by Calculated Risk on 5/14/2017 08:38:00 PM

Sunday, May 14, 2017

Monday: NY Fed Mfg Survey, Homebuilder Survey

Weekend:

• Schedule for Week of May 14, 2017

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 7.0, up from 5.2.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $47.82 per barrel and Brent at $50.81 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.33 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 10 cents a gallon year-over-year.

Update: "Scariest jobs chart ever"

by Calculated Risk on 5/14/2017 03:30:00 PM

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the April 2017 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 5.5% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Saturday, May 13, 2017

Schedule for Week of May 14, 2017

by Calculated Risk on 5/13/2017 08:11:00 AM

The key economic report this week is April Housing Starts.

For manufacturing, April industrial production, and the May New York, and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 7.0, up from 5.2.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low).

The consensus is for 1.256 million, up from the March rate of 1.215 million.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.3%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

11:00 AM: The New York Fed will release their Q1 2017 Household Debt and Credit Report

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 236 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 19.6, down from 22.0.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2017

Friday, May 12, 2017

Oil: "Price weakness failed to dent enthusiasm for rig additions this week"

by Calculated Risk on 5/12/2017 04:22:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 12, 2017:

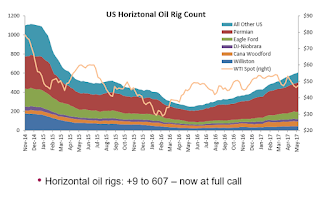

• Total US oil rigs added 9 to 712

• US horizontal oil rigs were up 9 to 607, breaking through the total ‘call’ for the cycle

• Once again, all the action was in the Permian, taking 8 of 9 horizontal rig additions

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Key Measures Show Inflation close to 2% in April

by Calculated Risk on 5/12/2017 11:30:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.4% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.1% (1.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.0% annualized rate) in April. The CPI less food and energy rose 0.1% (0.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 1.9%. Core PCE is for March and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 1.4% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI was at 0.9% annualized.

Using these measures, inflation was soft in April. Overall these measures are mostly close to the Fed's 2% target (Core PCE is still below).

Retail Sales increased 0.4% in April

by Calculated Risk on 5/12/2017 08:47:00 AM

On a monthly basis, retail sales increased 0.4 percent from March to April (seasonally adjusted), and sales were up 4.5 percent from April 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.9 billion, an increase of 0.4 percent from the previous month, and 4.5 percent above April 2016. ... The February 2017 to March 2017 percent change was revised from down 0.2 percent to up 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.4% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by3.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by3.8% on a YoY basis.The increase in April was below expectations, however sales for March were revised up. A decent report.

Thursday, May 11, 2017

Friday: Retail Sales, CPI

by Calculated Risk on 5/11/2017 08:46:00 PM

Friday:

• At 8:30 AM ET, Retail sales for April will be released. The consensus is for a 0.6% increase in retail sales.

• Also at 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 97.3, up from 97.0 in April.

• Also at 10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.1% increase in inventories.

LA area Port Traffic increased in April

by Calculated Risk on 5/11/2017 02:38:00 PM

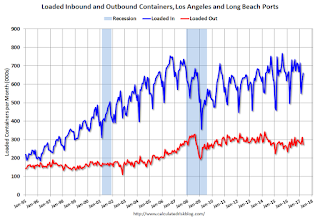

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

From the Port of LA: Port of Los Angeles April Cargo Volumes Set New Record

April cargo volumes surged 8.9 percent at the Port of Los Angeles compared to the same month last year. It was the best April in the Port’s 110-year history.From the Port of Long Beach: Port of Long Beach Sees April Boost

More ships calling at the Port of Long Beach in April thanks to new business and changes to vessel deployments helped to push container volumes 16.5 percent higher compared to the same month last year.The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in March. Outbound traffic was up 0.5% compared to 12 months ending in March.

The downturn in exports in 2015 was probably due to the slowdown in China and the stronger dollar. Now exports are picking up again,

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. The Chinese New Year was early this year, so imports declined in February and rebounded in March

In general both exports and imports have been increasing.

Hotels: Occupancy Rate Increases Year-over-Year

by Calculated Risk on 5/11/2017 11:41:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 May

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 30 April to 6 May 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 May 2016, the industry reported the following:

• Occupancy: +3.3% to 67.9%

• Average daily rate (ADR): +2.4% to US$126.67

• Revenue per available room (RevPAR): +5.8% to US$85.96

STR analysts note that performance growth was particularly strong on Friday and Saturday due to a comparison with Mother’s Day weekend a year ago.

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, the occupancy rate will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims decrease to 236,000

by Calculated Risk on 5/11/2017 08:43:00 AM

The DOL reported:

In the week ending May 6, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 2,000 from the previous week's unrevised level of 238,000. The 4-week moving average was 243,500, an increase of 500 from the previous week's unrevised average of 243,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 243,500.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.