by Calculated Risk on 11/22/2014 11:56:00 AM

Saturday, November 22, 2014

Schedule for Week of November 23rd

This will be a short, but busy holiday week. The key reports this week are the second estimate of Q3 GDP, October New Home sales, October personal income and outlays, and September Case-Shiller house prices.

For manufacturing, the November Dallas and Richmond Fed surveys will be released this week.

Also, the NY Fed Q3 Report on Household Debt and Credit will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%..

9:00 AM: FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

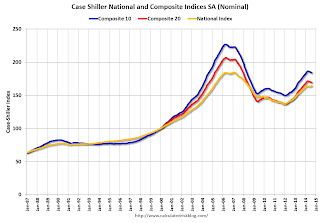

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

11:00 AM: NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 63.2, down from 66.2 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Unofficial Problem Bank list declines to 411 Institutions

by Calculated Risk on 11/22/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 21, 2014.

Changes and comments from surferdude808:

The OCC provided an update on its latest enforcement action activity that resulted in several removals from the Unofficial Problem Bank List. For the week, there were four removals that push the list count to 411 institutions with assets of $126.6 billion. A year ago, there were 654 institutions with assets of $222.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 411.

The OCC terminated actions against Queensborough National Bank & Trust Company, Louisville, GA ($808 million); First Bank Richmond, National Association, Richmond, IN ($495 million); and First National Bank, Groesbeck, TX ($55 million). Texas Savings Bank, Snyder, TX ($74 million) found their way off the list by being acquired in an unassisted transaction.

Next week, we anticipate the FDIC will provide an update on its enforcement action activity, industry results for the third quarter, and updated aggregate figures for their official problem bank list.

Friday, November 21, 2014

Vehicle Sales Forecast: "Could Reach 17 Million" SAAR in November

by Calculated Risk on 11/21/2014 05:13:00 PM

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here is an early forecast (I'll post more next week).

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.It appears there will be a strong finish to 2014 for both auto sales and the economy!

DOT: Vehicle Miles Driven increased 2.3% year-over-year in September

by Calculated Risk on 11/21/2014 01:33:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.3% (5.6 billion vehicle miles) for September 2014 as compared with September 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 246.6 billion vehicle miles

Cumulative Travel for 2014 changed by 0.7% (16.7 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 82 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.8% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In September 2014, gasoline averaged of $3.48 per gallon according to the EIA. That was down from September 2013 when prices averaged $3.60 per gallon.

In September 2014, gasoline averaged of $3.48 per gallon according to the EIA. That was down from September 2013 when prices averaged $3.60 per gallon. Prices will really be down year-over-year in October and November too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it does seem like miles driven is now increasing.

Kansas City Fed: Regional Manufacturing "Activity Expanded Further" in November

by Calculated Risk on 11/21/2014 11:47:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slightly faster pace in November, and producers’ expectations for future activity increased further.The last regional Fed manufacturing surveys for November will be released next week (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated solid growth in November - suggesting another strong reading for the ISM manufacturing survey - and significant optimism about the future.

“Regional factory growth improved somewhat in November, although many contacts reported that the cost to retain or hire quality employees is rising, said Wilkerson. The majority of firms expected activity to improve considerably in the next six months.”

The month-over-month composite index was 7 in November, up from 4 in October and 6 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.... The employment index decreased from 16 to 10 ...

The future composite index moved higher from 17 to 22, and the future production, shipments, and order backlog indexes also rose. The future employment index jumped from 16 to 31, its highest level in almost nine years. In contrast, the future new orders index eased from 26 to 24, and the future capital expenditures index also edged lower.

emphasis added