by Calculated Risk on 4/22/2015 03:56:00 PM

Wednesday, April 22, 2015

Lawler: D.R. Horton: Net Home Orders Up, Prices “Flattish;” Says If Prices are Low Enough, There is “Demand” from First-Time Buyers

From housing economist Tom Lawler:

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended March 31, 2015 totaled 11,135, up 29.9% from the comparable quarter of 2015. The average net order price last quarter was $284,400, up 2.0% from a year ago. Home deliveries totaled 8,243, up 33.1% from the comparable quarter of 2014, at an average sales price of $281,300, up 3.7% from a year ago. The company’s order backlog at the end of March was 12,177, up 21.1% from last March, at an average order price of $293,500, up 4.6% from last March. Horton’s home sales gross margin was 19.7% last quarter, down from 22.5% a year earlier but not too far from the company’s previous “guidance.”

Here in a table showing the share of Horton’s net orders and home closings for its three “brands:” Horton (traditional), Emerald (upscale), and Express (targeted at entry level).

| Horton Share of Home Orders/Closings by "Brand" | ||||||

|---|---|---|---|---|---|---|

| Net Orders | Homes Closed | Average Closing Price | ||||

| Qtr. Ended | 3/31/2015 | 3/31/2014 | 3/31/2015 | 3/31/2014 | 3/31/2015 | 3/31/2014 |

| Horton | 79% | 92% | 85% | 95% | $288,800 | $272,000 |

| Express | 18% | 6% | 13% | 4% | $179,100 | $157,300 |

| Emerald | 3% | 2% | 2% | 1% | $561,000 | $524,300 |

On “Express” Homes and first-time buyers, a company official said that it in the 44 markets (in 13 states) that Horton has Express communities (most being in Texas, the Carolinas, and Florida), there was plenty of demand from first-time buyers, mainly because of the price/”value proposition.” Very few large builders have been building homes sized and priced for entry-level buyers, and it hasn’t been clear if the reason was weak demand or many builders’ inability to produce affordable homes at margins deemed high enough for the builder.

Officials also said that they have yet to see any signs of weakness in its Texas markets, including Houston.

There was a little confusion on the reason for the sharp slowdown in the rate of increase in the company’s average sales price, which has been virtually unchanged over the last few quarters. In one part of the conference call there was a suggestion that the increase in the Express share of overall orders and sales was behind this trend, which at first glance made sense (see above). In another part of the call, however, a company official said that compared to a year ago the average size (in square footage) of homes sold last quarter was up 3%, suggesting that “most” of the 3.7% YOY increase in the average price of homes sold was related to selling larger homes.

A Few Comments on March Existing Home Sales

by Calculated Risk on 4/22/2015 12:52:00 PM

Inventory is still very low (but up 2.0% year-over-year in March). More inventory will probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch over the next few months during the Spring buying season.

Note: As usually happens, housing economist Tom Lawler's estimate was much closer than the consensus to the NAR reported sales rate.

Also, the NAR reported total sales were up 10.4% from March 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales—foreclosures and short sales—were 10 percent of sales in March, down from 11 percent in February and 14 percent a year ago. Seven percent of March sales were foreclosures and 3 percent were short sales. Foreclosures sold for an average discount of 16 percent below market value in March (17 percent in February), while short sales were also discounted 16 percent (15 percent in February).Last year in March the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in March 2014 were reported at 4.70 million SAAR with 14% distressed. That gives 658 thousand distressed (annual rate), and 4.04 million equity / non-distressed. In March 2015, sales were 5.19 million SAAR, with 10% distressed. That gives 519 thousand distressed - a decline of about 21% from March 2014 - and 4.67 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 15%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in March (red column) were the highest for March since 2007 (NSA).

Earlier:

• Existing Home Sales in March: 5.19 million SAAR, Inventory up 2.0% Year-over-year

Existing Home Sales in March: 5.19 million SAAR, Inventory up 2.0% Year-over-year

by Calculated Risk on 4/22/2015 10:01:00 AM

The NAR reports: Existing-Home Sales Spike in March

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 6.1 percent to a seasonally adjusted annual rate of 5.19 million in March from 4.89 million in February—the highest annual rate since September 2013 (also 5.19 million). Sales have increased year-over-year for six consecutive months and are now 10.4 percent above a year ago, the highest annual increase since August 2013 (10.7 percent). ...

Total housing inventory at the end of March climbed 5.3 percent to 2.00 million existing homes available for sale, and is now 2.0 percent above a year ago (1.96 million). Unsold inventory is at a 4.6-month supply at the current sales pace, down from 4.7 months in February.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (5.19 million SAAR) were 6.1% higher than last month, and were 10.4% above the March 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.00 million in March from 1.90 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.00 million in March from 1.90 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 2.0% year-over-year in March compared to March 2014.

Inventory increased 2.0% year-over-year in March compared to March 2014. Months of supply was at 4.6 months in March.

This was above expectations of sales of 5.03 million (Right at economist Tom Lawler's forecast of 5.18 million). For existing home sales, a key number is inventory - and inventory is still low but increasing. I'll have more later ...

AIA: Architecture Billings Index increases in March, Multi-Family Negative

by Calculated Risk on 4/22/2015 08:59:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Accelerates in March

For the second consecutive month, the Architecture Billings Index (ABI) indicated a modest increase in design activity in March. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.7, up from a mark of 50.4 in February. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.2, up from a reading of 56.6 the previous month.

“Business conditions at architecture firms generally are quite healthy across the country. However, billings at firms in the Northeast were set back with the severe weather conditions, and this weakness is apparent in the March figures,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The multi-family residential market has seen its first occurrence of back-to-back negative months for the first time since 2011, while the institutional and commercial sectors are both on solid footing.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.7 in March, up from 50.4 in February. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative in consecutive months for the first time since 2011 - and this might be indicating a slowdown for apartments. (just two months)

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was mostly positive over the last year, suggesting an increase in CRE investment in 2015.

MBA: Mortgage Applications Increase, Purchase Apps up 16% YoY

by Calculated Risk on 4/22/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 17, 2015. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier to its highest level since June 2013. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

“Purchase applications increased for the fourth time in five weeks as we proceed further into the spring home buying season. Despite mortgage rates below four percent, refinance activity increased less than one percent from the previous week,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.83 percent, its lowest level since January 2015, from 3.87 percent, with points decreasing to 0.32 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

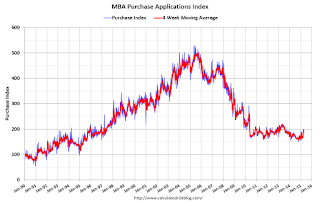

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the index is at the highest level since June 2013, and the unadjusted purchase index is 16% higher than a year ago.