by Calculated Risk on 7/27/2014 08:36:00 PM

Sunday, July 27, 2014

Monday: Pending Home Sales, Dallas Fed Mfg Survey

A quick note on employment ... Party like it's 1999?

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,770 | 2,662 |

| 1 2014 is current pace annualized (through June). | ||

Monday:

• At 10:00 AM ET, the Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

• During the day, the 2014 Social Security Trustees Report

Weekend:

• FOMC Preview: More Tapering

• Schedule for Week of July 27th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 29 (fair value).

Oil prices were mixed over the last week with WTI futures at $101.75 per barrel and Brent at $108.20 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.52 per gallon (down more than a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: More Tapering

by Calculated Risk on 7/27/2014 09:57:00 AM

The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday of this coming week, and it is almost certain that the FOMC will announce a reduction in monthly asset purchases by another $10 billion per month, from $35 billion to $25 billion. The FOMC statement will be released at 2:00 PM ET on Wednesday, and there will be no press conference after this meeting.

Right now it appears that the FOMC will also reduce QE3 another $10 billion at the September meeting (Sept 17th), and announce the end of QE3 in October (Oct 29th).

On the statement, the FOMC will probably only make small changes. From Goldman Sachs economist David Mericle:

We expect that next week’s FOMC statement will show very little change. The FOMC might choose to upgrade the language on growth in economic activity somewhat, and it might also strengthen the language on labor market indicators a touch in recognition of the strong June employment report. For the most part, however, recent data have supported the characterization of current conditions in the June statement. In particular, the softer June CPI print likely reinforced the Committee’s decision to downplay the firmer inflation prints seen from March to May, and weak housing starts and new home sales reports have likely reinforced concern about the housing sector.For review, here are the June FOMC projections (Projections will be updated next at the September meeting).

The advance estimate of Q2 GDP will be released Wednesday morning, and the consensus is that real GDP increased 2.9% annualized in Q2. Depending on revisions, this would suggest no growth in the first half of 2014 (although other indicators would suggest some growth) - and this would mean another downgrade for GDP at the September meeting.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.1% in June, and it seems the unemployment rate projection will be lowered again in September. It is possible the FOMC will also lower their long run unemployment projection too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of May, PCE inflation was up 1.8% from May 2013, and core inflation was up 1.5%. The FOMC expects inflation to increase in 2014, but remain below their 2% target (Note: the FOMC target is supposedly symmetrical around 2%, although some analysts think the FOMC is acting as if 2.0% is a ceiling).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Overall tapering will probably continue at the same pace, and the FOMC will be a little more positive. But I expect there will be no change on the timing for the end of QE3 (at the October meeting) or on the first rate hike (sometime in 2015).

Saturday, July 26, 2014

Schedule for Week of July 27th

by Calculated Risk on 7/26/2014 01:17:00 PM

This will be a busy week for economic data with several key reports including the July employment report on Friday and the advance Q2 GDP report on Wednesday.

Other key reports include the ISM manufacturing index on Friday, July vehicle sales, also on Friday, and the May Case-Shiller house price index on Tuesday.

There will a two-day FOMC meeting on Tuesday and Wednesday, and the Fed is expected to announce on Wednesday a decrease in asset purchases from $35 billion per month to $25 billion per month.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

During the day: the 2014 Social Security Trustees Reports

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May.

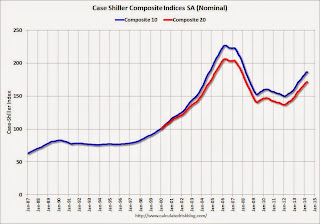

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the April 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May. The Zillow forecast is for the Composite 20 to increase 9.6% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

2:00 PM: FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 6.1% in July.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).June was the fifth month in a row with more than 200 thousand jobs added, and employment in June was up 2.495 million year-over-year.

The economy has added 9.7 million private sector jobs since employment bottomed in February 2010 (9.1 million total jobs added including all the public sector layoffs).

There are 895 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 415 thousand above the pre-recession peak.

8:30 AM: Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.

Unofficial Problem Bank list declines to 452 Institutions

by Calculated Risk on 7/26/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 25, 2014.

Changes and comments from surferdude808:

As anticipated, the FDIC provided an update on its enforcement action activity which contributed to many changes to the Unofficial Problem Bank list this week. In all, there were 11 removals this week pushing the list count down to 452 institutions with assets of $146.1 billion. A year ago the list held 729 institutions with assets of $260.9 billion. For the month, the list count fell by 16 after 10 action terminations, four mergers, and two failures. This is the smallest monthly count decline since a net drop of 12 during the month of June 2013. This may be the leading edge of a slowdown in action terminations.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 452.

The FDIC surprised us by closing GreenChoice Bank, FSB, Chicago, IL ($73 million) this Friday. This is the 14th failure this year approximating the pace last year when 16 banks had failed by this point. GreenChoice is the 60th Illinois-based institution to fail since the on-set of the Great Recession. The count in Illinois only trails the 88 in Georgia and 71 in Florida.

FDIC terminated actions against Alliance Bank Central Texas, Waco, TX ($187 million); Monarch Community Bank, Coldwater, MI ($182 million Ticker: MCBF); First Personal Bank, Orland Park, IL ($166 million); Rabun County Bank, Clayton, GA ($163 million); Flagship Bank Minnesota, Wayzata, MN ($94 million); One World Bank, Dallas, TX ($82 million); Bay Bank, Green Bay, WI ($81 million); and Kendall State Bank, Valley Falls, KS ($38 million).

Finding their way off the list through a merger partner were Atlas Bank, Brooklyn, NY ($116 million) and Bay Bank, Mobile, AL ($78 million).

Most likely there will be few changes to the list next week.

Friday, July 25, 2014

Bank Failure Friday: Greenchoice Bank, Chicago, Illinois,14th Failure of 2014

by Calculated Risk on 7/25/2014 07:39:00 PM

From the FDIC: Providence Bank, LLC, South Holland, Illinois, Assumes All of the Deposits of Greenchoice Bank, fsb, Chicago, Illinois

As of March 31, 2014, GreenChoice Bank, fsb had approximately $72.9 million in total assets and $71.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.2 million. ... GreenChoice Bank, fsb is the 14th FDIC-insured institution to fail in the nation this year, and the fourth in Illinois.There were 24 failures in 2013, and it appears there will be about the same this year. F

Vehicle Sales Forecasts: Over 16 Million SAAR again in July

by Calculated Risk on 7/25/2014 01:59:00 PM

The automakers will report July vehicle sales next Friday, August 1st. Sales in June were at 16.92 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in July will be above 16 million SAAR again. The analyst consensus is for July sales of 16.8 million SAAR.

Note: There were 26 selling days in July this year compared to 25 last year.

Here are a few forecasts:

From J.D. Power: U.S. auto sales seen rising 9 percent in July: JD Power-LMC

U.S. auto sales in July will be the strongest for the month since 2006, and rise 9 percent from last year, automotive industry consultants J.D. Power and LMC Automotive predicted on Thursday.From TrueCar: New Vehicle Sales Continue to Sizzle in July; TrueCar Increases 2014 Annual Sales Forecast to 16.35M

For the fifth consecutive month, the seasonally adjusted annualized sales rate will top 16 million new vehicles, at 16.6 million, the consultancies said.

LMC raised its full-year 2014 forecast for new auto sales to 16.3 million, from 16.2 million.

Seasonally Adjusted Annualized Rate ("SAAR") of 16.7 million new vehicle sales is up 6.8 percent from July 2013.From Kelley Blue Book: New-Car Sales to Jump 11.6 Percent Year-Over-Year in July

The seasonally adjusted annual rate (SAAR) for July 2014 is estimated to be 16.6 million, up from 15.7 million in July 2013 and down from 16.9 million in June 2014.Another solid month for auto sales.

Hotels: Record High Occupancy Rate for Week Ending July 19th

by Calculated Risk on 7/25/2014 11:10:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 19 July

In year-over-year measurements, the industry’s occupancy rate rose 2.9 percent to 77.1 percent. Average daily rate increased 4.1 percent to finish the week at US$117.57. Revenue per available room for the week was up 7.1 percent to finish at US$90.68.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

This is the highest occupancy rate for any week since at least January 2000. The previous high was 77.0% in late July 2000.

And from HotelNewNow.com: June US hotel occupancy best of this century

Just how good is the current state of demand? Take a bite of this juicy nugget: June occupancy of 71.7% is the highest of any June this century.The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

The above factoid was culled by Jan Freitag, senior VP of global development for STR and our resident hotel data aficionado. Jan’s also a master of context, explaining this milestone another way: The average occupancy for U.S. hotels is now higher than the previous peak recorded in June 2007 (71.1%).

To understand how we got here, you need look no further than economics 101. For much of the past few years, the relationship between supply and demand has been, well, just great.

As of June, demand growth (12-month moving average) was up 3.2%, according to STR data. Supply growth? Only 0.8%.

In other words, supply growth still has had no impact, as Freitag points out.

...

June ADR (12-month moving average) was $112, up 3.9%. The result is revenue per available room of $71, which represents growth of 6.4%.

Both those ADR and RevPAR numbers represent all-time highs for the U.S. hotel industry.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the same level as in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. A very strong year ...

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Chemical Activity Barometer "retains strong year-over-year growth; shows short-term tightening"

by Calculated Risk on 7/25/2014 09:38:00 AM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: U.S. Economic Expansion Being Tempered By Uncertainty in Energy Markets, Shows Leading Economic Indicator

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC) posted a 0.4 percent increase over June, as measured on a three-month moving average (3MMA). The pace of growth was consistent with earlier growth logged in the second quarter. Year over year growth now stands at a 4.4 percent increase. ...

During July production-related indicators were up, as were product/selling prices, and inventories. After rebounding sharply in May, chemical equity prices have weakened in response to the growing unrest in the Middle East and Ukraine.

Unlike earlier readings, trends in construction-related chemistries suggest a lackluster market for this sector, which includes plastic resins as well as adhesives and sealants, construction chemicals, paint additives, and other performance chemistries. Pigments are faring better, as are plastic resins used in consumer product applications. Continued strength in electronic chemicals is encouraging, as the semiconductor industry’s early place in the supply chain makes it a bellwether of the industrial cycle. Gains in oilfield chemicals suggest that the boom in unconventional oil and gas will continue to progress, contributing to the overall growth of the U.S. economy.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Thursday, July 24, 2014

Lawler: Various Builder Results: Horton Home Orders, Market Share Jumps on Increased Sales Incentives; Orders “Lackluster” at Other Builders

by Calculated Risk on 7/24/2014 09:25:00 PM

CR Note: The comments on D.R. Horton are very interesting (more incentives, no price increases). Also see table at bottom for summary stats.

From housing economist Tom Lawler:

D.R. Horton reported that net home orders in the quarter ended June 30, 2014 totaled 8,551, up 25.3% from the comparable quarter of 2013. Sales per community were up almost 13% YOY. Horton’s acquisition of Crown Communities added 290 to last quarter’s orders. DHI’s average net order price last quarter was $281,336, up 5.0% from a year ago. Home deliveries last quarter totaled 7,676, up 18.8% from the comparable quarter of 2013, at an average sales price of $272,316, up 7.9% from a year ago. The acquisition of Crown Communities added 254 to last quarter’s deliveries. DHI’s order backlog at the end was 11,365, up 14.7% from last June, at an average order price of $286,194, up 9.8% from a year ago.

In the company’s conference call Horton’s CEO characterized the overall demand for new homes last quarter as “relatively stable” compared to a year ago, but that Horton’s previous aggressive acquisition of land/lots, combined with more aggressive use of sales incentives to move inventory, enabled the company to boost its market share to its highest level ever. Another official said that the company increased sales incentives in MANY of its communities in order to meet its aggressive sales goals. The official noted that sales incentives were much lower than normal in 2013 and early 2014, but that last quarter (and currently) sales incentives were “back to normal.” Another official noted that home price appreciation had slowed appreciably.

...

PulteGroup reported that net home orders in the quarter ended June 30, 2014 totaled 4,778, down 2.2% from the comparable quarter of 2013. Sales per active community were up about 6% YOY, reflected the 6% YOY drop in community count. Pulte’s average net order price last quarter was $333,698, up 7.1% from a year ago. Home deliveries last quarter totaled 3,798, down 8.5% from the comparable quarter of 2013, at an average sales price of $328,000, up 11.6% from a year ago. The company’s order backlog at the end of June was 8,179, down 4.4% from last June, at an average order price of $338,689, up 6.8% from a year ago.

Meritage Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,647, up 0.6% from the comparable quarter of 2013. Net orders per community were down about 8.2% YOY. Meritage’s average net order price last quarter was $375,000, up 7.1% from a year ago. Home deliveries last quarter totaled 1,368, up 3.6% from the comparable quarter of 2013, at an average sales price of $368,000, up 11.5% from a year ago. The company’s order backlog at the end of June was 2,548, up 11.6% from last June, at an average order price of $373,000, up 5.7% from a year ago. Meritage owned or controlled about 25,800 lots at the end of June, up 14.2% from last June and up 44.5% from two years ago.

M/I Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,016, down 5.8% from the comparable quarter of 2013. Sales per community were down 14.4% YOY. Home deliveries last quarter totaled 894, up 13.5% from the comparable quarter of 2013, at an average sales price of $306,000, up 8.9% from a year ago. The company’s order backlog at the end of June was 1,647, down 1.7% from last June, at an average order price of $332,000, up 13.3% from a year ago. In its press release the company attributed the disappointed pace of new orders “primarily to delays in opening new communities and (to) lower traffic levels. Orders were especially weak in the Mid-Atlantic region, where orders were down 15.6% YOY. M/I owned or controlled 20,991 lots at the end of June, 22.3% from last June and up 98.1% from two years ago.

Here are some summary stats from large publicly-traded builders who have reported results for last quarter.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg |

| D.R. Horton | 8,551 | 6,822 | 25.3% | 7,676 | 6,464 | 18.8% | $272,316 | $252,290 | 7.9% |

| PulteGroup | 4,778 | 4,885 | -2.2% | 3,798 | 4,152 | -8.5% | $328,000 | $294,000 | 11.6% |

| NVR | 3,415 | 3,278 | 4.2% | 2,943 | 2,878 | 2.3% | $368,200 | $344,700 | 6.8% |

| Meritage Homes | 1,647 | 1,637 | 0.6% | 1,368 | 1,321 | 3.6% | $368,000 | $330,000 | 11.5% |

| M/I Homes | 1,016 | 1,078 | -5.8% | 894 | 788 | 13.5% | $306,000 | $281,000 | 8.9% |

| Total | 19,407 | 17,700 | 9.6% | 16,679 | 15,603 | 6.9% | $311,568 | $288,463 | 8.0% |

NMHC Survey: Apartment Market Conditions Tighter in Q2 2014

by Calculated Risk on 7/24/2014 03:45:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Continue Expansion in July NMHC Quarterly Survey

Apartment markets continued to expand in the second quarter of 2014, as growth accelerated in all four indexes in the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The market tightness (68), sales volume (56), equity financing (58) and debt financing (68) indexes all improved from the first quarter this year and marked the second quarter in a row with all above the breakeven level of 50.

“Despite concerns in some quarters about the pace of new development, most markets appear to be absorbing new supply with no downward pressure on rents or vacancies,” said NMHC Senior Vice President of Research and Chief Economist Mark Obrinsky. “The improvement in market tightness was particularly noteworthy. Four years into the apartment industry recovery and expansion, the increase in demand continues to outstrip the pickup in new supply.”

The survey also asked about urban vs. suburban development. Four in ten (43 percent) reported an increased share of urban development relative to suburban in the last six months, compared to one quarter (27 percent) reporting an increased share of suburban development. Of the suburban development taking place, more than half (54 percent) reported more town center-style developments, with 39 percent reporting no appreciable change and 7 percent reporting more garden-style developments. [These results exclude “Don’t know/not applicable.”]

“Early in the recovery, apartment development was concentrated in downtown areas of large cities. While such areas continue to attract investment, new construction is expanding more broadly into suburbs as well. But developers are bringing urban style to suburban locations, with a heavier emphasis on ‘town center’ communities than we’ve seen in the past,” said Obrinsky.

...

The Market Tightness Index rose from 56 to 68. The percentage of respondents who saw looser conditions continued to decline, down from 20 percent to 15 percent. While this improvement is partly seasonal, the index is higher than the average for the July quarter since the survey began 15 years ago.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates tighter market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. The apartment market is still solid right now.