by Calculated Risk on 11/16/2016 08:38:00 PM

Wednesday, November 16, 2016

Thursday: Housing Starts, CPI, Yellen, Unemployment Claims

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 257 thousand initial claims, up from 254 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for 0.4% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for October. The consensus is for 1.168 million, up from the September rate.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 8.0, down from 9.7.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee of Congress, U.S. Congress, Washington, D.C.

Earlier: Industrial Production unchanged in October

by Calculated Risk on 11/16/2016 03:21:00 PM

Earlier today from the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in October after decreasing 0.2 percent in September. Although the level of industrial production in September was the same as the previous estimate, revisions to the index for utilities raised the rate of change in total industrial production in August and lowered it in September. In October, manufacturing output increased 0.2 percent, and mining posted a gain of 2.1 percent for its largest increase since March 2014. The index for utilities dropped 2.6 percent, as warmer-than-normal temperatures reduced the demand for heating. At 104.3 percent of its 2012 average, total industrial production in October was 0.9 percent lower than its year-earlier level. Capacity utilization for the industrial sector edged down 0.1 percentage point in October to 75.3 percent, a rate that is 4.7 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

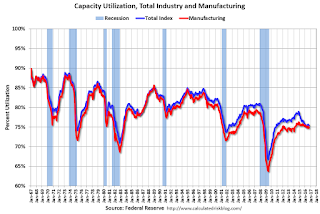

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.3% is 4.7% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in October at 104.2. This is 19.3% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.1% increase.

AIA: Architecture Billings Index increases in October

by Calculated Risk on 11/16/2016 12:31:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index rebounds after two down months

After seeing consecutive months of contracting demand for the first time in four years, the Architecture Billings Index (ABI) saw a modest increase demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 50.8, up from the mark of 48.4 in the previous month. This score reflects a slight increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 55.4, down sharply from a reading of 59.4 the previous month.

“There was a collective sense of uncertainty throughout the design and construction industry leading up to the presidential election,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Hopefully we’ll get a sense of what direction we will be headed once we get a clearer read on how the new administration’s policies might impact the overall economy as well as the construction industry.”

...

• Regional averages: South (53.7), West (49.7), Northeast (47.3) Midwest (46.8)

• Sector index breakdown: multi-family residential (51.2) commercial / industrial (49.8), mixed practice (49.5), institutional (49.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.8 in October, up from 48.4 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

NAHB: Builder Confidence at 63 in November

by Calculated Risk on 11/16/2016 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 63 in November, unchanged from 63 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

This graph show the NAHB index since Jan 1985.

This was at the consensus forecast of 63, and is another solid reading.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 11/16/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 11, 2016.

... The Refinance Index decreased 11 percent from the previous week to its lowest level since March 2016. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier to its lowest level since January 2016. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 3 percent higher than the same week one year ago.

"Following the election, mortgage rates saw their biggest week over week increase since the taper tantrum in June 2013, and reached their highest level since January of this year,” said David H. Stevens, CMB, President and CEO of the Mortgage Bankers Association. “Investor expectations of faster growth and higher inflation are driving the jump up in rates, and rates have now increased for five of the past six weeks, spurring a commensurate drop in refinance activity."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 3.95 percent, from 3.77 percent, with points increasing to 0.39 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note that this was for the week ending Nov 11th. Rates bumped up further on Monday this week, and the survey next week will probably show a further sharp decline in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "3 percent higher than the same week one year ago".

Tuesday, November 15, 2016

Today is Tanta's Birthday! Wednesday: PPI, Industrial Production, Homebuilder Survey

by Calculated Risk on 11/15/2016 07:30:00 PM

Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 75.4%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 63, unchanged from 63 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

FNC: Residential Property Values increased 6.0% year-over-year in September

by Calculated Risk on 11/15/2016 05:20:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.4% from August to September (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.4% (NSA), the 20-MSA RPI increased 0.5%, and the 30-MSA RPI also increased 0.5% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 9.2% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through September 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The September Case-Shiller index will be released on Tuesday, November 29th.

The Cupboard is Full

by Calculated Risk on 11/15/2016 01:22:00 PM

The recent economic data has been solid. From Merrill Lynch today:

Retail spending surged 0.8% mom in October, building on a 1.0% pop in September (revised up from 0.6%). Core retail sales also came in at a robust 0.8%, which was well above expectations of 0.4%. In addition, September and August core sales were revised up to 0.3% from 0.1% and 0.1% from -0.1%, respectively. Election uncertainty looked to have had no impact on the consumer, though Hurricane Matthew may have been a drag since eating & drinking sales tumbled 0.7% mom. These data boosted our 4Q GDP tracking estimate by 0.4pp to 2.4%, as well as our 3Q estimate by 0.2pp to 3.2%And from the Atlanta Fed GDPNow:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2016 is 3.3 percent on November 15, up from 3.1 percent on November 9. The forecast of fourth-quarter real personal consumption expenditures growth increased from 2.6 percent to 2.9 percent after this morning's retail sales report from the U.S. Census Bureau.We've seen a record 73 consecutive months of job gains (80 months if we remove the impact of the 2010 decennial census). And there is still some labor slack, so there is room for more job growth (as an example, part time for economic reasons is still elevated).

And wages are picking up.

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.8% YoY in October. This series is noisy, however overall wage growth is trending up - especially over the last year and a half.

And demographics are improving!

Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

And the demographics for housing is even better.

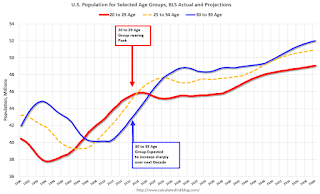

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften in a few years.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

These demographics are positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Sure, there are problems. Not everyone has participated in the current expansion. Wealth and income inequality are record extremes. There is too much student debt. And climate change is posing a real threat to the economy in the future. I could offer proposals to address those issues without negatively impacting the current expansion, and we will see if those issues are addressed in the coming years.

However, the bottom line is the cupboard is full. The expansion should continue for some time. What could possibly go wrong?

NY Fed: November "General business conditions index climbed eight points to 1.5"

by Calculated Risk on 11/15/2016 10:33:00 AM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity stabilized in New York State, according to firms responding to the November 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed out of negative territory for the first time in four months, rising eight points to 1.5.This was above the consensus forecast of -2.3, and suggests manufacturing expanded in the NY region in November.

...

Both employment indexes remained negative in November. The index for number of employees dropped six points to -10.9, a sign that employment levels were contracting, and the average workweek index, little changed at -10.9, pointed to a decline in hours worked.

...

Indexes for the six-month outlook suggested that respondents were somewhat less optimistic about future conditions than they were last month. ... Indexes for future employment and the future average workweek, at 10.9 and 10.0, respectively, indicated that firms expected to expand employee rolls and hours worked in the months ahead.

Retail Sales increased 0.8% in October

by Calculated Risk on 11/15/2016 08:38:00 AM

On a monthly basis, retail sales increased 0.8 percent from September to October (seasonally adjusted), and sales were up 4.3% from October 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.9 billion, an increase of 0.8 percent from the previous month, and 4.3 percent above October 2015. ... The August 2016 to September 2016 percent change was revised from up 0.6 percent to up 1.0 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.The increase in October was above expectations and the previous two months were revised up; a very strong report.