by Calculated Risk on 9/17/2014 07:01:00 AM

Wednesday, September 17, 2014

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2014. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. ...

...

“Application volume rebounded coming out of the Labor Day holiday, even as rates increased to their highest level in the last few months,” said Mike Fratantoni, MBA’s Chief Economist. “Given the volatility in activity around the long weekend, it can be helpful to look at the change over a two week span: refinance applications are down 1.4 percent while purchase applications are up 2.1 percent. Purchase volume continues to track almost ten percent behind last year’s levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.36 percent, the highest level since June 2014, from 4.27 percent, with points decreasing to 0.20 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

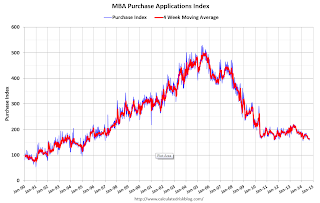

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 10% from a year ago.

Tuesday, September 16, 2014

Wednesday: FOMC Statement and Press Conference, CPI, Home Builder Confidence

by Calculated Risk on 9/16/2014 08:01:00 PM

More previews on the FOMC statement and press conference:

From Jon Hilsenrath at the WSJ: How the Federal Reserve Could Tweak ‘Considerable Time’

"Given the economic backdrop, they don’t want to send a signal right now that rate increases are imminent,” Hilsenrath said. “I think what they do, at the end of the day, is they qualify it.” ... One of the headlines they’re going to come out with I expect to be formalizing some of their exit plan,” Hilsenrath said. “It becomes, in their mind, a lot for the market to digest if they announce their exit strategy and change their guidance at the same time."From Robin Harding at the Financial Times: Money Supply: A “considerable” challenge

The bottom line is that “considerable time” may survive in some form on Wednesday, but if so, I’ll be surprised if there is not a significant change to the statement that sets up its eventual departure.Wednesday:

excerpt with permission

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, the September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the FOMC Statement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

• Also at 2:00 PM, the FOMC projections will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/16/2014 04:31:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On Orlando, Lawler notes: "MLS-based foreclosure sales in Orlando last month were up 30.1% from last August, while MLS-based short sales were down 64.9%."

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down significantly in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up sharply in Orlando, and up a little in Las Vegas and the Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | |

| Las Vegas | 11.5% | 25.0% | 8.9% | 8.0% | 20.4% | 33.0% | 32.1% | 52.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 5.0% | 12.0% | 26.0% | ||

| Phoenix | 3.6% | 10.3% | 6.6% | 8.9% | 10.3% | 19.3% | 25.2% | 34.1% |

| Minneapolis | 2.5% | 5.5% | 8.1% | 15.2% | 10.6% | 20.7% | ||

| Mid-Atlantic | 4.1% | 7.6% | 8.9% | 7.0% | 13.0% | 14.6% | 17.5% | 17.5% |

| Orlando | 7.1% | 17.2% | 25.8% | 16.7% | 32.9% | 33.9% | 42.1% | 46.0% |

| California * | 6.0% | 11.4% | 5.4% | 7.8% | 11.4% | 19.2% | ||

| Bay Area CA* | 3.8% | 7.6% | 2.9% | 4.3% | 6.7% | 11.9% | 21.8% | 23.7% |

| So. California* | 5.9% | 11.5% | 5.0% | 7.0% | 10.9% | 18.5% | 24.4% | 28.4% |

| Hampton Roads | 18.6% | 21.0% | ||||||

| Northeast Florida | 33.3% | 36.7% | ||||||

| Georgia*** | 26.8% | N/A | ||||||

| Toledo | 32.2% | 30.1% | ||||||

| Des Moines | 16.0% | 16.8% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Birmingham AL | ||||||||

| Springfield IL** | ||||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2014 02:14:00 PM

From housing economist Tom Lawler:

Based on August realtor association/board/MLS reports released so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.12 million, down 0.6% from July’s pace and down 3.9% from last August’s seasonally adjusted pace. I also estimate that unadjusted sales last month were down about 6% from a year ago.CR Note: The NAR is scheduled to release August existing home sales on Monday, September 22nd.

Based on realtor/MLS reports as well as other reports on home listings, I project that the NAR’s estimate of the number of existing homes for sales at the end of August will be 2.35 million, down 0.8% from July but up 6.3% from last August. Finally, I project that the NAR’s estimate of the median existing SF home sales price last month will be $217,500, up 3.7% from last August.

I also expect the NAR to revise downward its median existing SF home sales price for July to $222,600 from $223,900 – or to a YOY increase of 4.5% from a YOY increase of 5.1%. In the July report the NAR showed a YOY increase in the Northeast median existing SF home sales price of 2.7%, which was well above what state and local realtor reports would suggest.

On inventory, if Lawler is correct, this would put inventory in August down about 2% compared to August 2012 - two years ago - when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Census: Poverty Rate declined in 2013, Real Median Income increased slightly

by Calculated Risk on 9/16/2014 10:28:00 AM

From the Census Bureau: Income, Poverty and Health Insurance Coverage in the United States: 2013

The nation’s official poverty rate in 2013 was 14.5 percent, down from 15.0 percent in 2012. The 45.3 million people living at or below the poverty line in 2013, for the third consecutive year, did not represent a statistically significant change from the previous year’s estimate.

Median household income in the United States in 2013 was $51,939; the change in real terms from the 2012 median of $51,759 was not statistically significant. This is the second consecutive year that the annual change was not statistically significant, following two consecutive annual declines.

...

These findings are contained in two reports: Income and Poverty in the United States: 2013 and Health Insurance Coverage in the United States: 2013.

Click on graph for larger image.

Click on graph for larger image. From Census:

• In 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession (Figure 1 and Table A-1).

• Median household income was $51,939 in 2013, not statistically different in real terms from the 2012 median of $51,759 (Figure 1 and Table 1). This is the second consecutive year that the annual change was not statistically significant, following two consecutive years of annual declines in median household income.

From Census:

From Census:• In 2013, the official poverty rate was 14.5 percent, down from 15.0 percent in 2012 (Figure 4). This was the first decrease in the poverty rate since 2006.

• In 2013, there were 45.3 million people in poverty. For the third consecutive year, the number of people in poverty at the national level was not statistically different from the previous year’s estimate.

• The 2013 poverty rate was 2.0 percentage points higher than in 2007, the year before the most recent recession.