by Calculated Risk on 6/25/2016 11:29:00 AM

Saturday, June 25, 2016

Schedule for Week of June 26, 2016

The key economic reports this week are the third estimate of Q1 GDP, May personal income and outlays, June vehicle sales, the June ISM manufacturing, and Case-Shiller House prices.

10:30 AM ET: Dallas Fed Survey of Manufacturing Activity for June.

8:30 AM ET: Gross Domestic Product, 1st quarter 2016 (Third estimate). The consensus is that real GDP increased 1.0% annualized in Q1, revised up from a 0.8% increase.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the March 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.5% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 5.1% year-over-year in April.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June. This is the last of the regional Fed surveys for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Personal Income and Outlays for May. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:30 AM: Discussion, Fed Chair Janet Yellen, Policy Panel, ECB Forum on Central Banking, Linho Sintra, Portugal (CANCELLED: Probably due to Brexit)

10:00 AM: Pending Home Sales Index for May. The consensus is for a 1.0% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, up from 259 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.5, up from 49.3 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 51.5, up from 51.3 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 51.5, up from 51.3 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.3% in May. he employment index was at 49.2%, and the new orders index was at 55.7%.

10:00 AM: Construction Spending for May. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in June from 17.4 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in June from 17.4 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

June 2016: Unofficial Problem Bank list declines to 203 Institutions, Q2 2016 Transition Matrix

by Calculated Risk on 6/25/2016 08:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2016. During the month, the list fell from 206 institutions to 203 after four removals and one addition. Assets dropped by only $177 million to an aggregate $60.6 billion. Since the list has been in a net monthly decline starting in July 2012, this is the smallest monthly decline in the list count. A year ago, the list held 309 institutions with assets of $89.8 billion.

This month, actions have been terminated against Georgia Primary Bank, Atlanta, GA ($155 million); South County Bank, National Association, Rancho Santa Margarita, CA ($137 million); First State Bank of Warner, Warner, SD ($64 million); and Independence Bank, East Greenwich, RI ($39 million).

The addition this month was Grand Rivers Community Bank, Grand Chain, IL ($76 million). Also, we returned Gateway Bank, FSB, Oakland, CA, back to the list after it inadvertently was removed as the bank only divested a branch instead of being an entire sale.

With it being the end of the second quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,710 institutions have appeared on a weekly or monthly list at some point. There have been 1,507 institutions that have transitioned through the list. Departure methods include 854 action terminations, 398 failures, 240 mergers, and 15 voluntary liquidations. The second quarter of 2015 started with 222 institutions on the list, so the 17 action terminations during the quarter reduced the list by 7.7 percent, which is the lowest quarterly termination rate since the 6.9 percent in the fourth quarter of 2014. Of the 389 institutions on the first published list, 23 or 5.9 percent still remain more than six years later. The 398 failures represent 23.3 percent of the 1,710 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

At the start of the month, the FDIC provided updated figures on the Official Problem Bank List with the change during the quarter being a bit perplexing. The FDIC said the official list stood at 165 institutions with assets of $30.9 billion, down from 183 institutions with assets $46.8 billion at year-end. Thus, during the first quarter, the official list declined by 18 institutions and $15.9 billion in assets, which results in the 18 removals having an average asset size of $883 million. The average asset size of institutions on the official list at the start of the first quarter was only $256 million ($46.8 billion/183 institutions). In comparison, the average asset size of institutions currently on the unofficial list is higher at $299 million ($60.6 billion/203 institutions), which includes the $13.7 billion Flagstar Bank and six other institutions that range between $1-2.3 billion. Removing Flagstar Bank from the unofficial list reduces the list's average institution asset size to $232 million and aggregate assets drop to $46.9, much closer to the official figures at the end of the first quarter. In the preceding three quarters, the FDIC reported quarterly asset declines for the official list of $3.8 billion in the second quarter of 2015, $5.4 billion in the third quarter of 2015, and $4.3 billion in the fourth quarter of 2015. So it is unclear how the FDIC was able to ramp-up the asset removal rate to $15.9 billion during the first quarter absent the removal of Flagstar Bank, which is an SEC registrant that would be required to file an 8-K notice if its enforcement action had been terminated. While the FDIC closely guards the institutions on the official list, some banking industry participants believe the FDIC will manipulate the official list to mask the identity of large banks entering/exiting the list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 166 | (63,507,432) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (1,602,381) | ||

| Still on List at 6/30/2016 | 23 | 6,102,381 | |

| Additions after 8/7/2009 | 180 | 54,508,542 | |

| End (6/30//2016) | 203 | 60,610,923 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 688 | 279,432,438 | |

| Unassisted Merger | 201 | 79,734,581 | |

| Voluntary Liquidation | 11 | 2,389,500 | |

| Failures | 241 | 119,769,682 | |

| Total | 1,141 | 481,326,201 | |

| 1Institution not on 8/7/2009 or 6/30/2016 list but appeared on a weekly list. | |||

Friday, June 24, 2016

Mortgage Rates Near Record Lows

by Calculated Risk on 6/24/2016 04:52:00 PM

From Matthew Graham at Mortgage News Daily: Single Best Day For Mortgage Rates in More Than a Year

From yesterday's most prevalent conventional 30yr fixed quote of 3.625%, we're now easily down to 3.5% for most lenders. A few of the most aggressive lenders are already down to 3.375% on top tier scenarios. Back in 2012, 3.375% was the lowest rate that was maintained for more than a few days, although there were a few windows of opportunity for 3.25% and 3.125%. Considering some of the higher costs associated with today's mortgages (government guarantee fees and servicing costs), we're effectively back in line with all-time lows.Here is a table from Mortgage News Daily:

emphasis added

Philly Fed: State Coincident Indexes increased in 38 states in May

by Calculated Risk on 6/24/2016 03:27:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2016. In the past month, the indexes increased in 38 states, decreased in eight, and remained stable in four, for a one-month diffusion index of 60. Over the past three months, the indexes increased in 42 states, decreased in seven, and remained stable in one, for a three-month diffusion index of 70.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 40 states had increasing activity including minor increases.

Five states have seen declines over the last 6 months, in order they are Wyoming (worst), North Dakota, Louisiana, Alaska and Oklahoma - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

Vehicle Sales Forecasts: Sales to be Over 17 Million SAAR again in June

by Calculated Risk on 6/24/2016 12:15:00 PM

The automakers will report June vehicle sales on Friday, July 1st.

Note: There were 26 selling days in June, up from 25 in June 2015.

From WardsAuto: Forecast: June Sales to Reach 11-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.57 million light vehicles this month.From TrueCar: June Auto Sales Likely to Rebound From May’s Shortfall on Buoyant Retail Demand

The expected daily sales rate of 60,314 over 26 selling days represents a 2.5% improvement from like-2015 (25 days), with total volume for the month rising 6.6%.

...

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, shy of last month’s 17.37 million SAAR, but ahead of the current 3-month SAAR (17.0 million) and the year-to-date SAAR through May (17.2 million).

emphasis added

The seasonally adjusted annualized rate (SAAR) for total light vehicle sales in June is an estimated 17.2 million units, up from 17 million units a year ago.Looks like another strong month for vehicle sales.

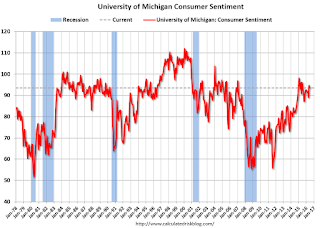

Consumer Sentiment at 93.5 in June

by Calculated Risk on 6/24/2016 10:03:00 AM

The final University of Michigan consumer sentiment index for June was at 93.5, down from the preliminary reading of 94.3, and down from 94.7 in May:

"Consumers were a bit less optimistic in late June due to rising concerns about prospects for the national economy. While no recession is anticipated, consumers increasingly expect a slower pace of economic growth in the year ahead. Importantly, the persistent strength in personal finances will keep the level of consumer spending at relatively high levels and continue to support an uninterrupted economic expansion. Over the past 18 months, the Sentiment Index has shown only minor fluctuations about a very positive trend, with the June 2016 level a bit higher than the overall average (93.5 vs. 92.6). This relative stability stands in sharp contrast to the much more volatile path of GDP. The stability in the overall Sentiment Index reflects a gradual improvement in assessments of current conditions being offset by a downward drift in the economic prospects. The Current Conditions Index reached in the June survey its highest level since January of 2007, while the Expectations Index declined a modest 9.5% from its January 2015 peak. "

emphasis added

Click on graph for larger image.

Federal Reserve on Brexit

by Calculated Risk on 6/24/2016 09:09:00 AM

From the Federal Reserve:

The Federal Reserve is carefully monitoring developments in global financial markets, in cooperation with other central banks, following the results of the U.K. referendum on membership in the European Union. The Federal Reserve is prepared to provide dollar liquidity through its existing swap lines with central banks, as necessary, to address pressures in global funding markets, which could have adverse implications for the U.S. economy.The magnitude of the economic impact on the U.S. of Brexit is unclear, but it probably means the Fed will wait longer to raise rates (maybe December, maybe 2017). Here is an except from a Merrill Lynch note this morning on the impact:

1. Reducing real GDP growth by an average of 0.2pp over the next 6 quarters. This leaves 2016 annual growth of 1.8% but slices 0.2pp from growth next year, bringing it also to 1.8%

2.Fed will delay rate hikes. We expect the Fed to wait until December to hike ...

Thursday, June 23, 2016

Friday: Brexit Result, Durable Goods, Consumer Sentiment

by Calculated Risk on 6/23/2016 08:52:00 PM

To track the Brexit vote, here is a great spreadsheet updated frequently from @britainelects

Friday:

• At 8:30 AM ET, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.7% decrease in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 94.1, down from the preliminary reading 94.0, and down from 94.7 in May.

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 6/23/2016 05:11:00 PM

On occupancy from HotelNewsNow.com: STR: US hotel results for week ending 18 June

The U.S. hotel industry reported mostly positive results in the three key performance metrics during the week of 12-18 June 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy was nearly flat (-0.1% to 74.6%). However, average daily rate increased 3.5% to US$126.89, and revenue per available room grew 3.3% to US$94.62.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

The occupancy rate should remain above 70% during the Summer travel period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in May

by Calculated Risk on 6/23/2016 02:09:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in May.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May- 2016 | May- 2015 | May- 2016 | May- 2015 | May- 2016 | May- 2015 | May- 2016 | May- 2015 | |

| Las Vegas | 4.5% | 7.3% | 6.1% | 8.0% | 10.6% | 15.3% | 28.2% | 29.1% |

| Reno** | 3.0% | 5.0% | 3.0% | 4.0% | 6.0% | 9.0% | ||

| Phoenix | 1.6% | 2.8% | 2.1% | 3.2% | 3.7% | 6.0% | 21.6% | 24.1% |

| Sacramento | 3.5% | 4.7% | 3.2% | 5.4% | 6.7% | 10.1% | 16.7% | 17.4% |

| Minneapolis | 1.2% | 2.4% | 5.5% | 6.7% | 6.7% | 9.1% | 11.6% | 12.0% |

| Mid-Atlantic | 2.9% | 3.4% | 8.8% | 10.4% | 11.7% | 13.8% | 15.0% | 16.1% |

| So. California* | 2.2% | 3.4% | 3.4% | 4.3% | 5.6% | 7.7% | 19.3% | 23.2% |

| Florida SF | 2.3% | 3.8% | 9.4% | 17.8% | 11.7% | 21.6% | 29.1% | 34.7% |

| Florida C/TH | 1.5% | 2.6% | 7.7% | 14.1% | 9.3% | 16.7% | 57.0% | 62.6% |

| Miami - Dade Co. SF | 3.8% | 8.8% | 16.4% | 18.2% | 20.2% | 27.0% | 31.3% | 33.0% |

| Miami - Dad Co. CTH | 2.6% | 4.0% | 15.1% | 19.0% | 17.7% | 23.0% | 62.0% | 62.7% |

| Broward Co. SF | 4.7% | 7.3% | 13.8% | 14.8% | 18.5% | 22.1% | 26.3% | 29.9% |

| Broward Co. CTH | 1.8% | 3.8% | 11.2% | 18.9% | 13.0% | 22.7% | 61.0% | 66.0% |

| Spokane | 6.3% | 12.8% | ||||||

| Chicago (city) | 11.3% | 16.2% | ||||||

| Northeast Florida | 17.0% | 26.6% | ||||||

| Tucson | 22.6% | 25.6% | ||||||

| Toledo | 26.9% | 28.5% | ||||||

| S.C. Wisconsin | 14.6% | 15.6% | ||||||

| Knoxville | 20.7% | 20.5% | ||||||

| Peoria | 21.7% | 17.9% | ||||||

| Georgia*** | 20.8% | 20.3% | ||||||

| Omaha | 13.2% | 15.9% | ||||||

| Pensacola | 29.9% | 31.3% | ||||||

| Rhode Island | 9.5% | 11.5% | ||||||

| Richmond VA | 7.5% | 8.5% | 15.1% | 14.9% | ||||

| Memphis | 11.0% | 14.3% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||