by Calculated Risk on 8/16/2015 09:01:00 PM

Sunday, August 16, 2015

Monday: Empire State Mfg, Homebuilder Confidence

NOTE: CR is on vacation this week and will return on Sunday, August 23rd.

Monday:

• At 8:30 AM ET, NY Fed Empire State Manufacturing Survey for August. The consensus is for a reading of 5.0, up from 3.9.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

December 2006: Tanta joined CR!

by Calculated Risk on 8/16/2015 11:38:00 AM

Note: CR is on vacation, and I will return on Sunday, August 23rd.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

Here are excerpts from her first two posts:

From December 2006: Let Slip the Dogs of Hell

I still haven’t gotten over the fact that there’s a “capital management” group out there having named itself “Cerberus”. Those of you who were not asleep in Miss Buttkicker’s Intro to Western Civ will recognize Cerberus; the rest of you may have picked up the mythological fix from its reprise as “Fluffy” in the first Harry Potter novel. Wherever you get your culture, Cerberus is the three-headed dog who guards the gates of Hell. It takes three heads to do that, of course, because it’s never clear, in theology or finance, whether the idea is to keep the righteous from falling into the pit or the demons from escaping out of it (the third head is busy meeting with the regulators). Cerberus is relevant not just because it supplies me with today’s metaphor, but because it was the Biggest Dog of three (including Citigroup and Aozora, a Japanese bank) who in April bought a 51% stake in GMAC’s mega-mortgage operation, GM having, of course, once been renowned as one of the Big Three Automakers until it became one of the Big Three Financing Outfits With A Sideline In Cars. I tried to find a link for you to Aozora Bank’s announcement of the purchase, but the only press release I could find for that day involved the loss of customer data. They must have been so busy letting GMAC into the underworld that the dog head keeping the deposit tickets from getting out got distracted.And from December 2006: On Hybrids, Teasers, and Other Mortgage Guidance Problems

...

Now, I’m just a Little Mortgage Weenie, not a Big Finance Dog, but bear with me while I ask some stupid questions. Like: how do the Big Dogs maintain “diverse and flexible production channels” (i.e., little mortgage banker Puppies to sell you correspondent business and little broker Puppies to sell you wholesale business) when “market share currently held by top-tier players” expands to two-thirds (meaning less diverse off-load strategies for the Little Puppies in the “production channels,” putting them at further pipeline/counterparty risk unless they become Bigger Puppies, which makes them competitors instead of “channels,”), while at the same time watching some of the Little Puppies (in whom the Big Dogs have a major equity stake) crawl under the porch to die? I know Citi doesn’t seem to have noticed that the “increased regulatory scrutiny” is not just of “products” but of “wholesale operational/management controls,” but I did.

First of all, a “hybrid ARM” is called a “hybrid” because it is, basically, a cross between a fixed rate and adjustable rate mortgage. Before the early 90s, an “ARM” basically meant a one-year ARM. The initial interest rate was set for one year, and the rate adjusted every year. The only real variations on this theme involved shortening the adjustment frequency: you could get an ARM that adjusted every six months instead of one year.CR Note: If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

Around the early 90s, the “hybrid ARM” was introduced. It had an initial period in which the rate was “fixed” that didn’t match the subsequent adjustment frequency: this is the classic 3/1, 5/1, 7/1, and even 10/1 ARM. The whole idea of the hybrid ARM was to provide a kind of medium-range risk/reward tradeoff for borrowers and lenders.

Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Saturday, August 15, 2015

Schedule for Week of August 16, 2015

by Calculated Risk on 8/15/2015 08:11:00 AM

Special Note: CR is on vacation this week and will return on Sunday, August 23rd. The early consensus looks low for existing home sales!

The key reports this week are July housing starts on Tuesday, and July existing home sales on Thursday.

For prices, CPI will be released on Wednesday.

8:30 AM: NY Fed Empire State Manufacturing Survey for August. The consensus is for a reading of 5.0, up from 3.9.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts increased to 1.174 million (SAAR) in June. Single family starts decreased to 685 thousand SAAR in June.

The consensus for 1.185, up from 1.174 million in June.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of July 28-29, 2015

8:30 AM: The initial weekly unemployment claims report will be released.

10:00 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 7.0, up from 5.7.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.49 million in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.49 million in June. Sales in June were at a 5.49 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.64 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

10:00 AM ET: Regional and State Employment and Unemployment for July.

Friday, August 14, 2015

CR on Housing in 2005

by Calculated Risk on 8/14/2015 10:01:00 AM

Note: CR is on vacation, and I will return on Sunday, August 23rd.

Back in 2005 and 2006, at least every other post was about the housing bubble and the possible impact on the economy. Here are a few examples:

From April 2005: Housing: Speculation is the Key

I have taken to calling the housing market a "bubble". But how do I define a bubble?This is relevant to the current housing situation. Some analysts are arguing prices are forming a new bubble now - based on fundamentals such as price-to-rent and price-to-income - however there is very little of the crazy speculation that was happening in 2005. And even on a fundamental basis, the current situation is nothing like 2005.

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

From March 2005: California Real Estate Prices: Boom and Bust

Today I heard someone comment that California Real Estate never goes down. In fact, California RE has declined in the past in both real and nominal terms.And from August 2006: Housing: Inverted Reasoning?

...

The decline in the '90s lasted 24 quarters from peak to trough. It took 9 years for prices to recover in nominal terms to their early '91 peak. Overall prices declined 12% in nominal terms and 26% in real terms.

Even more important for the economy are the coincident declines in sales volume. Real Estate prices are “sticky downward” since sellers are slow to adjust their prices down, and buyers are reluctant to buy a declining price asset. In this regards, real estate is an imperfect market in that prices adjust slowly to changes in supply and demand (unlike commodities like corn or wheat). Although prices do decline, it’s the decline in volume that leads to declining employment in real estate related occupations like construction, RE sales, mortgages, and more, and impacts the general economy.

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.CR Note: I do not have a crystal ball, but the housing bubble / bust seemed obvious!

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Thursday, August 13, 2015

Friday: PPI, Industrial Production, Consumer Sentiment

by Calculated Risk on 8/13/2015 09:00:00 PM

NOTE: CR is on vacation and will return on Sunday, August 23rd.

Friday:

• At 8:30 AM ET, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 93.5, up from 93.1 in July.

CR takes a Vacation!

by Calculated Risk on 8/13/2015 05:47:00 PM

I'll be on vacation - at an undisclosed location - starting tomorrow morning. I'm going to unplug completely from the internet for 10 days (hopefully nothing too crazy will happen).

I will return on August 23rd.

I've arranged to have posts every day, but there will not be any current reports (so I'll miss housing starts and existing home sales for July to be released next week).

All my best to everyone, Bill

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/13/2015 02:42:00 PM

From housing economist Tom Lawler:

Based on reports from local realtors/MLS from across the country released through today, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.64 million in July, up 2.7% from June’s pace and up 11.2% from last July’s seasonally adjusted pace.

I also project that the NAR’s estimate of the number of existing homes for sale at the end of July will be about 2.37 million, up 3.0% from June and up 0.9% from last July.

Finally, I predict that the NAR’s estimate of the median existing SF home sales price in July will be up by about 5.3% from last July.

CR Note: The NAR is scheduled to report July existing home sales next Thursday at 10:00 AM. The sales rate in July will likely be the highest since February 2007.

NY Fed: Household Debt "Flat" in Q2 2015

by Calculated Risk on 8/13/2015 11:34:00 AM

Here is the Q2 report: Household Debt and Credit Report.

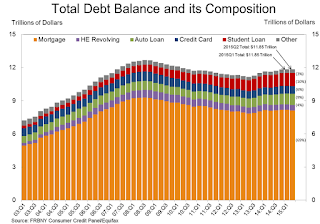

From the NY Fed: Auto Loans Race Ahead, Foreclosures Plunge, and Overall Household Debt Remains Flat

Household debt balances were largely flat in the second quarter of this year, according to the Federal Reserve Bank of New York’s Household Debt and Credit Report. Total indebtedness increased just $2 billion from Q1 2015. Foreclosures hit their lowest point in the 16-year history of the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Auto loan originations reached a 10-year high in the second quarter, at $119 billion, supporting a $38 billion increase in the aggregate auto loan balance, which has now passed $1 trillion. The increase in auto loans also drove most of the $67 billion increase in non-housing debt balances. Credit card balances increased, by $19 billion, to $703 billion, while student loan balances remained flat. Mortgage balances and HELOC dropped by $55 billion and $11 billion, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests household (in the aggregate) deleveraging is over although mortgage debt is still declining (foreclosures of legacy loans continue).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 5.6% in Q2, from 5.7% in Q1.

There are a number of credit graphs at the NY Fed site.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q2

by Calculated Risk on 8/13/2015 10:55:00 AM

From the MBA: Mortgage Delinquencies and Foreclosures Continue to Drop in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.30 percent of all loans outstanding at the end of the second quarter of 2015. This was the lowest level since the second quarter of 2007. The delinquency rate decreased 24 basis points from the previous quarter, and 74 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 2.09 percent, down 13 basis points from the first quarter and 40 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate since the fourth quarter of 2007.

...

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey:

"Overall delinquency rates and the percentage of loans in foreclosure continued to fall in the second quarter and are at their lowest levels since 2007. Even more telling, nearly every state in the nation reported declining foreclosure inventory rates over the second quarter, reflecting a nationwide housing market recovery and strong job market that provide opportunities for distressed loans to be resolved rather than be put into foreclosure.

...

"As has been the case since the fourth quarter of 2012, New Jersey, New York, and Florida had the highest percentage of loans in foreclosure in the nation. ... "Legacy loans continued to account for the majority of all troubled mortgages. 73 percent of the loans that were seriously delinquent, either more than 90 days delinquent or in the foreclosure process were originated before 2008, even as the overall rate of serious delinquencies for those cohorts decreased."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 78% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 75% of the way back to normal.

So it has taken over 5 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 75%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Weekly Initial Unemployment Claims increased to 274,000, 4-Week Average Lowest since 2000

by Calculated Risk on 8/13/2015 09:15:00 AM

The DOL reported:

In the week ending August 8, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 270,000 to 269,000. The 4-week moving average was 266,250, a decrease of 1,750 from the previous week's revised average. This is the lowest level for this average since April 15, 2000 when it was 266,250. The previous week's average was revised down by 250 from 268,250 to 268,000.The previous week was revised down by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 266,250.

This was higher than the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

This ties, with April 15, 2000, the lowest level for the 4-week average since 1973 (over 40 years).