by Calculated Risk on 11/19/2014 11:10:00 AM

Wednesday, November 19, 2014

AIA: Architecture Billings Index shows slower expansion in October

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Pace of Demand Slows Slightly, but Positive Outlook for Architecture Billings Index Continues

Headed by the continued strength in the multi-family residential market and the emerging growth for institutional projects, demand for design services continues to be healthy as exhibited in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 53.7, down from a mark of 55.2 in September. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.7, following a mark of 64.8 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in October was 56.4.

“Though it has been slow in emerging, we’re finally seeing some momentum develop in design activity for nonprofits and municipal governments, and as such we’re seeing a new round of activity in the institutional sector,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “It will be interesting to see if and how the results of the mid-term Congressional and gubernatorial elections impact this developing momentum.”

• Regional averages: South (58.4), West (56.1), Midwest (54.4), Northeast (47.0) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.7 in October, down from 55.2 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the positive readings over the last six months suggest an increase in CRE investment in 2015.

Housing Starts decrease to 1.009 Million Annual Rate in October

by Calculated Risk on 11/19/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,009,000. This is 2.8 percent below the revised September estimate of 1,038,000, but is 7.8 percent above the October 2013 rate of 936,000.

Single-family housing starts in October were at a rate of 696,000; this is 4.2 percent above the revised September figure of 668,000. The October rate for units in buildings with five units or more was 300,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,080,000. This is 4.8 percent above the revised September rate of 1,031,000 and is 1.2 percent above the October 2013 estimate of 1,067,000.

Single-family authorizations in October were at a rate of 640,000; this is 1.4 percent above the revised September figure of 631,000. Authorizations of units in buildings with five units or more were at a rate of 406,000 in October.

Click on graph for larger image.

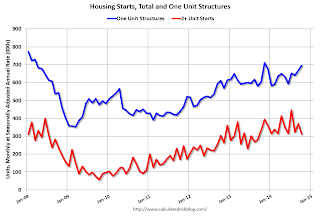

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in October (Multi-family is volatile month-to-month). Note that permits were strong for multi-family, so multi-family starts will probably increase in November.

Single-family starts (blue) increased solidly in October.

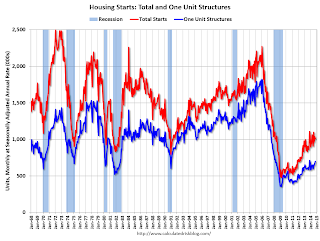

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 1.025 million starts in October, but this was due to the volatile multi-family sector.

Overall this was a solid report, with a solid increase in single family starts, upward revisions to the previous two months, and a solid increase in permits. I'll have more later ...

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 11/19/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 14, 2014. This week’s results included an adjustment for the Veterans Day holiday. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier to the highest level since July 2014.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.18 percent from 4.19 percent, with points decreasing to 0.24 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 70% from the levels in May 2013.

Even with the recent slight small increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

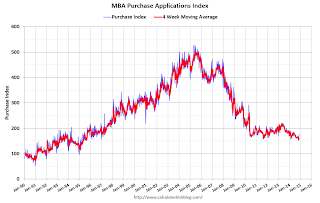

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 6% from a year ago.

Tuesday, November 18, 2014

Wednesday: Housing Starts, FOMC Minutes

by Calculated Risk on 11/18/2014 09:02:00 PM

An excerpt from a research piece by Goldman Sachs economist Alec Phillips: Fiscal Effects on Growth Should Be Neutral over the Coming Year

• As 2015 approaches, we take a look at our fiscal policy assumptions for the coming year. Overall, we estimate the effect of federal fiscal policy on growth to be very slightly positive in 2014, at about +0.1pp, and roughly neutral in 2015.Less fiscal drag in 2015 will be a positive for the economy!

• Tax policy looks fairly stable. We do not expect any significant changes in tax policy, assuming Congress extends a number of tax benefits that expired at the start of 2014.

• On the spending side, we see modest downside risk to our projection of federal spending, offset to some extent by the possibility that federal funding, particularly for defense, could be increased by Congress in 2015. Spending on subsidies under the Affordable Care Act (ACA) poses modest downside risk: enrollment estimates for 2015 have been reduced, and an upcoming Supreme Court decision could reduce them further.

Wednesday:

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM ET, Housing Starts for October. The consensus is for total housing starts to increase to 1.025 million (SAAR) in October.

• During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

• At 2:00 PM, the the FOMC Minutes for the Meeting of October 28-29, 2014

Builder Confidence and Housing Starts

by Calculated Risk on 11/18/2014 06:25:00 PM

I used to post a graph of the NAHB homebuilder confidence index and single family housing starts. However I stopped posting the graph when I realized that many readers misunderstood the graph.

First, here is the graph through the November builder confidence report released this morning and housing starts for September (October starts will be released tomorrow).

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale).

This chart shows that confidence and single family starts generally move in the same direction, but the graph doesn't tell us anything about the expected level of single family starts.

From the NAHB:

[T]he NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.How builders respond to this survey is dependent on the recent past. After a few years of sales around 450 thousand, annual sales of 600+ thousand seem "fair" or "good" to many builders - and the NAHB index increased significantly.

But, as a counter example, in 1995 many builders thought single family sales of 1 million were "poor" (the index fell to 40). But that decline in confidence was because sales were declining from a recent peak of 1.3 million.

It should be no surprise that confidence is currently at 58 with single family starts currently at 650 thousand, but that confidence in 1995 was at 40 with single family starts at 1 million! Confidence is relative to the recent past!

With confidence at 58 for November, no one should expect a specific level of starts (or look at the gap between the two lines), however we can probably expect starts to increase some from recent levels. At that is why I used to post this graph (Several times I cautioned not to expect starts to increase in step with confidence, but some readers missed that warning).