by Calculated Risk on 8/10/2017 03:33:00 PM

Thursday, August 10, 2017

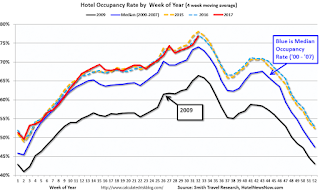

Hotels: Occupancy Rate Down Year-over-Year

From HotelNewsNow.com: STR: US hotel results for week ending 5 August

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 30 July through 5 August 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 31 July through 6 August 2016, the industry recorded the following:

• Occupancy: -1.5% to 74.5%

• Average daily rate (ADR): +0.7% to US$129.00

• Revenue per available room (RevPAR): -0.8% to US$96.08

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and behind the record year in 2015.

Seasonally, the occupancy rate will remain strong over the next few weeks and then decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Fannie and Freddie: REO inventory declined in Q2, Down 30% Year-over-year

by Calculated Risk on 8/10/2017 11:33:00 AM

Fannie and Freddie reported results last week. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 9,915 at the end of Q2 2017 compared to 13,284 at the end of Q2 2016.

For Freddie, this is down 87% from the 74,897 peak number of REOs in Q3 2010. For Freddie, this is the lowest since at least 2007.

Fannie Mae reported the number of REO declined to 31,371 at the end of Q2 2017 compared to 45,981 at the end of Q2 2016.

For Fannie, this is down 81% from the 166,787 peak number of REOs in Q3 2010. For Fannie, this is the lowest since at least 2007.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 for both Fannie and Freddie, and combined inventory is down 30% year-over-year.

There are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is close to normal levels of REOs.

Weekly Initial Unemployment Claims increase to 244,000

by Calculated Risk on 8/10/2017 08:33:00 AM

The DOL reported:

In the week ending August 5, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 240,000 to 241,000. The 4-week moving average was 241,000, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 241,750 to 242,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,000.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 09, 2017

Thursday: Unemployment Claims, PPI

by Calculated Risk on 8/09/2017 06:38:00 PM

From Matthew Graham at Mortgage News Daily: New 2017 Lows for Rates, But There's a Catch

Mortgage rates fell to new lows for the year today, following the North Korea nuclear threat headlines. In truth, the preceding sentence gives too much credit to geopolitical risk. Rates were already drifting very close to the lowest levels since the election, even before yesterday's news broke. Additionally, the improvements are still too small to be translating to NOTE rates themselves (the actual interest rate applied to your loan balance). Instead, it's the upfront costs that are allowing for fine-tuning adjustments. (This means the EFFECTIVE rate is changing, but not the NOTE rate.) [30YR FIXED - 4.00%]Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, up from 240 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for July from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 8/09/2017 01:30:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up solidly year-over-year and once again approaching the housing bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through June 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 16% from a year ago, and CME futures are up about 19% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Goldman on the "Debt Limit"

by Calculated Risk on 8/09/2017 09:34:00 AM

A few brief excerpts from some analysis by Goldman Sachs economists:

The Treasury projects that the debt limit will need to be raised by September 29, and we expect Congress to take at least that long to raise it.CR note: I'll have much more on the "debt limit" as the deadline approaches. I've written about this nonsense before, from 2011:

...

What happens if Congress does not raise it in time?

Scheduled federal payments would be delayed and financial markets would be disrupted. The primary consequence of a failure to raise the debt limit before October 2 would be a likely failure to make some payments on that day or soon thereafter. This could include, for example, the main monthly payment to Social Security beneficiaries, which occurs on the 3rd of every month. All told, the decline in federal payments that would be necessary to avoid breaching the debt limit would be roughly equal to the budget deficit, resulting in a temporary fiscal contraction of 3-4% of GDP for the period the debt limit is binding. A sharp decline like this would likely be disruptive to financial markets and could have consequences for the real economy, which is why Congress has managed to avoid such an outcome in the past.

Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills".And here from 2014:

There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. That is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but in a few months, not "paying the bills" will ripple through the entire economy.

...

The only smart vote would be to eliminate the debt ceiling vote in the future, and let the annual budget process automatically set the debt limit. But then there wouldn't be as much camera time ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 8/09/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 4, 2017.

... The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 0.3 percent compared with the previous week and was 7 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.14 percent from 4.17 percent, with points increasing to 0.38 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 7% year-over-year.

Tuesday, August 08, 2017

Leading Index for Commercial Real Estate "Stumbles" in July

by Calculated Risk on 8/08/2017 05:18:00 PM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Stumbles in July

The Dodge Momentum Index fell in July, dropping 3.3% to 135.0 (2000=100) from its revised June reading of 139.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move lower in July was due to a 6.6% decline in the institutional component of the Momentum Index, while the commercial component fell 1.1%.This month continues a recent trend of volatility in the Momentum Index where a string of gains is interrupted by a step backwards in planning intentions. Despite the decline from June to July, the Momentum Index is 6.9% higher than one year ago, which suggests further moderate gains in construction activity throughout the year. The commercial component of the Momentum Index is 8.0% higher than last year, while the Institutional component is 5.3% higher.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 135.0 in July, down from 139.6 in June.

The index is still up 6.9% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

Corelogic: "May 2017 Delinquency Rate Lowest in Nearly a Decade"

by Calculated Risk on 8/08/2017 01:00:00 PM

From Corelogic: May 2017 Delinquency Rate Lowest in Nearly a Decade

CoreLogic® ... today released its monthly Loan Performance Insights Report which shows that, nationally, 4.5 percent of mortgages were in some stage of delinquency (30 days or more past due including those in foreclosure) in May 2017. This represents a 0.8 percentage point decline in the overall delinquency rate compared with May 2016 when it was 5.3 percent.

As of May 2017, the foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.7 percent compared with 1 percent in May 2016. The serious delinquency rate, defined as 90 days or more past due including loans in foreclosure, was 2 percent, unchanged from April 2017 and down from 2.6 percent in May 2016. The 2 percent serious delinquency rate in April and May this year was the lowest since November 2007 when it was also 2 percent.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies, defined as 30-59 days past due, was 1.9 percent in May 2017, down from 2 percent in May 2016. The share of mortgages that were 60-89 days past due in May 2017 was 0.63 percent, down slightly from 0.66 percent in May 2016.

“Strong employment growth and home price increases have contributed to improved mortgage performance,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Early-stage delinquencies are hovering around 17-year lows, and the current-to-30-day past due transition rate remained low at 0.8 percent. However, the same positive economic conditions helping performance have also contributed to a lack of affordable supply, creating challenges for homebuyers.”

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30-days past due was 0.8 percent in May 2017 compared with 0.9 percent in May 2016, a 0.1 percentage point decrease year over year. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent and it peaked in November 2008 at 2 percent.

“A prolonged period of relatively tight underwriting criteria has driven delinquencies down to pre-crisis levels across many parts of the country,” said Frank Martell, president and CEO of CoreLogic. “As pressure to relax underwriting standards increases, the industry needs to proceed carefully and take progressive, sensible actions that protect hard-fought improvements in mortgage performance.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Corelogic compares the delinquency rate by bucket for May 2016 (red) and May 2017 (blue).

BLS: Job Openings Increased in June

by Calculated Risk on 8/08/2017 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 6.2 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.4 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.1 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.1 million in June. The quits rate was 2.1 percent. The number of quits was little changed for total private and for government. Quits decreased in finance and insurance (-21,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 6.163 million from 5.702 in May. This is the highest number of job openings since this series started in December 2000.

The number of job openings (yellow) are up 11% year-over-year.

Quits are up 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing. This is another strong report.