by Calculated Risk on 3/18/2014 01:41:00 PM

Tuesday, March 18, 2014

A comment on Housing Starts

There were 123.5 thousand total housing starts in January and February this year (not seasonally adjusted, NSA), down 1% from the 124.8 thousand during the first two months of 2013.

Historically January and February are the two weakest months of the year for housing starts (NSA) due to winter weather - and the weather this year was especially severe - so I wouldn't read too much into the weak start for 2014. Note: Permits were up 5% for the first two months of 2014 compared to 2013 - still weak growth, but positive.

I don't blame all of the recent weakness on the weather (probably just a small factor) - there are also higher mortgage rates, higher prices and probably supply constraints in some areas. But I still think fundamentals support a higher level of starts, and I expect starts to pick up solidly again this year.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up, and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Measures Shows Low Inflation in February

by Calculated Risk on 3/18/2014 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. The price for fuel oil and other fuels increased sharply in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in February. The CPI less food and energy increased 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.6%. Core PCE is for January and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI increased 1.4% annualized.

These measures suggest inflation remains below the Fed's target.

Housing Starts at 907 Thousand Annual Rate in February

by Calculated Risk on 3/18/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 907,000. This is 0.2 percent below the revised January estimate of 909,000 and is 6.4 percent below the February 2013 rate of 969,000.

Single-family housing starts in February were at a rate of 583,000; this is 0.3 percent above the revised January figure of 581,000. The February rate for units in buildings with five units or more was 312,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,018,000. This is 7.7 percent above the revised January rate of 945,000 and is 6.9 percent above the February 2013 estimate of 952,000.

Single-family authorizations in February were at a rate of 588,000; this is 1.8 percent below the revised January figure of 599,000. Authorizations of units in buildings with five units or more were at a rate of 407,000 in February.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased slightly in February (Multi-family is volatile month-to-month).

Single-family starts (blue) increased slightly in February.

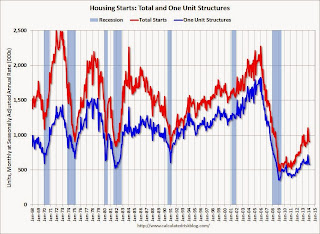

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 915 thousand starts in February. Note: Starts for January were revised up to 907 thousand from 880 thousand. I'll have more later.

Monday, March 17, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 3/17/2014 08:39:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not now due to the severe weather and limited starts and sales in many parts of the country).

In February 2013, starts were at a 969 thousand seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.162 million SAAR in February (not gonna happen). For NDD to win, starts would have to fall to 869 thousand SAAR (possible). NDD could also "win" if permits fall to 852 thousand SAAR from 952 thousand SAAR in February 2013.

Tuesday:

• At 8:30 AM ET, Consumer Price Index for February. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.1%.

• Also at 8:30 AM, Housing Starts for February. Total housing starts were at 880 thousand (SAAR) in January. Single family starts were at 573 thousand SAAR in January. The consensus is for total housing starts to increase to 915 thousand (SAAR) in February.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/17/2014 05:56:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in February.

From CR: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up a little in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year). Orlando also saw a slight increase in foreclosures.

The All Cash Share (last two columns) is declining in most areas year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | |

| Las Vegas | 14.0% | 37.9% | 12.0% | 10.2% | 26.0% | 48.1% | 46.8% | 59.5% |

| Reno** | 13.0% | 37.0% | 7.0% | 13.0% | 20.0% | 50.0% | ||

| Phoenix | 5.3% | 15.0% | 8.3% | 13.8% | 13.7% | 28.8% | 33.6% | 46.1% |

| Sacramento | 12.3% | 30.3% | 7.0% | 13.5% | 19.3% | 43.8% | 26.5% | 39.5% |

| Minneapolis | 5.0% | 11.3% | 25.3% | 32.7% | 30.3% | 43.9% | ||

| Mid-Atlantic | 7.7% | 13.6% | 10.9% | 12.1% | 18.6% | 25.6% | 21.4% | 22.8% |

| Orlando | 9.7% | 22.0% | 24.6% | 24.0% | 34.3% | 46.0% | 48.2% | 56.3% |

| California * | 9.6% | 22.4% | 8.2% | 17.9% | 17.8% | 40.3% | ||

| Bay Area CA* | 7.0% | 20.2% | 5.4% | 13.9% | 12.4% | 34.1% | 26.8% | 32.4% |

| So. California* | 9.4% | 22.4% | 6.8% | 16.2% | 16.2% | 38.6% | 30.9% | 36.9% |

| Chicago | 12.0% | NA | 33.0% | NA | 45.0% | 49.0% | ||

| Hampton Roads | 30.7% | 34.2% | ||||||

| Charlotte | 10.5% | 15.9% | ||||||

| Naples | 12.2% | 22.1% | ||||||

| Georgia*** | 35.3% | NA | ||||||

| Toledo | 41.8% | 46.7% | ||||||

| Des Moines | 22.4% | 21.9% | ||||||

| Peoria | 30.9% | 26.8% | ||||||

| Tucson | 37.0% | 39.5% | ||||||

| Pensacola | 41.0% | 36.1% | ||||||

| Memphis* | 22.1% | 29.0% | ||||||

| Springfield IL** | 17.9% | 26.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Research: Tight Credit significantly impacting Purchase Mortgage Lending

by Calculated Risk on 3/17/2014 04:29:00 PM

The researchers compared currently lending to lending standards in 2001. They found that if lending standards were similar to 2001 (prior to the loose bubble lending), then there would have been up to 1.2 million more purchase mortgage in 2012.

From Laurie Goodman, Jun Zhu, and Taz George: Where Have All the Loans Gone? The Impact of Credit Availability on Mortgage Volume

Credit availability for mortgage purchases has been very tight over the post-crisis period. In fact, over the past decade, the number of mortgages originated to purchase a home declined dramatically. In this commentary, we examine this decline and explain how limited access to credit has contributed to the drop. We estimate the number of “missing loans” that would have been made if credit availability were at normal levels—we find this number could be as high as 1.2 million units annually....

Based on the upper bound calculation, 1.22 million fewer purchase mortgages were made in 2012 than would have been the case had credit availability remained at 2001 levels. ... This is, however, likely to overstate the impact of tighter credit. We calculate a lower bound estimate, using a similar methodology, to be 273,000 missing 2012 first lien purchase loans. ... The truth is somewhere between these estimates, but likely closer to the upper bound because many prospective borrowers with FICO scores well above 660 are affected by the tight credit box and credit overlays.

Weekly Update: Housing Tracker Existing Home Inventory up 5.5% year-over-year on March 17th

by Calculated Risk on 3/17/2014 12:44:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January - February data will be released this week). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.5% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

NAHB: Builder Confidence increased slightly in March to 47

by Calculated Risk on 3/17/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 47 in March, up from 46 in February. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Treads Water in March

Builder confidence in the market for newly-built, single-family homes rose one point to 47 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“A number of factors are raising builder concerns over meeting demand for the spring buying season,” said NAHB Chief Economist David Crowe. “These include a shortage of buildable lots and skilled workers, rising materials prices and an extremely low inventory of new homes for sale.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The index’s components were mixed in March. The component gauging current sales conditions rose one point to 52 and the component measuring buyer traffic increased two points to 33. The component gauging sales expectations in the next six months fell one point to 53.

The three-month moving averages for regional HMI scores all fell in March. The Northeast dropped three points to 35, the Midwest fell three points to 53, the South posted a four-point decline to 49 and the West registered a two-point drop to 61.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the second consecutive reading below 50.

Fed: Industrial Production increased 0.6% in February

by Calculated Risk on 3/17/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in February after having declined 0.2 percent in January. In February, manufacturing output rose 0.8 percent and nearly reversed its decline of 0.9 percent in January, which resulted, in part, from extreme weather. The gain in factory production in February was the largest since last August. The output of utilities edged down 0.2 percent following a jump of 3.8 percent in January, and the production at mines moved up 0.3 percent. At 101.6 percent of its 2007 average, total industrial production in February was 2.8 percent above its level of a year earlier. The capacity utilization rate for total industry increased in February to 78.8 percent, a rate that is 1.3 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is still 1.3 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.6% in February to 101.6. This is 21% above the recession low, and slightly above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

NY Fed: Empire State Manufacturing Activity indicates "business conditions improved" in March

by Calculated Risk on 3/17/2014 08:37:00 AM

From the NY Fed: Empire State Manufacturing Survey

The March 2014 Empire State Manufacturing Survey indicates that business conditions continued to improve for New York manufacturers, though activity grew slowly. At 5.6, the general business conditions index was little changed from last month. [up from 4.5] ...This is the first of the regional surveys for March. The general business conditions index was close to the consensus forecast of a reading of 6.5, and indicates slightly faster expansion in March than in February.

The new orders index climbed three points to 3.1, pointing to a slight increase in orders. ...

Labor market conditions continued to improve. The employment index fell five points but, at 5.9, indicated a small increase in employment levels. The average workweek index, holding steady at 4.7, pointed to a small increase in hours worked.

emphasis added