by Calculated Risk on 5/22/2015 04:01:00 PM

Friday, May 22, 2015

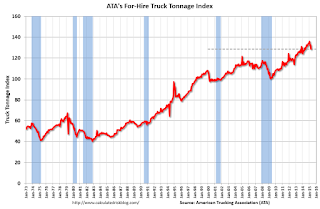

ATA Trucking Index decreased 3% in April

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3% in April

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index fell 3% in April, following a revised gain of 0.4% during the previous month. In April, the index equaled 128.6 (2000=100), which was the lowest level since April 2014. The all-time high is 135.8, reached in January 2015.

Compared with April 2014, the SA index increased just 1%, which was well below the 4.2% gain in March and the smallest year-over-year gain since February 2013. ...

“Like most economic indicators, truck tonnage was soft in April,” said ATA Chief Economist Bob Costello. “Unless tonnage snaps back in May and June, GDP growth will likely be suppressed in the second quarter.”

Costello added that truck tonnage is off 5.3% from the high in January.

“The next couple of months will be telling for both truck freight and the broader economy. Any significant jump from the first quarter is looking more doubtful,” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.0% year-over-year.

Yellen: Expect Rate Hike in 2015, Several Years before Fed Funds Rate "back to normal" level

by Calculated Risk on 5/22/2015 01:18:00 PM

From Fed Chair Janet Yellen: The Outlook for the Economy

[I]f the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy. To support taking this step, however, I will need to see continued improvement in labor market conditions, and I will need to be reasonably confident that inflation will move back to 2 percent over the medium term.

After we begin raising the federal funds rate, I anticipate that the pace of normalization is likely to be gradual. The various headwinds that are still restraining the economy, as I said, will likely take some time to fully abate, and the pace of that improvement is highly uncertain. If conditions develop as my colleagues and I expect, then the FOMC's objectives of maximum employment and price stability would best be achieved by proceeding cautiously, which I expect would mean that it will be several years before the federal funds rate would be back to its normal, longer-run level.

Having said that, I should stress that the actual course of policy will be determined by incoming data and what that reveals about the economy. We have no intention of embarking on a preset course of increases in the federal funds rate after the initial increase. Rather, we will adjust monetary policy in response to developments in economic activity and inflation as they occur. If conditions improve more rapidly than expected, it may be appropriate to raise interest rates more quickly; conversely, the pace of normalization may be slower if conditions turn out to be less favorable.

emphasis added

Key Measures Show Low Inflation in April

by Calculated Risk on 5/22/2015 11:54:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in April. The CPI less food and energy rose 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for March and increased 1.35% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 3.1% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

BLS: CPI increased 0.1% in April, Core CPI increased 0.3%

by Calculated Risk on 5/22/2015 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.1% increase for CPI, and above the forecast of a 0.1% increase in core CPI.

The index for all items less food and energy rose 0.3 percent in April and led to the slight increase in the seasonally adjusted all items index.

emphasis added

Black Knight: Mortgage Delinquencies increased slightly in April

by Calculated Risk on 5/22/2015 07:01:00 AM

According to Black Knight's First Look report for April, the percent of loans delinquent increased 1% in April compared to March, and declined 15% year-over-year.

The percent of loans in the foreclosure process declined 2% in March and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.77% in April, up from 4.70% in March.

The percent of loans in the foreclosure process declined in April to 1.51%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 406,000 properties year-over-year, and the number of properties in the foreclosure process is down 252,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for April in early June.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2015 | Mar 2015 | Apr 2014 | Apr 2013 | |

| Delinquent | 4.77% | 4.70% | 5.62% | 6.21% |

| In Foreclosure | 1.51% | 1.55% | 2.02% | 3.17% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,463,000 | 1,409,000 | 1,634,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 952,000 | 971,000 | 1,187,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 764,000 | 782,000 | 1,016,000 | 1,588,000 |

| Total Properties | 3,179,000 | 3,162,000 | 3,837,000 | 4,699,000 |