by Calculated Risk on 12/22/2015 10:11:00 AM

Tuesday, December 22, 2015

Existing Home Sales declined in November to 4.76 million SAAR

From the NAR: Existing-Home Sales Suffer Setback in November, Fall to Slowest Pace Since April 2014

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 10.5 percent to a seasonally adjusted annual rate of 4.76 million in November (lowest since April 2014 at 4.75 million) from a downwardly revised 5.32 million in October. After last month's decline (largest since July 2010 at 22.5 percent), sales are now 3.8 percent below a year ago — the first year-over-year decrease since September 2014. ...

Total housing inventory at the end of November decreased 3.3 percent to 2.04 million existing homes available for sale, and is now 1.9 percent lower than a year ago (2.08 million). Unsold inventory is at a 5.1-month supply at the current sales pace, up from 4.8 months in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (4.76 million SAAR) were 10.5% lower than last month, and were 3.8% below the November 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.04 million in November from 2.11 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.04 million in November from 2.11 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 1.9% year-over-year in November compared to November 2014.

Inventory decreased 1.9% year-over-year in November compared to November 2014. Months of supply was at 5.1 months in November.

This was below consensus expectations of sales of 5.32 million (but not a surprise for CR readers). For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Q3 GDP Revised Down to 2.0% Annual Rate

by Calculated Risk on 12/22/2015 08:36:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 2.0 percent in the third quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.9 percent.Here is a Comparison of Third and Second Estimates. PCE growth was unrevised at 3.0%. Residential investment was revised up from 7.3% to 8.2%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.1 percent. With the third estimate for the third quarter, the general picture of economic growth remains the same; private inventory investment decreased more than previously estimated ...

emphasis added

Monday, December 21, 2015

Tuesday: GDP, Existing Home Sales, and More

by Calculated Risk on 12/21/2015 07:53:00 PM

From Joe Weisenthal at Bloomberg Odd Lots: How One Woman Tried To Warn Everyone About The Housing Crash

Or as Bloomberg's Tracy Alloway tweeted: "Big Short be damned. Listen to the conversation @TheStalwart and I had with @calculatedrisk about who saw it coming"

Tanta Vive!!!

Tuesday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2015 (Third estimate). The consensus is that real GDP increased 2.0% annualized in Q3, revised down from the second estimate of 2.1%.

• At 9:00 AM, FHFA House Price Index for October 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.36 million in October. Economist Tom Lawler estimates the NAR will report sales of 4.97 million SAAR.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for December.

Bloomberg: "How One Woman Tried To Warn Everyone About The Housing Crash"

by Calculated Risk on 12/21/2015 03:45:00 PM

CR Note: One of the criticisms of "The Big Short" is there are no women lead characters. That is a huge oversight, especially since Tanta was a key source for understanding the mortgage industry for many hedge fund managers!

From Joe Weisenthal at Bloomberg Odd Lots: How One Woman Tried To Warn Everyone About The Housing Crash

In the middle of the last decade, a blog called Calculated Risk became a must-read for its obsessive coverage of the economy and its warnings about the overheating housing market. During the 2006-08 period, Calculated Risk had two authors: One was the blog's founder, Bill McBride, and the other was "Tanta," a pseudonymous mortgage industry professional who was trying to blow the whistle on the problems she saw emanating from her industry.

Tanta's posts, which were extraordinarily detailed, good humored, and prescient, became must-reads for a host of bloggers, traditional journalists, and Wall Street professionals trying to get a handle on the crisis. Sadly, the world found out her name only in December 2008, when she died of cancer. But her influence remained enormous. And the world was fortunate that in the final two years of her life, she produced such an extraordinary wealth of information detailing exactly how the mortgage industry worked and produced the mess that was the housing bubble.

In the latest edition of Odd Lots, we spoke with Bill McBride, who still writes Calculated Risk, about her work.

Existing Home Sales: Take the Under Tomorrow

by Calculated Risk on 12/21/2015 02:10:00 PM

I mentioned this over the weekend.

The NAR will report November Existing Home Sales on Tuesday, December 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.32 million. Housing economist Tom Lawler estimates the NAR will report sales of 4.97 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.36 million SAAR in October.

Based on Lawler's estimate, I expect a miss tomorrow.

Note: Lawler is not always right on, but he is usually pretty close. See this post for a review of Lawler's track record.

An update on oil prices

by Calculated Risk on 12/21/2015 10:59:00 AM

From the NY Times: Oil Prices Slump to 11-Year Lows in Asia and Europe

Oil prices hit 11-year lows in Asia and Europe on Monday, as a glut of crude on world markets and the recent global climate accord continue to depress fossil-fuel prices.

Brent crude oil, the international benchmark, was trading at $36.50 per barrel in late European trading.

...

In a recent report, the International Energy Agency said it expected global inventories to keep growing at least until late 2016, although at a much slower pace than this year. “As inventories continue to swell into 2016, there will still be a lot of oil weighing on the market,” the agency said.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $34.46 per barrel today, and Brent is at $36.62

Prices really collapsed a year ago - and then rebounded a little - and have collapsed again. There are many factors pushing down oil prices - more global supply (even as shale producers cut back), global economic weakness (slowing demand), and warm weather in the US (less heating demand) to mention a few.

Chicago Fed: "Index shows Economic Growth Slowed in November"

by Calculated Risk on 12/21/2015 08:42:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows Economic Growth Slowed in November

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to –0.30 in November from –0.17 in October. Two of the four broad categories of indicators that make up the index decreased from October, and three of the four categories made negative contributions to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.20 in November from –0.18 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, December 20, 2015

Sunday Night Futures

by Calculated Risk on 12/20/2015 07:19:00 PM

From Reuters: U.S. gas prices fall to lowest in more than six years: survey

U.S. gasoline prices dropped by 4 cents to $2.06 a gallon on average in the past two weeks to the lowest in more than six years, according to a Lundberg survey released on Sunday.According to Gasbuddy.com, average national regular gasoline prices today are now under $2.00 per gallon. And prices should fall further over the next few weeks (based on the recent decline in oil prices).

The price, for regular grade as of Friday, was the lowest since $2.05 in April 2009 ...

Weekend:

• Schedule for Week of December 20th

• Lawler: "Yes, Houston will have a problem next year"

• Existing Home Sales: Expect a Miss

• Goldman Sachs on Fed Funds rate: "Fairly easy path to a second hike in March"

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 2 and DOW futures are up 20 (fair value).

Oil prices were down over the last week with WTI futures at $34.66 per barrel and Brent at $36.88 per barrel. A year ago, WTI was at $57, and Brent was at $59 - so prices are down almost 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at close to $1.99 per gallon (down about $0.40 per gallon from a year ago). Gasoline prices are now at the lowest level since the financial crisis.

Lawler: "Yes, Houston will have a problem next year"

by Calculated Risk on 12/20/2015 01:17:00 PM

Some thoughts on the Houston housing market from housing economist Tom Lawler:

Earlier this week I sent out a message with a link to the Houston Association of Realtors report showing that MLS-based home sales in the Houston metro market showed a double digit YOY decline for the second straight month in November, and that total property listings were up by over 20% from a year earlier.

Here are some other “macro” numbers (in table or graph form) for the Houston metro area.

Non-farm payroll employment, YOY growth, November 2014 – November 2015, Not Seasonally Adjusted (released this morning for Texas/Houston)

| Year-over-year Employment Growth | |||

|---|---|---|---|

| US | Houston | Rest of Texas | |

| Total | 1.9% | 0.8% | 1.8% |

| Mining and Logging | -13.5% | -4.9% | -12.4% |

| Construction | 4.2% | 1.9% | 1.4% |

| Manufacturing | 0.3% | -6.0% | -3.2% |

| Education and Health | 2.9% | 4.2% | 4.1% |

| Leisure and Hospitality | 3.0% | 6.7% | 3.8% |

| Other Private Services | 2.1% | -0.3% | 2.4% |

| Government | 0.4% | 2.7% | 1.1% |

| Total Less L&H | 1.7% | 0.2% | 1.5% |

| Total Less L&H and Govt | 2.0% | -0.3% | 1.7% |

Houston was one of the fastest growing large MSAs in terms of both population growth and employment growth from 2011 to 2014. Over the 12-month period ending in November, however, employment growth was quite anemic in Houston, and excluding the Leisure & Hospitality Sector (which has lower than average hourly wages and lower than average hours worked per week) employment was virtually unchanged from a year ago.

Unemployment rate (Not Seasonally Adjusted)

| Unemployment rate (Not Seasonally Adjusted) | ||

|---|---|---|

| November-15 | November-14 | |

| US | 4.81% | 5.53% |

| Houston | 4.89% | 4.33% |

| Rest of Texas | 4.53% | 4.46% |

Despite a sharp slowdown in employment growth, the CPS-based unemployment rate for Houston actually declined somewhat in the first half of this year, which seemed “odd.” Since then, however, the unemployment rate has risen sharply, and Houston’s unemployment rate is now higher than the national average for the first time since 2006.

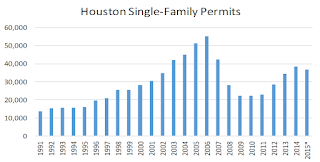

Single-Family Building Permits

*2015, SAAR through October

Reflecting the relatively strong population and employment growth, Housing SF building permits recovered by a substantially greater amount than the nation as a whole in the current recovery, and in 2013 and 2014 builders often described the market as “red-hot.” Permits in Houston have slowed a bit this year compared to last year, but have not slowed as much as one might have hoped given the sharp deceleration in employment growth, as well as dim prospects for employment growth next year.

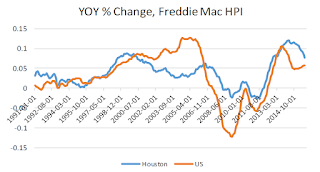

Home Prices

Reflecting strong demand relative to the rest of the nation, Houston home price growth has considerably outpaced the national average over the past few years.

CR Note: This graph shows the Year-over-year (YoY) change in the Freddie Mac House Price Index (HPI) for both Houston and the U.S..

Oil Prices

Oil prices continued to fall in December.

Outlook

Houston’s economy has not yet fully adjusted to the decline in oil prices, and especially the slide in the past few months. There is a pretty good chance that Houston will see negative employment growth next year, along with a rise in its unemployment rate to above 6%. This environment, combined with the lack of any meaningful reduction in housing production to date, suggests that (1) housing production in the Houston MSA should decline significantly next year; and (2) overall home prices should fall as well.

Existing Home Sales: Expect a Miss

by Calculated Risk on 12/20/2015 08:11:00 AM

The NAR will report November Existing Home Sales on Tuesday, December 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.32 million. Housing economist Tom Lawler estimates the NAR will report sales of 4.97 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.36 million SAAR in October.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last five years, the consensus average miss was 145 thousand, and Lawler's average miss was 68 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | --- |

| 1NAR initially reported before revisions. | |||