by Calculated Risk on 8/15/2016 08:33:00 AM

Monday, August 15, 2016

NY Fed: August "General business conditions index fell five points to -4.2"

From the NY Fed: Empire State Manufacturing Survey

Business activity in New York State declined slightly this month, according to firms responding to the August 2016 Empire State Manufacturing Survey. The headline general business conditions index fell five points to -4.2.This was below the consensus forecast of 2.5, and suggests manufacturing contracted in the NY region in August.

...

The employment index climbed three points to -1.0, indicating that employment levels were little changed, and the average workweek index rose to 2.1, pointing to a slight increase in hours worked.

...

Indexes for the six-month outlook revealed that respondents remained optimistic about future conditions, though to a lesser extent than in July. The index for future business conditions fell for a second consecutive month, dropping six points to 23.7.

Sunday, August 14, 2016

WTI Oil Prices UP Year-over-year

by Calculated Risk on 8/14/2016 06:47:00 PM

Weekend:

• Schedule for Week of Aug 14, 2016

Monday:

• At 8:30 AM ET, the New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, up from 0.6.

• At 10:00 AM, the August NAHB homebuilder survey. The consensus is for a reading of 60, up from 59 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $44.57 per barrel and Brent at $46.97 per barrel. A year ago, WTI was at $42, and Brent was at $48 - so prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon (down about $0.55 per gallon from a year ago).

This graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

WTI oil prices are now up YoY! (Brent is still down YoY)

According to Bloomberg, WTI is at $44.57 per barrel today, and Brent is at $46.97

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Unless prices fall sharply again, oil prices - and eventually gasoline prices - will be up year-over-year and no longer a drag on CPI.

Hotels: Occupancy Rate on Track to be 2nd Best Year

by Calculated Risk on 8/14/2016 10:55:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 August

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 31 July through 6 August 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy decreased 1.6% to 75.6%. However, average daily rate was up 2.7% to US$127.69, and revenue per available room increased 1.1% to US$96.59.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Also 2016 is tracking just ahead of 2000 (the previous 2nd best year).

This is the peak of the Summer travel period, and the occupancy rate will decline seasonally over the next month.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, August 13, 2016

Schedule for Week of Aug 14, 2016

by Calculated Risk on 8/13/2016 08:09:00 AM

The key economic reports this week are July housing starts and the July Consumer Price Index (CPI).

For manufacturing, July industrial production, and the August New York and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, up from 0.6.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 60, up from 59 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts increased to 1.189 million (SAAR) in June. Single family starts increased to 778 thousand SAAR in June.

The consensus for 1.180 million, down from the June rate.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a no change in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 75.5%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: the FOMC Minutes from the July 26-27, 2016 Meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 2.0, up from -2.9.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2016

Friday, August 12, 2016

"Mortgage Rates Drop Back to 1-Month Lows"

by Calculated Risk on 8/12/2016 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop Back to 1-Month Lows

Just a day after bouncing firmly higher from the lowest levels in a month, mortgage rates are right back down to the bottom of the recent range. For some lenders, there have been one or two days with lower rates over the past, but for most, today is the best in exactly one month. Incidentally, that also puts rates fairly close to the lowest levels in 3 years seen in the immediate wake of the UK vote to leave the European Union (Brexit).Here is a table from Mortgage News Daily:

For flawless scenarios, 3.375% is now a more prevalent quote than 3.5% on conventional 30yr fixed loans. At current levels, the most aggressive fringe of the marketplace is beginning to offer 3.25% again--a rate that enjoyed a brief spat of popularity in early July. It should also be noted that government rates (FHA/VA/USDA) have been shining of late, with several lenders offering 30yr rates near or under 3.0%, and the vast majority able to do at least 3.25%. But again, don't expect to see these rates without a perfect scenario (in terms of credit score, property type, loan purpose, Loan-to-value, etc).

emphasis added

The Housing Bottom and Comparing Recoveries

by Calculated Risk on 8/12/2016 12:44:00 PM

In early 2012 I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Here is an update to that graph.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the most recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

In 2012, I argued that the current housing recovery would continue to be sluggish relative to previous housing recoveries. I suggested there were several reasons for this. From my 2012 post:

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.That was correct, and the recovery continued to be sluggish.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

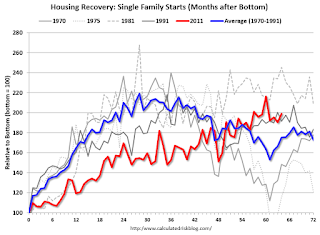

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.For the first several years, the current recovery (red) under performed previous recoveries.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

In 2012 I wrote:

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).The current recovery (red) started slowly, but is still ongoing!

Preliminary August Consumer Sentiment at 90.4

by Calculated Risk on 8/12/2016 10:03:00 AM

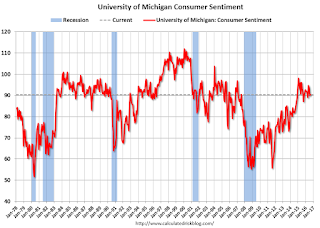

The preliminary University of Michigan consumer sentiment index for August was at 90.4, up from 90.0 in July.

Confidence inched upward in early August due to more favorable prospects for the overall economy offsetting a small pullback in personal finances. Most of the weakness in personal finances was among younger households who cited higher expenses than anticipated as well as somewhat smaller expected income gains. Concerns about Brexit have faded amid rising references to the outcome of the presidential election as a source of uncertainty about future economic prospects. Home buying has become particularly dependent on low interest rates, with net references to low interest rates spontaneously mentioned by 48%-this figure has been exceeded in only two months in the past ten years. In contrast, low housing prices were cited by just 25%, the lowest figure in ten years. Overall, the data remains consistent with real personal consumption expenditures improving at an annual rate of 2.6% through mid 2017, with new and existing home sales also benefitting from low mortgage rates.

emphasis added

Click on graph for larger image.

Retail Sales unchanged in July

by Calculated Risk on 8/12/2016 08:41:00 AM

On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 2.3% from July 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $457.7 billion, virtually unchanged from the previous month, and 2.3 percent above July 2015. ... The May 2016 to June 2016 percent change was revised from up 0.6 percent to up 0.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.The increase in July was below expectations for the month, however retail sales for June were revised up.

Thursday, August 11, 2016

Friday: Retail Sales, PPI, Consumer Sentiment

by Calculated Risk on 8/11/2016 06:18:00 PM

From the WSJ: Home Equity Loans Come Back to Haunt Borrowers, Banks

More homeowners are missing payments on their home-equity lines of credit, or Helocs ... These loans typically require interest-only payments for the first 10 years, but then principal payments kick in for the next 15 or 20 years.This isn't a large concern for the economy. But the ripples from the housing bubble are still being felt.

The increased cost of the loan can become a strain for some borrowers. This is becoming an issue now because many borrowers signed up for Helocs in the run-up to the housing bust as home values kept rising. Roughly 840,000 Helocs taken out in 2006 are resetting this year, with principal payments on an additional nearly one million loans expected to hit in 2017.

Friday:

• At 8:30 AM ET, Retail sales for July will be released. The consensus is for retail sales to increase 0.4% in July.

• Also at 8:30 AM, The Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices, and a 0.2% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.1% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 91.0, up from 90.0 in July.

Mortgage Delinquencies and the Unemployment Rate

by Calculated Risk on 8/11/2016 01:43:00 PM

In the press release for the MBA quarterly National Delinquency Survey for Q2, Marina Walsh, MBA's Vice President of Industry Analysis, wrote:

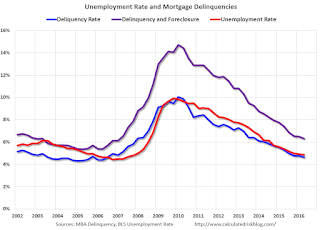

"The mortgage delinquency rate tracks closely with the nation's improving unemployment rate. In the second quarter of 2016, the mortgage delinquency rate was 4.66 percent, while the unemployment rate was 4.87 percent. By comparison, at its peak in the first quarter of 2010, the delinquency rate was 10.06 percent and the unemployment rate stood at 9.83 percent."Here is a graph comparing the mortgage delinquency rate and the unemployment rate. The unemployment rate is in Red, the mortgage delinquency rate (excluding in foreclosure) is in Blue, and the combined delinquency and in foreclosure is in Purple.

Click on graph for larger image.

Click on graph for larger image.As Ms. Walsh noted, the delinquency rate has pretty much tracked the unemployment rate since the great recession.

In 2002, the mortgage delinquency rate was below the unemployment rate, probably because house prices were rising even as the unemployment rate was still recovering from the 2001 recession.

A huge difference between the great recession and prior periods was the large number of homes in the foreclosure process (Purple is a combination of the mortgage delinquency rate and the percent of homes in foreclosure).

The combined rate of delinquencies and in foreclosure is now below the combined rate in 2002. The mix is different (more in the foreclosure process now). These rates are getting close to normal (foreclosures are still elevated).