by Calculated Risk on 7/06/2017 04:51:00 PM

Thursday, July 06, 2017

Goldman Employment Preview

A few excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased by 180k in June, roughly in line with consensus of +177k ... Our forecast reflects mixed labor market fundamentals in the month – including solid employment surveys but weaker jobless claims – as well as a positive impact from youth summer hiring ...CR Note: My employment preview is here.

We estimate the unemployment rate remained stable at 4.3%, though we view the risks as skewed towards rounding up to 4.4% ... Finally, we expect average hourly earnings to increase 0.3% month over month, reflecting somewhat favorable calendar effects, and 2.6% year-over-year.

June Employment Preview

by Calculated Risk on 7/06/2017 01:45:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus, according to Bloomberg, is for an increase of 170,000 non-farm payroll jobs in June (with a range of estimates between 140,000 to 200,000), and for the unemployment rate to be unchanged at 4.3%.

The BLS reported 138,000 jobs added in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of 158,000 private sector payroll jobs in June. This was below expectations of 178,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index increased in June to 57.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 20,000 in June. The ADP report indicated 6,000 manufacturing jobs added in June.

The ISM non-manufacturing employment index decreased in June to 55.8%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 230,000 in June.

Combined, the ISM indexes suggests employment gains of about 250,000. This suggests employment growth above expectations.

• Initial weekly unemployment claims averaged 243,000 in June, up from 238,000 in May. For the BLS reference week (includes the 12th of the month), initial claims were at 242,000, up from 233,000 during the reference week in May.

The increase during the reference week suggests slightly more layoffs during the reference week in June than in May. This suggests a somewhat weaker employment report in June than in May.

• The final May University of Michigan consumer sentiment index decreased to 95.1 from the May reading of 97.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: None of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and weekly unemployment claims suggest below consensus job growth in June, although the ISM reports suggest stronger job growth.

Las Vegas Real Estate in June: Sales up 10% YoY, Inventory down Sharply

by Calculated Risk on 7/06/2017 11:59:00 AM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices and sales keep climbing amid tight supply, GLVAR Housing Statistics for June 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices and sales continued to climb as homes continue to sell faster amid a very tight housing supply.1) Overall sales were up 10% year-over-year.

...

By the end of June, GLVAR reported 5,174 single-family homes listed for sale without any sort of offer. While up 4.1 percent from May, that’s down 27.1 percent from one year ago. For condos and townhomes, the 639 properties listed without offers in June were up 1.4 percent from May, but still represented a 51.9 percent drop from one year ago.

Meanwhile, local home sales continue to increase. The total number of existing local homes, condos and townhomes sold in June was 4,368, up from 3,957 in June 2016. Compared to one year ago, sales were up 10.3 percent for homes and up 10.6 percent for condos and townhomes.

According to GLVAR, total sales so far in 2017 continue to outpace 2016, when 41,720 total properties were sold in Southern Nevada. That was more than the 38,577 properties sold during 2015. It was also more total sales than in 2014, but fewer than each year from 2009 through 2013.

...

For several years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in June, when 3.4 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That compares to 4.4 percent of all sales in June 2016. Another 2.9 percent of all June sales were bank-owned, down from 5.9 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago (A very sharp decline in condo inventory).

3) Fewer distressed sales.

ISM Non-Manufacturing Index increased to 57.4% in June

by Calculated Risk on 7/06/2017 10:07:00 AM

The June ISM Non-manufacturing index was at 57.4%, up from 56.9% in May. The employment index decreased in June to 55.8%, from 57.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 90th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 57.4 percent, which is 0.5 percentage point higher than the May reading of 56.9 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 60.8 percent, 0.1 percentage point higher than the May reading of 60.7 percent, reflecting growth for the 95th consecutive month, at a slightly faster rate in June. The New Orders Index registered 60.5 percent, 2.8 percentage points higher than the reading of 57.7 percent in May. The Employment Index decreased 2 percentage points in June to 55.8 percent from the May reading of 57.8 percent. The Prices Index increased 2.9 percentage points from the May reading of 49.2 percent to 52.1 percent, indicating prices increased in June after decreasing in May. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector continued to reflect strength for the month of June. The majority of respondents’ comments are positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slightly faster expansion in June than in May.

Trade Deficit at $46.5 Billion in May

by Calculated Risk on 7/06/2017 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $46.5 billion in May, down $1.1 billion from $47.6 billion in April, revised. May exports were $192.0 billion, $0.9 billion more than April exports. May imports were $238.5 billion, $0.2 billion less than April imports.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in May.

Exports are 16% above the pre-recession peak and up 5% compared to May 2016; imports are 3% above the pre-recession peak, and up 7% compared to May 2016.

In general, trade has been picking up.

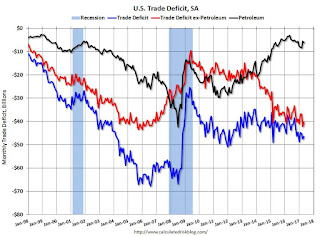

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.03 in May, down from $45.40 in April, and up from $34.19 in May 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $31.6 billion in May, from $29.0 billion in May 2016.

Weekly Initial Unemployment Claims increase to 248,000

by Calculated Risk on 7/06/2017 08:33:00 AM

The DOL reported:

In the week ending July 1, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 4,000 from the previous week's unrevised level of 244,000. The 4-week moving average was 243,000, an increase of 750 from the previous week's unrevised average of 242,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 243,000.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

ADP: Private Employment increased 158,000 in June

by Calculated Risk on 7/06/2017 08:20:00 AM

Private sector employment increased by 158,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 178,000 private sector jobs added in the ADP report.

...

“Despite a slight moderation in the month of June, the labor market remains strong,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “For the month of June, jobs were primarily created in the service-providing sector.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to power forward. Abstracting from the monthly ups and downs, job growth remains a stalwart between 150,000 and 200,000. At this pace, which is double the rate of labor force growth, the tight labor market will continue getting tighter.”

The BLS report for June will be released Friday, and the consensus is for 170,000 non-farm payroll jobs added in June.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/06/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

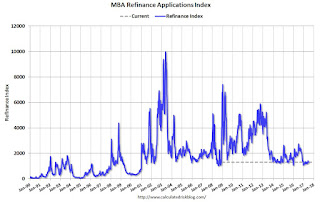

Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 30, 2017.

... The Refinance Index decreased 0.4 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to its highest level since May 2017, 4.20 percent, from 4.13 percent, with points decreasing to 0.31 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is mostly moving sideways at a low level this year, and will not increase significantly unless rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 6% year-over-year.

Wednesday, July 05, 2017

Thursday: Unemployment Claims, ADP Employment, Trade Deficit, ISM non-Mfg Survey

by Calculated Risk on 7/05/2017 07:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Finally Catch a Break

Mortgage rates had been rising at an uncomfortable pace since June 27th. As of Monday, the average conventional 30yr fixed rate quote was 0.125% higher in 5 business days. That's a fairly abrupt move--especially when compared with almost any other 5-day stretch. In any event, it was the biggest 5-day move seen since the Presidential election.Thursday:

...

Today was the first day that bond markets (which dictate rates) were able to fight back. [top tier scenarios 30YR FIXED - 4.125%]

emphasis added

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 178,000 payroll jobs added in June, down from 253,000 added in May.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, unchanged from 244 thousand the previous week.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to be at $46.2 billion in May from $47.6 billion in April.

• At 10:00 AM, the ISM non-Manufacturing Index for June. The consensus is for index to decrease to 56.5 from 56.9 in May.

FOMC Minutes: Inflation Discussions

by Calculated Risk on 7/05/2017 02:09:00 PM

From the Fed: Minutes of the Federal Open Market Committee, June 13-14, 2017. Excerpts:

With regard to the outlook for inflation, some participants emphasized downside risks, particularly in light of the recent low readings on inflation along with measures of inflation compensation and some survey measures of inflation expectations that were still low. However, a couple of participants expressed concern that a substantial undershooting of the longer-run normal rate of unemployment could pose an appreciable upside risk to inflation or give rise to macroeconomic or financial imbalances that eventually could lead to a significant economic downturn. Participants agreed that the Committee should continue to monitor inflation developments closely.

...

Several participants endorsed a policy approach, such as that embedded in many participants' projections, in which the unemployment rate would undershoot their current estimates of the longer-term normal rate for a sustained period. They noted that the longer-run normal rate of unemployment is difficult to measure and that recent evidence suggested resource pressures generated only modest responses of nominal wage growth and inflation. Against this backdrop, possible benefits cited by policymakers of a period of tight labor markets included a further rise in nominal wage growth that would bolster inflation expectations and help push the inflation rate closer to the Committee's 2 percent longer-run goal, as well as a stimulus to labor market participation and business fixed investment. It was also suggested that the symmetry of the Committee's inflation goal might be underscored if inflation modestly exceeded 2 percent for a time, as such an outcome would follow a long period in which inflation had undershot the 2 percent longer-term objective. Several participants expressed concern that a substantial and sustained unemployment undershooting might make the economy more likely to experience financial instability or could lead to a sharp rise in inflation that would require a rapid policy tightening that, in turn, could raise the risk of an economic downturn. However, other participants noted that if a sharp rise in inflation or inflation expectations did occur, the Committee could readily respond using conventional monetary policy tools.

emphasis added