by Calculated Risk on 7/19/2016 11:04:00 AM

Tuesday, July 19, 2016

Comments on June Housing Starts

Earlier: Housing Starts increased to 1.189 Million Annual Rate in June

The housing starts report this morning was above consensus, however there were downward revisions to the prior two months. Also starts were down 2.0% from June 2015. Still a decent report.

Once again the key take away from the Housing Starts report is that multi-family is slowing, and single family growth is ongoing year-over-year.

This graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 7.1% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 3.9% year-to-date, and single-family starts are up 13.2% year-to-date.

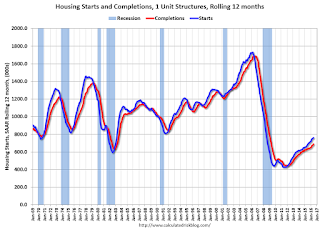

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will probably catch up to starts soon (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, however - as I've noted before - I expect most of the growth will be from single family going forward.

Housing Starts increased to 1.189 Million Annual Rate in June

by Calculated Risk on 7/19/2016 08:41:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,189,000. This is 4.8 percent above the revised May estimate of 1,135,000, but is 2.0 percent below the June 2015 rate of 1,213,000.

Single-family housing starts in June were at a rate of 778,000; this is 4.4 percent above the revised May figure of 745,000. The June rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,153,000. This is 1.5 percent above the revised May rate of 1,136,000, but is 13.6 percent below the June 2015 estimate of 1,334,000.

Single-family authorizations in June were at a rate of 738,000; this is 1.0 percent above the revised May figure of 731,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in June compared to May. Multi-family starts are down 22% year-over-year.

Single-family starts (blue) increased in June, and are up 13% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in June were above to expectations, however combined starts for April and May were revised down. I'll have more later ...

Monday, July 18, 2016

Tuesday: Housing Starts

by Calculated Risk on 7/18/2016 09:11:00 PM

Tuesday:

• At 8:30 AM ET, Housing Starts for June. Total housing starts decreased to 1.164 million (SAAR) in May. Single family starts increased to 764 thousand SAAR in May. The consensus for 1.170 million, up from the May rate.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates remain under pressure over the past few weeks after hitting near-all-time lows in early July. With one exception, rates have been either sideways or higher every day since July 6th. In that time, they've moved up roughly an eighth of a point. Today would be easier to characterize as "sideways" for most lenders, although a few raised costs just slightly. The most prevalently-quoted conventional 30yr fixed rate for top tier scenarios remains 3.375%.Here is a table from Mortgage News Daily:

emphasis added

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/18/2016 03:36:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.62 million in June, up 1.6% from May’s preliminary pace and up 3.9% from last June’s seasonally adjusted pace.

Local realtor/MLS data also suggest that existing home listings in aggregate increased modestly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of June will be 2.19 million, up 1.9% from May’s preliminary estimate and down 2.7% from last June. Finally, I project that the NAR’s estimate of the median existing single-family home sales price for June will be up 5.6% from last June’s estimate.

CR Note: The NAR is scheduled to release June existing home sales this Thursday, July 21st. The consensus is for 5.48 million SAAR in June, down from 5.53 million in May. Take the over!

LA area Port Traffic Mostly Unchanged in June

by Calculated Risk on 7/18/2016 01:34:00 PM

Special note: Now that the expansion to the Panama Canal has been completed, some of traffic that used the ports of Los Angeles and Long Beach will probably go through the canal. This could impact TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in May. Outbound traffic was down 0.1% compared to 12 months ending in May.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports are moving sideways and imports are gradually increasing.

NAHB: Builder Confidence declines to 59 in July

by Calculated Risk on 7/18/2016 10:18:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 59 in July, down from 60 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Holds Firm in July

Builder confidence in the market for newly built, single-family homes in July fell one point to 59 from a June reading of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“For the past six months, builder confidence has remained in a relatively narrow positive range that is consistent with the ongoing gradual housing recovery that is underway,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. “However, we are still hearing reports from our members of scattered softness in some markets, due largely to regulatory constraints and shortages of lots and labor.”

“The economic fundamentals are in place for continued slow, steady growth in the housing market,” said NAHB Chief Economist Robert Dietz. “Job creation is solid, mortgage rates are at historic lows and household formations are rising. These factors should help to bring more buyers into the market as the year progresses.”

...

All three HMI components edged lower in July. The components measuring current sales expectations and buyer traffic each fell one point to 63 and 45, respectively. The index measuring sales expectations in the next six months posted a three-point decline to 66.

The three-month moving averages for regional HMI scores held remarkably steady. The Northeast, Midwest and South were unchanged at 39, 57 and 61, respectively. The West edged one point higher to 69.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 61, however this is still a solid reading.

FNC: Residential Property Values increased 4.9% year-over-year in May

by Calculated Risk on 7/18/2016 08:01:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their May 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.7% from April to May (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.3% (NSA), the 20-MSA RPI increased 0.5%, and the 30-MSA RPI increased 0.6% in May. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

From FNC: FNC Index: May Home Prices Up 0.7%

According to the latest FNC Residential Price Index™ (RPI), U.S. home prices rose at a less robust pace in May, up 0.7% at a seasonally unadjusted rate. On a year-over-year basis, home price appreciation continues to level off, ending in May with a seasonally unadjusted rate of 4.9%.Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 11.6% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through May 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The May Case-Shiller index will be released on Tuesday, July 26th.

Sunday, July 17, 2016

Sunday Night Futures

by Calculated Risk on 7/17/2016 06:57:00 PM

From Tim Duy on Friday: Data Dump

Interesting mix of data today that will give monetary policymakers plenty of food for thought. My guess is that it will probably drive a deeper division in the Fed between those who looking to secure two hikes this year rather and those good with just one or none at all.Weekend:

...

Bottom Line: Generally solid data sufficient to keep the prospect of a rate hike or two alive for this year. But soft or mixed enough on key points to lean policy closer to the former than the latter.

• Schedule for Week of July 17, 2016

Monday:

• At 10:00 AM ET, the July NAHB homebuilder survey. The consensus is for a reading of 61, up from 60 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P are up 4 and DOW futures are up 35 (fair value).

Oil prices were up over the last week with WTI futures at $45.91 per barrel and Brent at $47.61 per barrel. A year ago, WTI was at $51, and Brent was at $56 - so prices are down 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (down over $0.50 per gallon from a year ago).

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 7/17/2016 11:06:00 AM

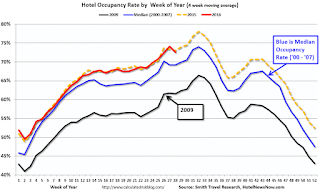

Note: The large year-over-year decline in the occupancy rate last week was related to the timing of the July 4th weekend.

From HotelNewsNow.com: STR: US hotel results for week ending 9 July

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 3-9 July 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with a full 2015 week that did not include the Fourth of July, the industry’s occupancy decreased 6.4% to 67.4%. Average daily rate was up 1.3% to US$121.11. Revenue per available room fell 5.2% to US$81.59.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

The 4-week average occupancy rate should remain above 70% during the Summer travel period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, July 16, 2016

Schedule for Week of July 17, 2016

by Calculated Risk on 7/16/2016 08:11:00 AM

The key economic reports this week are June housing starts, and June Existing Home Sales.

For manufacturing, the July Philly Fed manufacturing survey will be released this week.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 61, up from 60 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts decreased to 1.164 million (SAAR) in May. Single family starts increased to 764 thousand SAAR in May.

The consensus for 1.170 million, up from the May rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 254 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.0, up from 4.7.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

9:00 AM: FHFA House Price Index for May 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, down from 5.53 million in May.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, down from 5.53 million in May.10:00 AM: Regional and State Employment and Unemployment for June 2016