by Calculated Risk on 7/22/2014 10:14:00 AM

Tuesday, July 22, 2014

Existing Home Sales in June: 5.04 million SAAR, Inventory up 6.5% Year-over-year

The NAR reports: Existing-Home Sales Up in June, Unsold Inventory Shows Continued Progress

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 2.6 percent to a seasonally adjusted annual rate of 5.04 million in June from an upwardly-revised 4.91 million in May. Sales are at the highest pace since October 2013 (5.13 million), but remain 2.3 percent below the 5.16 million-unit level a year ago. ...

Total housing inventory at the end of June rose 2.2 percent to 2.30 million existing homes available for sale, which represents a 5.5-month supply at the current sales pace, unchanged from May. Unsold inventory is 6.5 percent higher than a year ago, when there were 2.16 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.04 million SAAR) were 2.6% higher than last month, but were 2.3% below the June 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.30 million in June from 2.25 million in May. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

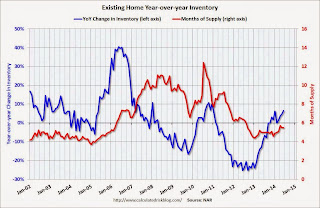

According to the NAR, inventory increased to 2.30 million in June from 2.25 million in May. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.5% year-over-year in June compared to June 2013.

Inventory increased 6.5% year-over-year in June compared to June 2013. Months of supply was at 5.5 months in June.

This was above expectations of sales of 4.99 million. For existing home sales, the key number is inventory - and inventory is still low, but up solidly year-over-year. I'll have more later ...

CPI increases 0.3% in June, Core CPI 0.1%

by Calculated Risk on 7/22/2014 08:35:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - June 2014

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.1 percent before seasonal adjustment.On a year-over-year basis, CPI is up 2.1 percent, and core CPI is up also up 1.9 percent. This was close to the consensus forecast of a 0.3% increase for CPI, and a 0.2% increase in core CPI.

In contrast to the broad-based increase last month, the June seasonally adjusted increase in the all items index was primarily driven by the gasoline index. It rose 3.3 percent and accounted for two-thirds of the all items increase.

...

The index for all items less food and energy also decelerated in June, increasing 0.1 percent after a 0.3 percent increase in May.

emphasis added

Note: CPI-W (used for cost of living adjustment, COLA) is up 2.0% year-over-year in June. The COLA is calculated using the average Q3 data (July, August, and September).

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Monday, July 21, 2014

Tuesday: CPI, Existing Home Sales, Richmond Fed Mfg Survey

by Calculated Risk on 7/21/2014 08:01:00 PM

Here is a followup on an earlier article concerning short sale fraud, from E. Scott Reckard at the LA Times: Former BofA short-sales employee gets prison term for taking bribes

A former Bank of America mortgage employee was sentenced to 30 months in prison for pocketing $1.2 million in payoffs to approve sales of distressed properties for far less than their actual value.Short sale fraud was widespread, especially in the 2009 through 2012 period. Fraud has always been a key problem with short sales (the agent represents the "seller" who has no equity in the home - and this creates an obvious agency problem with unscrupulous agents).

...

Plea agreements filed by three other defendants at the time of Lauricella's arrest indicated that the manipulation of Southland home sales for illicit profit was widespread.

"It's part of a large, ongoing investigation," Katzenstein said. "There are a large number of related cases."

There are many types of short sales fraud (money under the table to either seller or agent, agents not actually marketing property, etc.), and unfortunately most of the fraud will never be prosecuted - but we can still hope some more of them will be caught.

Tuesday:

• At 8:30 AM ET, the Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

• At 9:00 AM, the FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

Lawler: NVR: Net Home Orders Up Slightly in Q2, Little Changed YTD; Sales Per Community Down; Prices Flat on Quarter

by Calculated Risk on 7/21/2014 04:30:00 PM

From housing economist Tom Lawler:

NVR, Inc. the fourth largest US home builder with a heavy concentration in the Mid-Atlantic region, reported that net home orders in the quarter ended June 30, 2014 totaled 3,415, up 4.2% from the comparable quarter of 2013. Net orders per active community were down 4.7% YOY. NVR’s average net order price last quarter was $368,000, up 1.9% from a year ago, but virtually unchanged from the previous quarter.

For the first two quarters of 2014 NVR’s net home orders were down 0.7% from the first half of 2013, while net orders per active community were down 9.5%. Home settlements last quarter totaled 2,943, up 2.3% from the comparable quarter of 2013, at an average sales price of $368,200, up 6.8% from a year ago and up 1.9% from the previous quarter. Home settlements in the first half of 2014 were virtually unchanged from the first half of 2013.

The company’s order backlog at the end of June was 6,513, down 1.3% from last June, at an average order price of $374,100, up 4.3% from last June but virtually unchanged from the previous quarter. NVR controlled (owned or optioned) 67,500 lots at the end of June, up 10.3% from a year earlier and up 22.7% from two years earlier.

Tanta: What Is "Subprime"?

by Calculated Risk on 7/21/2014 01:42:00 PM

CR Note: If you want to understand subprime lending, I strongly suggest the following post from my former co-blogger Doris "Tanta" Dungey. This was written in 2007, but the concepts are forever. Read it all.

What Is "Subprime"?

For other Tanta posts, see: The Compleat UberNerd and Compendium of Tanta's Posts