by Calculated Risk on 2/16/2016 10:25:00 AM

Tuesday, February 16, 2016

NAHB: Builder Confidence declined to 58 in February

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in February, down from 61 in January (revised up). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Drops Three Points in February

Builder confidence in the market for newly-built single-family homes fell three points to 58 in February from an upwardly revised January reading of 61 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Though builders report the dip in confidence this month is partly attributable to the high cost and lack of availability of lots and labor, they are still positive about the housing market,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. “Of note, they expressed optimism that sales will pick up in the coming months.”

“Builders are reflecting consumers’ concerns about recent negative economic trends,” said NAHB Chief Economist David Crowe. “However, the fundamentals are in place for continued growth of the housing market. Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead.”

...

The HMI component measuring sales expectations in the next six months rose one point to 65 in February. The index measuring current sales condition fell three points to 65 and the component charting buyer traffic dropped five points to 39.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Midwest fell one point to 57, the West registered a three-point drop to 72 and the Northeast and South each posted a two-point decline to 47 and 59, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 61, but still a strong reading.

NY Fed: "Business activity continued to decline for New York manufacturers" in February

by Calculated Risk on 2/16/2016 08:36:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity declined for a seventh consecutive month for New York manufacturing firms, according to the February 2016 survey. After dropping to its lowest level since the Great Recession in January, the general business conditions index edged up three points to -16.6. The new orders index climbed twelve points to -11.6, indicating that orders fell, though at a slower pace than last month.This was below the consensus forecast of -10.0, and indicates manufacturing continued to contract in the NY region.

...

The index for number of employees rose twelve points to -1.0, indicating that employment levels were flat, and the average workweek index held steady at -6.0, signaling that the average workweek shortened.

Monday, February 15, 2016

Tuesday: NY Fed Mfg, NAHB Homebuilder Survey

by Calculated Risk on 2/15/2016 07:33:00 PM

Tuesday:

• At 8:30 AM ET, NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of -10.0, up from -19.4.

• At 10:00 AM, the February NAHB homebuilder survey. The consensus is for a reading of 61, up from 60 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

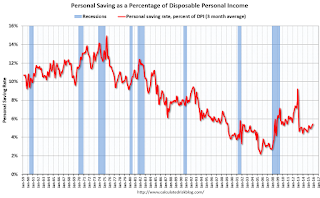

Some people are wondering if consumers are saving the extra money from the decline in oil and gasoline prices - and are waiting to see if the price decline will hold.

This graph shows the three month trailing average of the personal saving rate from the BEA (Personal saving as a percentage of disposable personal income). The rate has been increasing a little recently, but not that much.

Note: this data is heavily revised, so I'm not confident in the trend.

It still isn't clear from the data what is happening to the money saved on gasoline.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 2/15/2016 01:40:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 32.8% from the peak, and may be starting to increase again (but up less than 1% year-over-year). The number of salesperson's licenses has fallen to April 2004 levels.

Brokers' licenses are off 11.3% from the peak and have only fallen to April 2006 levels, but are still slowly declining (down 1.5% year-over-year).

So far there been no significant pickup in the number of real estate agents!

FNC: Residential Property Values increased 6.2% year-over-year in December

by Calculated Risk on 2/15/2016 10:35:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their December 2015 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.4% from November to December (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.1% (NSA), the 20-MSA RPI increased 0.2%, and the 30-MSA RPI increased 0.4% in December. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 14.2% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through December 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The December Case-Shiller index will be released on Tuesday, February 22nd.

Sunday, February 14, 2016

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 2/14/2016 08:40:00 PM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2015.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

When data for February is released - WTI oil futures are currently at $29 per barrel, down from $37 in December - we will probably see energy expenditures as a percent of PCE at all time lows.

LA area Port Traffic Increased YoY in January, Busiest January in LA Port History

by Calculated Risk on 2/14/2016 10:46:00 AM

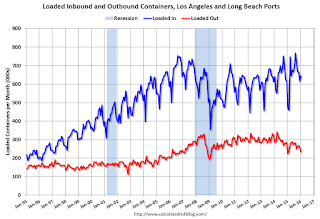

Note: There were some large swings in LA area port traffic early last year due to labor issues that were settled in late February. Port traffic slowed in January and February last year, and then surged in March 2015 as the waiting ships were unloaded (the trade deficit increased in March too). This will impact the YoY changes for the first few months of 2016.

From the Port of Los Angeles: Port of Los Angeles January Volumes increase 33%; 704,398 TEUs Busiest January in Port History

The Port of Los Angeles handled 704,398 Twenty-Foot Equivalent Units (TEUs) in January 2016, an increase of 33 percent compared to January 2015. It was the busiest January in the port’s 109-year history. ...Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

"Record January volumes is a very encouraging way to start 2016, particularly after the slow start that West Coast ports experienced last year," said Port of Los Angeles Executive Director Gene Seroka.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 2.2% compared to the rolling 12 months ending in December. Outbound traffic was up 0.3% compared to 12 months ending in December.

The recent downturn in exports is probably due to the strong dollar and weakness in China.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up sharply year-over-year in January; exports were up 5% year-over-year. This suggests a larger trade deficit with the Far East in January.

Saturday, February 13, 2016

Schedule for Week of February 14, 2016

by Calculated Risk on 2/13/2016 08:11:00 AM

The key economic report this week is January housing starts on Wednesday.

For prices, PPI and CPI will be released this week.

From manufacturing, January Industrial Production and the February NY and Philly Fed manufacturing surveys will be released this week.

All US markets are closed in observance of the Presidents' Day holiday.

8:30 AM: NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of -10.0, up from -19.4.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 61, up from 60 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts decreased to 1.149 million (SAAR) in December. Single family starts decreased to 768 thousand SAAR in December.

The consensus for 1.175 million, up from December.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to increase to 76.7%.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of January 26-27, 2016

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, up from 269 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of -2.5, up from -3.5.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for a 0.1% decrease in CPI, and a 0.1% increase in core CPI.

Friday, February 12, 2016

Mortgage News Daily: "Lenders quoting 30yr fixed rates of 3.65%"

by Calculated Risk on 2/12/2016 09:42:00 PM

Mortgage rates increased today, but are still very low.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump Higher From Long-Term Lows

The average lender is now back to quoting conventional 30yr fixed rates of 3.625%, up from 3.5% yesterday. A few of the less-aggressive lenders are back to 3.75% already. But again, factoring out the past 3 days, today would be the best day for mortgage rates in more than a year.Here is a table from Mortgage News Daily:

emphasis added

Hotel Occupancy: 2016 Tracking Record Year

by Calculated Risk on 2/12/2016 02:22:00 PM

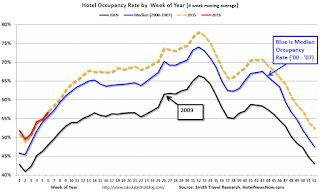

Interesting tidbit: Even though January is one of the weakest periods of the year, average weekly hotel occupancy in 2016 is already above the average for all of 2009 (the worst year for hotels since the Depression)!

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 6 February

In year-over-year measurements, the industry’s occupancy decreased 1.9% to 56.6%. However, ADR for the week was up 5.2% to $119.03 and RevPAR rose 3.3% to $67.33.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should continue to increase for the next couple of months.

In year-over-year measurements, the industry’s occupancy decreased 1.9% to 56.6%. However, average daily rate for the week was up 5.2% to US$119.03, and revenue per available room rose 3.3% to US$67.33.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking 2015. A solid start to the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com