by Calculated Risk on 8/06/2015 12:14:00 PM

Thursday, August 06, 2015

Preview: Employment Report for July

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 212,000 non-farm payroll jobs in July (with a range of estimates between 210,000 to 262,000), and for the unemployment rate to be unchanged at 5.3%.

The BLS reported 223,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 185,000 private sector payroll jobs in July. This was below expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in July to 52.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 5,000 in July. The ADP report indicated a 2,000 increase for manufacturing jobs.

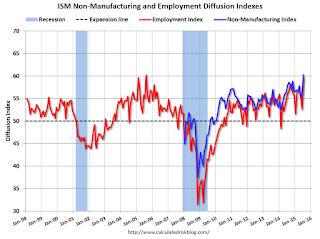

The ISM non-manufacturing employment index increased in July to 59.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 330,000 in July. This employment reading was unusually strong, and the correlation might not be as useful.

Combined, the ISM indexes suggests employment gains of 325,000. This suggests employment growth well above expectations.

• Initial weekly unemployment claims averaged close to 275,000 in July, about the same as in June. For the BLS reference week (includes the 12th of the month), initial claims were at 255,000; down from 268,000 during the reference week in June.

This suggests a lower level of layoffs in July.

• The final July University of Michigan consumer sentiment index decreased to 93.1 from the June reading of 96.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 10,000 increase in small business employment in July, lower than in June. From Intuit: Small Businesses Employment Increases in June

Small business employment rose by 10,000 jobs in July, an annual rate of 0.5 percent. However, Susan Woodward, the economist who works with Intuit to produce the indexes, said this is slower than the growth rate of 1.0 percent over the past year.• Trim Tabs reported that the U.S. economy added 268,000 jobs in July. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“Small business employment is still 2.3 percent below its pre-recession peak,” said Woodward. “The continued low level of construction employment, which is 17.5 percent below the pre-recession peak in mid-2006, accounts for the slow rate of small business recovery.

“A sign of continuing recovery in small business activity is the hiring rate, which has risen slowly but steadily since July 2009. An increase in the hiring rate reflects improved opportunities for workers,” Woodward said.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. And the data was mixed.

There were several weaker indicators such the ADP report, ISM manufacturing, and small business hiring.

The ISM non-manufacturing, TrimTabs, and the low level of unemployment claims for the BLS reference week, all suggest a stronger report.

Historically the initial report for July tends to be weak, and I'll take the under on the consensus this month.

Weekly Initial Unemployment Claims increased to 270,000

by Calculated Risk on 8/06/2015 08:33:00 AM

The DOL reported:

In the week ending August 1, the advance figure for seasonally adjusted initial claims was 270,000, an increase of 3,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 268,250, a decrease of 6,500 from the previous week's unrevised average of 274,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 268,250.

This was lower than the consensus forecast of 273,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, August 05, 2015

Q2 2015 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/05/2015 08:01:00 PM

The BEA released the underlying details for the Q2 advance GDP report today.

Last Thursday, the BEA reported that investment in non-residential structures decreased slightly in Q2.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $112.5 billion annual rate in Q1 to a $81.1 billion annual rate in Q2.

Excluding petroleum, non-residential investment in structures increased at a 6.8% annual rate in Q2 (solid growth).

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, is down about 33% from the recent peak (as a percent of GDP) and increasing from a very low level - and is still below the lows for previous recessions (as percent of GDP). .

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 54% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 57%.

Investment in single family structures is now back to being the top category for residential investment. Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 7 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $210 billion (SAAR) (almost 1.2% of GDP).

Investment in home improvement was at a $176 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just under 1.0% of GDP).

These graphs show investment is generally increasing, but is still very low.

Phoenix Real Estate in July: Sales Up 17%, Inventory DOWN 15% Year-over-year

by Calculated Risk on 8/05/2015 04:10:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the eight consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were up 16.6% year-over-year.

2) Cash Sales (frequently investors) were down to 21.9% of total sales.

3) Active inventory is now down 15.3% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 2.1% through May (increasing faster than in 2014).

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 8/05/2015 01:45:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted earlier: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 2.8% | 3.8% | 3.6% | 6.2% | 6.4% | 10.0% | 23.0% | 26.6% |

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Tampa MSA SF | 3.7% | 6.4% | 17.4% | 21.3% | 21.1% | 27.6% | 33.1% | 36.3% |

| Tampa MSA C/TH | 2.5% | 4.2% | 12.1% | 17.0% | 14.6% | 21.2% | 57.1% | 60.4% |

| Miami MSA SF | 5.8% | 8.7% | 17.1% | 17.6% | 22.9% | 26.3% | 34.9% | 41.9% |

| Miami MSA C/TH | 2.9% | 5.3% | 19.2% | 19.6% | 22.2% | 24.8% | 63.1% | 68.9% |

| Florida SF | 3.4% | 5.9% | 16.5% | 20.3% | 20.0% | 26.2% | 33.4% | 39.3% |

| Florida C/TH | 2.4% | 4.4% | 14.6% | 17.5% | 17.1% | 21.9% | 60.9% | 65.8% |

| Bay Area CA* | 2.1% | 3.0% | 1.9% | 2.8% | 4.0% | 5.8% | 20.0% | 21.6% |

| So. California* | 3.1% | 4.6% | 3.8% | 4.7% | 6.9% | 9.3% | 22.3% | 25.9% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Peoria | 16.1% | 21.3% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Pensacola | 31.6% | 30.5% | ||||||

| Knoxville | 18.9% | 22.9% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

ISM Non-Manufacturing Index increased to 60.3% in July

by Calculated Risk on 8/05/2015 10:17:00 AM

The July ISM Non-manufacturing index was at 60.3%, up from 56.0% in June. The employment index increased in July to 59.6%,up from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 66th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 60.3 percent in July, 4.3 percentage points higher than the June reading of 56 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 64.9 percent, which is 3.4 percentage points higher than the June reading of 61.5 percent, reflecting growth for the 72nd consecutive month at a faster rate. The New Orders Index registered 63.8 percent, 5.5 percentage points higher than the reading of 58.3 percent registered in June. The Employment Index increased 6.9 percentage points to 59.6 percent from the June reading of 52.7 percent and indicates growth for the 17th consecutive month. The Prices Index increased 0.7 percentage point from the June reading of 53 percent to 53.7 percent, indicating prices increased in July for the fifth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents continue to have a positive outlook on business conditions and the overall economy. This is reflected directly by a number of new highs for some of the indexes." "

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 56.2% and suggests much faster expansion in July than in June. Very strong.

Trade Deficit increased in June to $43.8 Billion

by Calculated Risk on 8/05/2015 08:39:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.8 billion in June, up $2.9 billion from $40.9 billion in May, revised. June exports were $188.6 billion, $0.1 billion less than May exports. June imports were $232.4 billion, $2.8 billion more than May imports.The trade deficit was close to the consensus forecast of $43.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports were mostly unchanged in June.

Exports are 14% above the pre-recession peak and down 4% compared to June 2014; imports are at the pre-recession peak, and down 2% compared to June 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $53.76 in June, up from $50.76 in May, and down from $96.41 in June 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.5 billion in June, from $30.1 billion in June 2014. The deficit with China is a large portion of the overall deficit.

ADP: Private Employment increased 185,000 in July

by Calculated Risk on 8/05/2015 08:19:00 AM

Private sector employment increased by 185,000 jobs from June to July according to the June [July] ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 8,000 jobs in July, after adding 13,000 in June. The construction industry added 15,000 jobs in July, down from 17,000 last month. Meanwhile, manufacturing added 2,000 jobs in July, after gaining 9,000 in June.

Service-providing employment rose by 178,000 jobs in July, down from 216,000 in June. month. The 19,000 new jobs added in financial activities was an increase from last month’s 12,000. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but it has moderated since the beginning of the year. Layoffs in the energy industry and weaker job gains in manufacturing are behind the slowdown. Nonetheless, even at this slower pace of growth, the labor market is fast approaching full employment.”

The BLS report for July will be released Friday, and the consensus is for 212,000 non-farm payroll jobs added in July.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 23% YoY

by Calculated Risk on 8/05/2015 07:00:00 AM

From the MBA: Refinance, Purchase Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 31, 2015. ...

The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 23 percent higher than the same week one year ago.

“Despite recent concerns about the economy, both purchase and refinance applications increased strongly in response to lower interest rates last week,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Refinance activity was the highest since May when rates were last at this level. The increase in purchase activity was also notable for this time of year, up 23 percent relative to a year ago.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.13 percent, its lowest level since May 2015, from 4.17 percent, with points decreasing to 0.34 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

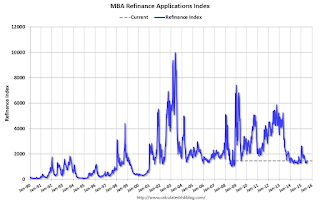

Click on graph for larger image.The first graph shows the refinance index.

Even with the increase in activity, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 23% higher than a year ago.

Tuesday, August 04, 2015

Wednesday: Trade Deficit, ADP Employment, ISM non-Mfg Survey

by Calculated Risk on 8/04/2015 06:59:00 PM

From Jon Hilsenrath at the WSJ: Atlanta Fed’s Lockhart: Fed Is ‘Close’ to Being Ready to Raise Short-Term Rates

“I think there is a high bar right now to not acting, speaking for myself,” Mr. Lockhart said ...Wednesday:

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in July, down from 238,000 in June.

• At 8:30 AM, Trade Balance report for June from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.9 billion in May.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for index to increase to 56.2 from 56.0 in June.

• Also at 10:00 AM, Speech by Fed Governor Jerome Powell, The Structure and Liquidity of Treasury Bond Markets, At the Brookings Institute Conference: Are There Structural Issues in the U.S. Bond Markets?, Washington, D.C.