by Calculated Risk on 1/06/2014 10:00:00 AM

Monday, January 06, 2014

ISM Non-Manufacturing Index at 53.0 indicates slower expansion in December

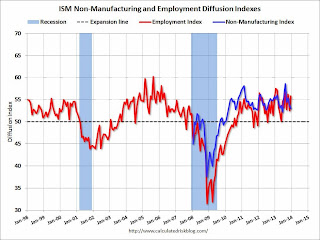

The December ISM Non-manufacturing index was at 53.0%, down from 53.9% in November. The employment index increased in December to 55.8%, up from 52.5% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 48th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI® registered 53 percent in December, 0.9 percentage point lower than November's reading of 53.9 percent. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 55.2 percent, which is 0.3 percentage point lower than the 55.5 percent reported in November, reflecting growth for the 53rd consecutive month, but at a slightly slower rate. The New Orders Index contracted after 52 consecutive months of growth for the first time since July 2009, when it registered 48 percent. The index decreased significantly by 7 percentage points to 49.4 percent, and the Employment Index increased 3.3 percentage points to 55.8 percent, indicating growth in employment for the 17th consecutive month and at a faster rate. The Prices Index increased 2.9 percentage points to 55.1 percent, indicating prices increased at a faster rate in December when compared to November. According to the NMI®, eight non-manufacturing industries reported growth in December. Despite the substantial decrease in the New Orders Index, respondents' comments predominately reflect that business conditions are stable."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.8% and indicates slower expansion in December than in November.

The stronger employment index is a positive, but new orders contracted for the first time in over four years.

Reis: Office Vacancy Rate unchanged in Q4 at 16.9%

by Calculated Risk on 1/06/2014 08:40:00 AM

Reis released their Q4 2013 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 16.9% in Q4. This is down from 17.1% in Q4 2012, and down from the cycle peak of 17.6%.

There has been a pick up in demand, but construction has also increased - so the vacancy rate was unchanged.

From Reis Senior Economist Ryan Severino:

The national vacancy rate was unchanged during the fourth quarter at 16.9%. This is slightly worse than the performance from last quarter, but not out of line with the performance that has persisted since the office market began to recover in mid‐2011. Not since the third quarter of 2007 has the national vacancy rate declined by more than 10 basis points. For 2013, the vacancy rate fell by just 20 basis points, 10 basis points worse than the market's performance in 2012. National vacancies remain elevated at 440 basis points above the sector's cyclical low, recorded in the third quarter of 2007 before the recession began that December. Supply and demand have remained largely in balance during this recovery, accounting for the slow pace of vacancy compression.On new construction:

emphasis added

Occupied stock increased by 8.521 million SF in the fourth quarter. This is an increase from the 7.641 million SF that were absorbed during the third quarter. However, this was largely due to a jump in completions. For the quarter, 9.126 million SF were completed, up from last quarter's 6.301 million SF. This dynamic between net absorption and construction held throughout the year. For 2013, quarterly net absorption averaged 7.042 million SF, a 67% increase from 2012's average of 4.225 million SF. For construction, the quarterly average was 6.471 million SF, a 108% increase from 2012's average of 3.110. So while demand certainly increased during 2013, it did so more or less in lockstep with the increase in construction. This clearly intimates the ongoing use of pre‐leasing that is being required by lenders of construction and development financing. Moreover, and possibly more meaningfully for the office market, it also indicates that tenants looking for space clearly preferred newly completed inventory in 2013.On rents:

Asking and effective rents both grew by 0.7% during the fourth quarter. This a reversal of the trend that we have observed in recent quarters with rent growth slowing gradually. Asking and effective rents have now risen for thirteen consecutive quarters. During 2013 asking rent grew by 2.1% while effective rent grew by 2.2%. This was somewhat better than 2012's performance when asking rents grew by 1.8% while effective rents grew by 2.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.9% in Q4, and was down from 17.1% in Q4 2012. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Office vacancy data courtesy of Reis.

Sunday, January 05, 2014

Monday: ISM Service Index, Q4 Office Vacancy Survey

by Calculated Risk on 1/05/2014 07:34:00 PM

From Stephen Fidler at the WSJ: Where Deflation Risks Stir Concerns

Anxieties are rising in the euro zone that deflation—the phenomenon of persistent falling prices across the economy that blighted the lives of millions in the 1930s—may be starting to take root as it did in Japan in the mid-1990s. "Deflation: the hidden threat," ran a headline emblazoned across a December research note by economists at HSBC.The article lists several problems caused by deflation (too low inflation has many of the same problems). Germany's policies - and their fear of inflation - have really damaged Europe. Europe has been "Schäubled" (Germany's finance minister is Wolfgang Schäuble who is always wrong, but never in doubt).

At last count, prices are falling only in Latvia, Greece and Cyprus. And most forecasters, including those at HSBC, see low inflation as more likely than deflation on average in the euro zone.

Monday:

• Early: Reis Q4 2013 Office Survey of rents and vacancy rates.

• At 10:00 AM ET, the ISM non-Manufacturing Index for December. The consensus is for a reading of 54.8, up from 53.9 in November. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 1.6% increase in orders.

Weekend:

• Schedule for Week of January 5th

The Nikkei is down about 1.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 25 (fair value).

Oil prices have declined with WTI futures at $94.22 per barrel and Brent at $106.89 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.30 per gallon (about the same as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Extended unemployment benefits

by Calculated Risk on 1/05/2014 01:04:00 PM

Not extending unemployment benefits is a clear policy error, and extending the program has widespread support. This why doesn't Congress extend the program this week?

From CNBC: Facing cuts, long-term unemployed brace for grim new year

Nancy Shields is among the millions of unemployed Americans who are losing their extended unemployment benefits starting this month.From the NELP: New Poll Finds Strong Voter Support for Renewing Federal Jobless Aid

Many like Shields depend on these meager payments, a federal extension of state unemployment programs that expired Dec. 28, to stay afloat.

...

The National Employment Law Project estimates that more than a million Americans are in the same situation. "For a lot of people and a lot of families, this is their only income source," said NELP federal advocacy coordinator Judy Conti. "This could pull the rug out from under 1.3 million families," she said. Without an extension, an additional 2 million will fall off the rolls in the first half of the year.

Only one-third of voters believe Congress should allow federal jobless aid to end this week. By a strong 21-point margin, voters say Congress should act to maintain (55%) rather than cut off (34%) these benefits.Also from NELP: Congress’s Failure to Renew Federal Unemployment Insurance Means Share of Unemployed Receiving Jobless Aid Will Hit Record Low

There is also more intensity of feeling on the side favoring an extension. More than twice as many voters strongly favor maintaining benefits (43%) as strongly feel benefits should end (21%).

Voters reject the claim that unemployed workers are not trying to find work. Just 33% of voters agree that most of those receiving jobless aid “are not trying to find a job, and prefer to collect benefits without working.” Instead, 57% say that the unemployed “would rather work, but cannot find a job in today’s economy.”

As a result of Congress’s failure to renew federal jobless aid for the long-term unemployed in its budget agreement, the share of unemployed workers receiving jobless aid will drop to a record low of just one in four (26 percent) as of January 2014, according to an analysis released today by the National Employment Law Project. Not only is this the lowest share during this downturn, it is the lowest since the U.S. Department of Labor started recording this information in 1950.

The loss of federal jobless aid will not only be a tough hit on unemployed workers and their families, but will also hit the economies of struggling states.

Saturday, January 04, 2014

Housing Demolitions: The Return of the Bulldozers

by Calculated Risk on 1/04/2014 12:50:00 PM

Below is an interesting article from Andrew Khouri at the LA Times. As the article notes, demolitions and new construction in beach communities and other desirable areas in California has picked up significantly.

The article doesn't mention that many of these small cottages were built in the '20s, '30s, '40s and 50s as summer homes. An example in the article is "a 3,500-square-foot, three-level house that replaced a small 784-square-foot cottage near the beach."

The zoning hasn't changed. It just didn't make sense to build a 3,500 sq ft house as a summer home in the '30s. For the new owners, these are mostly primary residences and the owners work nearby. It makes sense that the new owners will want to max out the lot (the lots are very expensive), but, as expected, some existing residences don't want their communities to change.

From Andrew Khouri at the LA Times: Housing tear-downs on the rise as real estate rebounds

The front-end loader swung to the right and took a bite out of the shingled roof of the quaint cottage. The roar of the engine and crackle of buckling lumber carried down Elm Avenue in Manhattan Beach.

Within 40 minutes, a demolition crew reduced the 1950s one-story to rubble. The 782-square-foot house would be replaced by a 3,300-square-foot Cape Cod.

...

The upscale South Bay town of Manhattan Beach exemplifies the trend. Builders in the city pulled permits to demolish 84 residential units from July 2012 to June 2013, the latest available data. That's nearly double the number pulled for the same period a year earlier.

...

In the city of Los Angeles last year, builders received approval to raze 1,227 houses and duplexes from January through mid-December, according to Department of Building and Safety records. That's 29% higher than in all of 2012, though still well off the pace of more than 3,000 in 2006, during the housing bubble.

Schedule for Week of January 5th

by Calculated Risk on 1/04/2014 10:20:00 AM

The key report this week is the December employment report to be released on Friday.

Other key reports include the December ISM non-manufacturing report on Monday and the November trade report on Tuesday.

Also, Reis is scheduled to release their Q4 surveys of rents and vacancy rates for apartments, offices and malls.

Early: Reis Q4 2013 Office Survey of rents and vacancy rates.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a reading of 54.8, up from 53.9 in November. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 1.6% increase in orders.

Early: Reis Q4 2013 Apartment Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. Both imports and exports increased in October.

The consensus is for the U.S. trade deficit to decrease to $39.9 billion in November from $40.6 billion in October.

Early: Reis Q4 2013 Mall Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index for the previous two weeks.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in December, down from 215,000 in November.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of December 17-18, 2013.

3:00 PM: Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $14.2 billion in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 331 thousand from 339 thousand.

10:00 AM: Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs in December, down from the 203,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to be unchanged at 7.0% in December.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through November.

The economy has added 8.1 million private sector jobs since employment bottomed in February 2010 (7.45 million total jobs added including all the public sector layoffs).

The economy has added 8.1 million private sector jobs since employment bottomed in February 2010 (7.45 million total jobs added including all the public sector layoffs).There are still almost 760 thousand fewer private sector jobs now than when the recession started in 2007.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.5% increase in inventories.

Friday, January 03, 2014

Unofficial Problem Bank list declines to 618 Institutions

by Calculated Risk on 1/03/2014 07:29:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 3, 2013.

Changes and comments from surferdude808:

Quiet week to start off the New Year as expected. This week there were two removals and one addition to the Unofficial Problem Bank List. After the changes, the list stands at 618 institutions with assets of $205.6 billion. A year ago, the list held 834 institutions with assets of $311.6 billion.

Removals include the FDIC terminating an action against Oconee State Bank, Watkinsville, GA ($265 million) and Advance Bank, Baltimore, MD ($54 million) finding a merger partner. Hat tip to reader HR for alerting us to the Consent Order issued against The Bank of Oswego, Lake Oswego, OR ($118 million), which cannot be located on the FDIC website.

Next week should be as quiet as we do not anticipate the OCC releasing an update on its enforcement actions until January 17th.

U.S. Light Vehicle Sales decrease to 15.5 million annual rate in December, Annual Sales up 7.5%

by Calculated Risk on 1/03/2014 03:27:00 PM

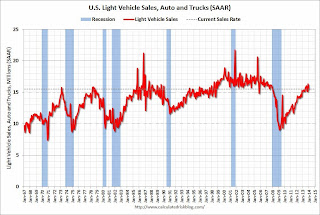

Based on an estimate from WardsAuto, light vehicle sales were at a 15.53 million SAAR in December. That is up 2.3% from December 2012, and down 4.8% from the sales rate last month.

This was below the consensus forecast of 16.0 million SAAR (seasonally adjusted annual rate).

For the year, most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Actually sales growth were up about 7.5% to 15.5 million.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2000 | 17.4 | 2.7% |

| 2001 | 17.1 | -1.3% |

| 2002 | 16.8 | -1.8% |

| 2003 | 16.6 | -1.1% |

| 2004 | 16.9 | 1.4% |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.5 | 7.5% |

| 1Initial estimate. | ||

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 15.53 million SAAR from WardsAuto).

December sales were a little disappointing, but overall 2013 was solid.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a 4% sales gain in 2014 to around 16.1 million light vehicles.

Bernanke: The Federal Reserve: Looking Back, Looking Forward

by Calculated Risk on 1/03/2014 02:40:00 PM

From Fed Chairman Ben Bernanke: The Federal Reserve: Looking Back, Looking Forward. On the economy:

I have discussed the factors that have held back the recovery, not only to better understand the recent past but also to think about the economy's prospects. The encouraging news is that the headwinds I have mentioned may now be abating. Near-term fiscal policy at the federal level remains restrictive, but the degree of restraint on economic growth seems likely to lessen somewhat in 2014 and even more so in 2015; meanwhile, the budgetary situations of state and local governments have improved, reducing the need for further sharp cuts. The aftereffects of the housing bust also appear to have waned. For example, notwithstanding the effects of somewhat higher mortgage rates, house prices have rebounded, with one consequence being that the number of homeowners with "underwater" mortgages has dropped significantly, as have foreclosures and mortgage delinquencies. Household balance sheets have strengthened considerably, with wealth and income rising and the household debt-service burden at its lowest level in decades. Partly as a result of households' improved finances, lending standards to households are showing signs of easing, though potential mortgage borrowers still face impediments. Businesses, especially larger ones, are also in good financial shape. The combination of financial healing, greater balance in the housing market, less fiscal restraint, and, of course, continued monetary policy accommodation bodes well for U.S. economic growth in coming quarters. But, of course, if the experience of the past few years teaches us anything, it is that we should be cautious in our forecasts.CR Note: This fits my current view - and I hope Bernanke is correct!

emphasis added

Fed's Lacker: Projecting 2% GDP Growth in 2014

by Calculated Risk on 1/03/2014 01:58:00 PM

From Richmond Fed President Jeffery Lacker: Economic Outlook, January 2014

Many forecasters are citing the recent surge as support for projections of sustained growth at around 3 percent starting later this year. It's worth pointing out, however, that this has been true at virtually every point in this expansion. Ever since the recovery began, most forecasters have the economy picking up speed in the next couple of quarters with the easing of headwinds that have been temporarily restraining growth. My own forecasts (at least initially) followed this script as well.CR Note: I was forecasting 2% in 2013, as were several key forecasters. So not everyone was overly optimistic last year.

Lacker:

Although consumption grew rapidly at the end of last year, we have seen similar surges since the last recession, only to see spending return to a more moderate trend. Consumer spending trends are likely to depend on whether the dramatic events of the last few years are only a temporary disturbance to household sentiment or if they instead represent a more persistent shift in attitudes about borrowing and saving. At this point, I am inclined toward the latter view.Lacker is referring to the NFIB index. What he fails to mention is that during good times, small business owners complain about "government regulations and red tape". This is usually a good sign. It could be a bad sign this time, but I expect small business growth to improve in 2014.

Businesses also appear to be quite reticent to hire and invest. A widely followed index of small business optimism fell sharply during the recession and has only partially recovered since then. Interestingly, when small business owners were asked about the single most important problem they face, the most frequent answer in the latest survey was "government regulations and red tape." This observation accords with reports we've been hearing from many business contacts for several years now. They've seen a substantial increase in the pace of regulatory change and a substantial increase in uncertainty about the shape of new regulations. Both are said to discourage new hiring and investment commitments.

Lacker:

I've discussed consumer spending and business investment, which together account for about four-fifths of the economy. Residential investment is one area in which we have seen strong growth. Real residential investment increased by more than 15 percent in 2012, and through the third quarter of last year it increased at a 12 percent annual rate. Many housing market indicators, such as housing starts and new home sales, remain well below levels that were typical during the expansions of the Great Moderation, so there is a reasonable basis to expect residential investment to continue to grow. But since this category is only 3 percent of GDP, it has only a marginal effect on the overall outlook.CR: This is something I've been writing about since I started the blog in 2005, but it is worth repeating ... even though Residential Investment usually only accounts for around 4% to 5% GDP (3% right now), it isn't the size of the sector, but the contribution during a recovery that matters - and housing is usually a large contributor to economic and employment growth in a recovery. And there also many ripple effects from housing. (see: Professor Leamer's presentation from the 2007 Jackson Hole Symposium: Housing and the Business Cycle )

Lacker:

Adding up all these categories of spending yields a forecast for GDP growth of just a little above 2 percent — not much different from what we've seen for the last three years.Could be ... but I'm more optimistic.