by Calculated Risk on 10/29/2015 01:01:00 PM

Thursday, October 29, 2015

Q3 GDP: Investment

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 6.1% annual rate in Q3. Equipment investment increased at a 5.3% annual rate, and investment in non-residential structures decreased at a 4.0% annual rate. On a 3 quarter trailing average basis, RI (red) and equipment (green) are both positive, and nonresidential structures (blue) is slightly negative.

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a slight decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

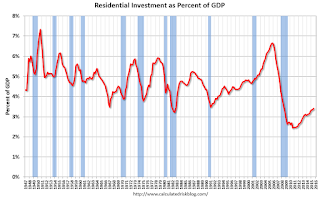

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

NAR: Pending Home Sales Index decreased 2.3% in September, up 3% year-over-year

by Calculated Risk on 10/29/2015 10:05:00 AM

From the NAR: Pending Home Sales Lose Further Steam in September

The Pending Home Sales Index, a forward–looking indicator based on contract signings, declined 2.3 percent to 106.8 in September from a slightly downwardly revised 109.3 in August but is still 3.0 percent above September 2014 (103.7). With last month's decline, the index is now at its second lowest level of the year (103.7 in January), but has still increased year–over–year for 13 straight months.This is well below expectations of a 1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

...

The PHSI in the Northeast fell 4.0 percent to 89.6 in September, but is still 3.9 percent above a year ago. In the Midwest the index declined 2.5 percent to 104.7 in September, but remains 4.3 percent above September 2014.

Pending home sales in the South decreased 2.6 percent to an index of 118.3 in September and are now 0.1 percent below last September. The index in the West inched back 0.2 percent in September to 104.4, but is still 6.6 percent above a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 260,000, 4-Week Average Lowest since 1973

by Calculated Risk on 10/29/2015 08:56:00 AM

The DOL reported:

In the week ending October 24, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 1,000 from the previous week's unrevised level of 259,000. The 4-week moving average was 259,250, a decrease of 4,000 from the previous week's unrevised average of 263,250. This is the lowest level for this average since December 15, 1973 when it was 256,750.The previous week was unrevised at 259,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 259,250. This is the lowest level since 1973.

This was below the consensus forecast of 265,000, and the low level of the 4-week average suggests few layoffs.

BEA: Real GDP increased at 1.5% Annualized Rate in Q3

by Calculated Risk on 10/29/2015 08:37:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2015 (Advance Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.5 percent in the third quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.9 percent.The advance Q3 GDP report, with 1.5% annualized growth, was below expectations of a 1.7% increase.

...

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), state and local government spending, nonresidential fixed investment, exports, and residential fixed investment that were partly offset by negative contributions from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Personal consumption expenditures (PCE) increased at a 3.2% annualized rate - a solid pace. Residential investment (RI) increased at a 6.1% pace, and equipment investment at a 5.3% pace - both solid. Domestic demand was solid.

The key negatives were investment in inventories (subtracted 1.44 percentage point) and investment in nonresidential structures (subtracted 0.11 percentage points).

I'll have more later ...

Wednesday, October 28, 2015

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 10/28/2015 06:39:00 PM

From the WSJ: House Passes Two-Year Budget Deal

The House on Wednesday passed a two-year budget deal that would extend the government’s borrowing limit less than a week before the Treasury risks being unable to pay its bills.Thursday:

The legislation passed the House by a vote of 266-167 and now heads to the Senate, which is expected to pass it later this week or weekend ...

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2015 (Advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

FOMC Statement: No Rate Hike

by Calculated Risk on 10/28/2015 02:00:00 PM

Less global concern. Slightly more positive. December still on table.

FOMC Statement:

Information received since the Federal Open Market Committee met in September suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft. The pace of job gains slowed and the unemployment rate held steady. Nonetheless, labor market indicators, on balance, show that underutilization of labor resources has diminished since early this year. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved slightly lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring global economic and financial developments. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

emphasis added

Bankruptcy Filings declined 11% in Fiscal 2015, Lowest Filings since 2007

by Calculated Risk on 10/28/2015 11:20:00 AM

From the US Court: Fiscal Year Bankruptcy Filings Continue Fall

Bankruptcy cases filed in federal courts for the fiscal year 2015—the 12-month period ending September 30, 2015—totaled 860,182, down 11 percent from the 963,739 bankruptcy filings in FY 2014, according to statistics released today by the Administrative Office of the U.S. Courts. This is the lowest number of bankruptcy filings for any 12-month period since 2007, and the fifth consecutive fiscal year filings have fallen.The number of filings for the fiscal year ending Sept 2015 were the lowest since 2007, and business filings were the lowest in decades.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by year since 1987.

The sharp decline in 2006 and 2007 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Other than 2007, this was the lowest level for filings since 1994. This is another indicator of an economy mostly recovered from the housing bust and financial crisis.

Merrill on FOMC: Expect No "major changes in policy or language"

by Calculated Risk on 10/28/2015 10:07:00 AM

From Merrill Lynch:

The October FOMC meeting is unlikely to deliver any major changes in policy or language ... At this stage, we continue to see a relatively flat distribution for the timing of liftoff. December is our modal forecast for the first rate hike, but there is a significant chance that it could be later — depending on the upcoming data flow.

Markets are expecting a more dovish assessment of the outlook from the Fed, and the FOMC statement is likely to acknowledge that the recent US data have been more mixed since the September meeting. The FOMC may mark down their assessment of growth from moderate to modest, and may note that the pace of improvement in the labor market has slowed. They also may note the significant drag from inventory reduction and a widening trade deficit. However, watch for the possibility that the FOMC suggests that much of the current weakness should be short-lived — that would be a hawkish signal relative to market expectations for the first rate hike no earlier than March 2016.

...

The FOMC has tried to dissuade markets from expecting any explicit signals about upcoming policy changes, emphasizing data dependence. As such, we anticipate no meaningful changes to the policy guidance language. That should not be read as a sign the Fed will not hike in December; rather that they are keeping all options open. We still see a significant chance that the FOMC will hike this year ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Applications up 23% YoY

by Calculated Risk on 10/28/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 23, 2015. The previous week’s results included an adjustment for the Columbus Day holiday.

...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 23 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.98 percent from 3.95 percent, with points increasing to 0.44 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

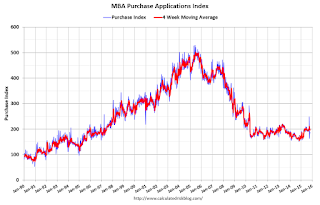

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 23% higher than a year ago.

Tuesday, October 27, 2015

Regional Fed Manufacturing Surveys Weak Again in October

by Calculated Risk on 10/27/2015 04:50:00 PM

Earlier from the Richmond Fed: Manufacturing Sector Activity Remained Soft; Volume of New Orders Leveled Off

Overall, manufacturing conditions remained soft in October. The composite index for manufacturing flattened to a reading of −1, following last month's reading of −5. Additionally, the index for new orders leveled off this month, gaining 12 points to end at 0. The index for shipments remained negative, losing one point to end at −4. Manufacturing employment continued to increase mildly this month. The indicator remained at a reading of 3 for a second month.This was the last of the regional Fed surveys for October. All of the regional surveys indicated contraction in October - although mostly slower than in September - and mostly due to weakness from oil and exports.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

It seems likely the ISM index will be weak again in October, and could possibly show contraction - a reading below 50. (although these regional surveys overemphasize oil producing areas). The early consensus is for an increase to 51.0 for the ISM index, from 50.2 in September.