by Calculated Risk on 5/20/2015 10:08:00 AM

Wednesday, May 20, 2015

AIA: Architecture Billings Index declined in April

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Remain Stuck in Winter Slowdown

Riding a stretch of increasing levels of demand for thirteen out of the last fifteen months, the Architecture Billings Index (ABI) dropped in April for the second month this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 48.8, down sharply from a mark of 51.7 in March. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, up from a reading of 58.2 the previous month.

“The fundamentals in the design and construction industry remain very healthy,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The fact that both inquires for new projects and new design contracts continued to accelerate at a healthy pace in April points to strong underlying demand for design activity. However, April would typically be a month where these projects would be in full swing, but a severe winter in many parts of the Northeast and Midwest has apparently delayed progress on projects.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.8 in April, down from 51.7 in March. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the third consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was mostly positive over the last year, suggesting an increase in CRE investment in 2015.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/20/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 15, 2015. ...

The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier, to the lowest level since April. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 11 percent higher than the same week one year ago.

“Mortgage rates increased last week, and Treasury rates increased to a recent high at mid week before falling at the end of the week. Overall purchase activity fell for the week, along with conventional refinance volume, but government refinance volume increased. The level of purchase applications remained 11 percent higher than the same week last year, but the drop this week may indicate borrowers being wary of the recent run up in mortgage rates,” said Mike Fratantoni, MBA’s Chief Economist.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.04 percent, its highest level since December 2014, from 4.00 percent, with points decreasing to 0.32 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 11% higher than a year ago.

Tuesday, May 19, 2015

Wednesday: FOMC Minuites, Architecture Billings Index

by Calculated Risk on 5/19/2015 08:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Near Recent Highs Ahead of Fed

Mortgage rates continued higher at an unsettling pace today, following an exceptionally strong reading on Residential Construction data. This particular report doesn't historically cause a lot of rate volatility, but it comes at a time when markets are considering the Fed's next move and where any strong showing for the economy increases the odds of a rate hike.Wednesday:

Although the Fed Funds Rate doesn't correlate directly with mortgage rates, this particular rate hike (whenever it happens) will be a major symbolic shift away from the 'emergency' rate levels that haven't budged since 2008. As such, rates are likely to move higher across the board at first. Indeed, much of the recent move higher is due to market participants pricing in their expectations for that sort of big-picture shift. The fact that it coincides with a separate potential big-picture shift in European rates markets is only making things worse.

And yet, rates remain in historically good territory today. Additionally, they haven't been seeing nearly the same sort of freakouts that characterized 2013's taper tantrum. After getting down to 3.875% on Friday, the average lender is now back to quoting conventional 30yr fixed rates of 4.0% on top tier scenarios.

emphasis added

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM: the Fed will release the FOMC Minutes for the Meeting of April 28-29, 2015.

Quarterly Housing Starts by Intent

by Calculated Risk on 5/19/2015 04:15:00 PM

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report today.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

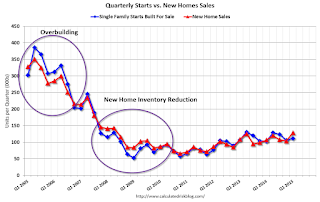

The quarterly report released today showed there were 112,000 single family starts, built for sale, in Q1 2015, and that was below the 129,000 new homes sold for the same quarter, so inventory decreased in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 9% compared to Q1 2014.

Single family starts built for sale were up about 9% compared to Q1 2014. Owner built starts were down 4% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, but was only 1% compared to Q1 2014.

Sacramento Housing in April: Total Sales up 9% Year-over-year

by Calculated Risk on 5/19/2015 01:27:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April, 11.9% of all resales were distressed sales. This was down from 12.4% last month, and down from 16.3% in April 2014. Since distressed sales happen year round, but conventional sales decline in December and January, the percent of distressed sales bumps up in the winter (seasonal).

The percentage of REOs was at 6.5%, and the percentage of short sales was 5.5%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 26.0% year-over-year (YoY) in April. In general the YoY increases have been trending down after peaking at close to 100%, however the YoY increase was slightly larger in April than in March.

Cash buyers accounted for 16.4% of all sales (frequently investors).

Total sales were up 8.9% from April 2014, and conventional equity sales were up 14.6% compared to the same month last year.

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.