by Calculated Risk on 4/18/2017 08:39:00 AM

Tuesday, April 18, 2017

Housing Starts decreased to 1.215 Million Annual Rate in March

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,215,000. This is 6.8 percent below the revised February estimate of 1,303,000, but is 9.2 percent above the March 2016 rate of 1,113,000. Single-family housing starts in March were at a rate of 821,000; this is 6.2 percent below the revised February figure of 875,000. The March rate for units in buildings with five units or more was 385,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,260,000. This is 3.6 percent above the revised February rate of 1,216,000 and is 17.0 percent above the March 2016 rate of 1,077,000. Single-family authorizations in March were at a rate of 823,000; this is 1.1 percent below the revised February figure of 832,000. Authorizations of units in buildings with five units or more were at a rate of 401,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in March compared to February. Multi-family starts are up year-over-year.

Multi-family is volatile.

Single-family starts (blue) increased in March, and are up 9.3% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in March were below expectations. However February starts were revised up slightly. Still a decent report. I'll have more later ...

Monday, April 17, 2017

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 4/17/2017 07:45:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fairly Steady Near 2017 Lows

For the third day in a row, mortgage rates set new 2017 lows this morning. But as bond markets weakened into the afternoon, several lenders recalled rate sheets for "negative reprices." This brought the afternoon's rate sheet offerings back in line with those seen on Thursday afternoon. Although that's slightly worse than this morning, rates are still effectively at 2017 lows.Tuesday:

The average lender continues to quote 4.0% on top tier conventional 30yr fixed scenarios. Any changes from Thursday would be seen in the form of slightly higher upfront costs. Many borrowers will see no difference.

emphasis added

• At 8:30 AM ET, Housing Starts for March. The consensus is for 1.262 million, down from the February rate of 1.288 million.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.0%.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/17/2017 03:23:00 PM

From housing economist Tom Lawler:

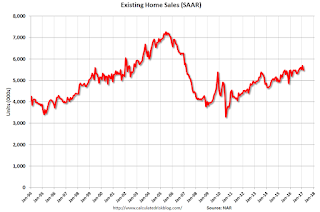

Based on publicly available state and local realtor/MLS reports released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.74 million in March, up 4.7% from February’s preliminary pace and up 6.5% from last March’s seasonally adjusted pace. Local realtor/MLS data also suggest that active listings increased by more this March than last March, and my “best guess” is that the NAR’s March inventory estimate will be 1.86 million, up 6.3% from February’s preliminary estimate and down 5.1% from last March’s estimate. Finally, local realtor/MLS data suggest that the NAR’s estimate for the median existing SF home sales price in March will be about 7.5% higher than last March’s estimate.

CR Note: The NAR is scheduled to release existing home sales for March on Friday. The consensus forecast is for sales of 5.61 million SAAR (take the over this month!).

Phoenix Real Estate in March: Sales up 9%, Inventory down 10% YoY

by Calculated Risk on 4/17/2017 01:02:00 PM

This is a key housing market to follow since Phoenix saw a large bubble and bust, followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in March were up 8.8% year-over-year.

2) Cash Sales (frequently investors) were down to 23.9% of total sales.

3) Active inventory is now down 9.8% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the fifth consecutive month with a YoY decrease in inventory following eight months with YoY increases.

| March Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Mar-08 | 4,303 | --- | 822 | 19.1% | 57,0811 | --- |

| Mar-09 | 7,636 | 77.5% | 2,994 | 39.2% | 49,743 | -12.9% |

| Mar-10 | 8,969 | 17.5% | 3,745 | 41.8% | 42,755 | -14.0% |

| Mar-11 | 9,927 | 10.7% | 4,946 | 49.8% | 37,632 | -12.0% |

| Mar-12 | 8,868 | -10.7% | 4,222 | 47.6% | 21,863 | -41.9% |

| Mar-13 | 8,146 | -8.1% | 3,384 | 41.5% | 20,729 | -5.2% |

| Mar-14 | 6,708 | -17.7% | 2,222 | 33.1% | 30,167 | 45.5% |

| Mar-15 | 7,884 | 17.5% | 2,172 | 27.5% | 26,623 | -11.7% |

| Mar-16 | 8,555 | 8.5% | 2,107 | 24.6% | 27,580 | 3.6% |

| Mar-17 | 9,304 | 8.8% | 2,226 | 23.9% | 24,871 | -9.8% |

| 1 March 2008 probably included pending listings | ||||||

NAHB: Builder Confidence decreased to 68 in April

by Calculated Risk on 4/17/2017 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in April, down from 71 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Holds Firm in April

Builder confidence in the market for newly-built single-family homes remained solid in April, falling three points to a level of 68 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) after an unusually high March reading.

“Even with this month’s modest drop, builder confidence is on very firm ground, and builders are reporting strong interest among potential home buyers,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas.

“The fact that the HMI measure of current sales conditions has been over 70 for five consecutive months shows that there is continued demand for new construction,” said NAHB Chief Economist Robert Dietz. “However, builders are facing several challenges, such as hefty regulatory costs and ongoing increases in building material prices."

...

All three HMI components posted losses in April but remain at healthy levels. The components gauging current sales conditions fell three points to 74 while the index charting sales expectations in the next six months dropped three points to 75. Meanwhile, the component measuring buyer traffic edged one point down to 52.

Looking at the three-month moving averages for regional HMI scores, the West and Midwest both rose one point to 77 and 68, respectively. The South held steady at 68, and the Northeast fell two points to 46.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly below the consensus forecast but still a solid reading.

NY Fed: Empire State Manufacturing Index indicates slower expansion in April

by Calculated Risk on 4/17/2017 08:56:00 AM

From the NY Fed: Empire State Manufacturing Survey: General Business Conditions Index Fell Eleven Points to 5.2

Responses from New York State manufacturers suggested that business activity expanded at a considerably slower pace than in the prior two months. Although the general business conditions index remained above the levels seen through most of 2016, it slipped eleven points to 5.2. ...This was well below the consensus forecast of 15.

Employment indexes continued to signal strength in the labor market. The index for number of employees climbed another five points to 13.9—its highest level in just over two years. ...

Forward-looking indexes were mixed but generally at high levels, suggesting fairly widespread optimism about future conditions. The index for future business conditions rose three points to 39.9, while the future new orders and shipments indexes declined modestly. Employment and hours worked were expected to increase fairly briskly in the months ahead.

emphasis added

Sunday, April 16, 2017

Sunday Night Futures

by Calculated Risk on 4/16/2017 11:51:00 PM

Weekend:

• Schedule for Week of Apr 16, 2017

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 15.0, down from 16.4.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 70, down from 71 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up slightly over the last week with WTI futures at $52.75 per barrel and Brent at $55.44 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so oil prices are up about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.41 per gallon - a year ago prices were at $2.12 per gallon - so gasoline prices are up about 29 cents a gallon year-over-year.

Saturday, April 15, 2017

Schedule for Week of Apr 16, 2017

by Calculated Risk on 4/15/2017 08:11:00 AM

The key economic reports this week are March Housing Starts and Existing Home Sales.

For manufacturing, March industrial production, and the April New York, and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 15.0, down from 16.4.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 70, down from 71 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low).

The consensus is for 1.262 million, down from the February rate of 1.288 million.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.0%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 26.0, down from 32.8.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.61 million SAAR, up from 5.48 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.61 million SAAR, up from 5.48 million in February.10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2017

Friday, April 14, 2017

Q1 GDP Forecasts Downgraded Again

by Calculated Risk on 4/14/2017 06:50:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.5 percent on April 14, down from 0.6 percent on April 7. The forecast for first-quarter real consumer spending growth fell from 0.6 percent to 0.3 percent after this morning's retail sales report from the U.S. Census Bureau and the Consumer Price Index release from the U.S. Bureau of Labor Statistics.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.6% for 2017:Q1 and 2.1% for 2017:Q2.

Incoming data during the week lead to a reduction of the nowcast by 0.2 and 0.5 percentage point for 2017:Q1 and 2017:Q2, respectively.

The changes in the nowcast were mainly driven by a negative surprise from retail sales.

Key Measures Show Inflation close to 2% in March

by Calculated Risk on 4/14/2017 12:09:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.8% annualized rate) in March. The 16% trimmed-mean Consumer Price Index was unchanged (0.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel was down 53% annualized in March.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.3% (-3.4% annualized rate) in March. The CPI less food and energy fell 0.1% (-1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.0%. Core PCE is for February and increased 1.75% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 0.3% annualized, and core CPI was at -1.5% annualized.

Using these measures, inflation was soft in March - but has generally been moving up, and most of these measures are at or above the Fed's 2% target (Core PCE is still below).