by Calculated Risk on 3/08/2017 03:31:00 PM

Wednesday, March 08, 2017

Leading Index for Commercial Real Estate Increases in February

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Increases in February

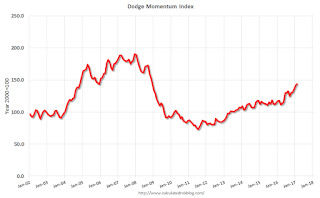

The Dodge Momentum Index rose 1.6% in February to 144.0 (2000=100) from its revised January reading of 141.7. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. February’s increase was due to a 4.4% jump in institutional planning, while commercial planning slipped slightly, falling 0.3% for the month. The Momentum Index has now increased for five consecutive months; however, the underlying components continue to be volatile on a month-to-month basis as large projects continue to sway the data. The overall trend, however, is rising. On a year-over-year basis the Momentum Index is 22% higher, with commercial planning up 28% and institutional planning moving 15% ahead of last year. This suggests that construction activity will continue to see further growth as the year progresses.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 144.0 in February, up from 141.7 in January.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

February Employment Preview

by Calculated Risk on 3/08/2017 11:42:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 195,000 non-farm payroll jobs in February (with a range of estimates between 168,000 to 215,000), and for the unemployment rate to decline to 4.7%.

The BLS reported 227,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 298,000 private sector payroll jobs in February. This was well above expectations of 183,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in February to 54.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 3,000 in February. The ADP report indicated 32,000 manufacturing jobs added in February.

The ISM non-manufacturing employment index increased in February to 55.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 212,000 in February.

Combined, the ISM indexes suggests employment gains of about 215,000. This suggests employment growth above expectations.

• Initial weekly unemployment claims averaged 234,000 in February, down from 248,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 244,000, up from 237,000 during the reference week in January.

The increase during the reference suggests slightly more layoffs during the reference week in February than in January. This suggests an employment report close to January - above the consensus.

• The final February University of Michigan consumer sentiment index decreased to 96.3 from the January reading of 98.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. However the ADP report and ISM surveys suggest stronger job growth. Weekly unemployment claims suggest job growth similar to January. So my guess is the February report will be above the consensus forecast.

ADP: Private Employment increased 298,000 in February

by Calculated Risk on 3/08/2017 08:26:00 AM

Private sector employment increased by 298,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 183,000 private sector jobs added in the ADP report.

...

“February proved to be an incredibly strong month for employment with increases we have not seen in years,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Gains were driven by a surge in the goods sector, while we also saw the information industry experience a notable increase.”

Mark Zandi, chief economist of Moody’s Analytics said, “February was a very good month for workers. Powering job growth were the construction, mining and manufacturing industries. Unseasonably mild winter weather undoubtedly played a role. But near record high job openings and record low layoffs underpin the entire job market.”

The BLS report for February will be released Friday, and the consensus is for 195,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/08/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 3, 2017. The previous week’s results included an adjustment for the President’s Day holiday.

... The Refinance Index increased 5 percent from the previous week to the highest level since December 2016. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.36 percent from 4.30 percent, with points increasing to 0.44 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.

Tuesday, March 07, 2017

Phoenix Real Estate in February: Sales up 13%, Inventory down 11% YoY

by Calculated Risk on 3/07/2017 06:59:00 PM

This is a key housing market to follow since Phoenix saw a large bubble and bust, followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in February were up 12.6% year-over-year.

2) Cash Sales (frequently investors) were down to 25.9% of total sales.

3) Active inventory is now down 10.8% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the fourth consecutive month with a YoY decrease in inventory following eight months with YoY increases. This is a key change in trend - something to watch.

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| Feb-2016 | 5,816 | -2.6% | 1,688 | 29.0% | 27,202 | -0.7% |

| Feb-2017 | 6,547 | 12.6% | 1,696 | 25.9% | 24,275 | -10.8% |

| 1 February 2008 probably included pending listings | ||||||

Las Vegas Real Estate in February: Sales up 5.2% YoY, Inventory down Sharply

by Calculated Risk on 3/07/2017 01:53:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada Home Prices Keep Moving On Up GLVAR Housing Statistics for February 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported Tuesday that Southern Nevada home prices and sales continued to increase despite a shrinking housing supply.1) Overall sales were up 5.2% year-over-year.

...

The total number of existing local homes, condos and townhomes sold in February was 2,815, up from 2,676 in February 2016. Compared to one year ago, sales were up 6.5 percent for homes and up 0.4 percent for condos and townhomes.

...

By the end of February, GLVAR reported 5,564 single-family homes listed for sale without any sort of offer. That’s down 24.1 percent from one year ago. For condos and townhomes, the 758 properties listed without offers in February represented a 66.6 percent decrease from one year ago.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in February, when 4.6 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 6.6 percent of all sales in February 2016. Another 6.0 percent of all February sales were bank-owned, down from 8.6 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago (A very sharp decline in condo inventory).

3) Fewer distressed sales.

CoreLogic: House Prices up 6.9% Year-over-year in January

by Calculated Risk on 3/07/2017 11:05:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.9 Percent in January 2017

Home prices nationwide, including distressed sales, increased year over year by 6.9 percent in January 2017 compared with January 2016 and increased month over month by 0.7 percent in January 2017 compared with December 2016, according to the CoreLogic HPI.

...

“With lean for-sale inventories and low rental vacancy rates, many markets have seen housing prices outpace inflation,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Over the 12 months through January of this year, the CoreLogic Home Price Index recorded a 6.9 percent rise in home prices nationally and the CoreLogic Single-Family Rental Index was up 2.7 percent—both rising faster than inflation.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in January (NSA), and is up 6.9% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 4.0% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for five consecutive years since turning positive year-over-year in February 2012.

Trade Deficit at $48.5 Billion in January

by Calculated Risk on 3/07/2017 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $48.5 billion in January, up $4.2 billion from $44.3 billion in December, revised. January exports were $192.1 billion, $1.1 billion more than December exports. January imports were $240.6 billion, $5.3 billion more than December imports.The trade deficit was at the consensus forecast.

The first graph shows the monthly U.S. exports and imports in dollars through January 2017.

Click on graph for larger image.

Click on graph for larger image.Imports and exports increased in January.

Exports are 16% above the pre-recession peak and up 7% compared to January 2016; imports are 4% above the pre-recession peak, and up 8% compared to January 2016.

Clearly trade is picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $43.94 in January, up from $41.45 in December, and up from $32.06 in January 2016. The petroleum deficit has generally been declining and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $31.3 billion in January, from $28.9 billion in January 2016. The increase this year was probably due to the timing of the Chinese New Year (the deficit will probably be smaller in February). In general the deficit with China has generally been declining.

Monday, March 06, 2017

Tuesday: Trade Deficit

by Calculated Risk on 3/06/2017 07:49:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Losing Streak Pauses

After moving higher for 5 days in a row, mortgage rates finally moved a bit lower today [4.24% 30 year fixed on top tier]. The improvement was fairly small, however, merely undoing Friday's modest move higher.Tuesday:

It would take something very compelling to push rates significantly lower between now and next Wednesday's Fed announcement. This could come in the form of shockingly bad employment numbers on Friday or massive geopolitical drama, but until it happens, it's safer to remain defensive with respect to locking and floating. Inclined floaters should understand there's not a huge payout if rates manage to improve this week.

emphasis added

• At 8:30 AM ET, Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to be at $48.5 billion in January from $44.3 billion in December.

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $18.3 billion increase in credit.

February NFP Forecasts

by Calculated Risk on 3/06/2017 01:35:00 PM

A couple of NFP forecasts ...

From Nomura:

Incoming data on the labor market suggest strong job gains in February. Data on sentiment, including the Empire State, Philly Fed and ISM manufacturing surveys, point to better hiring activity in February. Initial and continuing claims data continued to trend lower, implying that involuntary layoffs remain low and that firms are eager to retain workers. In particular, the 4-week moving average of initial jobless claims inched down further, reaching its lowest point in decades. Based on these positive readings, we forecast private nonfarm payrolls to have added 215k jobs in February. Given the recent employment trend in the public sector, we expect public sector payrolls to remain unchanged. ...From Merrill Lynch:

Moreover, we forecast the unemployment rate to inch down slightly to 4.7% in February ... we expect average hourly earnings to have increased by 0.3% m-o-m (2.7% y-o-y) ...

emphasis added

We expect nonfarm payrolls to grow by 185,000 in February ... Given the recent bump up in optimism in manufacturing surveys, we could see better job growth in the industrial sector. Moreover, weather conditions have been broadly favorable for construction activity in February as temperatures have been warmer than normal. This could lead to another month of strong payroll gains in the construction sector. We expect limited gains in government payrolls.

We are forecasting the unemployment rate to tick down to 4.7% from 4.8% ... We are forecasting a solid rebound of 0.3% mom gain which will boost the yoy rate to 2.8% (unrounded: 2.75%), which was the trend over the second half of last year.