by Calculated Risk on 2/26/2015 02:58:00 PM

Thursday, February 26, 2015

Vehicle Sales Forecasts: Best February since 2002

The automakers will report February vehicle sales on Tuesday, March 3rd. Sales in January were at 16.6 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in February will be about the same, and will probably be the best February since 2002.

Note: There were 24 selling days in February, the same as last year. Here are a couple of forecasts:

From J.D. Power: New-Vehicle Retail Sales in February Expected to Cross the Million Mark

New-vehicle retail sales in February 2015 are projected to reach 1,033,100 units, which is a 9 percent increase compared with February 2014 and the highest retail sales volume for the month as well as the first time that February retail sales are expected to exceed 1 million units since February 2002, when sales hit 1.1 million. ...And from TrueCar: TrueCar forecasts sustained U.S. auto sales expansion in February with 8.5% volume increase

Total new light-vehicle sales in February 2015 are expected to reach 1.3 million units, a 9 percent increase, compared with February 2014, and match the recent high for the month set in February 2002. [16.7 million SAAR] Fleet volume in February is projected to hit 264,000 units, accounting for 20 percent of total sales.

New-vehicle sales in early 2015 are continuing the robust pattern from the fourth quarter of 2014. As a result, LMC Automotive is increasing its 2015 forecast for both retail and total light vehicles by approximately 40,000 units, each still rounding to 14.0 million and 17.0 million, respectively.

"Strength at the start of 2015 is a key factor in keeping the industry on target to surpass annual vehicle sales of 17 million units for the first time since 2001," said Jeff Schuster, senior vice president of forecasting at LMC Automotive.

TrueCar, Inc. ... projects the pace of February auto sales expanded to a seasonally adjusted annualized rate (SAAR) of 16.7 million new units on continued strong consumer demand.Another strong month for auto sales.

New light vehicle sales, including fleet, should reach 1,295,600 units for the month, up 8.5 percent over a year ago. This same increase is expected on a daily selling rate (DSR) basis with 24 selling days this February versus a year ago.

"Strong February auto sales signal a very healthy U.S. economy," said Eric Lyman, vice president of industry insights for TrueCar. "Given this month's robust demand, the industry remains on track to hit TrueCar's 17 million-unit projection for the 2015."

Key Measures Show Low Inflation in January

by Calculated Risk on 2/26/2015 12:18:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.9% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for January here. Motor fuel declined at a 92% annualized rate in January, following a 69% annualized rate decline in December, a 55% annualized rate decline in November, and a 31% annualized rate decline in October. However motor fuel will add to inflation in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.7% (−7.8% annualized rate) in January. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.6%. Core PCE is for December and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.3% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

Kansas City Fed: Regional Manufacturing Activity Expanded "Slightly" in February, Weaker Energy Sector

by Calculated Risk on 2/26/2015 11:36:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Rose Just Slightly

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity rose just slightly from the previous month, but producers expected activity to pick up moderately in the months ahead.We are seeing some impact from lower oil prices - however, overall, lower prices is a positive for the economy.

“We saw a further slowing in growth this month, driven in part by weaker factory activity in our energy states”, said Wilkerson. “The raw materials prices index also fell for the first time in over five years.”

The month-over-month composite index was 1 in February, down from 3 in January and 8 in December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to large declines in primary metals and computer and electronics production. Looking across District states, the weakest activity was in Colorado, Oklahoma, and New Mexico. In contrast, production activity in the fabricated metals and machinery industries both increased moderately. ... the new orders index inched lower from 5 to 3, and the employment index fell for the second straight month.

emphasis added

Weekly Initial Unemployment Claims increased to 313,000

by Calculated Risk on 2/26/2015 08:30:00 AM

The DOL reported:

In the week ending February 21, the advance figure for seasonally adjusted initial claims was 313,000, an increase of 31,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 283,000 to 282,000. The 4-week moving average was 294,500, an increase of 11,500 from the previous week's revised average. The previous week's average was revised down by 250 from 283,250 to 283,000.The previous week was revised down to 282,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 294,500.

This was above the consensus forecast of 290,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, February 25, 2015

Thursday: CPI, Unemployment Claims, Durable Goods

by Calculated Risk on 2/25/2015 08:45:00 PM

First, from the ATA: ATA Truck Tonnage Index Jumped 1.2% in January

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.2% in January, following a revised gain of 0.1% during the previous month. In January, the index equaled 135.7 (2000=100), an all-time high.Thursday:

Compared with January 2014, the SA index increased 6.6%, which was the largest year-over-year gain in over a year.

...

ATA recently revised the seasonally adjusted index back five years as part of its annual revision. For all of 2014, tonnage was up 3.7%, slightly better than the 3.4% originally reported. In 2013, the index increased 5.5%.

“Truck tonnage continued to improve in January, marking the fourth straight gain totaling 3.5%,” said ATA Chief Economist Bob Costello. “Last year was slightly better for truck tonnage than we originally thought and I am expecting that momentum to continue in 2015.”

emphasis added

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 283 thousand.

• Also at 8:30 AM, the Consumer Price Index for January. The consensus is for a 0.6% decrease in CPI, and for core CPI to increase 0.1%.

• Also at 8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

• At 9:00 AM, FHFA House Price Index for December 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

• At 11:00 AM: the Kansas City Fed manufacturing survey for February.

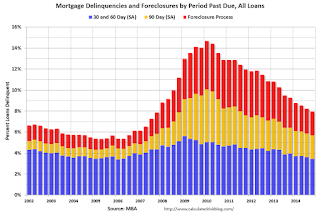

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q4, Lowest since 2007

by Calculated Risk on 2/25/2015 05:42:00 PM

Earlier from the MBA: Mortgage Delinquencies Continue to Decrease in Fourth Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.68 percent of all loans outstanding at the end of the fourth quarter of 2014. This was the lowest level since the third quarter of 2007. The delinquency rate decreased 17 basis points from the previous quarter, and 71 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 2.27 percent, down 12 basis points from the third quarter and 59 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate seen since the fourth quarter of 2007.

...

“Delinquency rates and the percentage of loans in foreclosure decreased for another quarter and were at their lowest levels since 2007,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “We are now back to pre-crisis levels for most measures.”

Walsh continued: “The foreclosure inventory rate has decreased every quarter since the second quarter of 2012, and is now at the lowest level since the fourth quarter of 2007. Foreclosure starts ticked up two basis points, after being flat last quarter, largely due to state-level fluctuations in the speed of the foreclosure process. Compared to the same quarter last year, foreclosure starts are down eight basis points.

“At the state level, 45 states saw a decline in their foreclosure inventory rates over the quarter, although judicial states continue to account for a disproportionately high share. Fewer than half the states had an increase in non-seasonally adjusted 30 day delinquencies, which is highly seasonal and usually increases in the fourth quarter. Foreclosure starts increased in 28 states, but this has become more volatile, with recent state-level mediation requirements and changing laws, as well as servicer procedures, dictating the changes from quarter to quarter.

“States that utilize a judicial foreclosure process continue to have a foreclosure inventory rate that is roughly three times that of non-judicial states. For states where the judicial process is more frequently used, 3.79 percent of loans were in the foreclosure process, compared to 1.23 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of to the non-judicial states at 1.43 percent.

“Legacy loans continue to account for the bulk of all troubled mortgages. Within loans that were seriously delinquent (either more than 90 days delinquent or in the foreclosure process), 73 percent of those loans were originated in 2007 and earlier. More recent loan cohorts, specifically loans originated in 2012 and later, continue to exhibit low serious delinquency rates.

“We expect the improvement in mortgage performance to continue due to the improving economy and a strengthening job market, and the improved credit quality of recent vintages.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 70% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about two-thirds of the way back to normal.

So it has taken about 4 years to reduce the backlog of seriously delinquent and in-foreclosure loans by two-thirds, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal in a couple more years. Most other measures are already back to normal (still working through the backlog of bubble legacy loans).

Comments on New Home Sales

by Calculated Risk on 2/25/2015 03:16:00 PM

Earlier: New Home Sales at 481,000 Annual Rate in January, Highest January since 2008

Here is an updated table of new home sales since 2000 and the change from the previous year, including the revisions for the last few months. Sales in 2014 were only up 1.9% from 2013.

| New Home Sales (000s) | ||

|---|---|---|

| Year | Sales | Change |

| 2000 | 877 | -0.3% |

| 2001 | 908 | 3.5% |

| 2002 | 973 | 7.2% |

| 2003 | 1,086 | 11.6% |

| 2004 | 1,203 | 10.8% |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 368 | 20.3% |

| 2013 | 429 | 16.6% |

| 2014 | 437 | 1.9% |

There are two ways to look at 2014: 1) sales were below expectations, or 2) this just means more growth over the next several years! Both are correct, and what matters now is the present (sales are picking up), and the future (still bright).

It is important not to be influenced too much by one month of data, but if sales averaged the January rate in 2015 of 481 thousand - just moved sideways - then sales for 2015 would be up 10.1% over 2014.

Based on the low level of sales, more lots coming available, changing builder designs and demographics, I expect sales to increase over the next several years.

As I noted last month, it is important to remember that demographics is a slow moving - but unstoppable - force!

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. One major reason for that optimism was demographics - a large cohort was moving into the renting age group.

Now demographics are slowly becoming more favorable for home buying.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for several key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts - and new home sales - to continue to increase in coming years.

There are several reasons to expect a return to double digit (or close) new home sales growth in 2015: Builders bringing lower priced homes on the market, more finished lots available, looser credit and demographics (as discussed above). The housing recovery is ongoing.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Black Knight: Mortgage Delinquencies Declined in January

by Calculated Risk on 2/25/2015 12:46:00 PM

According to Black Knight's First Look report for January, the percent of loans delinquent decreased 1% in January compared to December, and declined 11% year-over-year.

The percent of loans in the foreclosure process declined slightly in January and were down about 31% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.56% in January, down from 5.64% in December. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined slightly in January and remained at 1.61%.

The number of delinquent properties, but not in foreclosure, is down 327,000 properties year-over-year, and the number of properties in the foreclosure process is down 360,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in March.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2015 | Dec 2014 | Jan 2014 | Jan 2013 | |

| Delinquent | 5.56% | 5.64% | 6.27% | 7.03% |

| In Foreclosure | 1.61% | 1.61% | 2.35% | 3.41% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,701,000 | 1,736,000 | 1,851,000 | 1,974,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,112,000 | 1,132,000 | 1,289,000 | 1,531,000 |

| Number of properties in foreclosure pre-sale inventory: | 815,000 | 820,000 | 1,175,000 | 1,703,000 |

| Total Properties | 3,628,000 | 3,688,000 | 4,315,000 | 5,208,000 |

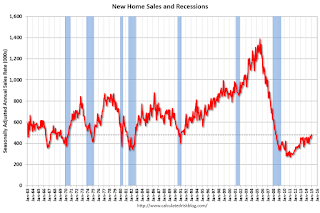

New Home Sales at 481,000 Annual Rate in January, Highest January since 2008

by Calculated Risk on 2/25/2015 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 481 thousand.

November sales were revised up from 431 thousand to 446 thousand, and December sales were revised up from 481 thousand to 482 thousand.

"Sales of new single-family houses in January 2015 were at a seasonally adjusted annual rate of 481,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.2 percent below the revised December rate of 482,000, but is 5.3 percent above the January 2014 estimate of 457,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are barely above the bottom for previous recessions.

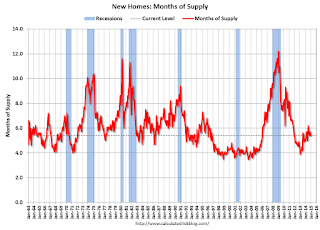

The second graph shows New Home Months of Supply.

The months of supply was unchanged in January at 5.4 months.

The months of supply was unchanged in January at 5.4 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of January was 218,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2015 (red column), 36 thousand new homes were sold (NSA). Last year 33 thousand homes were sold in January. This is the highest for January since 2008.

The high for January was 92 thousand in 2005, and the low for January was 21 thousand in 2011.

This was above expectations of 471,000 sales in January, and is a decent start to 2015. I'll have more later today.

MBA: Purchase Mortgage Applications Increase, Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 2/25/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 20, 2015. This week’s results include an adjustment to account for the Presidents’ Day holiday. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.99 percent from 3.93 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down 2% from a year ago.