by Calculated Risk on 2/21/2016 07:36:00 PM

Sunday, February 21, 2016

Sunday Night Futures

From Marcoblog: Are Paychecks Picking Up the Pace?

Based on the Atlanta Fed's Wage Growth Tracker (WGT), the median annual growth in hourly wage and salary earnings of continuously employed workers in 2015 was 3.1 percent—up from 2.5 percent in 2014 and 2.2 percent in 2013. That is, the typical wage growth of workers employed for at least 12 months appears to be trending higher.Weekend:

However, wage growth by job type varies considerably. For example, the WGT for part-time workers has been unusually low since 2010. ...

The take-away? Wage growth for continuously employed workers appears to have picked up some steam in 2015, and the recent trend in wage growth is positive across a variety of job characteristics. Wage growth for people in lower-skill jobs has increased during the last couple of years, consistent with evidence of increasing tightness in the market for those types of jobs. The largest discrepancy in wage growth appears to be among part-time workers, whose median gain in hourly wages in 2015 still fell well short of those in full-time jobs.

• Schedule for Week of February 21, 2016

• Fannie and Freddie: REO inventory declined in Q4, Down 34% Year-over-year

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 4 and DOW futures are down 32 (fair value).

Oil prices were down over the last week with WTI futures at $29.64 per barrel and Brent at $33.01 per barrel. A year ago, WTI was at $50, and Brent was at $60 - so prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.71 per gallon (down about $0.45 per gallon from a year ago).

Fannie and Freddie: REO inventory declined in Q4, Down 34% Year-over-year

by Calculated Risk on 2/21/2016 11:11:00 AM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae: Fannie Mae Reports Net Income of $11.0 Billion and Comprehensive Income of $10.6 Billion for 2015

Fannie Mae reported annual net income of $11.0 billion and annual comprehensive income of $10.6 billion in 2015. For the fourth quarter of 2015, Fannie Mae reported net income of $2.5 billion and comprehensive income of $2.3 billion. The company reported a positive net worth of $4.1 billion as of December 31, 2015, resulting in a dividend obligation to Treasury of $2.9 billion, which the company expects to pay in March 2016.Fannie Mae reported the number of REO declined to 57,253 at the end of 2015 compared to 87,063 at the end of 2014.

And from Freddie Mac: Freddie Mac Reports Net Income of $6.4 Billion for Full-Year 2015; Comprehensive Income of $5.8 Billion

Freddie Mac today reported net income of $6.4 billion for the full-year 2015, compared to net income of $7.7 billion for the full-year 2014. The company also reported comprehensive income of $5.8 billion for the full-year 2015, compared to comprehensive income of $9.4 billion for the full-year 2014.Freddie Mac reported the number of REO (Real Estate Owned) declined to 17,004 at the end of 2015 compared to 25,768 at the end of 2014.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 34% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007. For Fannie, this is the lowest level since Q2 2008.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Saturday, February 20, 2016

Schedule for Week of February 21, 2016

by Calculated Risk on 2/20/2016 08:11:00 AM

The key reports this week are the second estimate of Q4 GDP, January Existing and New Home sales, and the Case-Shiller House Price Index for December.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.9% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.3% year-over-year in November.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.46 million in December.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.46 million in December.Economist Tom Lawler expects the NAR to report sales of 5.36 million SAAR for January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for a decrease in sales to 520 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 544 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 262 thousand the previous week.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

9:00 AM: FHFA House Price Index for December 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Gross Domestic Product, 4th quarter 2015 (Second estimate). The consensus is that real GDP increased 0.4% annualized in Q4, revised down from 0.7%.

10:00 AM ET: Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 91.0, up from the preliminary reading 90.7.

Friday, February 19, 2016

Goldman: Inflation "likely to rise more than bond markets currently discount"

by Calculated Risk on 2/19/2016 07:01:00 PM

Some interesting comments from a research note by Goldman Sachs economists Sven Jari Stehn and Jan Hatzius: Meeting the Low Bar. A few excerpts:

In recent years, economic forecasters have been too optimistic about GDP growth but too pessimistic about employment across many advanced economies. To better understand this puzzle, we construct a new supply side model for the US, the Euro area, Japan, and the UK. ...

... our results have two potential implications for bond markets. First, with output and employment already close to potential in the US and the UK, inflation there is likely to rise more than bond markets currently discount. Second, assuming that the hit to potential is truly one-off, potential growth should pick up modestly in coming years, and thus challenge the market’s view that we have entered an era of secular stagnation and permanently depressed real interest rates.

Quarterly Housing Starts by Intent

by Calculated Risk on 2/19/2016 02:53:00 PM

In addition to housing starts for January, the Census Bureau also released the Q4 "Started and Completed by Purpose of Construction" report this week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released yesterday showed there were 119,000 single family starts, built for sale, in Q4 2015, and that was above the 111,000 new homes sold for the same quarter, so inventory increased slightly in Q4 (Using Not Seasonally Adjusted data for both starts and sales).

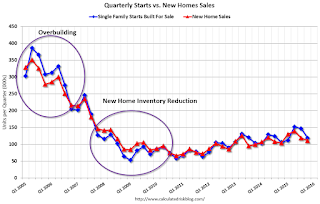

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting a few more homes than they are selling, and the inventory of under construction and completed new home sales is increasing, but still low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories mostly under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 12% compared to Q4 2014.

Single family starts built for sale were up about 12% compared to Q4 2014. Owner built starts were up slightly year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, and is near the highest level since the mid-80s, and was up 8% compared to Q4 2014.

Key Measures Show Inflation close to 2% in January

by Calculated Risk on 2/19/2016 11:33:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in January. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for January here. Motor fuel was down 44% annualized in January.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (0.3% annualized rate) in January. The CPI less food and energy rose 0.3% (3.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.2%. Core PCE is for December and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI was at 3.6% annualized.

On a year-over-year basis, three of these measures are at or above 2%.

Using these measures, inflation has been mostly moving up, and three of the measures are at or above the Fed's target (Core PCE is still way below).

CPI unchanged in January, Core CPI up 2.2% YoY

by Calculated Risk on 2/19/2016 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was above the consensus forecast of a 0.1% decrease for CPI, and also above the forecast of a 0.1% increase in core CPI.

An increase in the index for all items less food and energy offset a decline in the energy index to lead to the seasonally adjusted all items index being unchanged. The energy index fell 2.8 percent as all of its major component indexes declined. The index for all items less food and energy rose 0.3 percent in January. The increase was broad-based, with most of the major components rising, but increases in the indexes for shelter and medical care were the largest contributors. ...

The all items index rose 1.4 percent over the last 12 months, compared to the 0.7-percent 12-month increase for the period ending December. ... The index for all items less food and energy increased 2.2 percent over the last 12 months, a figure that has been gradually rising over the last several months.

emphasis added

Thursday, February 18, 2016

Phoenix Real Estate in January: Sales up 9%, Inventory down 6%

by Calculated Risk on 2/18/2016 05:15:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

For the fourteenth consecutive month, inventory was down year-over-year in Phoenix.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in January were up 8.7% year-over-year.

2) Cash Sales (frequently investors) were down to 27.4% of total sales.

3) Active inventory is now down 5.5% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

With falling inventory, prices increased a little faster in 2015 (something to watch in 2016 if inventory continues to decline). Prices are already up 5.3% through November according the Case-Shiller (more than double the increase in 2014).

| January Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jan-08 | 2,907 | --- | 553 | 19.0% | 56,8741 | --- |

| Jan-09 | 4,736 | 62.9% | 1,625 | 34.3% | 53,581 | -5.8% |

| Jan-10 | 5,789 | 22.2% | 2,475 | 42.8% | 41,506 | -22.5% |

| Jan-11 | 6,539 | 13.0% | 3,263 | 49.9% | 42,881 | 3.3% |

| Jan-12 | 6,455 | -1.3% | 3,198 | 49.5% | 25,025 | -41.6% |

| Jan-13 | 5,790 | -10.3% | 2,555 | 44.1% | 22,090 | -11.7% |

| Jan-14 | 4,799 | -17.1% | 1,740 | 36.3% | 28,630 | 29.6% |

| Jan-15 | 4,785 | -0.3% | 1,529 | 32.0% | 27,238 | -4.9% |

| Jan-16 | 5,199 | 8.7% | 1,425 | 27.4% | 25,736 | -5.5% |

| 1 January 2008 probably included pending listings | ||||||

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/18/2016 01:52:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.36 million, down 1.8% from December’s preliminary pace and up 11.2% from last January’s subdued seasonally adjusted pace. I should note that estimating the NAR’s seasonally-adjusted pace is unusually tricky in January, as the January NAR report incorporates annual seasonal adjustment revisions. I have tried to take likely revisions into account in my January projection. On an unadjusted basis I estimate that home sales last month were up about 8.5% from last January’s unadjusted pace. Since this January had one fewer business day than last January, such an unadjusted sales gain should translate into a higher YOY gain in seasonally-adjusted sales.

It is difficult to assess the degree to which weather played a role in last month’s sales, as weather patterns (relatively to “the norm”) varied dramatically across the country. For example, in the broad “Mid-Atlantic” region weather was unusually mild during much of the month, but the region got hit with a historic snowstorm that kept much of the area blanketed during the last 8-9 days of January. The severity of the snow was predicted well in advance, however, and as such there were probably fewer than normal home closings scheduled at the end of the month. MRIS, which covers most of Maryland, DC, Northern and much of Central Virginia, parts of West Virginia, and a very small part of Pennsylvania, reported that closed home sales in the region were up 10.1% from last January, a gain close to what one would have expected given past pending sales. MRIS also reported, however, than new pending sales in the area were down 5.7% from a year ago last month, a drop that was almost certainly related to the snowstorm.

Local realtor/MLS reports also suggest to me that the inventory of existing homes for sale as estimated by the NAR at the end of January will be down about 0.6% from December, and down about 4.3% from last January.

Finally, local realtor/MLS reports suggest that the NAR’s median existing single-family home sales price in January should be up by about 7.5% from a year earlier.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q4

by Calculated Risk on 2/18/2016 10:57:00 AM

From the MBA: Mortgage Foreclosures and Delinquencies Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.77 percent of all loans outstanding at the end of the fourth quarter of 2015. This was the lowest level since the third quarter of 2006. The delinquency rate decreased 22 basis points from the previous quarter, and 91 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey, released today at the association's National Mortgage Servicing Conference and Expo 2016 in Orlando, FL. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.36 percent, a decrease of two basis points from the previous quarter, and down 10 basis points from one year ago. This foreclosure starts rate was at the lowest level since the second quarter of 2003.

The percentage of loans in the foreclosure process at the end of the third quarter was 1.77 percent, down 11 basis points from the third quarter and 50 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.44 percent, a decrease of 13 basis points from last quarter, and a decrease of 108 basis points from last year. This was the lowest serious delinquency rate since the third quarter of 2007.

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey:

"As the job market has improved and national home prices have rebounded, fewer borrowers were becoming seriously delinquent, while borrowers previously behind on their payments were in a better position to pursue alternative options to resolve delinquent loans.

"The overall delinquency rate fell to pre-recession levels and at 4.8 percent, was lower than the historical average of 5.4 percent for the time period 1979 to 2015. The rate at which new foreclosures were started decreased to 0.36 percent, the lowest rate since 2003 and only one-fourth of the record high level during the worst of the foreclosure crisis in the third quarter of 2009.

emphasis added

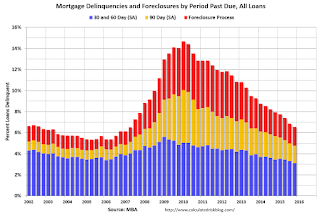

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are at the lowest level since at least 2000.

The 90 day bucket peaked in Q1 2010, and is about 85% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 85% of the way back to normal.

So it has taken 5 3/4 years to reduce the backlog of seriously delinquent and in-foreclosure loans by 85%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of the current year. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.