by Calculated Risk on 12/15/2014 04:06:00 PM

Monday, December 15, 2014

Lawler: Early Read on Existing Home Sales in November (look for big dip)

From housing economist Tom Lawler

Based on local realtor/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.93 million in November, down 6.3% from October’s preliminary pace but up 2.1% from last November’s pace. On the inventory front, the vast majority of local reports showed a larger monthly decline in listings this November compared to last November, and I estimate that the inventory of existing homes for sale as measured by the NAR for the end of November will be 2.12 million, down 4.5% from October and up 3.4% from a year ago.

Finally, a median existing SF home sales price for November that was up about 4.7% from last November would be consistent with local realtor/MLS reports. On this latter point, I should note that the YOY increases shown in the NAR’s median sales prices for the last several months have been higher than local realtor/MLS reports would have suggested.

CR Note: Existing home sales will be released next week on Monday, December 22nd.

A Comment on Oil Prices

by Calculated Risk on 12/15/2014 02:20:00 PM

Recently there has been a dramatic decline in oil prices. This has led to some wild and confusing articles. As an example, Barry Ritholtz excerpted from an article that started: "Most observers thought the Organization of Petroleum Exporting Countries (OPEC) would cut its production to protect its members’ incomes and slash frackers’ profits."

That is wrong. If OPEC cut production, that would help the frackers (not hurt them). And most analysts I know didn't except OPEC to cut production.

For example, from Professor Hamilton on Oct 19th: How will Saudi Arabia respond to lower oil prices?

Oil prices (along with prices of many other commodities) have fallen dramatically since last summer. Some observers are waiting to see if Saudi Arabia responds with significant cutbacks in production. I say, don’t hold your breath.So it was no surprise that OPEC didn't cut production.

...

[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy.

As far as Libya is concerned, the politics on the ground remain quite unsettled. It makes sense to wait and see if anticipated production gains are really going to hold before anybody makes major adjustments.

In terms of surging U.S. production, the key question is how low the price can get before significant numbers of U.S. producers decide to pull out. If world economic growth indeed slows, and if most of the frackers are willing to keep going strong ... trying to maintain the price ... could be a losing bet for the Saudis. They’d be giving up their own revenue just in order to keep the money flowing into ever-growing operations in Texas and North Dakota.

...

And as for worries of another global economic downturn, so far they are only that– worries. If and when we see a downturn materialize, then I would expect to see the Saudis cut back production.

But until then it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production as long as that’s the name of the game.

emphasis added

And the speculation that oil producers are trying to hurt Iran, Russia, or terrorists ... that is also incorrect.

The reason prices have fallen sharply is supply and demand. It is important to remember that the short term supply and demand curves for oil are very steep.

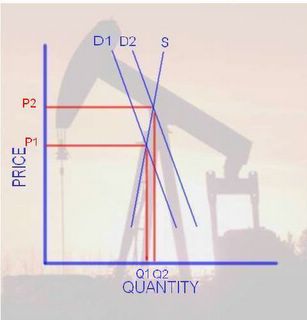

If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

Click on graph for larger image.

Click on graph for larger image.This is a graph I post in 2005. Back in 2005, I pointed out that with a small increase in Demand (from D1 to D2), we would see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would also occur if we had a small decrease in supply such as a disruption to production, transport or refining.

And the opposite is also true. A relatively small decrease in demand or increase in supply (fracking) could cause a significant decline in prices. Especially now with OPEC's diminished role (since cutting production helps other producers).

In the long run, supply and demand will adjust to price changes. But if someone asks why prices have fallen so sharply recently, the answer is "supply and demand" and that the short term supply and demand curves are steep for oil.

NAHB: Builder Confidence decreased to 57 in December

by Calculated Risk on 12/15/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 57 in December, down from 58 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Drops One Point in December

Following a four-point uptick last month, builder confidence in the market for newly built single-family homes fell one point in December to a level of 57 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Members in many markets across the country have seen their businesses improve over the course of the year, and we expect builders to remain confident in 2015,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

“After a sluggish start to 2014, the HMI has stabilized in the mid-to-high 50s index level trend for the past six months, which is consistent with our assessment that we are in a slow march back to normal,” said NAHB Chief Economist David Crowe. “As we head into 2015, the housing market should continue to recover at a steady, gradual pace.”

...

Two of the three HMI components posted slight losses in December. The index gauging current sales conditions fell one point to 61, while the index measuring expectations for future sales dropped a single point to 65 and the index gauging traffic of prospective buyers held steady at 45.

Looking at the three-month moving averages for regional HMI scores, the West rose by four points to 62 and the Northeast edged up one point to 45, while the Midwest registered a three-point loss to 54 and the South dropped two points to 60.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 59.

Fed: Industrial Production increased 1.3% in November

by Calculated Risk on 12/15/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.3 percent in November after edging up in October; output is now reported to have risen at a faster pace over the period from June through October than previously published. In November, manufacturing output increased 1.1 percent, with widespread gains among industries. The rise in factory output was well above its average monthly pace of 0.3 percent over the previous five months and was its largest gain since February. In November, the output of utilities jumped 5.1 percent, as weather that was colder than usual for the month boosted demand for heating. The index for mining decreased 0.1 percent. At 106.7 percent of its 2007 average, total industrial production in November was 5.2 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.8 percentage point in November to 80.1 percent, a rate equal to its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 13.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 80.1% is is at the average from 1972 to 2012 and near the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 1.3% in November to 106.7. This is 27.4% above the recession low, and 5.9% above the pre-recession peak.

This was a strong report - with upward revisions to prior months - and well above expectations.

NY Fed: Empire State Manufacturing Survey indicates "activity declined for New York manufacturers" in December

by Calculated Risk on 12/15/2014 08:36:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2014 Empire State Manufacturing Survey indicates that business activity declined for New York manufacturers. The headline general business conditions index dropped fourteen points to -3.6, its first negative reading in nearly two years. The new orders index also fell into negative territory, tumbling eleven points to -2.0, and the shipments index fell to -0.2. Labor market conditions were mixed, with the index for number of employees holding steady at 8.3, while the average workweek index declined to -11.5. ...This is the first of the regional surveys for December. The general business conditions index was well below the consensus forecast of a reading of 12.0, and indicates contraction in December for the first time in two years.

...

Indexes assessing the six-month outlook were generally lower this month, but nevertheless conveyed considerable optimism about future business activity. The index for future general business conditions fell nine points to 38.6—still a fairly high figure by historical standards. emphasis added