by Calculated Risk on 3/26/2015 11:00:00 AM

Thursday, March 26, 2015

Kansas City Fed: Regional Manufacturing Activity Declined in March

From the Kansas City Fed: Tenth District Manufacturing Activity Declined

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive.Some of this decline was due to lower oil prices (Oklahoma was especially weak), however overall, lower oil prices will a positive for the economy. Also some of this decline was related to the West Coast port labor issues that are now resolved.

“We saw our first monthly decline in regional factory activity in over a year," said Wilkerson. “Some firms blamed the West Coast port disruptions, while producers of oil and gas-related equipment blamed low oil prices.”

Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive. Most price indexes continued to decrease, with several reaching their lowest level since 2009. In a special question about the West Coast port disruptions, 32 percent of firms said it had affected them negatively.

The month-over-month composite index was -4 in March, down from 1 in February and 3 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to declines in plastics, food, and chemical production and continued weakness in metals and machinery. Looking across District states, the largest decline was in Oklahoma, with moderate slowdowns in Kansas and Nebraska. ... the employment and new orders for exports indexes inched higher but remained negative.

emphasis added

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.

Weekly Initial Unemployment Claims decreased to 282,000

by Calculated Risk on 3/26/2015 08:34:00 AM

The DOL reported:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 282,000, a decrease of 9,000 from the previous week's unrevised level of 291,000. The 4-week moving average was 297,000, a decrease of 7,750 from the previous week's unrevised average of 304,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,000.

This was below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, March 25, 2015

Thursday: Unemployment Claims, Kansas City Mfg Survey

by Calculated Risk on 3/25/2015 07:05:00 PM

Some excerpts from a research piece by Goldman Sachs economist Kris Dawsey: Core Inflation Still Has Room to Fall

... With the PPI and CPI reports already in hand for the month, we think that the core PCE price index—the Fed’s preferred inflation measure—will post an above-trend 0.20% increase in February. ... In light of the latest news, one might be tempted to wonder whether we have seen the bottom on core inflation, which could help the Fed to be "reasonably confident" that inflation will be moving back to its target over the medium term—a precondition for the first rate hike.Thursday:

We ... find that in the near term downward pressure on core inflation from the effects of the stronger dollar and energy price pass-through are likely to overwhelm upward pressure from diminished slack in the economy. ... Recent firmness in shelter inflation—which appears insensitive to dollar and oil effects—is likely to persist, but we think that core goods inflation will probably move down further. Our bottom-up analysis suggests that headline and core consumer prices will probably bottom around the middle of the year ...

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

Vehicle Sales Forecasts: Best March since 2005

by Calculated Risk on 3/25/2015 03:28:00 PM

The automakers will report March vehicle sales on Wednesday, April 1st. Sales in February were at 16.2 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales rebounded in March to close to 17.0 million SAAR. March sales (SA) will probably be the best since 2005.

Note: There were 25 selling days in March, one less than last year. Here are a couple of forecasts:

From WardsAuto: Forecast: March Sales Spring Forward

A WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles this month. The forecasted daily sales rate (DSR) of 60,935 over 25 days represents a 3.5% improvement from like-2014 (26 days). ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, compared with year-ago’s 16.4 million and February’s 16.2 million mark.From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Rebound in March to Highest Levels for the Month since 2005

U.S. total new-vehicle sales in March 2015 are bouncing back from last month and are expected to reach their highest levels for the month in a decade, according to a monthly sales forecast from J.D. Power and LMC Automotive.Looks like a strong month for auto sales.

After winter storms stymied sales in February, total new light-vehicle sales in March 2015 are expected to reach 1,539,600 units, a 4 percent increase on a selling-day adjusted basis compared with March 2014 and their highest levels for the month since March 2005 when 1,572,909 new vehicles were sold. [17.0 million SAAR[

New Home Prices: More homes priced in the $200K to $300K range

by Calculated Risk on 3/25/2015 12:31:00 PM

Here are two graphs I haven't posted for some time ...

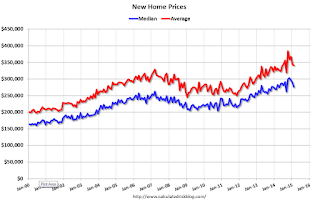

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in February 2015 was $275,500; the average sales price was $341,000."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

Recently some builders have announced new homes at lower price points.

The average price in February 2015 was $341,000 and the median price was $275,500. Both are above the bubble high (this is due to both a change in mix and rising prices), but are below the recent peak.

The second graph shows the percent of new homes sold by price.

However there has been a pickup in homes sold in the $200K to $300K range (Up to 37.8% of homes in February 2015).

Yesterday on New Home Sales:

• New Home Sales at 539,000 Annual Rate in February

• Comments on New Home Sales