by Calculated Risk on 6/24/2016 04:52:00 PM

Friday, June 24, 2016

Mortgage Rates Near Record Lows

From Matthew Graham at Mortgage News Daily: Single Best Day For Mortgage Rates in More Than a Year

From yesterday's most prevalent conventional 30yr fixed quote of 3.625%, we're now easily down to 3.5% for most lenders. A few of the most aggressive lenders are already down to 3.375% on top tier scenarios. Back in 2012, 3.375% was the lowest rate that was maintained for more than a few days, although there were a few windows of opportunity for 3.25% and 3.125%. Considering some of the higher costs associated with today's mortgages (government guarantee fees and servicing costs), we're effectively back in line with all-time lows.Here is a table from Mortgage News Daily:

emphasis added

Philly Fed: State Coincident Indexes increased in 38 states in May

by Calculated Risk on 6/24/2016 03:27:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2016. In the past month, the indexes increased in 38 states, decreased in eight, and remained stable in four, for a one-month diffusion index of 60. Over the past three months, the indexes increased in 42 states, decreased in seven, and remained stable in one, for a three-month diffusion index of 70.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 40 states had increasing activity including minor increases.

Five states have seen declines over the last 6 months, in order they are Wyoming (worst), North Dakota, Louisiana, Alaska and Oklahoma - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

Vehicle Sales Forecasts: Sales to be Over 17 Million SAAR again in June

by Calculated Risk on 6/24/2016 12:15:00 PM

The automakers will report June vehicle sales on Friday, July 1st.

Note: There were 26 selling days in June, up from 25 in June 2015.

From WardsAuto: Forecast: June Sales to Reach 11-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.57 million light vehicles this month.From TrueCar: June Auto Sales Likely to Rebound From May’s Shortfall on Buoyant Retail Demand

The expected daily sales rate of 60,314 over 26 selling days represents a 2.5% improvement from like-2015 (25 days), with total volume for the month rising 6.6%.

...

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, shy of last month’s 17.37 million SAAR, but ahead of the current 3-month SAAR (17.0 million) and the year-to-date SAAR through May (17.2 million).

emphasis added

The seasonally adjusted annualized rate (SAAR) for total light vehicle sales in June is an estimated 17.2 million units, up from 17 million units a year ago.Looks like another strong month for vehicle sales.

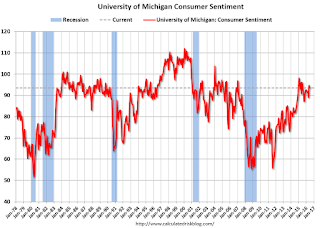

Consumer Sentiment at 93.5 in June

by Calculated Risk on 6/24/2016 10:03:00 AM

The final University of Michigan consumer sentiment index for June was at 93.5, down from the preliminary reading of 94.3, and down from 94.7 in May:

"Consumers were a bit less optimistic in late June due to rising concerns about prospects for the national economy. While no recession is anticipated, consumers increasingly expect a slower pace of economic growth in the year ahead. Importantly, the persistent strength in personal finances will keep the level of consumer spending at relatively high levels and continue to support an uninterrupted economic expansion. Over the past 18 months, the Sentiment Index has shown only minor fluctuations about a very positive trend, with the June 2016 level a bit higher than the overall average (93.5 vs. 92.6). This relative stability stands in sharp contrast to the much more volatile path of GDP. The stability in the overall Sentiment Index reflects a gradual improvement in assessments of current conditions being offset by a downward drift in the economic prospects. The Current Conditions Index reached in the June survey its highest level since January of 2007, while the Expectations Index declined a modest 9.5% from its January 2015 peak. "

emphasis added

Click on graph for larger image.

Federal Reserve on Brexit

by Calculated Risk on 6/24/2016 09:09:00 AM

From the Federal Reserve:

The Federal Reserve is carefully monitoring developments in global financial markets, in cooperation with other central banks, following the results of the U.K. referendum on membership in the European Union. The Federal Reserve is prepared to provide dollar liquidity through its existing swap lines with central banks, as necessary, to address pressures in global funding markets, which could have adverse implications for the U.S. economy.The magnitude of the economic impact on the U.S. of Brexit is unclear, but it probably means the Fed will wait longer to raise rates (maybe December, maybe 2017). Here is an except from a Merrill Lynch note this morning on the impact:

1. Reducing real GDP growth by an average of 0.2pp over the next 6 quarters. This leaves 2016 annual growth of 1.8% but slices 0.2pp from growth next year, bringing it also to 1.8%

2.Fed will delay rate hikes. We expect the Fed to wait until December to hike ...

Thursday, June 23, 2016

Friday: Brexit Result, Durable Goods, Consumer Sentiment

by Calculated Risk on 6/23/2016 08:52:00 PM

To track the Brexit vote, here is a great spreadsheet updated frequently from @britainelects

Friday:

• At 8:30 AM ET, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.7% decrease in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 94.1, down from the preliminary reading 94.0, and down from 94.7 in May.

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 6/23/2016 05:11:00 PM

On occupancy from HotelNewsNow.com: STR: US hotel results for week ending 18 June

The U.S. hotel industry reported mostly positive results in the three key performance metrics during the week of 12-18 June 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy was nearly flat (-0.1% to 74.6%). However, average daily rate increased 3.5% to US$126.89, and revenue per available room grew 3.3% to US$94.62.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

The occupancy rate should remain above 70% during the Summer travel period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in May

by Calculated Risk on 6/23/2016 02:09:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in May.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May- 2016 | May- 2015 | May- 2016 | May- 2015 | May- 2016 | May- 2015 | May- 2016 | May- 2015 | |

| Las Vegas | 4.5% | 7.3% | 6.1% | 8.0% | 10.6% | 15.3% | 28.2% | 29.1% |

| Reno** | 3.0% | 5.0% | 3.0% | 4.0% | 6.0% | 9.0% | ||

| Phoenix | 1.6% | 2.8% | 2.1% | 3.2% | 3.7% | 6.0% | 21.6% | 24.1% |

| Sacramento | 3.5% | 4.7% | 3.2% | 5.4% | 6.7% | 10.1% | 16.7% | 17.4% |

| Minneapolis | 1.2% | 2.4% | 5.5% | 6.7% | 6.7% | 9.1% | 11.6% | 12.0% |

| Mid-Atlantic | 2.9% | 3.4% | 8.8% | 10.4% | 11.7% | 13.8% | 15.0% | 16.1% |

| So. California* | 2.2% | 3.4% | 3.4% | 4.3% | 5.6% | 7.7% | 19.3% | 23.2% |

| Florida SF | 2.3% | 3.8% | 9.4% | 17.8% | 11.7% | 21.6% | 29.1% | 34.7% |

| Florida C/TH | 1.5% | 2.6% | 7.7% | 14.1% | 9.3% | 16.7% | 57.0% | 62.6% |

| Miami - Dade Co. SF | 3.8% | 8.8% | 16.4% | 18.2% | 20.2% | 27.0% | 31.3% | 33.0% |

| Miami - Dad Co. CTH | 2.6% | 4.0% | 15.1% | 19.0% | 17.7% | 23.0% | 62.0% | 62.7% |

| Broward Co. SF | 4.7% | 7.3% | 13.8% | 14.8% | 18.5% | 22.1% | 26.3% | 29.9% |

| Broward Co. CTH | 1.8% | 3.8% | 11.2% | 18.9% | 13.0% | 22.7% | 61.0% | 66.0% |

| Spokane | 6.3% | 12.8% | ||||||

| Chicago (city) | 11.3% | 16.2% | ||||||

| Northeast Florida | 17.0% | 26.6% | ||||||

| Tucson | 22.6% | 25.6% | ||||||

| Toledo | 26.9% | 28.5% | ||||||

| S.C. Wisconsin | 14.6% | 15.6% | ||||||

| Knoxville | 20.7% | 20.5% | ||||||

| Peoria | 21.7% | 17.9% | ||||||

| Georgia*** | 20.8% | 20.3% | ||||||

| Omaha | 13.2% | 15.9% | ||||||

| Pensacola | 29.9% | 31.3% | ||||||

| Rhode Island | 9.5% | 11.5% | ||||||

| Richmond VA | 7.5% | 8.5% | 15.1% | 14.9% | ||||

| Memphis | 11.0% | 14.3% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Kansas City Fed: Regional Manufacturing Activity "Increased Slightly" in June

by Calculated Risk on 6/23/2016 11:14:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Increased Slightly

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Megan Williams, survey manager and associate economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity increased slightly.The Kansas City region was hit hard by lower oil prices. Now that "energy prices have stabilized somewhat", manufacturing has stopped contracting (at least for one month).

“Regional factory activity posted a positive reading for the first time since January 2015, as energy prices have stabilized somewhat and orders have increased,” said Williams. “Additionally, firms continue to expect further improvements for the months ahead.”

...

The month-over-month composite index was 2 in June, up from -5 in May and -4 in April ... The employment index edged up from -13 to -4, its highest level in over a year

emphasis added

New Home Sales decreased to 551,000 Annual Rate in May

by Calculated Risk on 6/23/2016 10:13:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 551 thousand.

The previous three months were revised down by a total of 55 thousand (SAAR).

"Sales of new single-family houses in May 2016 were at a seasonally adjusted annual rate of 551,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.0 percent below the revised April rate of 586,000, but is 8.7 percent above the May 2015 estimate of 507,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in May to 5.3 months.

The months of supply increased in May to 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of May was 244,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2016 (red column), 51 thousand new homes were sold (NSA). Last year 47 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 26 thousand in 2010.

This was below expectations of 565,000 sales SAAR in May, and prior months were revised down. I'll have more later today.