by Calculated Risk on 8/18/2016 02:43:00 PM

Thursday, August 18, 2016

LA area Port Traffic Mostly Unchanged in July

Special note: Now that the expansion to the Panama Canal has been completed, some of the traffic that used the ports of Los Angeles and Long Beach will eventually go through the canal. This could impact TEUs on the West Coast in the future.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in June. Outbound traffic was down 0.2% compared to 12 months ending in June.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports are moving sideways and imports are gradually increasing.

Earlier: Philly Fed Manufacturing Survey showed Weak Growth in August

by Calculated Risk on 8/18/2016 12:51:00 PM

From the Philly Fed: August 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey suggest that growth was positive but tenuous this month. The diffusion index for current general activity moved from a negative reading to a marginally positive reading, while the indicators for new orders and employment suggested continued general weakness in business conditions.This was at the consensus forecast of a reading of 2.0 for August.

...

The index for current manufacturing activity in the region rose 5 points to only 2.0 in August ... The survey’s indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

...

The survey’s index of future manufacturing activity rose 12 points to 45.8 in August, strongly indicating that the current weakness is expected to be temporary. This index is at its highest reading since January 2015

emphasis added

Click on graph for larger image.

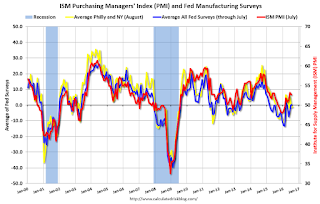

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys was slightly negative again in August (yellow). This suggests the ISM survey will probably indicate sluggish expansion this month.

Zillow: Negative Equity Rate declined in Q2 2016

by Calculated Risk on 8/18/2016 09:53:00 AM

From Zillow: Q2 2016 Negative Equity Report: Why Cities and Suburbs are only Sometimes Impacted Similarly

According to the Q2 Zillow Negative Equity Report, the overall U.S. negative equity rate as of the end of Q2 2016 – the share of homeowners that were underwater, owing more to their lenders than their home was worth – was 12.1 percent. That’s down from 12.7 percent in the first quarter and 14.4 percent at the same time a year ago (figure 1). When examining the negative equity rate in urban and suburban areas, we found that 13.7 percent of homeowners in urban areas and 11.2 percent of homeowners in suburban communities were underwater at the end of Q2.The following graph from Zillow shows a time series for negative equity.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Despite steady improvement in the overall negative equity rate, pockets with relatively high shares of underwater homeowners remain, especially in the Midwest. Of the 35 largest metro areas covered by Zillow, the overall negative equity rate in Q2 was highest in Las Vegas (19.5 percent), Chicago (19 percent) and Baltimore (16.7 percent). Five of the 10 largest metros with the highest rates of negative equity are in the middle of the country (Chicago, Cleveland, Indianapolis, Kansas City, St. Louis). Meanwhile, the West Coast is home to the largest three metros with the lowest levels of negative equity (San Jose, San Francisco and Portland).

Weekly Initial Unemployment Claims decreased to 262,000

by Calculated Risk on 8/18/2016 08:33:00 AM

The DOL reported:

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 262,000, a decrease of 4,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 265,250, an increase of 2,500 from the previous week's unrevised average of 262,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 76 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 265,250.

This was close to the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 17, 2016

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 8/17/2016 08:24:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 2.0, up from -2.9.

Something to think about on hotels from HotelNewsNow.com: California building boom leads to worries over supply

An extended period of strong hotel development has led to some supply concerns across California, but some markets are expected to remain strong as they enjoy favorable fundamentals and conditions that will keep supply growth to a minimum.

...

Flattening RevPAR growth “is coming at a time when a lot of product is coming online,” [Atlas President Alan Reay] said. “I won’t say we’re at the tipping point because some say we’re getting to where we should be because we didn’t do new construction for a few years.”

...

“There are pockets with a tremendous amount of supply coming in,” Reay said. “In downtown (Los Angeles) and north San Diego County, you definitely want to be cautious. If you’re not already out of the early planning stages, you need to be mindful of (new supply). And I think lenders will look at that more carefully.”

FOMC Minutes: "Near-term risks to the domestic outlook had diminished"

by Calculated Risk on 8/17/2016 02:08:00 PM

From the Fed: Minutes of the Federal Open Market Committee July 26-27, 2016. Excerpts:

With respect to the economic outlook and its implications for monetary policy, members continued to expect that, with gradual adjustments in the stance of monetary policy, economic activity would expand at a moderate pace and labor market indicators would strengthen. Members saw developments during the intermeeting period as reducing near-term uncertainty along two dimensions discussed at the June meeting. The first was about the outlook for the labor market. They agreed that the strong rebound in job gains in June--together with a rise in the labor force participation rate and a decline in the number of individuals who were working part time for economic reasons--suggested that, despite the very soft employment report for May, labor market conditions remained solid and slack had continued to diminish. Many members commented on the somewhat slower average pace of improvement in labor market conditions in recent months. Several of these members observed that the recent pace of job gains remained well above that consistent with stable rates of labor utilization. A couple of members indicated that, in light of their judgment that labor market conditions were at or close to the Committee's objectives, some moderation in employment gains was to be expected. In contrast, several other members expressed concern about the likelihood of a further reduction in the pace of job gains, and it was noted that if that slowing turned out to be persistent, the case for increasing the target range for the federal funds rate in the near term would be less compelling.

A second source of near-term uncertainty that members had discussed at the June meeting pertained to the potential economic and financial market consequences of the U.K. referendum on membership in the EU. At the current meeting, most members pointed to the quick recovery of financial market conditions since the "leave" vote as an encouraging sign of resilience in global financial markets that helped reduce near-term uncertainty about the outlook for the U.S. economy.

While members judged that near-term risks to the domestic outlook had diminished, some noted that the U.K. vote, along with other developments abroad, still imparted significant uncertainty to the medium- to longer-term outlook for foreign economies, with possible consequences for the U.S. outlook. As a result, members agreed to indicate that they would continue to closely monitor global economic and financial developments.

Members continued to expect inflation to remain low in the near term, in part because of earlier declines in energy prices, but most anticipated that inflation would rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipated and the labor market strengthened further. Nonetheless, in light of the current shortfall of inflation from 2 percent, members agreed that they would continue to carefully monitor actual and expected progress toward the Committee's inflation goal.

After assessing the outlook for economic activity, the labor market, and inflation, as well as the risks around that outlook, members decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent at this meeting. Members generally agreed that, before taking another step in removing monetary accommodation, it was prudent to accumulate more data in order to gauge the underlying momentum in the labor market and economic activity. A couple of members preferred also to wait for more evidence that inflation would rise to 2 percent on a sustained basis. Some other members anticipated that economic conditions would soon warrant taking another step in removing policy accommodation. One member preferred to raise the target range for the federal funds rate at the current meeting, citing the easing of financial conditions since the U.K. referendum, the return to trend economic growth, solid job growth, and inflation moving toward 2 percent.

Members again agreed that, in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee would assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. They noted that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee expected that economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate, and that the federal funds rate was likely to remain, for some time, below levels that are expected to prevail in the longer run. However, members emphasized that the actual path of the federal funds rate would depend on the economic outlook as informed by incoming data. In that regard, members judged it appropriate to continue to leave their policy options open and maintain the flexibility to adjust the stance of policy based on incoming information and its implications for the Committee's assessment of the outlook for economic activity, the labor market, and inflation, as well as the risks to the outlook. Most members noted that effective communications from the Committee would help the public understand how monetary policy might respond to incoming data and developments.

emphasis added

AIA: Architecture Billings Index "moderates slightly, remains positive" in July

by Calculated Risk on 8/17/2016 11:25:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index moderates slightly, remains positive

The Architecture Billings Index (ABI) was positive in July for the sixth consecutive month, and tenth out of the last twelve months as demand across all project types continued to increase. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 51.5, down from the mark of 52.6 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.5, down from a reading of 58.6 the previous month.Note that multi-family has picked up again, so we might see another pickup in multi-family starts.

“The uncertainty surrounding the presidential election is causing some funding decisions regarding larger construction projects to be delayed or put on hold for the time being,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “It’s likely that these concerns will persist up until the election, and therefore we would expect higher levels of volatility in the design and construction sector in the months ahead.”

...

• Regional averages: South (56.9), Midwest (50.1), Northeast (49.3), West (49.2)

• Sector index breakdown: multi-family residential (55.2), institutional (50.7), mixed practice (50.5), commercial / industrial (50.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.5 in July, down from 52.6 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoY

by Calculated Risk on 8/17/2016 09:25:00 AM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July, total sales were down 6.7% from July 2015, and conventional equity sales were down 4.2% compared to the same month last year.

In July, 4.9% of all resales were distressed sales. This was down from 5.0% last month, and down from 9.1% in July 2015, and the lowest level since Sacramento started tracking distressed sales.

The percentage of REOs was at 2.2% in July, and the percentage of short sales was 2.7%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 9.8% year-over-year (YoY) in June. This was the fifteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.3% of all sales (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 8/17/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 12, 2016.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier to the lowest level since February 2016, but remained 10 percent higher than the same week last year.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.64 percent from 3.65 percent, with points decreasing to 0.31 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "10 percent higher than the same week last year".

Tuesday, August 16, 2016

Comments on July Housing Starts

by Calculated Risk on 8/16/2016 08:59:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Minutes from the July 26-27, 2016 Meeting.

Earlier: Housing Starts increased to 1.211 Million Annual Rate in July

The housing starts report this morning was above consensus, however there were downward revisions to the prior two months. Still a solid report.

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 6.7% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 0.6% year-to-date, and single-family starts are up 10.6% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will probably catch up to starts soon (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues ...