by Calculated Risk on 1/29/2015 11:58:00 AM

Thursday, January 29, 2015

Philly Fed: State Coincident Indexes increased in 46 states in December

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2014. In the past month, the indexes increased in 46 states and remained stable in four, for a one-month diffusion index of 94. Over the past three months, the indexes increased in 50 states, for a three-month diffusion index of 100.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 49 states had increasing activity (including minor increases). This measure has been moving up and down, and is in the normal range for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again. It seems likely that several oil producing states will turn red sometime in 2015 - possibly Texas, North Dakota, Alaska or Oklahoma.

HVS: Q4 2014 Homeownership and Vacancy Rates

by Calculated Risk on 1/29/2015 10:15:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2014.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

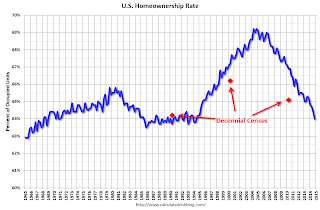

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.0% in Q4, from 64.4% in Q3.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

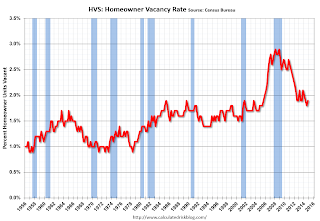

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate increased slightly over the last few quarters - and might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

NAR: Pending Home Sales Index decreased 3.7% in December, up 6.1% year-over-year

by Calculated Risk on 1/29/2015 10:03:00 AM

From the NAR: Pending Home Sales Stall in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 3.7 percent to 100.7 in December from a slightly downwardly revised 104.6 in November but is 6.1 percent above December 2013 (94.9). Despite last month’s decline (the largest since December 2013 at 5.8 percent), the index experienced its highest year-over-year gain since June 2013 (11.7 percent).Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast experienced the largest decline, dropping 7.5 percent to 82.1 in December, but is still 6.3 percent above a year ago. In the Midwest the index decreased 2.8 percent to 97.1in December, but is 1.9 percent above December 2013.

Pending home sales in the South declined 2.6 percent to an index of 116.6 in December, but are 8.6 percent above last December. The index in the West fell 4.6 percent in December to 94.0, but is 6.3 percent above a year ago.

Weekly Initial Unemployment Claims decreased to 265,000

by Calculated Risk on 1/29/2015 08:34:00 AM

The DOL reported:

In the week ending January 24, the advance figure for seasonally adjusted initial claims was 265,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week's level was revised up by 1,000 from 307,000 to 308,000. The 4-week moving average was 298,500, a decrease of 8,250 from the previous week's revised average. The previous week's average was revised up by 250 from 306,500 to 306,750.The previous week was revised up to 308,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 298,500.

This was much lower than the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, January 28, 2015

Thursday: Unemployment Claims, Pending Home Sales

by Calculated Risk on 1/28/2015 08:01:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Back to Long Term Lows After Fed

Mortgage rates fell again today, and while the move wasn't big, it was enough to bring most lenders back in line with the best rates from two weeks ago. Those have the added distinction of being the best rates since May 2013. At these levels, 3.625% is widely available as a top tier conforming 30yr fixed quote and a few lenders are quoting 3.5%.CR Note: The Ten Year yield declined to 1.72% from 1.83% yesterday. The low for the Ten Year yield was 1.4% back in July 2012.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 307 thousand.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).