by Calculated Risk on 4/18/2014 10:33:00 AM

Friday, April 18, 2014

BLS: No State had 9% Unemployment Rate in March, First time since September 2008

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in March. Twenty-one states had unemployment rate decreases, 17 states and the District of Columbia had increases, and 12 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in March, 8.7 percent. The next highest rates were in Nevada and Illinois, 8.5 percent and 8.4 percent, respectively. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. No state has double digit or even a 9% unemployment rate.

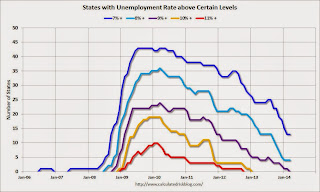

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).Currently no state has an unemployment rate at or above 9% (purple), four states are at or above 8% (light blue), and 13 states are at or above 7% (blue).

Thursday, April 17, 2014

Merrill Lynch Reduces Housing Forecast for 2014

by Calculated Risk on 4/17/2014 09:06:00 PM

From Michelle Meyer at Merrill Lynch: Will April showers bring May flowers?

We have all been waiting for the weather to unleash stronger economic activity, particularly for the housing market. However, the housing data so far have been less than encouraging. We think it will be challenging to realize average housing starts of 1.1 million this year and are therefore trimming our forecast to 1.03 million. Our trajectory through year end is still up, with starts rising 11% from last year, but the rebound is more muted. Slower growth in starts combined with the weaker pace of home sales suggests residential investment will add 0.2pp to GDP growth this year versus our prior forecast of 0.3pp.Merrill has reduced their forecast for housing starts from 1.100 million this year to 1.033 million (still an 11% increase from 2013). They have kept their forecast for new home sales at 515 thousand (close to a 20% gain).

...

It is important to put the recovery in housing construction into perspective. The turn started in early 2011 and gained momentum at the end of 2012. However, last year growth was weak until the bounce at the very end of the year. The question is whether that bounce was a start of a stronger rebound which just got delayed due to the weather or simply noise in the data. We think the truth is somewhere in between and are therefore penciling in an acceleration in starts, but not at the pace we experienced in Q4 of last year.

We have to remember that while this is not a V-shaped trajectory, it is still a recovery. Housing construction will head higher as household formation gradually recovers, capacity constraints around available lots and labor are resolved and credit conditions slowly ease for homebuyers. But this all takes time, and we must be patient as the market finds its new equilibrium.

LA area Port Traffic: Up year-over-year in March, Exports at New High

by Calculated Risk on 4/17/2014 05:59:00 PM

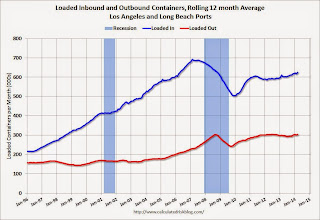

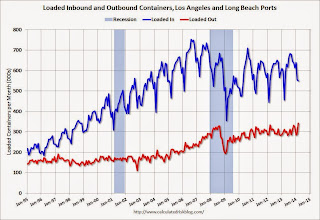

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for March since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1.3% compared to the rolling 12 months ending in February. Outbound traffic was up 0.9% compared to 12 months ending in February.

Inbound traffic has generally been increasing, and outbound traffic has been moving up a little after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in trade with Asia in March.

Hotels: Strongest Year since 2000

by Calculated Risk on 4/17/2014 01:12:00 PM

From HotelNewsNow.com: US hotels report strong weekly RevPAR

The U.S. hotel industry posted positive results in the three key performance measurements during the week of 6-12 April 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room. These metrics are now at new highs.

In year-over-year measurements, the industry’s revenue per available room jumped 12.8% to $80.09. Occupancy for the week increased 7.1% to 68.5%. Average daily rate rose 5.3% to finish the week at $116.85.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels.

Through April 12th, the 4-week average of the occupancy rate is tracking higher than pre-recession levels.

It looks like 2014 should be a good year for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Philly Fed Manufacturing Survey indicated Faster Expansion in April

by Calculated Risk on 4/17/2014 10:29:00 AM

From the Philly Fed: April Manufacturing Survey

Manufacturing activity in the region increased in April, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment all remained positive and increased from their readings in March. Price pressures remain modest. The surveyʹs indicators of future activity reflected optimism about continued expansion over the next six months, although the indicators have fallen from higher readings in recent months.This was above the consensus forecast of a reading of 9.1 for April.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 9.0 in March to 16.6 this month, its highest reading since last September.

The employment index remained positive for the 10th consecutive month and increased 5 points, suggesting overall improvement.

emphasis added

Weekly Initial Unemployment Claims at 304,000; 4-Week average lowest since 2007

by Calculated Risk on 4/17/2014 08:37:00 AM

The DOL reports:

In the week ending April 12, the advance figure for seasonally adjusted initial claims was 304,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 300,000 to 302,000. The 4-week moving average was 312,000, a decrease of 4,750 from the previous week's revised average. This is the lowest level for this average since October 6, 2007 when it was 302,000.The previous week was revised up from 300,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 312,000.

This was lower than the consensus forecast of 320,000. The 4-week average is at normal levels for an expansion.

Wednesday, April 16, 2014

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 4/16/2014 08:55:00 PM

Some more data from DataQuick: California March Home Sales

An estimated 32,923 new and resale houses and condos sold statewide in March. That was up 28.2 percent from 25,680 in February, and down 12.8 percent from 37,764 sales in March 2013, according to San Diego-based DataQuick.A common theme now: As distress sales decline, overall sales decline too.

Last month’s sales were the lowest for a March since 2008, when 24,565 homes sold – a record low for the month of March. California’s high for March sales was 68,848 in 2005. Last month's sales were 23.9 percent below the average of 43,251 sales for all months of March since 1988, when DataQuick's statistics begin. California sales haven’t been above average for any particular month in more than eight years.

...

Of the existing homes sold last month, 7.4 percent were properties that had been foreclosed on during the past year. That was down from a revised 8.0 percent in February and down from 15.0 percent a year earlier. California’s foreclosure resales peaked at 58.8 percent in February 2009.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 7.4 percent of the homes that resold last month. That was down from an estimated 9.3 percent the month before and 18.7 percent a year earlier.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 300 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.1, up from 9.0 last month (above zero indicates expansion).

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in March

by Calculated Risk on 4/16/2014 05:11:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in March.

From CR: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in the mid-Atlantic area and Orlando - and a little in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably decline. Toledo's cash share is up.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar-14 | Mar-13 | Mar-14 | Mar-13 | Mar-14 | Mar-13 | Mar-14 | Mar-13 | |

| Las Vegas | 12.9% | 33.3% | 11.7% | 11.2% | 24.6% | 44.5% | 43.1% | 57.5% |

| Reno** | 14.0% | 32.0% | 7.0% | 9.0% | 21.0% | 41.0% | ||

| Phoenix | 5.1% | 15.1% | 6.9% | 11.6% | 11.9% | 26.8% | 33.1% | 41.5% |

| Sacramento | 8.2% | 27.0% | 7.9% | 10.5% | 16.1% | 37.5% | 22.5% | 36.5% |

| Minneapolis | 4.7% | 9.3% | 21.9% | 28.3% | 26.6% | 37.6% | ||

| Mid-Atlantic | 6.4% | 11.4% | 10.9% | 10.7% | 17.3% | 22.1% | 19.9% | 20.6% |

| Orlando | 7.9% | 21.7% | 23.7% | 21.4% | 31.6% | 43.0% | 44.6% | 55.6% |

| So. California* | 7.7% | 18.7% | 6.4% | 13.8% | 14.1% | 32.5% | 29.1% | 35.1% |

| Hampton Roads | 24.5% | 28.4% | ||||||

| Northeast Florida | 39.1% | 40.2% | ||||||

| Toledo | 40.7% | 38.9% | ||||||

| Des Moines | 20.8% | 19.1% | ||||||

| Tucson | 33.5% | 35.0% | ||||||

| Georgia*** | 33.8% | NA | ||||||

| Houston | 6.8% | 12.3% | ||||||

| Memphis* | 18.5% | 26.7% | ||||||

| Springfield IL** | 14.0% | 26.1% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Fed's Beige Book: "Economic activity increased in most regions"

by Calculated Risk on 4/16/2014 02:07:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Richmond and based on information collected before April 7, 2014."

Reports from the twelve Federal Reserve Districts suggest economic activity increased in most regions of the country since the previous report. The expansion was characterized as modest or moderate by the Boston, Philadelphia, Richmond, Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco Districts. Chicago reported that economic growth had picked up, and New York and Philadelphia indicated that business activity had rebounded from weather-related slowdowns earlier in the year. The Cleveland and St. Louis Districts both reported a decline in economic activity.And on real estate:

Reports on residential housing markets varied. However, across most Districts, home prices rose modestly and inventory levels remained low. Residential construction increased in several Districts; only Cleveland, St. Louis, and Minneapolis reported a decrease. ...Some positive comments on commercial real estate. This is similar to the previous beige book, but it appears there is some weather related rebound in some areas.

Commercial construction activity strengthened since the previous survey period for the Kansas City and Dallas Districts. The Richmond, Atlanta, Chicago, St. Louis, Minneapolis, and San Francisco Districts reported modest to moderate expansion in commercial construction. Philadelphia noted mild growth, while Cleveland reported a slight decline in commercial construction.

emphasis added

Yellen: Three Big Questions for the FOMC

by Calculated Risk on 4/16/2014 12:20:00 PM

From Fed Chair Janet Yellen: Monetary Policy and the Economic Recovery. Excerpts:

Is there still significant slack in the labor market?Currently Yellen sees substantial slack in the labor market, and is more concerned about low inflation than high inflation. This suggests rate will be low for a long time.

...

I will refer to the shortfall in employment relative to its mandate-consistent level as labor market slack, and there are a number of different indicators of this slack. Probably the best single indicator is the unemployment rate. At 6.7 percent, it is now slightly more than 1 percentage point above the 5.2 to 5.6 percent central tendency of the Committee's projections for the longer-run normal unemployment rate. This shortfall remains significant, and in our baseline outlook, it will take more than two years to close.

Other data suggest that there may be more slack in labor markets than indicated by the unemployment rate. For example, the share of the workforce that is working part time but would prefer to work full time remains quite high by historical standards. Similarly, while the share of workers in the labor force who are unemployed and have been looking for work for more than six months has fallen from its peak in 2010, it remains as high as any time prior to the Great Recession. ...

The low level of labor force participation may also signal additional slack that is not reflected in the headline unemployment rate. Participation would be expected to fall because of the aging of the population, but the decline steepened in the recovery. Although economists differ over what share of those currently outside the labor market might join or rejoin the labor force in a stronger economy, my own view is that some portion of the decline in participation likely represents labor market slack.

Lastly, economists also look to wage pressures to signal a tightening labor market. At present, wage gains continue to proceed at a historically slow pace in this recovery, with few signs of a broad-based acceleration.

Is inflation moving back toward 2 percent?

...

I will mention two considerations that will be important in assessing whether inflation is likely to move back to 2 percent as the economy recovers. First, we anticipate that, as labor market slack diminishes, it will exert less of a drag on inflation. However, during the recovery, very high levels of slack have seemingly not generated strong downward pressure on inflation. We must therefore watch carefully to see whether diminishing slack is helping return inflation to our objective.10 Second, our baseline projection rests on the view that inflation expectations will remain well anchored near 2 percent and provide a natural pull back to that level. But the strength of that pull in the unprecedented conditions we continue to face is something we must continue to assess.

Finally, the FOMC is well aware that inflation could also threaten to rise substantially above 2 percent. At present, I rate the chances of this happening as significantly below the chances of inflation persisting below 2 percent, but we must always be prepared to respond to such unexpected outcomes, which leads us to my third question.

What factors may push the recovery off track?

Myriad factors continuously buffet the economy, so the Committee must always be asking, "What factors may be pushing the recovery off track?" For example, over the nearly 5 years of the recovery, the economy has been affected by greater-than-expected fiscal drag in the United States and by spillovers from the sovereign debt and banking problems of some euro-area countries. Further, our baseline outlook has changed as we have learned about the degree of structural damage to the economy wrought by the crisis and the subsequent pace of healing.