decreased in Q2, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

Kansas City Fed: Regional Manufacturing Activity "Expanded Moderately" in August

by Calculated Risk on 8/24/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Moderately

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a faster pace and expectations remained solid.The Kansas City region was hit hard by the sharp decline in oil prices, but activity started expanding last year when oil prices increased. Now growth is moderate with oil prices mostly moving sideways.

“Factories reported acceleration in activity in August to the fastest pace since March,” said Wilkerson. “Many firms also reported plans to raise finished goods prices in coming months.”

...

The month-over-month composite index was 16 in [August], up from 10 in July and 11 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased solidly at durable goods plants, particularly for electronics, metals, and aircraft products, while nondurable goods activity rose more modestly. Most month-over-month indexes increased over the previous month. The production index jumped from 4 to 22, and shipments, new orders, and order backlog indexes rebounded strongly after falling last month. The employment index has remained basically unchanged for the past three months, while the new orders for exports index edged higher. The finished goods inventory index fell from 7 to 2, while the raw materials inventory index was unchanged.

emphasis added

NAR: "Existing-Home Sales Slide 1.3 Percent in July"

by Calculated Risk on 8/24/2017 10:13:00 AM

From the NAR: Existing-Home Sales Slide 1.3 Percent in July

Listings in July typically went under contract in under 30 days for the fourth consecutive month because of high buyer demand, but existing-home sales ultimately pulled back as large declines in the Northeast and Midwest outweighed sales increases in the South and West, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 1.3 percent to a seasonally adjusted annual rate of 5.44 million in July from a downwardly revised 5.51 million in June. July’s sales pace is still 2.1 percent above a year ago, but is the lowest of 2017.

...

Total housing inventory at the end of July declined 1.0 percent to 1.92 million existing homes available for sale, and is now 9.0 percent lower than a year ago (2.11 million) and has fallen year-over-year for 26 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.8 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.44 million SAAR) were 1.3% lower than last month, and were 2.1% above the July 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.92 million in July from 1.94 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.92 million in July from 1.94 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 9.0% year-over-year in July compared to July 2016.

Inventory decreased 9.0% year-over-year in July compared to July 2016. Months of supply was at 4.2 months in July.

As expected, sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 8/24/2017 08:32:00 AM

The DOL reported:

In the week ending August 19, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 2,000 from the previous week's unrevised level of 232,000. The 4-week moving average was 237,750, a decrease of 2,750 from the previous week's unrevised average of 240,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 237,750.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 23, 2017

Thursday: Existing Home Sales, Unemployment Claims, Jackson Hole Economic Symposium

by Calculated Risk on 8/23/2017 08:50:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 232 thousand the previous week.

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.52 million in June. Take the under!

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

• Three days (Thursday, Friday and Saturday): The 2017 Jackson Hole Economic Symposium, "Fostering a Dynamic Global Economy, will take place Aug. 24-26, 2017. (The program will be available at 6 p.m., MT, Aug. 24, 2017)."

Philly Fed: State Coincident Indexes increased in 33 states in July

by Calculated Risk on 8/23/2017 05:32:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2017. Over the past three months, the indexes increased in 41 states and decreased in nine, for a three-month diffusion index of 64. In the past month, the indexes increased in 33 states, decreased in 15, and remained stable in two, for a one-month diffusion index of 36.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In July, 34 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the recent sharp decrease in the number of states with increasing activity is unclear - and might be revised away.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

A few Comments on July New Home Sales

by Calculated Risk on 8/23/2017 02:44:00 PM

New home sales for July were reported at 571,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, however the three previous months were revised up sharply. Overall this was decent report.

Sales were down 8.9% year-over-year in July.

Earlier: New Home Sales decrease to 571,000 Annual Rate in July.

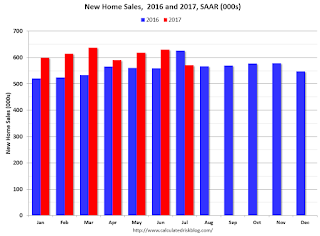

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were down 8.9% year-over-year in July.

Note that sales in July 2016 were strong, so this was a difficult year-over-year comparison.

For the first seven months of 2017, new home sales are up 9.2% compared to the same period in 2016.

This was a strong year-over-year increase through July.

AIA: Architecture Billings Index "growth moderates" in July

by Calculated Risk on 8/23/2017 11:47:00 AM

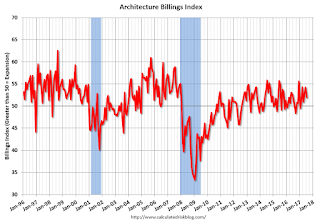

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index growth moderates

For the sixth consecutive month, architecture firms reported increasing demand for design services as reflected in the July Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 51.9, down from a score of 54.2 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.5, up from a reading of 58.6 the previous month, while the new design contracts index increased from 53.7 to 56.4.

“The July figures show the continuation of healthy trends in the construction sector of our economy,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In addition to the balanced increases in design billings across all major regions and construction sectors, the strong gains in new project work coming into architecture firms points to future growth in design and construction activity over coming quarters.”

...

• Regional averages: South (53.8), Midwest (53.8), Northeast (53.6), West (50.9)

• Sector index breakdown: multi-family residential (55.8), commercial / industrial (55.4), institutional (52.0), mixed practice (48.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in July, up from 54.2 the previous month. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

New Home Sales decrease to 571,000 Annual Rate in July

by Calculated Risk on 8/23/2017 10:12:00 AM

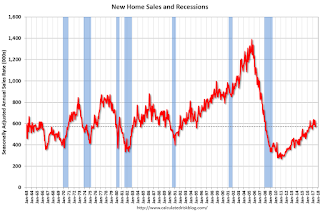

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 571 thousand.

The previous three months were revised up solidly.

"Sales of new single-family houses in July 2017 were at a seasonally adjusted annual rate of 571,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.4 percent below the revised June rate of 630,000 and is 8.9 percent below the July 2016 estimate of 627,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 5.8 months from 5.2 month in June.

The months of supply increased in July to 5.8 months from 5.2 month in June. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of July was 276,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2017 (red column), 49 thousand new homes were sold (NSA). Last year, 54 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for June was 26 thousand in 2010.

This was below expectations of 610,000 sales SAAR, however the previous months were revised up solidly. I'll have more later today.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/23/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

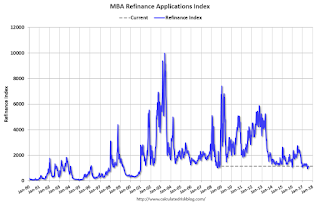

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 18, 2017.

... The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged from the week prior at 4.12 percent, with points increasing to 0.39 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.