by Calculated Risk on 6/22/2016 07:00:00 AM

Wednesday, June 22, 2016

MBA: Mortgage "Rates Drop, Refi Apps Jump in Latest Weekly Survey"

From the MBA: Rates Drop, Refi Apps Jump in Latest MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 17, 2016.

...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since May 2013, 3.76 percent, from 3.79 percent, with points increasing to 0.33 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

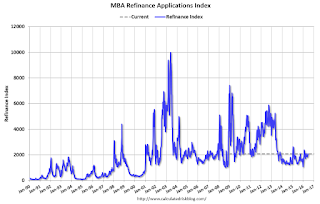

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

30-year fixed rates would probably have to fall below 3.35% (the previous low) before there is a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "12 percent higher than the same week one year ago".

Tuesday, June 21, 2016

Wednesday: Existing Home Sales, Fed Chair Yellen

by Calculated Risk on 6/21/2016 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for April 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.6% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.45 million in April. Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR in May.

• Also at 10:00 AM, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

• During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

CoreLogic: Orange County home prices above Bubble Peak

by Calculated Risk on 6/21/2016 04:23:00 PM

From Andrew Khouri at the LA Times: Orange County home prices rise above their 2007 bubble-era peak

Median home prices in Orange County rose in May to surpass their bubble-era peak in 2007, making the county the first in Southern California where that has happened, according to a new report.This brings up a few important points ...

...

May's median in Los Angeles County — $525,000 — is still 4.5% below the county’s bubble-era peak of $550,000. Riverside County is 23.6% below, San Bernardino County 25% below, San Diego County 5.3% below and Ventura County 17.9% below.

1. This is the median price - not a repeat sales index - and the median price can be impacted by the mix of homes sold (not as useful as a repeat sales index).

2. As Khouri notes in the article, these are nominal prices. When adjusted for inflation (real prices), prices are still 13% below the bubble peak.

3. This is not a bubble. A bubble requires both excess appreciation and speculation, and there is a little evidence of speculation - these are qualified buyers who will not default if prices decline (unlike many buyers during the bubble).

4. Note that the central / coastal areas are closer to the previous peak than the outlying areas. This is the typical pattern; the price increases start in the central / coastal areas, and then move inland as the cycle matures. Plus the inland areas saw the most speculation during the bubble - especially using subprime loans - and it will take longer for prices to reach a new peak.

Chemical Activity Barometer indicated "Solid Growth in June"

by Calculated Risk on 6/21/2016 01:01:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Solid Growth in June; Signals Higher U.S. Business Activity Through End Of The Year

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.8 percent in June following a revised 0.9 percent increase in May and 0.7 percent increase in April. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 2.5 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 2.7 percent year-over-year gain from 2014. On an unadjusted basis the CAB jumped 0.4 percent in June, following a similar 0.4 percent gain in May. The CAB is signaling higher U.S. business activity through the end of the year.

...

AApplying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased over the last three months, and this suggests an increase in Industrial Production over the next year.

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 6/21/2016 10:04:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C. (starts at 10 AM ET). An excerpt on risks:

The latest readings on the labor market and the weak pace of investment illustrate one downside risk--that domestic demand might falter. In addition, although I am optimistic about the longer-run prospects for the U.S. economy, we cannot rule out the possibility expressed by some prominent economists that the slow productivity growth seen in recent years will continue into the future. Vulnerabilities in the global economy also remain. Although concerns about slowing growth in China and falling commodity prices appear to have eased from earlier this year, China continues to face considerable challenges as it rebalances its economy toward domestic demand and consumption and away from export-led growth. More generally, in the current environment of sluggish growth, low inflation, and already very accommodative monetary policy in many advanced economies, investor perceptions of and appetite for risk can change abruptly. One development that could shift investor sentiment is the upcoming referendum in the United Kingdom. A U.K. vote to exit the European Union could have significant economic repercussions. For all of these reasons, the Committee is closely monitoring global economic and financial developments and their implications for domestic economic activity, labor markets, and inflation.Here is the C-Span Link

emphasis added

Here is the Bloomberg TV link.

Atlanta Fed: "Wage Growth moved Higher in May"

by Calculated Risk on 6/21/2016 09:16:00 AM

From John Robertson at the Atlanta Fed Macroblog: Wage Growth for Job Stayers and Switchers Added to the Atlanta Fed's Wage Growth Tracker

The Atlanta Fed's Wage Growth Tracker (WGT) moved higher again in May—the third increase in a row and consistent with a labor market that is continuing to tighten. At 3.5 percent, the WGT is at a level last seen in early 2009.

As was noted in an early macroblog post, when the labor market is tightening, people changing jobs experience higher median wage growth than those who remain in the same job. Median wage growth for job switchers has significantly outpaced that of job stayers in recent months. For job stayers, the May WGT was 3.0 percent, the same as in April, whereas for people switching jobs the median WGT increased from 4.1 percent to 4.3 percent in May (the highest reading since December 2007; see the chart).

Click on graph for larger image.

Click on graph for larger image.The Wage Growth Tracker is another measure of wages. From the Atlanta Fed:

The Atlanta Fed's Wage Growth Tracker is a measure of the wage growth of individuals. It is constructed using microdata from the Current Population Survey (CPS), and is the median percent change in the hourly wage of individuals observed 12 months apart.This measure is indicating a pickup in wages, especially for job switchers.

Monday, June 20, 2016

Tuesday: Fed Chair Yellen

by Calculated Risk on 6/20/2016 05:27:00 PM

From Kate Davidson at the WSJ: What to Watch for in Janet Yellen’s Congressional Testimony

Central bank watchers will hear from the Fed chief for the fourth time in as many weeks on Tuesday when she appears before the Senate Banking Committee for her semiannual monetary policy testimony. Ms. Yellen will return to the Hill on Wednesday for round two before the House Financial Services Committee.Tuesday:

The timing of these so-called Humphrey-Hawkins hearings is of note. They come just days after the Fed’s latest policy meeting and before a U.K. referendum on whether to the leave the European Union. They also are the last scheduled chance lawmakers ... will have to publicly question the Fed chief before voters head to the polls in November.

• At 10:00 AM ET, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Higher to Begin Volatile Week

Mortgage rates continued higher today, and at a quicker pace than the modest increase seen at the end of last week. Financial markets are undergoing a change of heart regarding their approach to Brexit (market shorthand for a "British exit" from the European Union). Brexit fears had helped drive interest rates to long-term lows in the US and to all-time lows in Europe.

...

The bonds that underlie mortgage rates are somewhat more insulated from this global market drama, but were still noticeably affected (meaning rates moved higher). The most prevalent conventional 30yr fixed rate quotes are now back into a relatively balanced range between 3.5% and 3.625% on top tier scenarios.

emphasis added

Phoenix Real Estate in May: Sales up 6%, Inventory up YoY

by Calculated Risk on 6/20/2016 01:07:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 5.5% year-over-year in May. This is the third consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in May were up 6.4% year-over-year.

2) Cash Sales (frequently investors) were down to 21.8% of total sales.

3) Active inventory is now up 5.5% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow.

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Inventory | YoY Change Inventory | |

| May-08 | 5,6371 | --- | 1,062 | 18.8% | 54,1611 | --- |

| May-09 | 9,284 | 64.7% | 3,592 | 38.7% | 39,902 | -26.3% |

| May-10 | 9,067 | -2.3% | 3,341 | 36.8% | 41,326 | 3.6% |

| May-11 | 9,811 | 8.2% | 4,523 | 46.1% | 31,661 | -23.4% |

| May-12 | 8,445 | 13.5% | 3,907 | 46.3% | 20,162 | -36.3% |

| May-13 | 9,440 | 11.8% | 3,669 | 38.9% | 19,734 | -2.1% |

| May-14 | 7,442 | -21.2% | 2,193 | 29.5% | 29,091 | 47.4% |

| May-15 | 8,293 | 11.4% | 1,988 | 24.0% | 24,616 | -15.4% |

| May-16 | 8,820 | 6.4% | 1,931 | 21.9% | 25,980 | 5.5% |

| 1 May 2008 does not include manufactured homes, ~100 more | ||||||

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 6/20/2016 10:55:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire has mostly recovered.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 5.6% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still fairly low.

Overall the outlook for the Inland Empire is much better today.

FNC: Residential Property Values increased 5.6% year-over-year in April

by Calculated Risk on 6/20/2016 08:47:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.1% from March to April (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 1.6% (NSA), the 20-MSA RPI increased 1.5%, and the 30-MSA RPI increased 1.4% in April. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

From FNC: FNC Index: April Home Prices Up 1.1%

The latest FNC Residential Price Index™ (RPI) indicated U.S. home prices rose quickly in April, up 1.1% at a seasonally unadjusted rate. On a year-over-year basis, prices continue to enjoy modest growth, rising 5.6% from a year ago.Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 12.2% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through April 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The April Case-Shiller index will be released on Tuesday, June 28th.