by Calculated Risk on 7/23/2015 09:48:00 AM

Thursday, July 23, 2015

Chicago Fed: Index shows "Economic Growth Picked Up Slightly in June"

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Picked Up Slightly in June

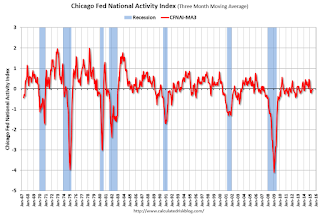

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.08 in June from –0.08 in May. Three of the four broad categories of indicators that make up the index increased from May, and two of the four categories made positive contributions to the index in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged up to –0.01 in June from –0.07 in May. June’s CFNAI-MA3 suggests that growth in national economic activity was very close to its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decreased to 255,000

by Calculated Risk on 7/23/2015 08:34:00 AM

The DOL reported:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 255,000, a decrease of 26,000 from the previous week's unrevised level of 281,000. This is the lowest level for initial claims since November 24, 1973 when it was 233,000. The 4-week moving average was 278,500, a decrease of 4,000 from the previous week's unrevised average of 282,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 278,500.

This was below to the consensus forecast of 279,000, and the low level of the 4-week average suggests few layoffs. This was also the reference week for the BLS employment report, and suggests few layoffs during the reference week.

Wednesday, July 22, 2015

Thursday: Unemployment Claims

by Calculated Risk on 7/22/2015 08:59:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

A Few Random Comments on June Existing Home Sales

by Calculated Risk on 7/22/2015 03:04:00 PM

First, as always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. Also I wouldn't be surprised if the seasonally adjusted pace for existing home sales slows over the next several months - due to limited inventory and higher mortgage rates.

Second, in general I'd ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). The NAR reported the median sales price was $236,400 in June, above the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.

Third, Inventory is still very low (up only 0.4% year-over-year in June). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch.

Note: I'm hearing reports of rising inventory in some mid-to-higher priced areas. However many low priced areas still have little inventory.

Also, the NAR reported total sales were up 9.6% from June 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — fell to 8 percent in June (matching an August 2014 low) from 10 percent in May, and are below the 11 percent share a year ago. Six percent of June sales were foreclosures and 2 percent were short sales.Last year in June the NAR reported that 11% of sales were distressed sales.

A rough estimate: Sales in June 2014 were reported at 5.01 million SAAR with 11% distressed. That gives 551 thousand distressed (annual rate), and 4.46 million equity / non-distressed. In June 2015, sales were 5.49 million SAAR, with 8% distressed. That gives 439 thousand distressed - a decline of about 20% from June 2014 - and 5.05 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 13%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) were the highest for June since 2007 (NSA).

Earlier:

• Existing Home Sales in June: 5.49 million SAAR, Highest Pace in Eight Years

AIA: Architecture Billings Index increased in June, "Multi-family housing design showing signs of slowing"

by Calculated Risk on 7/22/2015 12:27:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Institutional Project Demand Drives Architecture Billings Index to Highest Mark Since 2007

Paced by continued demand for projects such as new education and healthcare facilities, public safety and government buildings, the Architecture Billings Index (ABI) increased in June following fluctuations earlier this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 55.7, up substantially from a mark of 51.9 in May. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.4, up from a reading of 61.5 the previous month.

“The June numbers are likely showing some catch-up from slow growth earlier this year. This is the first month in 2015 that all regions are reporting positive business conditions and aside from the multi-family housing sector, all design project categories appear to be in good shape,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The demand for new apartments and condominiums may have crested with index scores going down each month this year and reaching the lowest point since 2011.”

...

Sector index breakdown: institutional (59.1), mixed practice (54.7), commercial / industrial (51.6) multi-family residential (47.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.7 in June, up from 51.9 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the fifth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment in the 2nd half of 2015.

Existing Home Sales in June: 5.49 million SAAR, Highest Pace in Eight Years

by Calculated Risk on 7/22/2015 10:10:00 AM

The NAR reports: Existing-Home Sales Rise in June as Home Prices Surpass July 2006 Peak

Existing-home sales increased in June to their highest pace in over eight years, while the cumulative effect of rising demand and limited supply helped push the national median sales price to an all-time high, according to the National Association of Realtors®. ...

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.2 percent to a seasonally adjusted annual rate of 5.49 million in June from a downwardly revised 5.32 million in May. Sales are now at their highest pace since February 2007 (5.79 million), have increased year-over-year for nine consecutive months and are 9.6 percent above a year ago (5.01 million). ...

Total housing inventory at the end of June inched 0.9 percent to 2.30 million existing homes available for sale, and is 0.4 percent higher than a year ago (2.29 million). Unsold inventory is at a 5.0-month supply at the current sales pace, down from 5.1 months in May.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.49 million SAAR) were 3.2% higher than last month, and were 9.6% above the June 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.30 million in June from 2.28 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.30 million in June from 2.28 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 0.4% year-over-year in June compared to June 2014.

Inventory increased 0.4% year-over-year in June compared to June 2014. Months of supply was at 5.0 months in June.

This was above expectations of sales of 5.40 million. For existing home sales, a key number is inventory - and inventory is still low, but increasing. I'll have more later ...

MBA: Mortgage Applications Unchanged in Latest Weekly Survey, Purchase Index up 18% YoY

by Calculated Risk on 7/22/2015 07:01:00 AM

From the MBA: Mortgage Applications Flat in Latest MBA Weekly Survey

Mortgage applications increased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 17, 2015. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.23 percent, with points decreasing to 0.34 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, July 21, 2015

Wednesday: Existing Home Sales, Architecture Billings Index

by Calculated Risk on 7/21/2015 06:58:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for May 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.40 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.35 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.45 million SAAR.

• During the day: the AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 7/21/2015 02:59:00 PM

The NAR will report June Existing Home Sales tomorrow, Wednesday, July 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.40 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.45 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.35 million SAAR in May.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last five years, the consensus average miss was 145 thousand with a standard deviation of 155 thousand. Lawler's average miss was 67 thousand with a standard deviation of 47 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | --- |

| 1NAR initially reported before revisions. | |||

DOT: Vehicle Miles Driven increased 2.7% year-over-year in May, Rolling 12 Months at All Time High

by Calculated Risk on 7/21/2015 11:59:00 AM

People are driving more!

The Department of Transportation (DOT) reported:

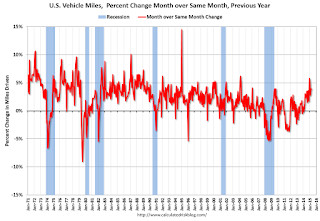

Travel on all roads and streets changed by 2.7% (7.3 billion vehicle miles) for May 2015 as compared with May 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 275.1 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for May 2015 is 262.1 billion miles, a 3.4% (8.7 billion vehicle miles) increase over May 2014. It also represents a 0.2% change (0.6 billion vehicle miles) compared with April 2015.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In May 2015, gasoline averaged of $2.80 per gallon according to the EIA. That was down significantly from May 2014 when prices averaged $3.75 per gallon.

In May 2015, gasoline averaged of $2.80 per gallon according to the EIA. That was down significantly from May 2014 when prices averaged $3.75 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is at a new high.