by Calculated Risk on 4/16/2015 05:50:00 PM

Thursday, April 16, 2015

NMHC: Apartment Market Conditions Tighter in April Survey

From the National Multi Housing Council (NMHC): Apartment Markets Expand in April NMHC Quarterly Survey

All four indexes landed above the breakeven level of 50 in the April National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions.

“The song remains the same—the apartment markets are not only strong but getting stronger,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite occasional predictions to the contrary, markets keep getting tighter. As new construction increases, so do absorptions, indicating the demand for apartments is not yet close to being sated.”

The Market Tightness Index increased by 7 points from last quarter (and by 2 points from a year earlier) to 58. Thirty-one percent of respondents reported tighter conditions than three months ago. This now marks the fifth consecutive quarter where the index indicates overall improving conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

Comments on March Housing Starts

by Calculated Risk on 4/16/2015 02:54:00 PM

March was another disappointing month for housing start.

In February, it was easy to blame the weather, especially in the Northeast where starts plunged and then bounced back in March. However, in March, the weakness was more in the South and West (maybe related to oil prices in Texas and the drought in California).

Note: It is also possible that the West Coast port slowdown impacted starts a little in March. The labor situation was resolved in February, and any impact should disappear quickly.

This graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with two weak months, starts are still running about 5% ahead of 2014 through March.

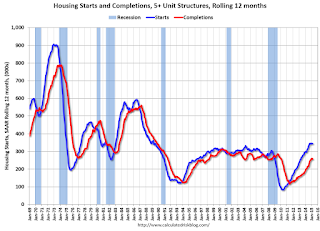

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

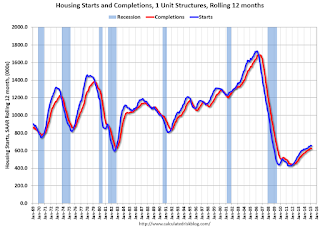

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey increased to 7.5 in April

by Calculated Risk on 4/16/2015 11:23:00 AM

Earlier from the Philly Fed: April Manufacturing Survey

Manufacturing activity in the region increased modestly in April, according to firms responding to this month’s Manufacturing Business Outlook Survey. Indicators for general activity and new orders were positive but remained at low readings. Firms reported overall declines in shipments this month, but employment and work hours increased at the reporting firms. Firms reported continued price reductions in April, with indicators for prices of inputs and the firms’ own products remaining negative. The survey’s indicators of future activity suggest a continuation of modest growth in the manufacturing sector over the next six months.This was above the consensus forecast of a reading of 5.0 for April.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 5.0 in March to 7.5 this month. ...

Firms’ responses suggest some improvement in labor market conditions compared with March. The current employment index increased 8 points, to 11.5, its highest reading in five months.

emphasis added

Earlier this week, the NY Fed reported: April Empire State Manufacturing Survey Indicates Sluggish Conditions

The survey’s headline general business conditions index turned slightly negative for the first time since December, falling 8 points to -1.2 in a sign that the growth in manufacturing had paused. The new orders index—a bellwether of demand for manufactured goods—was also negative, pointing to a modest decline in orders for a second consecutive month. Employment growth slowed, too.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys declined in April, and this suggests a slightly weaker ISM report for April.

Weekly Initial Unemployment Claims increased to 294,000

by Calculated Risk on 4/16/2015 09:30:00 AM

The DOL reported:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 294,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 281,000 to 282,000. The 4-week moving average was 282,750, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 282,250 to 282,500.The previous week was revised up by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 282,750.

This was above the consensus forecast of 280,000, and the low level of the 4-week average suggests few layoffs.

Housing Starts at 926 thousand Annual Rate in March

by Calculated Risk on 4/16/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 926,000. This is 2.0 percent above the revised February estimate of 908,000, but is 2.5 percent below the March 2014 rate of 950,000.

Single-family housing starts in March were at a rate of 618,000; this is 4.4 percent above the revised February figure of 592,000. The March rate for units in buildings with five units or more was 287,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,039,000. This is 5.7 percent below the revised February rate of 1,102,000, but is 2.9 percent above the March 2014 estimate of 1,010,000.

Single-family authorizations in March were at a rate of 636,000; this is 2.1 percent above the revised February figure of 623,000. Authorizations of units in buildings with five units or more were at a rate of 378,000 in March.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in March. Multi-family starts are down 2.5% year-over-year.

Single-family starts (blue) increased in March and are also down about 2.5% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was well below expectations of 1.040 million starts in March. Overall this was another weak report, although permits were decent. I'll have more later ...