by Calculated Risk on 2/12/2016 08:45:00 AM

Friday, February 12, 2016

Retail Sales increased 0.2% in January

On a monthly basis, retail sales were up 0.2% from December to January (seasonally adjusted), and sales were up 3.4% from January 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $449.9 billion, an increase of 0.2 percent from the previous month, and 3.4 percent above January 2015. ... The November 2015 to December 2015 percent change was revised from down 0.1 percent to up 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.The increase in January was at expectations, and retail sales for December were revised up from a 0.1% decrease to a 0.2% increase. The headline number was decent, and sales ex-gasoline are up a solid 4.5% YoY.

Thursday, February 11, 2016

Sacramento Housing in January: Sales up 3.9%, Inventory down 25% YoY

by Calculated Risk on 2/11/2016 08:22:00 PM

Friday:

• At 8:30 AM ET, Retail sales for January will be released. The consensus is for retail sales to increase 0.2% in January.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 92.5, up from 92.0 in January.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.1% increase in inventories.

• At 11:00 AM, the New York Fed will release their Q4 2015 Household Debt and Credit Report

On Sacramento: During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In January, total sales were up 3.9% from January 2015, and conventional equity sales were up 11.3% compared to the same month last year.

In December, 9.2% of all resales were distressed sales. This was up from 7.6% last month, and down from 16.6% in January 2015.

The percentage of REOs was at 4.3% in January, and the percentage of short sales was 4.9%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 25.0% year-over-year (YoY) in January. This was the ninth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 18.4% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.

An update on oil prices

by Calculated Risk on 2/11/2016 03:31:00 PM

From the WSJ: U.S. Crude Settles at 13-Year Low on Oversupply Fears

Oil prices settled at their lowest levels since 2003 as growing stockpiles in the U.S. and continuing worries about falls in the wider financial markets keep oil in the red.

Light, sweet crude for March delivery settled down $1.24, or 4.5%, to $26.21 a barrel on the New York Mercantile Exchange, the lowest settlement since May 2003.

Brent, the global benchmark, declined 2.5% to $30.06.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $27.08 per barrel today, and Brent is at $30.72

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again. Prices are now at the lowest since 2003 (even lower than during the Great Recession).

There are many factors pushing down oil prices - more global supply (even as some shale producers cut back), global economic weakness (slowing demand), strong dollar, and warm weather in the US (less heating demand) to mention a few.

AIA Forecast: 8% increase in Nonresidential Construction in 2016

by Calculated Risk on 2/11/2016 10:09:00 AM

Note: This does not include spending for oil and gas (that sector will be down in 2016).

From the AIA: Nonresidential Construction Market Momentum to Continue

Construction spending greatly exceeded expectations in the nonresidential market in 2015, and this year should see healthy growth levels as well. There continues to be significant demand for hotels, office space, manufacturing facilities and amusement and recreation spaces.

The American Institute of Architects’ (AIA) semi-annual Consensus Construction Forecast, a survey of the nation’s leading construction forecasters, is projecting that spending will increase just more than eight percent in 2016, with next year’s projection being an additional 6.7% gain.

“While rising interest rates could pose a challenge to the U.S. economy, lower energy prices, improved employment figures and an enacted federal budget for 2016 are all factoring into a very favorable outlook for the construction industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “And after several years of challenging economic circumstances the institutional project sector is finally on very solid footing.”

Weekly Initial Unemployment Claims decrease to 269,000

by Calculated Risk on 2/11/2016 08:36:00 AM

The DOL reported:

In the week ending February 6, the advance figure for seasonally adjusted initial claims was 269,000, a decrease of 16,000 from the previous week's unrevised level of 285,000. The 4-week moving average was 281,250, a decrease of 3,500 from the previous week's unrevised average of 284,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 281,250.

This was below the consensus forecast of 281,000. The low level of the 4-week average suggests few layoffs.

Wednesday, February 10, 2016

Thursday: Unemployment Claims, Fed Chair Janet Yellen

by Calculated Risk on 2/10/2016 06:41:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Inch Further Into 1-Year Lows

Mortgage rates barely budged today, but did manage to gain just a bit of ground. That means another 1-year low, technically, although many lenders are quoting the exact some conventional 30yr fixed rates as yesterday. The range is currently between 3.5% and 3.625% with most lenders still at the higher boundary.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 281 thousand initial claims, down from 285 thousand the previous week.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

Las Vegas: Record Visitor Traffic in 2015, Conventions Returning

by Calculated Risk on 2/10/2016 02:53:00 PM

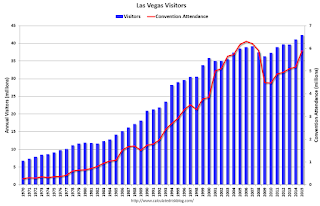

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

Visitor traffic was 2.9% above the record set in 2014 and 8% above the pre-recession peak.

And convention attendance is returning. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention traffic was up 14.0% in 2015 compared to 2014, but was still 6.6% below the pre-recession peak set in 2006.

It seemed like there were many housing related conventions during the housing bubble, so it has taken some time for convention attendance to recover.

Hilsenrath on Yellen

by Calculated Risk on 2/10/2016 01:29:00 PM

An excerpt from an article by Jon Hilsenrath at the WSJ: Fed Sees Risks to U.S. Economy Rising

The Fed’s assessment of the balance of risks is meaningful because officials won’t be inclined to raise short-term interest rates again if it sees growing risks to the outlook. Ms. Yellen’s testimony therefore underscores the market’s belief that a rate increase in March is highly unlikely ... In her testimony, Ms. Yellen made clear she saw an abundance of risks that could undermine growth and hiring and hold inflation down longer than hoped or expected.A rate hike in March seems very unlikely at this point, but Yellen still expects gradual increases in the Fed Funds rate going forward.

Yellen: "Financial conditions in the United States have recently become less supportive of growth"

by Calculated Risk on 2/10/2016 09:07:00 AM

From Fed Chair Janet Yellen: Semiannual Monetary Policy Report to the Congress. Excerpt:

Financial conditions in the United States have recently become less supportive of growth, with declines in broad measures of equity prices, higher borrowing rates for riskier borrowers, and a further appreciation of the dollar. These developments, if they prove persistent, could weigh on the outlook for economic activity and the labor market, although declines in longer-term interest rates and oil prices provide some offset. Still, ongoing employment gains and faster wage growth should support the growth of real incomes and therefore consumer spending, and global economic growth should pick up over time, supported by highly accommodative monetary policies abroad. Against this backdrop, the Committee expects that with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace in coming years and that labor market indicators will continue to strengthen.

As is always the case, the economic outlook is uncertain. Foreign economic developments, in particular, pose risks to U.S. economic growth. Most notably, although recent economic indicators do not suggest a sharp slowdown in Chinese growth, declines in the foreign exchange value of the renminbi have intensified uncertainty about China's exchange rate policy and the prospects for its economy. This uncertainty led to increased volatility in global financial markets and, against the background of persistent weakness abroad, exacerbated concerns about the outlook for global growth. These growth concerns, along with strong supply conditions and high inventories, contributed to the recent fall in the prices of oil and other commodities. In turn, low commodity prices could trigger financial stresses in commodity-exporting economies, particularly in vulnerable emerging market economies, and for commodity-producing firms in many countries. Should any of these downside risks materialize, foreign activity and demand for U.S. exports could weaken and financial market conditions could tighten further.

Of course, economic growth could also exceed our projections for a number of reasons, including the possibility that low oil prices will boost U.S. economic growth more than we expect. At present, the Committee is closely monitoring global economic and financial developments, as well as assessing their implications for the labor market and inflation and the balance of risks to the outlook.

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 25% YoY

by Calculated Risk on 2/10/2016 07:00:00 AM

From the MBA: Rates Drop, Refi Applications Surge in Latest MBA Weekly Surve

Mortgage applications increased 9.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 5, 2016.

...

The Refinance Index increased 16 percent from the previous week. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 25 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since April 2015, 3.91 percent, from 3.97 percent, with points unchanged at 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity has picked up recently as rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 25% higher than a year ago.