by Calculated Risk on 6/20/2017 11:52:00 AM

Tuesday, June 20, 2017

Chemical Activity Barometer "flat" in June

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Remains Steady

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), was flat in June following a 0.2 percent gain in May, and a 0.3 percent gain in April. This marks a slowing from the average 0.5 percent first quarter monthly gain. Compared to a year earlier, the CAB is up 4.3 percent year-over-year, a modest yet continued slowing. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Oil Prices Lower, Down Year-over-year

by Calculated Risk on 6/20/2017 09:57:00 AM

From CNBC: Oil prices are tumbling more than 2% to $43 a barrel right now

U.S. West Texas Intermediate crude oil futures were last down $1.19, or 2.7 percent, at $43.01.

Click on graph for larger image

Click on graph for larger imageThe first graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $42.87 per barrel today, and Brent is at $45.69.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Prices then rebounded to over $50 per barrel, but have been falling recently.

The second graph shows the year-over-year change in WTI based on data from the EIA.

The second graph shows the year-over-year change in WTI based on data from the EIA.Six times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Currently WTI is down about 12% year-over-year.

Monday, June 19, 2017

Lawler: Single-Family Housing Production ‘Shortfall” All In Modestly Sized, Modestly Price Segment

by Calculated Risk on 6/19/2017 07:59:00 PM

A short note from housing economist Tom Lawler: Single-Family Housing Production ‘Shortfall” All In Modestly Sized, Modestly Price Segment

The number of US single-family homes completed last year that had at least 3,000 square feet of floor area (222,000). was higher than any year in the 20th Century save for the year 2000, when 224,000 of such really large homes were completed.

LEHC Estimates Based on Latest and Historical Census “Annual Characteristics of Housing”

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/19/2017 01:58:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.65 million in May, up 1.4% from April’s preliminary pace and up 3.3% from last May’s seasonally adjusted pace. Unadjusted sales last month should show a larger YOY gain than seasonally adjusted sales. Local realtor/MLS data also suggest that existing home sales this May show a larger monthly increase than last May, and I project that the NAR’s estimate of the inventory of existing homes for sale in May will be 1.98 million, up 2.6% from April’s estimate and down 7.5% from last May. Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price in May will be up by about 6.5% from last May.

CR Note: The NAR is scheduled to release existing home sales for May on Wednesday, June 21st. The consensus forecast is for sales of 5.55 million SAAR (take the over).

Hotels: Hotel Occupancy down Year-over-Year

by Calculated Risk on 6/19/2017 11:27:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 10 June

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 4-10 June 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 5-11 June 2016, the industry recorded the following:

• Occupancy: -0.8% to 73.0%

• Average daily rate (ADR): +1.5% to US$128.37

• Revenue per available room (RevPAR): +0.7% to US$93.73

emphasis added

The red line is for 2017, dashed is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dashed is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and just behind the record year in 2015.

For hotels, occupancy will increase further during the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Q2 GDP Forecasts being Revised Down

by Calculated Risk on 6/19/2017 09:34:00 AM

From Merrill Lynch:

Housing starts were a big disappointment in May, plunging 5.5% to 1,092k saar from 1,156k in April. ... Feeding the data into our tracking model sliced 0.1pp from our 2Q estimate, leaving us at 2.2% qoq saar.From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.9 percent on June 16, down from 3.2 percent on June 14. The forecast for second-quarter real residential investment growth decreased from 1.8 percent to 0.4 percent after this morning's housing starts release from the U.S. Census Bureau.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.9% for 2017:Q2 and 1.5% for 2017:Q3.

Sunday, June 18, 2017

Sunday Night Futures

by Calculated Risk on 6/18/2017 09:16:00 PM

Weekend:

• Schedule for Week of June 18, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 6 and DOW futures are up 40 (fair value).

Oil prices were down over the last week with WTI futures at $44.84 per barrel and Brent at $47.13 per barrel. A year ago, WTI was at $49, and Brent was at $50 - so oil prices are DOWN year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $2.35 per gallon - so gasoline prices are down year-over-year.

Saturday, June 17, 2017

Schedule for Week of June 18, 2017

by Calculated Risk on 6/17/2017 08:09:00 AM

The key economic reports this week are New and Existing Home sales for May.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

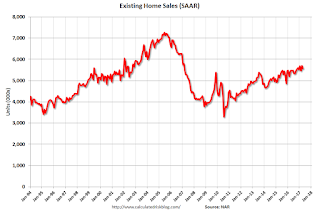

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.57 million in April.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.57 million in April.The graph shows existing home sales from 1994 through the report last month.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 237 thousand the previous week.

9:00 AM: FHFA House Price Index for April 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

11:00 AM: the Kansas City Fed manufacturing survey for June.

10:00 AM ET: New Home Sales for May from the Census Bureau.

10:00 AM ET: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 569 thousand in April.

Friday, June 16, 2017

Oil Rigs: "Smallest four week add since last year"

by Calculated Risk on 6/16/2017 08:25:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 16, 2017:

• The party’s over. Oil prices are beginning to weigh on drilling activity.

• Total US oil rigs were up 6 to 747

• However, only 1 new horizontal oil rig was added, and only 3 in the last two weeks

• On a 4 wma basis, this is the smallest gain since last October

• $45 / barrel WTI appears to be a pain point for US shales

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: Reasonable Population Projections Are Important!

by Calculated Risk on 6/16/2017 03:48:00 PM

From housing economist Tom Lawler: Reasonable Population Projections Are Important!

One of the key variables analysts look at in attempting to project such things as housing demand, labor force growth, government “entitlement” spending, and a host of other key “macro” indicators is the projected population -- not just (or even mainly) the total population, of course, but more especially the age distribution of the population. At first glance, one might think that projecting the age distribution of the population would be rather simple: if you know your country’s current age distribution, you should, if your country has “closed borders,” be able to “walk forward” each individual age “cohort” using reasonable assumptions of death rates by age. However, we are not a “closed border” country, and as such, projections of the population by age also need to take into account “net international migration” by age, which encompasses both immigration by age and emigration (folks moving out of the country) by age.

Rather than making their own assumptions about death rates and net international migration, many analysts rely on “official” Census long-term population projections to produce forecasts of other variables. Sadly, however, such “official” projections are done infrequently, and the last “official” Census population projection was from late 2014, and is extremely out of date.

To remind folks, the 2014 Census long-term population projection incorporated an assumption that net international migration would increase materially beginning in 2014, and gradually increase from these unusually high levels through the next several decades. Updated population estimates through 2016, however, suggest that these net international migration assumptions through 2016 were way too high. In addition, recent data suggest that death rates over the past two years have been higher than those incorporated in the Census 2014 projections. As a result, the latest estimate of the US population as of July 1, 2016 is 868,105 lower than the projection from 2014, with the bulk of this projection “miss” coming in the 20-64 year old range.

In addition, the Census 2014 population projections did not (for obvious reasons) incorporate an assumption that Donald Trump would be elected president and that the House and Senate would be controlled by Republicans, and what that combination might mean in terms of likely net international migration trends over the remainder of the decade. Suffice it to say, the net international migration assumptions from the Census 2014 population projections from 2016 on are unrealistically high.

In sum, as is obvious, the “latest” long-term population projections from Census are extremely out of date, and are of little if any use to anyone. While Census does plan to issue a new long-term population projection around the end of this year, in the interim any analysts who wish to issue projections of any variables that depend on population forecasts must produce their own population projections.

Unfortunately for analysts, there is no clear or logical methodology to project net international migration over the next few years based on either the rhetoric or the policy “statements” from the Trump administration. However, one thing analysts can do is to show different population projection “scenarios” based on different net international migration assumptions.

One must first, of course, start with the latest available estimates of the US population, which are for July 1, 2016, and which are shown in the chart below.

For sensitivity analysis, however, there are “shortcomings” of doing various scenarios from July 1, 2016: first, of course, that date is now almost a full year ago; and second, Trump “policies” probably have had only a modest impact on net international migration from July 1, 2016 until now.

As such, the “scenarios” I am showing are from July 1, 2017 to July 1, 2020. In estimating the age distribution of the population for 2017 I am assuming net international migration of 850,000, which is about 150,000 less than the latest estimate for 2016. I am using a similar age distribution for net international migration as that used in the Census 2014 projection, but I have adjusted assumptions on death rates to be consistent with the latest estimate for deaths in 2016 (which was higher than that assumed in the Census 2014 projection).

| US Resident Population Projection by Selected Age Groups, Various "Scenarios", Thousands | ||||||

|---|---|---|---|---|---|---|

| Zero Net International Migration, 7/1/2017 - 7/1/2017 | ||||||

| 07/01/16 | 07/01/17 | 07/01/18 | 07/01/19 | 07/01/20 | 7/1/2017 - 7/1/2010 | |

| Total | 323,128 | 325,148 | 326,287 | 327,387 | 328,487 | 3,339 |

| 0-14 | 60,975 | 60,954 | 60,792 | 60,612 | 60,492 | -463 |

| 15-24 | 43,511 | 43,149 | 42,660 | 42,274 | 41,977 | -1,172 |

| 25-34 | 44,677 | 45,185 | 45,362 | 45,530 | 45,463 | 278 |

| 35-44 | 40,470 | 40,760 | 41,138 | 41,514 | 41,909 | 1,149 |

| 45-54 | 42,787 | 42,323 | 41,638 | 40,907 | 40,395 | -1,927 |

| 55-64 | 41,463 | 41,986 | 42,337 | 42,556 | 42,542 | 556 |

| 65-74 | 28,630 | 29,667 | 30,497 | 31,530 | 32,649 | 2,982 |

| 75+ | 20,614 | 21,124 | 21,863 | 22,464 | 23,060 | 1,936 |

| 25-54 | 127,934 | 128,268 | 128,138 | 127,951 | 127,767 | -500 |

| Net International Migration of 700,000 per Year from 7/1/2017 to 7/1/2020 | ||||||

| 07/01/16 | 07/01/17 | 07/01/18 | 07/01/19 | 07/01/20 | 7/1/2017 - 7/1/2010 | |

| Total | 323,128 | 325,148 | 326,987 | 328,785 | 330,580 | 5,433 |

| 0-14 | 60,975 | 60,954 | 60,906 | 60,832 | 60,811 | -143 |

| 15-24 | 43,511 | 43,149 | 42,863 | 42,663 | 42,532 | -618 |

| 25-34 | 44,677 | 45,185 | 45,544 | 45,908 | 46,048 | 863 |

| 35-44 | 40,470 | 40,760 | 41,223 | 41,690 | 42,183 | 1,423 |

| 45-54 | 42,787 | 42,323 | 41,682 | 40,997 | 40,533 | -1,789 |

| 55-64 | 41,463 | 41,986 | 42,373 | 42,626 | 42,648 | 662 |

| 65-74 | 28,630 | 29,667 | 30,522 | 31,583 | 32,730 | 3,063 |

| 75+ | 20,614 | 21,124 | 21,874 | 22,486 | 23,095 | 1,971 |

| 25-54 | 127,934 | 128,268 | 128,449 | 128,595 | 128,764 | 497 |

| Projections from Census 2014 Long-Term Population Forecast | ||||||

| 07/01/16 | 07/01/17 | 07/01/18 | 07/01/19 | 07/01/20 | 7/1/2017 - 7/1/2010 | |

| Total | 323,996 | 326,626 | 329,256 | 331,884 | 334,503 | 7,878 |

| 0-14 | 61,037 | 61,176 | 61,314 | 61,435 | 61,577 | 401 |

| 15-24 | 43,613 | 43,352 | 43,202 | 43,125 | 43,107 | -245 |

| 25-34 | 44,865 | 45,490 | 46,018 | 46,561 | 46,890 | 1,400 |

| 35-44 | 40,578 | 40,930 | 41,477 | 42,035 | 42,628 | 1,698 |

| 45-54 | 42,864 | 42,443 | 41,860 | 41,239 | 40,842 | -1,601 |

| 55-64 | 41,619 | 42,180 | 42,619 | 42,931 | 43,019 | 840 |

| 65-74 | 28,747 | 29,825 | 30,743 | 31,860 | 33,075 | 3,250 |

| 75+ | 20,674 | 21,230 | 22,023 | 22,697 | 23,366 | 2,136 |

| 25-54 | 128,306 | 128,863 | 129,356 | 129,836 | 130,360 | 1,496 |

To give folks an idea of how much different, below is a table of what labor force growth and US household formations would be under each scenario if (1) labor force participation rates by age remained constant at 2016 levels; and (2) household headship rates by age remain constant at my “best guess” rates for 2016 (there are no good, reliable data on households since 2010, but that is a different story!). I realize, of course, that holding labor force participation rates and headship rates by age constant is not a “best guess” projection, but I’m just trying to show sensitivities to different population assumptions.

| Annual Growth Rate in the US Labor Force Assuming Constant Labor Force Participation Rates by Age | |||

|---|---|---|---|

| 2018 | 2019 | 2020 | |

| Zero Net International Migration | 0.04% | 0.02% | -0.01% |

| NIM of 700,000/year | 0.28% | 0.27% | 0.24% |

| Census 2014 Projections | 0.50% | 0.50% | 0.48% |

| US Household Growth Assuming Constant Headship Rates by Age | |||

| 2018 | 2019 | 2020 | |

| Zero Net International Migration | 1,026,077 | 966,155 | 924,937 |

| NIM of 700,000/year | 1,231,995 | 1,180,916 | 1,148,645 |

| Census 2014 Projections | 1,485,278 | 1,455,615 | 1,442,362 |

As the table suggests, analysts using the extremely dated Census 2014 population projections would conclude that the US would have “decent” labor force growth and quite strong US household growth over the next three years. Contrary to what some analysts suggest, however, that strong growth is not in the main the result of the current “demographics” of the population, but rather is mainly the result of what are now clearly unrealistically high assumptions about net international migration. If instead the US had zero net international migration of the next three years, the US labor force would show no growth unless labor force participation rates increased, and US household growth would average less than one million per year unless headship rates increased. Not surprisingly, a “sorta Trumpy” scenario of net international migration of 700,000 a year – probably the closest there is a a “base case” scenario” produces projections about half way in between these two extremes.

Folks may differ about what is or is not a “reasonable” assumption for net international migration over the next three years, but what seems almost crystal clear is that the assumptions in the latest official long-term population projections from Census released in 2014 are not realistic, and should not be used by competent analysts. That is why it was so surprisingly that in today’s release of its annual “The State of the Nation’s Housing,” the Joint Center for Housing Studies at Harvard University stuck with the housing projections it made near the end of last year, which used … you guessed it --- the Census 2014 long-term population projections! While the JCHS report did note that net international migration could well be a LOT lower than that assumed in the Census 2014 population projections, its report did not give any indication of what a “reasonable” assumption might be, of how a “reasonable” (and much lower) assumption might impact its projections for US household formations (possibly because doing so involves a lot of work.)