by Calculated Risk on 5/24/2016 11:10:00 AM

Tuesday, May 24, 2016

NY Fed: Household Debt Increased in Q1 2016, Delinquency Rates Declined

The Q1 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Steps Up, Delinquencies Drop

Household indebtedness continued to advance during the first three months of 2016 according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, which was released today. ...

The bulk of the $136 billion (1.1 percent) aggregate debt increase came from mortgages, which increased $120 billion from the fourth quarter of 2015 to a four and a half year high. The median credit score for newly originating mortgages increased slightly, and 58 percent of all new mortgage dollars went to borrowers with credit scores over 760. ...

Overall repayment rates generally improved in the first quarter of this year. Five percent of outstanding debt was in some stage of delinquency, the lowest amount since the second quarter of 2007.

...

"Delinquency rates and the overall quality of outstanding debt continue to improve," said Wilbert van der Klaauw, senior vice president at the New York Fed. "The proportion of overall debt that becomes newly delinquent has been on a steady downward trend and is at its lowest level since our series began in 1999. This improvement is in large part driven by mortgages."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

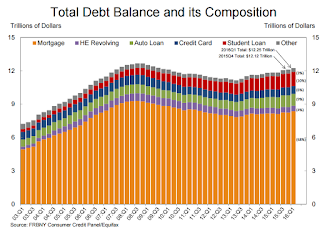

The first graph shows aggregate consumer debt increased in Q1. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt increased in Q1, from the NY Fed:

Mortgage balances, the largest component of household debt, increased in the first quarter. Mortgage balances shown on consumer credit reports stood at $8.37 trillion, a $120 billion increase from the fourth quarter of 2015. Balances on home equity lines of credit (HELOC) dropped by $2 billion, to $485 billion. Non-housing debt balances rose somewhat in the first quarter; increases of $7 billion and $29 billion in auto and student loans, respectively, were offset by a $21 billion decline in credit card balances.

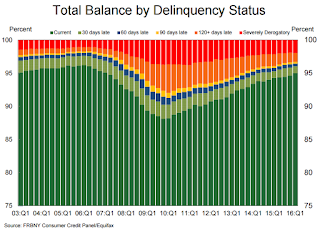

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased in Q1 to 5.0%. From the NY Fed:

Overall delinquency rates improved in 2016Q1. As of March 31, 5.0% of outstanding debt was in some stage of delinquency. Of the $613 billion of debt that is delinquent, $436 billion is seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

New Home Sales increased sharply to 619,000 Annual Rate in April

by Calculated Risk on 5/24/2016 10:14:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 619 thousand.

The previous three months were revised up by a total of 44 thousand (SAAR).

"Sales of new single-family houses in April 2016 were at a seasonally adjusted annual rate of 619,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.6 percent above the revised March rate of 531,000 and is 23.8 percent above the April 2015 estimate of 500,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 4.7 months.

The months of supply decreased in April to 4.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of April was 243,000. This represents a supply of 4.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

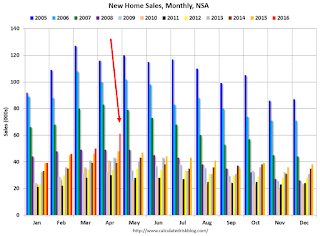

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2016 (red column), 55 thousand new homes were sold (NSA). Last year 48 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was well above expectations of 523,000 sales SAAR in April, and prior months were revised up. A very strong report. I'll have more later today.

Black Knight's First Look at April Mortgage Data: Lowest Number of Foreclosure Starts in 10 Years

by Calculated Risk on 5/24/2016 08:09:00 AM

From Black Knight: Black Knight Financial Services’ First Look at April Mortgage Data: Lowest Number of Foreclosure Starts in 10 Years; Prepay Activity Falls Despite Low Rates

• At 58,700, April 2016 saw the lowest number of foreclosure starts since April 2006According to Black Knight's First Look report for April, the percent of loans delinquent increased 3.8% in April compared to March, and declined 10.3% year-over-year.

• National delinquency rate is up from a 9-year low in March, but still 10 percent below last year’s level

• Prepayment speeds (historically a good indicator of refinance activity) fell in April, despite interest rates being near 3-year lows

• Active foreclosure inventory has now dropped below 600,000 for the first time since 2007

The percent of loans in the foreclosure process declined 5.9% in April and were down 27.8% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.24% in April, up from 4.08% in Maarch.

The percent of loans in the foreclosure process declined in April 1.17%.

The number of delinquent properties, but not in foreclosure, is down 235,000 properties year-over-year, and the number of properties in the foreclosure process is down 225,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for April on June 6th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2016 | Mar 2016 | Apr 2015 | Apr 2014 | |

| Delinquent | 4.24% | 4.08% | 4.72% | 5.59% |

| In Foreclosure | 1.17% | 1.25% | 1.63% | 2.11% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,146,000 | 2,062,000 | 2,381,000 | 2,813,000 |

| Number of properties in foreclosure pre-sale inventory: | 595,000 | 631,000 | 820,000 | 1,064,000 |

| Total Properties | 2,741,000 | 2,693,000 | 3,201,000 | 3,877,000 |

Monday, May 23, 2016

Tuesday: New Home Sales, Richmond Fed Mfg, Q1 2016 Household Debt and Credit Report

by Calculated Risk on 5/23/2016 08:42:00 PM

Tuesday:

• At 10:00 AM ET, New Home Sales for April from the Census Bureau. The consensus is for a increase in sales to 523 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 511 thousand in March.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

• At 11:00 AM, The New York Fed will release their Q1 2016 Household Debt and Credit Report

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Sideways for 3rd Straight Day

Mortgage rates were relatively steady again, marking the third straight business day with almost no rate movement following last week's quick spike higher. That spike was all about financial markets quickly coming to terms with a higher probability of a Fed rate hike. Given that there hasn't been any movement since then, we can increasingly assume that markets took care of this business by Wednesday afternoon. While it's reassuring that we haven't seen any additional move higher in rates, neither have we seen any meaningful move lower. That leaves the average conventional 30yr fixed rate quote at 3.75%, but there are still quite a few lenders quoting 3.625%.

emphasis added

Year-over-year Change in Oil Prices

by Calculated Risk on 5/23/2016 05:03:00 PM

Oil prices are "only" down about 20% year-over-year (YoY), and the YoY decline has been decreasing.

So I thought I'd look at the YoY change in oil prices over the last few decades.

This graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Oil prices are volatile! And it seems likely the YoY change will turn positive later this year.

Goldman Sachs on Rate Hike Odds: 35% in June, 35% in July

by Calculated Risk on 5/23/2016 11:40:00 AM

In a research note released this morning, Goldman Sachs chief economist Jan Hatzius wrote: Superforecasting Fed Policy

"... 35% probability for a hike in June, a 35% probability for July, a 20% probability for September—our previous modal forecast—and a 10% probability for either a later hike or a cut."This suggests a cumulative forecast probability of 70% by the July meeting, and 90% by September.

The Fed has definitely changed expectations.

For amusement ... early in my career, as a scientist at SAIC in San Diego (my undergraduate degree is in chemistry), I was invited to a sales meeting to discuss potential new contracts. A senior salesperson discussed one potential contract, and he was asked the probability of obtaining the contract. He said it was 50%.

Asked how he came up with the odds, he said: "Either we get it or we don't."

The Fed is more data dependent than that salesperson. A pickup in inflation and a decent jobs report will increase the odds of a June rate hike. But I suspect that sales guy would put the odds at 50%: Either they hike or they don't!

CoreLogic: Far Fewer Low Credit Score Applicants Than Before Housing Crisis

by Calculated Risk on 5/23/2016 09:35:00 AM

An interesting post from Archana Pradhan at CoreLogic Far Fewer Low Credit Score Applicants Than Before Housing Crisis. An excerpt:

One of the key factors used in mortgage underwriting as well as in our Housing Credit Index is the credit score. The average borrower credit score for home-purchase originations has increased from roughly 700 in 2005 to almost 750 in 2015 (Figure 2). In 2005, the credit score for the first percentile ranged from 520 to 540 and showed a dramatic rise during the Great Recession, and is currently running in a range of 620 to 630. By just gazing at the borrowers’ credit scores, one could conclude that mortgage originations were constrained as a result of tight underwriting standards. But how has loan demand changed, particularly for the borrowers with relatively low credit scores? The origination volume is the end result of an interplay between loan applicants’ demand and lenders’ risk tolerances. Is there a way to disentangle mortgage credit supply conditions from mortgage demand?

Click on graph for larger image

Click on graph for larger imageThis graph from CoreLogic shows the significant increase in credit scores for the first percentile of borrowers.

At first glance, this would appear to be due to tighter underwriting standards, but Pradhan looks at denial rates and asks: If Credit Underwriting Has Tightened, Why Have Denial Rates Fallen?

The data shows that demand has fallen for low credit score borrowers; either they are more cautious, or - more likely - they are discouraged from even applying. Interesting data.

Sunday, May 22, 2016

Sunday Night Futures

by Calculated Risk on 5/22/2016 06:50:00 PM

From Tim Duy at Fed Watch: This Is Not A Drill. This Is The Real Thing. Here is his conclusion:

Bottom Line: This is not a drill. This meeting is the real thing - an undoubtedly lively debate that could end with a rate hike. I think we narrowly avoid a rate hike, but at the cost of moving forward the next hike to the July meeting.Read the entire post!

Weekend:

• Schedule for Week of May 22, 2016

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $48.28 per barrel and Brent at $48.72 per barrel. A year ago, WTI was at $59, and Brent was at $64 - so prices are down about 20%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon (down about $0.45 per gallon from a year ago).

An update on oil prices

by Calculated Risk on 5/22/2016 10:30:00 AM

From the WSJ: Oil Prices Lower but Post Weekly Gain

U.S. crude for June delivery settled down 41 cents, or 0.9%, at $47.75 a barrel on the New York Mercantile Exchange. Prices rose 3.3% this week and are up 6.9% in the past two weeks.

Brent, the global benchmark, fell 9 cents, or 0.2%, to $48.72 a barrel on ICE Futures Europe. Prices rose 1.9% this week and 7.4% in the past two weeks.

Production outages around the world have fueled gains in oil prices in recent weeks, chipping away from the oversupply that has plagued the market for nearly two years. Wildfires in Canada have taken some oil fields there out of commission, while disruptions in Nigeria and Libya have also given prices a lift.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $48.41 per barrel today, and Brent is at $48.72

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again.

Some of the recent rebound is due to production outages, and some is probably seasonal.

Saturday, May 21, 2016

Schedule for Week of May 22, 2016

by Calculated Risk on 5/21/2016 08:12:00 AM

The key economic reports this week are April New Home sales, and the second estimate of Q1 GDP.

No economic releases scheduled.

10:00 AM ET: New Home Sales for April from the Census Bureau.

10:00 AM ET: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for a increase in sales to 523 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 511 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

11:00 AM: The New York Fed will release their Q1 2016 Household Debt and Credit Report

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for March 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 278 thousand the previous week.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for May.

8:30 AM ET: Gross Domestic Product, 1st quarter 2016 (Second estimate). The consensus is that real GDP increased 0.9% annualized in Q1, revised up from a 0.5% increase.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 95.5, down from the preliminary reading 95.8, and up from 89.0 in April.

10:30 AM: Fed Chair Janet Yellen will have a discussion with Professor Greg Mankiw at Radcliffe Institute for Advanced Study at Harvard University.