by Calculated Risk on 10/02/2015 10:01:00 AM

Friday, October 02, 2015

Reis: Apartment Vacancy Rate increased in Q3 to 4.3%

Reis reported that the apartment vacancy rate increased in Q3 2015 to 4.3%, up from 4.2% in Q2, and unchanged from 4.3% in Q3 2014. The vacancy rate peaked at 8.0% at the end of 2009.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

It appears as if the market has finally reached its inflection point during the third quarter. Although the national vacancy increase of 10 basis points was slight, it was actually a slight acceleration of a trend that began during the second quarter of 2014. That’s when vacancy technically started rising. While not a steady upward trend (vacancy declined slightly earlier this year), vacancy continues to generally inch higher as construction outpaces net absorption. Importantly, this rise in vacancy has occurred without the deluge of new supply that is in the pipeline but has not yet hit the market. When that occurs, likely in the next few quarters, vacancy increases are sure to accelerate because the market will not be able to digest that much new product.

Vacancy increased by 10 basis points to 4.3% during the quarter with construction slightly outpacing net absorption once again. Although vacancy has appeared to skip off of the bottom, vacancy has been largely unchanged over the last two years as supply and demand have been roughly in balance. However, slowly but surely construction is overtaking net absorption by a wider and wider margin and is nudging the national vacancy rate slightly higher. Although vacancy is unchanged over the last year, this is largely due to a weather‐induced pullback in construction during the first quarter of 2015. Without that, vacancy would likely be even higher now. Given the robust pipeline, further vacancy rate increases should be expected.

Asking and effective rents both grew by 1.3% during the third quarter. This was roughly in line with last quarter’s performance.

...

Even without the tsunami of new supply hitting the market, vacancy is on the way up. This does not portend goods things for the next couple of years as new completions increase and flood the market. ... That said, vacancy expansion will not be dramatic – there is far too much demand to prevent that from happening – so vacancy will marginally drift higher. Still‐low vacancy rates, coupled with new properties coming online with above‐average rents, should keep asking and effective rent growth around 4% for 2015 which would be the best calendar‐year performance since 2007.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate has been mostly moving sideways for the last few years. As completions catch-up with starts, the vacancy rate will probably start increasing.

Apartment vacancy data courtesy of Reis.

September Employment Report: 142,000 Jobs, 5.1% Unemployment Rate

by Calculated Risk on 10/02/2015 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 142,000 in September, and the unemployment rate was unchanged at 5.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and information, while mining employment fell.

...

The change in total nonfarm payroll employment for July was revised from +245,000 to +223,000, and the change for August was revised from +173,000 to +136,000. With these revisions, employment gains in July and August combined were 59,000 less than previously reported.

...

In September, average hourly earnings for all employees on private nonfarm payrolls, at $25.09, changed little (-1 cent), following a 9-cent gain in August. Hourly earnings have risen by 2.2 percent over the year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 142 thousand in September (private payrolls increased 118 thousand).

Payrolls for July and August were revised down by a combined 59 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.75 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate declined in September to 62.4%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio declined to 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in September at 5.1%.

This was well below expectations of 203,000 jobs, and revisions were down, and there was no wage growth ... a weak report.

I'll have much more later ...

Thursday, October 01, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 10/01/2015 08:40:00 PM

From the WSJ: Treasury’s Lew Says Congress Must Raise Debt Limit by Nov. 5

The government will run out of money to pay its bills sooner than previously thought, the Treasury Department said Thursday, accelerating the fiscal deadlines that confront Congress amid a leadership scramble on Capitol Hill.The U.S. pays its bills. Congress has a month to do their job.

Friday:

• At 8:30 AM ET, the Employment Report for September. The consensus is for an increase of 203,000 non-farm payroll jobs added in September, up from the 173,000 non-farm payroll jobs added in August. The consensus is for the unemployment rate to be unchanged at 5.1%.

• Early, Reis Q3 2015 Apartment Survey of rents and vacancy rates.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is a 1.3% decrease in orders.

Preview: Employment Report for September

by Calculated Risk on 10/01/2015 05:44:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus, according to Bloomberg, is for an increase of 203,000 non-farm payroll jobs in September (with a range of estimates between 180,000 to 235,000), and for the unemployment rate to be unchanged at 5.1%.

The BLS reported 173,000 jobs added in August.

Goldman Sachs economist David Mericle wrote today:

We forecast nonfarm payroll growth of 215k in September, above consensus expectations of 200k by about 0.3 standard deviations of a typical surprise. Labor market indicators were mixed in September, and we therefore expect a print roughly in line with the 212k monthly average seen so far in 2015. August payrolls were likely distorted downward by seasonal bias last month and may be revised up. We expect the unemployment rate to remain at 5.1%. Finally, average hourly earnings should rise a softer 0.1% in September as a result of calendar effects.Here is a summary of recent data:

• The ADP employment report showed an increase of 200,000 private sector payroll jobs in September. This was above expectations of 190,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly above expectations.

• The ISM manufacturing employment index decreased in September to 50.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 15,000 in September. The ADP report indicated a 15,000 decrease for manufacturing jobs.

The ISM non-manufacturing employment index for September will be released on Monday.

• Initial weekly unemployment claims averaged close to 271,000 in September, down slightly from August. For the BLS reference week (includes the 12th of the month), initial claims were at 264,000; down from 277,000 during the reference week in August.

The decrease during the reference suggests a slightly lower level of layoffs in September.

• The final September University of Michigan consumer sentiment index decreased to 87.2 from the August reading of 91.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a small decrease in small business employment in September. From Intuit: Small Business Employment Remains Stagnant in September

U.S. small business employment remained flat in September, posting a decline of 0.01 percent from the August figure.• Trim Tabs reported that the U.S. economy added 149,000 jobs in September. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“Despite the flat net hiring, the hiring rate, which reflects people hired to replace leaving workers as well as new hires, continued at 5.25 percent per month, accounting for turnover in small business employees. The hiring rate has risen steadily since mid-2009,” said Susan Woodward the economist who works with Intuit to produce the indexes.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report.

There were several weaker indicators this month such as ISM manufacturing, TrimTabs and small business hiring.

I'll take the under on the consensus for September, but I expect an upward revision for August.

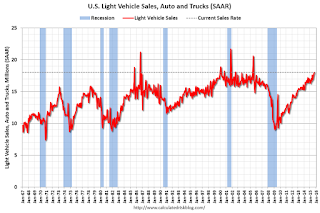

U.S. Light Vehicle Sales increased to 18 million annual rate in September

by Calculated Risk on 10/01/2015 03:15:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 18.03 million SAAR in September. That is up almost 10% from September 2014, and up 1.7% from the 17.7 million annual sales rate last month.

Labor day was included in September this year, and that probably pushed sales over 18 million.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 18.03 million SAAR from WardsAuto).

This was above to the consensus forecast of 17.5 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was another very strong month for auto sales and it appears 2015 will be the best year for light vehicle sales since 2001.

Reis: Office Vacancy Rate declined in Q3 to 16.5%

by Calculated Risk on 10/01/2015 01:17:00 PM

Reis released their Q3 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.5% in Q3, from 16.6% in Q2. This is down from 16.8% in Q3 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

During the third quarter, net absorption exceeded construction which caused vacancy to decline by 10 basis points to 16.5%. This marks the fourth time in the last five quarters that vacancy declined and kept the rate at its lowest level since the second quarter of 2009. Slowly and quietly, the recovery in the office market is gathering pace. 2015 is shaping up to be the best year for demand for office space since 2007, before the recession. Year‐to‐date figures for most metrics are already well ahead of last year. Because the improvement in the office market has been so gradual, it has largely gone unnoticed by many in the industry. However, improvement is becoming stronger and more consistent which portends better times ahead for the office market over the next five years.

...

Occupied stock increased by 9.865 million square feet during the third quarter. This was an increase versus last quarter and indicating of the gradual strengthening of demand for office space. Moreover, year‐to‐date figures show even more dramatic improvement. Through the third quarter net absorption for 2015 totaled 25.304 million SF. This exceeds the year‐to date figure from 2014 by 5.380 million SF, or roughly 26%. ...

New construction of 7.674 million SF is a bit of a decline from last quarter. While many lenders still require preleasing in order to provide construction and development financing, speculative new construction is slowly returning to the market. Admittedly, speculative projects remain at very low levels, well below cycles past, but their existence provides another sign of the ongoing recovery.

...

Asking and effective rents grew by 0.6% and 0.7%, respectively, during the third quarter, marking the twentieth consecutive quarter of asking and effective rent growth. These growth rates are more or less in line with the growth rates from last quarter. However, even though quarterly rent growth did not accelerate, year‐over‐year rental growth rates for both asking and effective rents did accelerate. Effective rent growth of 3.5% is quite strong for a market with such an elevated vacancy rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.5% in Q2.

Office vacancy data courtesy of Reis.

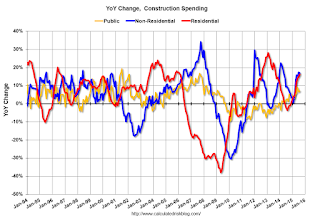

Construction Spending increased 0.7% in August, Up 13.7% YoY

by Calculated Risk on 10/01/2015 11:07:00 AM

The Census Bureau reported that overall construction spending increased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2015 was estimated at a seasonally adjusted annual rate of $1,086.2 billion, 0.7 percent above the revised July estimate of $1,079.1 billion. The August figure is 13.7 percent above the August 2014 estimate of $955.0 billion.Both private spending and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $788.0 billion, 0.7 percent above the revised July estimate of $782.3 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In August, the estimated seasonally adjusted annual rate of public construction spending was $298.2 billion, 0.5 percent above the revised July estimate of $296.8 billion.

emphasis added

As an example, construction spending for private lodging is up 43% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 9% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 44% below the bubble peak.

Non-residential spending is only 3% below the peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009 and about 12% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 16%. Non-residential spending is up 17% year-over-year. Public spending is up 7% year-over-year.

Looking forward, all categories of construction spending should increase this year and in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was at the consensus forecast of a 0.7% increase, however spending for June and July were revised down. Overall, another solid construction report.

ISM Manufacturing index decreased to 50.2 in September

by Calculated Risk on 10/01/2015 10:04:00 AM

The ISM manufacturing index barely suggested expansion in September. The PMI was at 50.2% in September, down from 51.1% in August. The employment index was at 50.5%, down from 51.2% in August, and the new orders index was at 50.1%, down from 51.6%.

From the Institute for Supply Management: September 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in September for the 33rd consecutive month, and the overall economy grew for the 76th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The September PMI® registered 50.2 percent, a decrease of 0.9 percentage point from the August reading of 51.1 percent. The New Orders Index registered 50.1 percent, a decrease of 1.6 percentage points from the reading of 51.7 percent in August. The Production Index registered 51.8 percent, 1.8 percentage points below the August reading of 53.6 percent. The Employment Index registered 50.5 percent, 0.7 percentage point below the August reading of 51.2 percent. Backlog of Orders registered 41.5 percent, a decrease of 5 percentage points from the August reading of 46.5 percent. The Prices Index registered 38 percent, a decrease of 1 percentage point from the August reading of 39 percent, indicating lower raw materials prices for the 11th consecutive month. The New Export Orders Index registered 46.5 percent, the same reading as in August. Comments from the panel are mixed with some concern about the global economy and customer confidence."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.5%, and indicates slower manufacturing expansion in September.

Weekly Initial Unemployment Claims increased to 277,000

by Calculated Risk on 10/01/2015 08:35:00 AM

The DOL reported:

In the week ending September 26, the advance figure for seasonally adjusted initial claims was 277,000, an increase of 10,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 270,750, a decrease of 1,000 from the previous week's unrevised average of 271,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 270,750.

This was above the consensus forecast of 272,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, September 30, 2015

Thursday: Vehicle Sales, ISM Mfg, Construction Spending, Unemployment Claims

by Calculated Risk on 9/30/2015 10:10:00 PM

From the WSJ: Congress Passes Bill to Fund Government Through Dec. 11

Congress now confronts a new Dec. 11 deadline to try to strike a long-term budget deal at a time when House Republicans are losing their most experienced leader and remain split about how to negotiate with Mr. Obama and Democrats.Thursday:

Moreover, the stopgap measure will end around the time when Congress also has to consider raising the debt ceiling, and one week before a key Federal Reserve meeting, at which many economists expect the central bank to raise interest rates for the first time in nearly a decade. Lawmakers also will contend with a long-term highway bill and expiring tax breaks at year’s end.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, up from 267 thousand the previous week.

• At 10:00 AM, the ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August. The ISM manufacturing index indicated expansion at 51.1% in August. The employment index was at 51.2%, and the new orders index was at 51.6%.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.7% increase in construction spending.

• All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).