by Calculated Risk on 7/16/2017 09:10:00 AM

Sunday, July 16, 2017

Sacramento Housing in June: Sales up Slightly, Active Inventory down 18% YoY

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggested healing in the Sacramento market and other distressed markets showed similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June, total sales were up 0.5% from June 2016, and conventional equity sales were up 2.5% compared to the same month last year.

In June, 4.2% of all resales were distressed sales. This was down from 4.7% last month, and down from 7.0% in May 2016.

The percentage of REOs was at 1.6%, and the percentage of short sales was 1.6%.

Sacramento Realtor Press Release: Most monthly sales since July 2009, median price continues to increase

June showed a 5.4% increase in sale from May, up to 1,824 sales from 1,731. This is the most monthly sales since July 2009, when that month closed with 1,848. Compared with 2016, current number is also an increase, rising .5% from the 1,815 sales of June 2016.Here are the statistics.

...

Total Active Listing Inventory increased 8.8% from 1,935 to 2,105 for the month, but is a 18.3% drop from the 2,577 inventory of June last year. The Months of Inventory increased slightly for the month from 1.1 Months to 1.2MMonths. A year ago the Months of inventory was 1.4. Listings published for the month decreased .3% from 2,385 to 2,377. “Listings published” signifies all listings that came on the market for the current month. Of the 2,385 listings that came on the market for the month of June, 870 were still listed as active, 1,203 are currently pending sales, 177 were already sold and 127 are either off the market, expired or other.

The Average DOM (days on market) for homes sold dropped from 20 to 18 days.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 18.3% year-over-year (YoY) in June. This was the 26th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.3% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Saturday, July 15, 2017

Schedule for Week of July 16, 2017

by Calculated Risk on 7/15/2017 08:11:00 AM

The key economic report this week is June Housing Starts on Wednesday.

For manufacturing, the July New York and Philly Fed manufacturing surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 15.0, down from 19.8.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 68, up from 67 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for June. The consensus is for 1.170 million SAAR, up from the May rate of 1.092 million.

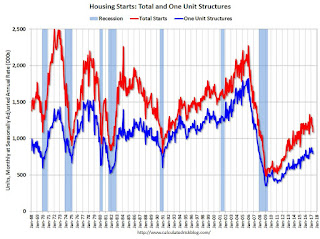

8:30 AM: Housing Starts for June. The consensus is for 1.170 million SAAR, up from the May rate of 1.092 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 247 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 23.5, down from 27.6.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for June 2017

Friday, July 14, 2017

Oil Rigs: "Winter is coming"

by Calculated Risk on 7/14/2017 06:13:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 14, 2017:

• Total US oil rigs were up 2 to 765

• Horizontal oil rigs were down 2 to 655

...

• Conclusion: The Eagle Ford is visibly struggling, the Bakken has been adapting, the Permian is still in play, and a lot is going on off-radar in the ‘Other’ basins

• $45 WTI seems to be the lower limit for the US shale patch

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

First Look at 2018 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/14/2017 02:11:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 238.813 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2016, the Q3 average of CPI-W was 235.057.

This was the highest Q3 average, so we have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.5% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will be positive this year, and will probably be around 1% to 2% this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA (seems likely this year), the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2016 yet, but wages probably increased again in 2016. If wages increased the same as last year, then the contribution base next year will increase to around $131,500 from the current $127,200.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Q2 GDP Forecasts: Moving on Down

by Calculated Risk on 7/14/2017 11:49:00 AM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.4 percent on July 14, down from 2.6 percent on July 11. The forecast of second-quarter real personal consumption expenditures growth declined from 3.1 percent to 2.9 percent after this morning's retail sales report from the U.S. Census Bureau and this morning's Consumer Price Index release from the U.S. Bureau of Labor Statistics.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.9% for 2017:Q2 and 1.8% for 2017:Q3.From Merrill Lynch:

Core retail sales disappointed for a third straight month, declining 0.1% mom in June after no growth in May. Expectations were for a strong 0.3% acceleration. ... The industrial production report later in the day revealed no change in utilities production, was below our assumption and suggests weaker utilities consumption. On balance, these data sliced 0.3pp from 2Q GDP tracking, bringing us down to 1.9% qoq saar.CR Note: Looks like real GDP growth will be around 2% in Q2.

Key Measures Show Inflation mostly below 2% in June

by Calculated Risk on 7/14/2017 11:10:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.1% annualized rate) in June. The 16% trimmed-mean Consumer Price Index also rose 0.1% (0.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for June here. Motor fuel declined 29% in June annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (-0.3% annualized rate) in June. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.7%. Core PCE is for May and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 1.1% annualized, trimmed-mean CPI was at 0.9% annualized, and core CPI was at 1.4% annualized.

Using these measures, inflation was soft again in June. Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Industrial Production Increased 0.4% in June

by Calculated Risk on 7/14/2017 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.4 percent in June for its fifth consecutive monthly increase. Manufacturing output moved up 0.2 percent; although factory output has gone up and down in recent months, its level in June was little different from February. The index for mining posted a gain of 1.6 percent in June, just slightly below its pace in May. The index for utilities, however, remained unchanged. For the second quarter as a whole, industrial production advanced at an annual rate of 4.7 percent, primarily as a result of strong increases for mining and utilities. Manufacturing output rose at an annual rate of 1.4 percent, a slightly slower increase than in the first quarter. At 105.2 percent of its 2012 average, total industrial production in June was 2.0 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in June to 76.6 percent, a rate that is 3.3 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.6% is 3.3% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 105.2. This is 20.8% above the recession low, and is close to the pre-recession peak.

The increase was close to expectations, however the previous months were revised down.

Retail Sales decreased 0.2% in June

by Calculated Risk on 7/14/2017 08:38:00 AM

On a monthly basis, retail sales decreased 0.3 percent from May to June (seasonally adjusted), and sales were up 2.8 percent from June 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $473.5 billion, a decrease of 0.2 percent from the previous month, and 2.8 percent above June 2016. ... The April 2017 to May 2017 percent change was revised from down 0.3 percent to down 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.1% in June.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by3.2% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by3.2% on a YoY basis.The decrease in June was below expectations, although sales in May were revised up. A disappointing report.

Thursday, July 13, 2017

Friday: Retail Sales, CPI, Industrial Production

by Calculated Risk on 7/13/2017 06:13:00 PM

Note: I will be interviewed by Prashant Kothari of String on July 20th. Here is the registration information. It should be fun.

Friday:

• At 8:30 AM ET: Retail sales for June will be released. The consensus is for a 0.1% increase in retail sales.

• Also at 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for a 0.3% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 95.1, unchanged from 95.1 in June.

Hotels: Occupancy, RevPAR down Year-over-Year

by Calculated Risk on 7/13/2017 11:50:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 8 July

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 2-8 July 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 July 2016, the industry recorded the following:

• Occupancy: -3.0% to 65.3%

• Average daily rate (ADR): +1.1% to US$122.73

• Revenue per available room (RevPAR): -2.0% to US$80.11

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and slightly behind the record year in 2015.

For hotels, occupancy will be strong over the next couple of months.

Data Source: STR, Courtesy of HotelNewsNow.com