by Calculated Risk on 6/29/2015 07:07:00 PM

Monday, June 29, 2015

Duy: "Events Continue to Conspire Against the Fed"

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices. The consensus is for a 5.4% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in April, and for prices to be unchanged month-to-month seasonally adjusted.

• At 9:45 AM, Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.6, up from 46.2 in May.

From Tim Duy: Events Continue to Conspire Against the Fed. Excerpts:

Federal Reserve policymakers just can't catch a break lately. Riding on the back of strong data in the second half of last year, they were positioning themselves to declare victory and begin the process of policy normalization, AKA "raising interest rates." Then the bottom fell out. Data in the first half of the year turned sloppy. Although policymakers on average - and Federal Reserve Chair Janet Yellen in particular - could reasonably believe the underlying momentum of the economy had not changed, that the data reflected largely temporary factors, the case for a rate hike by mid-year evaporated all the same. The risk of being wrong was simply more than they were willing to bear in the absence of clear inflation pressures.

The story was clearly shifting by the end of June. Key data on jobs and the consumer firmed as expected, raising the possibility that September was in play. ...

But then came Greece. Greece - will it never end? Financial markets were roiled as Greek Prime Minister Alexis Tsipras abandoned the latest round of bailout negotiations with the EU, IMF, and ECB and instead pursued a national referendum on the last version of the bailout proposal. Most of you know the story from that point on - run on Greek banks, the ECB ends further ELA extensions, a bank holiday is declared, likely missing a payment to the IMF etc., etc.

At this juncture, everything in Greece is now in flux. ...

Bottom Line: The Fed was already approaching the first rate hike cautiously, wary of even dipping their toes in the water. The crisis in Greece will make them even more cautious. Like their response to the first quarter data, until they see a clear path, they will be on the sidelines. That said, given the plethora of warnings not to underestimate the global impact of the crisis in Greece, one should be watching the opposite side of the story. Solid data and limited Greece impact would leave December at a minimum, and even September, in play.

Forecast: Auto Sales above 17 Million SAAR in June

by Calculated Risk on 6/29/2015 05:24:00 PM

Nothing to add on Greece right now, so here is another forecast for June auto sales.

From WardsAuto: Forecast: SAAR Expected to Remain Above 17 Million in June

A WardsAuto forecast calls for U.S. automakers to deliver 1.48 million light vehicles this month.Another strong month, and on pace for close to 17 million for the year.

...

The report puts the seasonally adjusted annual rate of sales for the month at 17.2 million units, shy of last month’s 17.7 million SAAR, but ahead of the current 3-month SAAR (17.1 million) and the year-to-date SAAR through May (16.8 million).

The forecast reflects reports of very strong retail activity for most automakers continuing from May offset somewhat by a downturn in sales to fleets.

...

Projected June LV sales would bring year-to-date deliveries to 8.5 million units, a 4.6% improvement from same-period 2014. WardsAuto currently is forecasting 16.94 million LV deliveries for calendar 2015.

Black Knight: House Price Index up 1.0% in April, 4.9% year-over-year

by Calculated Risk on 6/29/2015 02:21:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: April Transactions U.S. Home Prices Up 1.0 Percent for the Month; Up 4.9 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Home Price Index (HPI) report, based on April 2015 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 1.0% percent in April, and is off 7.6% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month’s home price trends, including detailed looks at the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report.

The year-over-year increase in the index has been about the same for the last seven months.

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 39.5% from the peak in Las Vegas, off 33.4% in Orlando, and 29.1% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado, New York, Tennessee and Texas, and several other cities around the country.

Note: Case-Shiller for April will be released tomorrow.

Dallas Fed: Texas Manufacturing Activity Still Contracting

by Calculated Risk on 6/29/2015 10:44:00 AM

From the Dallas Fed: Texas Manufacturing Activity Still Contracting

Texas factory activity declined again in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose to -6.5 but remained in negative territory, suggesting a fourth consecutive month of contracting output.This was the last of the regional Fed surveys for June. Three of the five surveys indicated contraction in June, mostly due to weakness in oil producing areas. However there was less contraction in those areas in June.

...

Perceptions of broader business conditions worsened further, although not as sharply in June as in prior months. The general business activity index jumped nearly 14 points to -7, its highest reading since January.

...

Labor market indicators reflected slight employment declines and shorter workweeks. The June employment index was negative for a second month in a row but pushed up 7 points to -1.2. Fourteen percent of firms reported net hiring, compared with 15 percent reporting net layoffs. The hours worked index inched up from -11.6 to -10.7.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

It seems likely the ISM index will be weak again in June, but will probably increase from the May level. The consensus is for an increase to 53.2 for the ISM index, from 52.8 in May.

NAR: Pending Home Sales Index increased 0.9% in May, up 10% year-over-year

by Calculated Risk on 6/29/2015 10:08:00 AM

From CNBC: Pending home sales rise 0.9% in May, highest level since 2006

Signed contracts to buy existing homes, so-called pending home sales, rose just 0.9 percent in May from April, according to the National Association of Realtors, after a downward revision to April's reading. That is slightly lower than analysts predicted, but is still the highest level on the association's index since April of 2006. Pending sales are now 10.4 percent higher than one year ago.This was close to expectations of a 0.6% increase.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

Sunday, June 28, 2015

Sunday Night Futures: Greece and Puerto Rico

by Calculated Risk on 6/28/2015 09:15:00 PM

From the NY Times: Puerto Rico’s Governor Says Island’s Debts Are ‘Not Payable’

Puerto Rico’s governor, saying he needs to pull the island out of a “death spiral,” has concluded that the commonwealth cannot pay its roughly $72 billion in debts, an admission that will probably have wide-reaching financial repercussions.And from the WSJ: Greece Orders Banks Closed, Imposes Capital Controls to Stem Deposit Flight

Greece shut down its banking system, ordering lenders to stay closed for six days starting Monday, and its central bank moved to impose controls to prevent money from flooding out of the country.I hope Greece is ready with the Drachma (It seemed there was no way out four months ago).

Monday:

• At 10:00 AM ET, Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for June.

Weekend:

• Schedule for Week of June 28, 2015

• June 2015: Unofficial Problem Bank list declines to 309 Institutions, Q2 2015 Transition Matrix

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 29 and DOW futures are down 217 (fair value).

Oil prices were down over the last week with WTI futures at $58.80 per barrel and Brent at $62.55 per barrel. A year ago, WTI was at $106, and Brent was at $112 - so prices are down 40%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.78 per gallon (down about $0.90 per gallon from a year ago).

Greece: ECB Freezes Level of Emergency Loans

by Calculated Risk on 6/28/2015 11:00:00 AM

Some comments from analysts at the Financial Times Alphaville: Greece: bank analysts and eurowatchers on what to expect on Monday

The analysts make good point on Greek banks, and also on the odds of the Greeks voting for more austerity, an excerpt:

"according to recent polls there may be a majority in the Greek population supporting the creditor-proposed package. Hence if the vote was a ‘yes’ then the creditor side will likely work hard at keeping Greece within the Eurozone. We may thus not see full-blown risk off sentiment tomorrow as there is still a fair chance of Grexit being avoided in the end."However no analyst mentions that the austerity program failed miserably (see: Did Germany Fulfill their Promises? Did Austerity in Greece Deliver?). The definition of insanity is repeating the same thing (austerity) and expecting different results. More austerity means more depression. Europe has been Schauble'd!

And from the WSJ: ECB to Keep Level of Emergency Loans for Greek Banks Unchanged

The European Central Bank said Sunday it will freeze for now the level of emergency loans for Greek banks at Friday’s level, a step that could push the country closer to having to impose capital controls to halt a deposit flight that appeared to have accelerated over the weekend.And from the NY Times: European Central Bank Limits Aid to Greek Banks Amid Debt Crisis

Saturday, June 27, 2015

June 2015: Unofficial Problem Bank list declines to 309 Institutions, Q2 2015 Transition Matrix

by Calculated Risk on 6/27/2015 09:54:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2015. During the month, the list fell from 324 institutions to 309 after 16 removals and one addition. Assets dropped by $1.4 billion to an aggregate $89.8 billion. A year ago, the list held 468 institutions with assets of $149.2 billion.

Actions have been terminated against North American Savings Bank, F.S.B., Grandview, MO ($1.3 billion); American Bank, Rockville, MD ($416 million); First Utah Bank, Salt Lake City, UT ($354 million); Regent Bank, Davie, FL ($349 million Ticker: PZBW); Grayson National Bank, Independence, VA ($332 million); Oregon Pacific Banking Company dba Oregon Pacific Bank, Florence, OR ($187 million); Cornerstone National Bank, Easley, SC ($144 million Ticker: CTOT); Independent Banker's Bank of Florida, Lake Mary, FL ($143 million); First National Bank of Crossett, Crossett, AR ($143 million Ticker: GSON); Boundary Waters Bank, Ely, MN ($112 million Ticker: NASB); The First National Bank of Le Center, Le Center, MN ($81 million); Plaza Bank, Seattle, WA ($75 million Ticker: ABKH); Heritage Bank, Topeka, KS ($49 million); First State Bank of Swanville, Swanville, MN ($28 million Ticker: ORBP); and Commonwealth Bank, FSB, Mount Sterling, KY ($19 million).

Prime Pacific Bank, National Association, Lynnwood, WA ($123 million) found its way off the list by merging with Town Square Bank, Ashland, KY.

The addition this month was Harvard Savings Bank, Harvard, IL ($161 million).

With it being the end of the second quarter, we bring an update on the transition matrix. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,694 institutions have appeared on the list at some point. There have been 1,385 institutions have come and gone on the list. Departure methods include 760 action terminations, 392 failures, 219 mergers, and 14 voluntary liquidations. The second quarter of 2015 started with 349 institutions on the list, so the 36 action terminations during the quarter reduced the list by 10.3 percent. Although it is easier to achieve a high removal percentage given the smaller overall list count, the 10.3 percent quarterly removal rate is the third fastest since the list has been published. Of the 389 institutions on the first published list, 40 still remain nearly six years later. The 392 failures are 23.1 percent of the 1,694 institutions that have appeared on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 153 | (58,436,369) | |

| Unassisted Merger | 38 | (9,059,178) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (3,635,297) | ||

| Still on List at 6/30/2015 | 40 | 10,328,893 | |

| Additions after 8/7/2009 | 269 | 77,127,497 | |

| End (6/30/2015) | 309 | 87,456,390 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 607 | 256,624,516 | |

| Unassisted Merger | 181 | 76,391,195 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,030 | 452,733,558 | |

| 1Institution not on 8/7/2009 or 6/30/2015 list but appeared on a weekly list. | |||

Schedule for Week of June 28, 2015

by Calculated Risk on 6/27/2015 08:51:00 AM

The key report this week is the June employment report on Thursday.

Other key indicators include the June ISM manufacturing index on Wednesday, June vehicle sales on June, and the April Case-Shiller house price index on Tuesday.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.

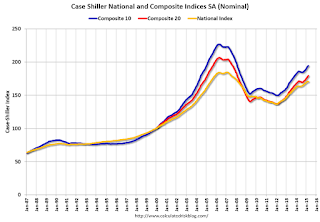

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the March 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in April, and for prices to be unchanged month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.6, up from 46.2 in May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in June, up from 200,000 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 52.8% in May. The employment index was at 51.7%, and the new orders index was at 55.8%.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

8:30 AM: Employment Report for June. The consensus is for an increase of 228,000 non-farm payroll jobs added in June, down from the 280,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to decrease to 5.4%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was almost 3.1 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 271 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is a 0.3% decrease in orders.

All US markets will be closed in observance of the Independence Day weekend.

Friday, June 26, 2015

June NFP: Merrill and Nomura Forecasts

by Calculated Risk on 6/26/2015 05:56:00 PM

The June employment report will be released on Thursday, July 2nd. Here are a couple of forecasts:

From Nomura:

[W]e forecast a 230k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 235k. We forecast that manufacturing employment increased by 5k in June. We forecast that average hourly earnings for private employees rose by 0.17% m-o-m in June, a slower pace than trend due to a calendar quirk. Last, we expect the household survey to show that the unemployment rate ticked down to 5.4% from 5.5%, previously.From Merrill:

We look for job growth of 220,000, a slowdown from the 280,000 pace in May but consistent with the recent trend. As a result, the unemployment rate will likely lower to 5.4% from 5.5%. With the continued tightening in the labor market, we think average hourly earnings (AHE) will increase a “strong” 0.2%, allowing the yoy rate to hold at 2.3%.