by Calculated Risk on 4/23/2015 10:12:00 AM

Thursday, April 23, 2015

New Home Sales decline to 481,000 Annual Rate in March

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 481 thousand.

The previous months were revised up by a total of 35 thousand (SA).

"Sales of new single-family houses in March 2015 were at a seasonally adjusted annual rate of 481,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.4 percent below the revised February rate of 543,000, but is 19.4 percent above the March 2014 estimate of 403,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in March to 5.3 months.

The months of supply increased in March to 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of March was 213,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

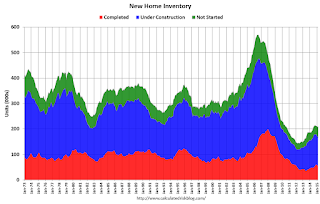

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2015 (red column), 45 thousand new homes were sold (NSA). Last year 39 thousand homes were sold in March. This is the highest for March since 2008.

The high for March was 127 thousand in 2005, and the low for March was 28 thousand in 2011.

This was below expectations of 510,000 sales in March, however with the upward revisions to previous months, this is still a solid start for 2015. I'll have more later today.

Weekly Initial Unemployment Claims increased to 295,000

by Calculated Risk on 4/23/2015 08:33:00 AM

The DOL reported:

In the week ending April 18, the advance figure for seasonally adjusted initial claims was 295,000, an increase of 1,000 from the previous week's unrevised level of 294,000. The 4-week moving average was 284,500, an increase of 1,750 from the previous week's unrevised average of 282,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 284,500.

This was above the consensus forecast of 290,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, April 22, 2015

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in March

by Calculated Risk on 4/22/2015 07:07:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 294 thousand.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for a decrease in sales to 510 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 539 thousand in February.

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a few selected cities in March.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar-15 | Mar-14 | Mar-15 | Mar-14 | Mar-15 | Mar-14 | Mar-15 | Mar-14 | |

| Las Vegas | 8.3% | 12.9% | 9.3% | 11.7% | 17.6% | 24.6% | 32.4% | 43.1% |

| Reno** | 5.0% | 14.0% | 8.0% | 7.0% | 13.0% | 21.0% | ||

| Phoenix | 3.2% | 5.1% | 4.2% | 6.9% | 7.4% | 11.9% | 27.5% | 33.1% |

| Sacramento | 5.4% | 8.2% | 6.9% | 7.9% | 12.3% | 16.1% | 19.3% | 22.5% |

| Minneapolis | 2.9% | 4.9% | 12.2% | 21.9% | 15.1% | 26.8% | ||

| Mid-Atlantic | 4.7% | 7.7% | 14.0% | 10.9% | 18.8% | 18.5% | 18.2% | 19.9% |

| Bay Area CA* | 4.1% | 4.6% | 3.1% | 4.3% | 7.2% | 8.9% | 25.8% | 29.8% |

| So. California* | 5.7% | 7.1% | 5.2% | 6.3% | 10.9% | 13.4% | 25.8% | 29.8% |

| Florida SF | 3.9% | 7.0% | 20.7% | 22.0% | 24.6% | 29.0% | 39.0% | 45.4% |

| Florida C/TH | 2.5% | 4.4% | 14.3% | 15.9% | 16.8% | 20.3% | 66.4% | 70.9% |

| Hampton Roads | 22.7% | 24.5% | ||||||

| Chicago (city) | 21.9% | 28.8% | ||||||

| Northeast Florida | 31.0% | 39.1% | ||||||

| Tucson | 32.0% | 33.5% | ||||||

| Toledo | 32.7% | 40.7% | ||||||

| Wichita | 23.2% | 32.0% | ||||||

| Des Moines | 16.3% | 20.8% | ||||||

| Georgia*** | 23.2% | 33.8% | ||||||

| Omaha | 16.2% | 20.3% | ||||||

| Pensacola | 33.4% | 35.7% | ||||||

| Knoxville | 22.9% | 25.1% | ||||||

| Richmond VA MSA | 11.9% | 18.1% | 18.0% | 21.1% | ||||

| Memphis | 15.5% | 18.5% | ||||||

| Springfield IL** | 11.8% | 14.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: D.R. Horton: Net Home Orders Up, Prices “Flattish;” Says If Prices are Low Enough, There is “Demand” from First-Time Buyers

by Calculated Risk on 4/22/2015 03:56:00 PM

From housing economist Tom Lawler:

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended March 31, 2015 totaled 11,135, up 29.9% from the comparable quarter of 2015. The average net order price last quarter was $284,400, up 2.0% from a year ago. Home deliveries totaled 8,243, up 33.1% from the comparable quarter of 2014, at an average sales price of $281,300, up 3.7% from a year ago. The company’s order backlog at the end of March was 12,177, up 21.1% from last March, at an average order price of $293,500, up 4.6% from last March. Horton’s home sales gross margin was 19.7% last quarter, down from 22.5% a year earlier but not too far from the company’s previous “guidance.”

Here in a table showing the share of Horton’s net orders and home closings for its three “brands:” Horton (traditional), Emerald (upscale), and Express (targeted at entry level).

| Horton Share of Home Orders/Closings by "Brand" | ||||||

|---|---|---|---|---|---|---|

| Net Orders | Homes Closed | Average Closing Price | ||||

| Qtr. Ended | 3/31/2015 | 3/31/2014 | 3/31/2015 | 3/31/2014 | 3/31/2015 | 3/31/2014 |

| Horton | 79% | 92% | 85% | 95% | $288,800 | $272,000 |

| Express | 18% | 6% | 13% | 4% | $179,100 | $157,300 |

| Emerald | 3% | 2% | 2% | 1% | $561,000 | $524,300 |

On “Express” Homes and first-time buyers, a company official said that it in the 44 markets (in 13 states) that Horton has Express communities (most being in Texas, the Carolinas, and Florida), there was plenty of demand from first-time buyers, mainly because of the price/”value proposition.” Very few large builders have been building homes sized and priced for entry-level buyers, and it hasn’t been clear if the reason was weak demand or many builders’ inability to produce affordable homes at margins deemed high enough for the builder.

Officials also said that they have yet to see any signs of weakness in its Texas markets, including Houston.

There was a little confusion on the reason for the sharp slowdown in the rate of increase in the company’s average sales price, which has been virtually unchanged over the last few quarters. In one part of the conference call there was a suggestion that the increase in the Express share of overall orders and sales was behind this trend, which at first glance made sense (see above). In another part of the call, however, a company official said that compared to a year ago the average size (in square footage) of homes sold last quarter was up 3%, suggesting that “most” of the 3.7% YOY increase in the average price of homes sold was related to selling larger homes.

A Few Comments on March Existing Home Sales

by Calculated Risk on 4/22/2015 12:52:00 PM

Inventory is still very low (but up 2.0% year-over-year in March). More inventory will probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch over the next few months during the Spring buying season.

Note: As usually happens, housing economist Tom Lawler's estimate was much closer than the consensus to the NAR reported sales rate.

Also, the NAR reported total sales were up 10.4% from March 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales—foreclosures and short sales—were 10 percent of sales in March, down from 11 percent in February and 14 percent a year ago. Seven percent of March sales were foreclosures and 3 percent were short sales. Foreclosures sold for an average discount of 16 percent below market value in March (17 percent in February), while short sales were also discounted 16 percent (15 percent in February).Last year in March the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in March 2014 were reported at 4.70 million SAAR with 14% distressed. That gives 658 thousand distressed (annual rate), and 4.04 million equity / non-distressed. In March 2015, sales were 5.19 million SAAR, with 10% distressed. That gives 519 thousand distressed - a decline of about 21% from March 2014 - and 4.67 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 15%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in March (red column) were the highest for March since 2007 (NSA).

Earlier:

• Existing Home Sales in March: 5.19 million SAAR, Inventory up 2.0% Year-over-year