by Calculated Risk on 1/18/2017 11:15:00 AM

Wednesday, January 18, 2017

AIA: Architecture Billings Index increased in December

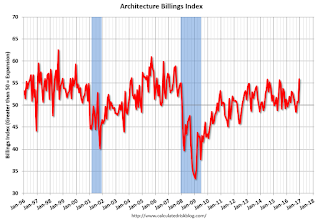

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index ends year on positive note

The Architecture Billings Index (ABI) concluded the year in positive terrain, with the December reading capping off three straight months of growth in design billings. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 55.9, up sharply from 50.6 in the previous month. This score reflects the largest increase in design services in 2016 (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.2, down from a reading of 59.5 the previous month.

“The sharp upturn in design activity as we wind down the year is certainly encouraging. This bodes well for the design and construction sector as we enter the new year”,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “However, December is an atypical month for interpreting trends, so the coming months will tell us a lot more about conditions that the industry is likely to see in 2017.”

...

• Regional averages: Midwest (54.4), Northeast (54.0), South (53.8), West (48.8)

• Sector index breakdown: commercial / industrial (54.3), institutional (53.3), mixed practice (51.9), multi-family residential (50.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.9 in December, up from 50.6 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017.

NAHB: Builder Confidence decreased to 67 in January

by Calculated Risk on 1/18/2017 10:09:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 67 in January, down from 69 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Homebuilder confidence pulls back by 2 points in January after election euphoria

A monthly sentiment index retreated 2 points in January, and December's seven-point jump was revised down by one. The National Association of Home Builders/Wells Fargo Housing Market Index (HMI) now stands at 67.

...

"NAHB expects solid 10 percent growth in single-family construction in 2017, adding to the gains of 2016," said NAHB Chief Economist Robert Dietz. "Concerns going into the year include rising mortgage interest rates as well as a lack of lots and access to labor."

Regionally, on a three-month moving average, sentiment in the Northeast rose two points to 52 and rose three point in the Midwest to 64. The South and West each held steady at 67 and 79, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 69, but still another solid reading.

Industrial Production increased 0.8% in December

by Calculated Risk on 1/18/2017 09:31:00 AM

From the Fed: Industrial production and Capacity Utilization

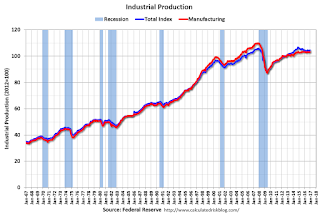

Industrial production rose 0.8 percent in December after falling 0.7 percent in November. For the fourth quarter as a whole, the index slipped 0.6 percent at an annual rate. In December, manufacturing output moved up 0.2 percent and mining output was unchanged. The index for utilities jumped 6.6 percent, largely because of a return to more normal temperatures following unseasonably warm weather in November; the gain last month was the largest since December 1989. At 104.6 percent of its 2012 average, total industrial production in December was 0.5 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.6 percentage point in December to 75.5 percent, a rate that is 4.5 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.5% is 4.5% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 104.6. This is 19.7% above the recession low, and is close to the pre-recession peak.

This was above expectations of a 0.6% increase.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/18/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 13, 2017. The previous week’s results included an adjustment for the New Year’s holiday.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 25 percent compared with the previous week and was 1 percent lower than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,000 or less) decreased to its lowest level since December 2016, 4.27 percent, from 4.32 percent, with points decreasing to 0.39 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity - although we might see more cash-out refis.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates, purchase activity is still holding up. However refinance activity has declined significantly.

Tuesday, January 17, 2017

Wednesday: CPI, Industrial Production, Homebuilder Survey, Beige Book, Yellen Speech

by Calculated Risk on 1/17/2017 05:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Near 2-Month Lows

Mortgage rates moved lower today, generally recovering the losses seen last Friday. This brings many lenders back in line with the lowest levels since November 17th, although last Wednesday (Jan 11) was slightly better on average. There hasn't been enough volatility to unseat 4.125% as the most prevalent 30yr fixed "note rate" on top tier scenarios. As such, today's improvement is limited to "effective rates" (which take closing costs into consideration)..Wednesday:

emphasis added

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:30 AM, the Consumer Price Index for December from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.4%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 69, down from 70 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• At 3:00 PM, Speech, Fed Chair Janet Yellen, The Goals of Monetary Policy and How We Pursue Them, At the Commonwealth Club, San Francisco, California

LA area Port Traffic increases Year-over-year in December

by Calculated Risk on 1/17/2017 11:43:00 AM

From the Port of Long Beach: Port Trade Dips to 6.8 Million TEUs in 2016

Slowed by industry headwinds and challenges that included a major customer declaring bankruptcy, the Port of Long Beach still moved almost 6.8 million containers in 2016, its fifth best year ever.Although port traffic decreased in Long Beach, traffic was up in Los Angeles.

Overall cargo declined 5.8 percent in 2016 compared to 2015, as the Port was impacted by new ocean carrier alliances and the August bankruptcy of Hanjin Shipping, a South Korean company and former majority stakeholder at the 381-acre Pier T container terminal — Long Beach’s largest.

By year’s end, the Harbor Commission had approved an agreement for a subsidiary of Mediterranean Shipping Co., one of the world’s largest container ship operators, to take sole control of the long-term lease at Pier T.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.6% compared to the rolling 12 months ending in November. Outbound traffic was up 0.9% compared to 12 months ending in November.

The downturn in exports in 2015 was probably due to the slowdown in China and the stronger dollar. Now exports are picking up a little - but the stronger dollar might impact exports once again.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). In general exports have started increasing, and imports have been gradually increasing.

NY Fed: Manufacturing Activity Continues to Expand in New York Region

by Calculated Risk on 1/17/2017 10:21:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity grew in January. The general business conditions index was little changed at 6.5, its third consecutive positive reading. The new orders index fell seven points to 3.1, indicating that orders increased at a slower clip than last month, and the shipments index held steady at 7.3, pointing to an ongoing increase in shipments. ...This was close to expectations, and suggests manufacturing activity expanded further in January.

...

The index for number of employees rose but held below zero at -1.7, a sign that employment levels edged slightly lower; the average workweek index, at -4.2, pointed to a small decline in hours worked.

...

Indexes for the six-month outlook suggested that respondents remained very optimistic about future conditions. The index for future business conditions was unchanged at 49.7, matching last month’s multiyear high.

emphasis added

Monday, January 16, 2017

Monday Night Futures

by Calculated Risk on 1/16/2017 07:37:00 PM

Weekend:

• Schedule for Week of Jan 15, 2017

Tuesday:

• At 8:30 AM ET,The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 8.0, down from 9.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 3, and DOW futures are down 28 (fair value).

Oil prices were down over the last week with WTI futures at $52.49 per barrel and Brent at $55.86 per barrel. A year ago, WTI was at $28, and Brent was at $28 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $1.92 per gallon - so gasoline prices are up 40 cents a gallon year-over-year.

Bank Failures by Year

by Calculated Risk on 1/16/2017 11:28:00 AM

In 2016, five FDIC insured banks failed. This was the lowest level since 2007.

Most of the great recession / housing bust / financial crisis related failures are behind us.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year, so the 5 failures in 2015 was close to normal.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. A large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s then during the recent crisis, the recent financial crisis was much worse (large banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Sunday, January 15, 2017

Krugman: "Infrastructure Delusions"

by Calculated Risk on 1/15/2017 12:14:00 PM

From Professor Krugman: Infrastructure Delusions

Ben Bernanke has a longish post about fiscal policy ... Notably, Bernanke, like yours truly, argues that the fiscal-stimulus case for deficit spending has gotten much weaker, but there’s still a case for borrowing to build infrastructure:CR Note: Just after the election, I noted that members of Mr. Trump's team had been talking about a $1 trillion infrastructure plan. However the infrastructure proposal really was a proposal for about $100 billion in tax credits to spur private investment in infrastructure. The $1 trillion in infrastructure investment was the projected size of the private investment, not the proposed government spending. This proposal is actually very modest in terms of a fiscal boost. Also, if this becomes a privatization scheme, then there might be a modest short term boost, but the long term impact would be negative.

When I was Fed chair, I argued on a number of occasions against fiscal austerity (tax increases, spending cuts). The economy at the time was suffering from high unemployment, and with monetary policy operating close to its limits, I pushed (unsuccessfully) for fiscal policies to increase aggregate demand and job creation. Today, with the economy approaching full employment, the need for demand-side stimulus, while perhaps not entirely gone, is surely much less than it was three or four years ago. There is still a case for fiscal policy action today, but to increase output without unduly increasing inflation the focus should be on improving productivity and aggregate supply—for example, through improved public infrastructure that makes our economy more efficient or tax reforms that promote private capital investment.But he gently expresses doubt that this kind of thing is actually going to happen:

In particular, will Republicans be willing to support big increases in spending, including infrastructure spending? Alternatively, if Congress opts to reduce the deficit impact of an infrastructure program by financing it through tax credits and public-private partnerships, as candidate Trump proposed, the program might turn out to be relatively small.Let me be less gentle: there will be no significant public investment program, for two reasons.