by Calculated Risk on 4/24/2015 11:59:00 AM

Friday, April 24, 2015

Philly Fed: State Coincident Indexes increased in 41 states in March

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2015. In the past month, the indexes increased in 41 states, decreased in four, and remained stable in five, for a one-month diffusion index of 74. Over the past three months, the indexes increased in 46 states, decreased in three, and remained stable in one, for a three-month diffusion index of 86.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In March, 44 states had increasing activity (including minor increases).

It appears we are seeing weakness in several oil producing states including Alaska and Oklahoma. It wouldn't be surprising if North Dakota, Texas and other oil producing states also turned red later this year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. Note: Blue added for Red/Green issues.

Black Knight: Mortgage Delinquencies Declined in March, First time below 5% since August 2007

by Calculated Risk on 4/24/2015 09:15:00 AM

According to Black Knight's First Look report for March, the percent of loans delinquent decreased 12% in March compared to February, and declined 15% year-over-year.

The percent of loans in the foreclosure process declined 2% in March and were down about 27% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.70% in March, down from 5.36% in February. This is the lowest level of delinquencies since August 2007.

The percent of loans in the foreclosure process declined in March to 1.55%. This was the lowest level of foreclosure inventory since December 2007.

The number of delinquent properties, but not in foreclosure, is down 390,000 properties year-over-year, and the number of properties in the foreclosure process is down 288,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for March in early May.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2015 | Feb 2015 | Mar 2014 | Mar 2013 | |

| Delinquent | 4.70% | 5.36% | 5.52% | 6.59% |

| In Foreclosure | 1.55% | 1.58% | 2.13% | 3.38% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,409,000 | 1,646,000 | 1,571,000 | 1,842,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 971,000 | 1,067,000 | 1,199,000 | 1,466,000 |

| Number of properties in foreclosure pre-sale inventory: | 782,000 | 800,000 | 1,070,000 | 1,689,000 |

| Total Properties | 3,162,000 | 3,512,000 | 3,840,000 | 4,997,000 |

Merrill Lynch forecasting 1.5% GDP in Q1

by Calculated Risk on 4/24/2015 07:59:00 AM

From Merrill Lynch:

We are forecasting GDP growth of 1.5% in 1Q, suggesting the economy hit a soft patch at the start of the year. Business investment looks particularly weak with a likely decline in nonresidential structures investment, as suggested by the monthly Census data, and sluggish growth in equipment investment. We also look for the trade deficit to widen, reflecting the stronger dollar and weaker growth abroad. There is room for surprise with both the investment and trade figures, however. Most importantly, the BEA does not have estimates yet from the Census Bureau on March trade and construction spending, creating room for interpretation from the BEA. Moreover, the port shutdown on the West Coast disrupted activity, adding additional uncertainty for both trade flows and business investment. Elsewhere, we look for consumer spending to increase 2.0% in 1Q. Both auto sales and core control retail sales improved through the quarter after the slow start. We also expect services spending to look stronger, owing in part to greater spending on utilities given the winter weather. Residential investment is likely to be little changed as a decline in housing starts offsets a pickup in existing home sales.The Atlanta Fed is forecasting:

It is important to remember that there is scope for error in forecasting the first release of GDP since the BEA does not have complete data for the month. Indeed, it is not unusual for the first release of GDP to miss the consensus forecast by a full percentage point in either direction. We would argue that there is additional uncertainty this quarter given the potential drag from the harsh winter weather and port shutdown in February.

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2015 was 0.1 percent on April 16, down from 0.2 percent on April 14.Ouch.

Thursday, April 23, 2015

Freddie Mac: 30 Year Mortgage Rates decrease to 3.65% in Latest Weekly Survey

by Calculated Risk on 4/23/2015 07:51:00 PM

From Freddie Mac today: Mortgage Rates Move Down Slightly

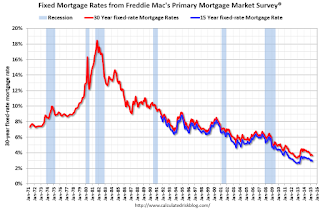

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down slightly this week and remaining near their 2015 lows as the spring homebuying season continues. ...

30-year fixed-rate mortgage (FRM) averaged 3.65 percent with an average 0.6 point for the week ending April 23, 2015, down from last week when it averaged 3.67 percent. A year ago at this time, the 30-year FRM averaged 4.33 percent.

15-year FRM this week averaged 2.92 percent with an average 0.6 point, down from last week when it averaged 2.94 percent. A year ago at this time, the 15-year FRM averaged 3.39 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (30 bps) from the all time low of 3.35% in late 2012, but down from 4.33% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

The PMMS is a weekly survey. Here is an update on daily rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Ground at Recent Highs

Freddie collects data for the Survey from Monday through Wednesday, but most of the responses have been received by Tuesday. This week, that meant that most of the respondents had not yet seen the steep losses on Wednesday. Naturally then, Freddie's numbers suggest rates are lower than they actually are by the time people read about them on Thursday morning. Rates are, in fact, markedly higher than last week's. Whereas most top tier scenarios were being quoted 3.625% for conventional 30yr fixed loans last week, 3.75% is more prevalent today

Lawler: More Builder Results

by Calculated Risk on 4/23/2015 03:31:00 PM

From housing economist Tom Lawler:

PulteGroup reported that net home orders in the quarter ended March 31, 2015 totaled 5,139, up 5.7% from the comparable quarter of 2014. The average net order price last quarter was $332,400, up 0.5% from a year ago. Home deliveries last quarter totaled 3,365, down 2.1% from the comparable quarter of 2014, at an average sales price of $323,000, up 1.9% from a year ago. The company’s order backlog at the end of March was 7,624, up 5.9% from last March. Pulte’s net home building margin was 22.7%, compared to 23.8% a year ago.

Meritage Homes reported that net home orders in the quarter ended March 31, 2015 totaled 1,979, up 29.8% from the comparable quarter of 2014. The average net order price last quarter was $396,000, up 8.8% from a year ago. Home deliveries totaled 1,335, up 20.4% from the comparable quarter of 2014, at an average sales price of $387,000, up 5.7% from a year ago. The company’s order backlog at the end of March was 2,758k up 22.0% from last quarter. The company’s gross home building margin last quarter was 18.5%, down from 22.5% a year ago.

M/I Homes reported that net home orders in the quarter ended March 31, 2015 totaled 1,108, up 12.8% from the comparable quarter of 2014. Home deliveries last quarter totaled 717, down 2.0% from the comparable quarter of 2014, at an average sales price of $325,000, up 8.7% from a year ago. The company’s order backlog at the end of March was 1,613, up 5.8% from last March, at an average order price of $358,000, up 9.8% from a year ago. The company’s gross home building margin last quarter was 21.7%, unchanged from a year ago.

The general theme of builder reports so far compared to a year ago are (1) significantly stronger growth in net orders; (2) substantially lower increases in sales prices (with the exception of M/I Homes); and (3) lower gross margins (with the exception of M/I Homes).

Here are some summary stats.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/15 | 3/14 | % Chg | 3/15 | 3/14 | % Chg | 3/15 | 3/14 | % Chg |

| D.R. Horton | 11,135 | 8,569 | 29.9% | 8,243 | 6,194 | 33.1% | $281,305 | 271,230 | 3.7% |

| PulteGroup | 5,139 | 4,863 | 5.7% | 3,365 | 3,436 | -2.1% | $323,000 | 317,000 | 1.9% |

| NVR | 3,926 | 3,325 | 18.1% | 2,534 | 2,211 | 14.6% | $371,000 | 361,400 | 2.7% |

| Meritage Homes | 1,979 | 1,525 | 29.8% | 1,335 | 1,109 | 20.4% | $387,000 | 366,000 | 5.7% |

| M/I Homes | 1,108 | 982 | 12.8% | 717 | 732 | -2.0% | $325,000 | 299,000 | 8.7% |

| Total | 23,287 | 19,264 | 20.9% | 16,194 | 13,682 | 18.4% | $314,652 | $306,463 | 2.7% |

Sales per active community for the above five builders combined last quarter were up 17.3% from the comparable quarter of 2014.

By way of comparison, the YOY increase in net orders for these five builders combined for the quarter ended March 31, 2014 was 0.4%, net orders per community were down 6.2% YOY; and the average sales price was up 10.4% YOY.