by Calculated Risk on 3/06/2015 06:00:00 PM

Friday, March 06, 2015

Duy: "Patient" is History

From Tim Duy at Fed Watch: "Patient" is History

The February employment report almost certainly means the Fed will no longer describe its policy intentions as "patient" at the conclusion of the March FOMC meeting. And it also keep a June rate hike in play. But for June to move from "in play" to "it's going to happen," I still feel the Fed needs a more on the inflation side. ...CR Note: Based on Yellen's testimony last week, it seemed likely that "patient" would be dropped from the March FOMC statement. June might be in play, but like Duy, I think the FOMC will wait until it is clear inflation is moving towards 2% before raising rates.

Bottom Line: "Patient" is out. Tough to justify with unemployment at the top of the Fed's central estimates of NAIRU. Pressure to begin hiking rates will intensify as unemployment heads lower. The inflation bar will fall, and Fed officials will increasingly look for reasons to hike rates rather than reasons to delay. They may not want to admit it, but I suspect one of those reasons will be fear of financial instability in the absence of tighter policy. June is in play.

emphasis added

Update: Best Private Sector Job Creation "Ever"?

by Calculated Risk on 3/06/2015 03:33:00 PM

Last month, I mentioned that private job creation was on pace for the best ever during a presidential term. I received a few emails asking if that was correct. The answer is "yes".

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Note: Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s. The prime working age labor force was growing more than 3% per year in the '80s with a surge in younger workers and women joining the labor force. Now, the overall population is larger, but the prime working age population has declined this decade and the participation rate is generally declining now.

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term. Public sector job creation increased the most during Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 34 thousand public sector jobs have been added during the first twenty five months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is just 2% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,885 | 692 | 11,577 |

| 2 | Clinton 2 | 10,070 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 5,799 | 34 | 5,833 | |

| Pace2 | 11,134 | 65 | 11,199 | |

| 125 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs need per month for Obama's 2nd term to be in the top three presidential terms.

| Jobs needed per month (average) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 221 | 250 | ||

| #2 | 186 | 238 | ||

| #3 | 155 | 216 | ||

Trade Deficit decreased in January to $41.8 Billion

by Calculated Risk on 3/06/2015 11:59:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.8 billion in January, down $3.8 billion from $45.6 billion in December, revised. January exports were $189.4 billion, down $5.6 billion from December. January imports were $231.2 billion, down $9.4 billion from December.The trade deficit was at the consensus forecast of $41.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in January (some impact of West Coast port slowdown).

Exports are 14% above the pre-recession peak and down 2% compared to January 204; imports are at the pre-recession peak, and unchanged compared to January 2014.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $58.96 in January, down from $73.64 in December, and down from $90.21 in January 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts.

The trade deficit with China increased to $28.6 billion in January, from $27.8 billion in January 2013. The deficit with China is a large portion of the overall deficit.

The decrease in the trade deficit was due to a lower volume and lower price of oil imports (volatile month-to-month), and a slightly larger deficit with the Euro Area ($8.0 billion in Jan 2015 compared to $7.2 billion in Jan 2014).

Employment Report Comments and Graphs

by Calculated Risk on 3/06/2015 09:45:00 AM

Earlier: February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

This was a very solid employment report with 295,000 jobs added, although job gains for January were revised down 18,000.

Unfortunately there was little good news on wage growth, from the BLS: "In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.78. Over the year, average hourly earnings have risen by 2.0 percent."

However I expect real wages to increase this year.

A few more numbers: Total employment increased 295,000 from January to February and is now 2.8 million above the previous peak. Total employment is up 11.5 million from the employment recession low.

Private payroll employment increased 288,000 from January to February, and private employment is now 3.2 million above the previous peak. Private employment is up 12.0 million from the recession low.

In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since March '00.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 81.0%, and the 25 to 54 employment population ratio increased to 77.3%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth has been running close to 2% since 2010 and will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in February at 6.6 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in February to 6.635 million from 6.810 million in January. This is the lowest level since September 2008. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.0% in February from 11.3% in January. This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.709 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.800 in January. This is trending down, but is still very high.

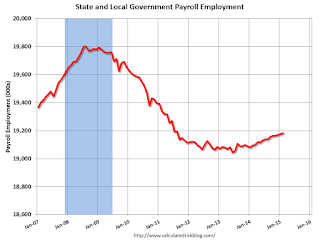

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2015, state and local governments added 7,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 620,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed (Federal payrolls were unchanged in February).

Overall this was a very solid employment report.

February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

by Calculated Risk on 3/06/2015 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 295,000 in February, and the unemployment rate edged down to 5.5 percent, the U.S. Bureau of Labor Statistics reported today.

...

After revision, the change in total nonfarm payroll employment for December remained at +329,000, and the change for January was revised from +257,000 to +239,000. With these revisions, employment gains in December and January were 18,000 lower than previously reported. Over the past 3 months, job gains have averaged 288,000 per month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 295 thousand in February (private payrolls increased 288 thousand).

Payrolls for December and January were revised down by a combined 18 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 3.3 million jobs.

This was the highest year-over-year gain since end of the '90s.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in February to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 5.5%.

This was above expectations of 230,000, and this was another solid report.

I'll have much more later ...